Wealth management, formerly the responsibility of the ultra-rich and delivered through in-person meetings, is undergoing a seismic shift. The emergence of advanced technology not only facilitated broader access to financial services but has also fundamentally transformed their delivery, management and use.

Technology is shifting the industry from legacy, manual systems toward a data-driven, effective and personalised future. This article will examine how technology is transforming today’s wealth management industry, from the automation of basic tasks to providing a more transparent and secure client experience.

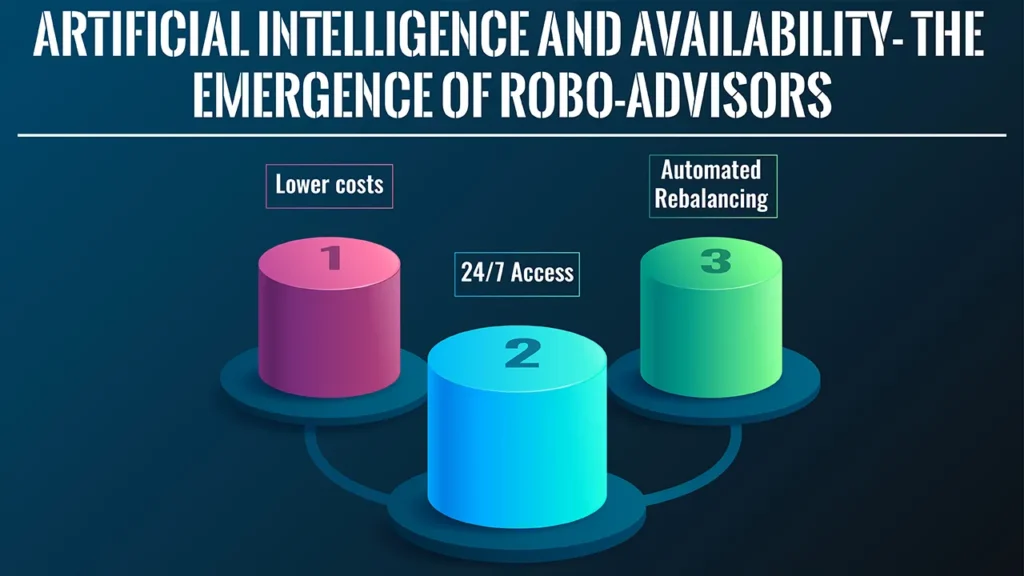

1. Artificial Intelligence and Availability: The Emergence of Robo-Advisors

Perhaps the most readily apparent sign of tech changes is the rise of robo-advisors. These are digital platforms that employ algorithms to offer computerised, low-cost financial advice and portfolio management.

Clients can fill out a questionnaire, rather than relying on a human advisor, to give details about financial goals, risk tolerance and time frame. It then builds and maintains a diversified portfolio for them.

- Lower costs: Robo-advisors usually take a percentage of your assets under management, rather than charging fees based on trades; this makes professional wealth management services available to more people, including younger investors who have smaller portfolios.

- 24/7 Access: Instead of having to look for an adviser to make a change or get information, clients can now log in to their accounts to see how they’re doing, make changes, etc. in the middle of the night on a Saturday if that is when it’s convenient for them, instead of according to a traditional model where that would be taken away from them.

- Automated Rebalancing: They assist in automated rebalancing of portfolios according to the target asset allocation so that the investor’s risk profile does not get skewed manually over time.

2. Data-Driven Decision-Making and AI

Technology has provided financial advisors and clients with a degree of data and analytical power that would have been unthinkable even a decade or two ago. Algorithms and AI can handle large volumes of data in real time and provide deep insights that help us make better decisions.

- Predictive Analytics: AI has the ability to analyse market trends, economic indicators and past data to make predictions of potential market movements and recognise opportunities or risks.

- Risk assessment: You can model the risk of a portfolio better than established methods, enabling better asset allocation to reach a preferred risk-adjusted return.

- Behavioural Finance: Even a client’s behaviour and spending habits can be analysed by technology to provide more relevant and personal advice. For example, a platform may notify a customer of a potentially over-budget situation or recommend an optimal savings plan for the customer based on his or her behaviour.

3. Personalization and Enhanced Client Experience

Contemporary clients want a smooth, customised and potentially on-demand experience akin to what they already receive from other digital services, such as streaming platforms or e-commerce sites. Wealth managers can use technology to fulfil each of these needs and offer a tailored experience accordingly.

- Personalised Portfolios: Algorithms can build highly individualised portfolios to correspond to an individual client’s specific goals, values (ESG investing, for instance), and tax considerations.

- Interactive Dashboards: With interactive dashboards, clients can access a complete picture of their finances at any time, anywhere, with mobile apps and a web portal – including real-time cash flow and investment performance, opening windows of trust.

- Digital Communication: Technology provides a means for clients to interact with their advisors securely and in real-time—consider secure messaging, video conferencing or collaborative planning tools.

4. Security and Transparency

Now more than ever, security is the top concern in a world which is more fraught with cyber threats. Technology has a paradoxical role here: it creates new vulnerabilities while also offering the most potent tools for fighting them.

- Strong Encryption: Secure encryption protocols are now implemented by the platforms of today, meaning your clients’ sensitive information, such as personal and financial data, is safe.

- Biometric Authentication: As we are already doing on mobile devices with fingerprint and facial recognition, this could provide that extra security layer, making it more difficult for unauthorised users to get into our accounts.

- Real-time Transparency: Clients can see their accounts in real time, which means they can view what’s happening with their transactions and how their portfolios are performing. The transparency fostered by this enables your clients to have more confidence and control over their finances.

5. The Rise of the Hybrid Model

Technology has given life to the robo-advisors but not killed the human advisor. In its place has emerged the hybrid wealth management model.

In this structure, technology is automating the mundane administrative tasks (like data entry and rebalancing) and managing straightforward investment questions. This means the human advisor is liberated to concentrate on higher-value tasks like:

- Sophisticated Financial Planning: Complicated finances such as estate planning, retirement planning and tax efficiency.

- Emotional Support: Offering clients support and reassurance during times of market volatility, the kind of human touch an algorithm cannot provide.

- Relationship Development: This includes developing deep, personal relationships with clients in order to have truly intimate knowledge of their long-term life goals.

The hybrid nature combines the best of both worlds, as it not only leverages the effectiveness and convenience of technology, but it also taps into the empathy and expertise of a human professional.

Conclusion: A New Financial Empowerment Age

The importance of technology to today’s wealth management is not on the verge of a decline; it’s a profound change that has already occurred. Wealth management is shifting from being an exclusive and expensive service to becoming increasingly inclusive, transparent and efficient, driven by technological developments.

Using automation, data analytics and better security, advisors can make better decisions, and clients can feel more secure and in control of a sound financial future. The digitisation of finance is indeed a golden age for finance professionals as well as their investors.

Frequently Asked Questions

1. What is the biggest distinction between a robo-advisor and a traditional financial advisor?

A robo-adviser is a series of algorithmic-based choices to create a custom portfolio at a reduced cost, with minimal human contact.

A traditional adviser is a human adviser who is capable of providing holistic, bespoke advice across multiple aspects of your finances.

2. Will technology make financial advisers obsolete?

Not entirely. Technology can automate many aspects of the process, but it can’t mirror the human touch of empathy, nuanced problem-solving and emotional support, particularly in many high-stress financial situations.

It seems to me that the future is probably some sort of hybrid model in which tech enables the advisory role rather than eliminating it.”

3. Will a digital wealth management platform keep my money safe?

Legitimate digital wealth management platforms invest heavily in bank-grade security features such as sophisticated encryption and multi-factor authentication to secure your data.

Typically, your investments are also insured by organisations like the SIPC (Securities Investor Protection Corporation).

4. In what ways does technology help make wealth management more accessible?

Technology significantly diminishes the operational costs of a company by automating the manual work. Then it passes the savings on to customers in the form of reduced fees and account minimums, allowing all to have access to financial advice.