Picture entering a great financial market. On one end, it’s familiar — rows of stocks, bonds and mutual funds line up in neat little rows and the numbers are flashing on screens. These are the investments that most of us know.

But what if you dared to round the corner? You’d come across a more private, interesting room — one filled with wine barrels, art, mansions in faraway lands, venture capital rooms of brash entrepreneurs, and secured doors labeled “hedge funds” or “private equity.”

This is the secret section where alternative investments reside. They are the tactics that extend far beyond stocks and government bonds, providing investors new ways to build wealth, spread risks and even stumble across opportunities not available to the ordinary investor.

Alternative Investment Strategies are not just for the wealthy—they are for the creative, the diversified and the connected. Let’s take a trip through this world — and figure out what makes these strategies so attractive, the various types of strategies out there, and why investors are gravitating to them.

The Appeal of Alternative Investment Strategies

Different approaches have at their core one strong idea: spreading out. There is an expression that most people have probably heard: “Don’t put all your eggs in one basket.” This applies directly to investments.

Traditional investments — stocks and bonds — have a tendency to rise and fall in concert with economic cycles. Both can lose value when the market crashes. But the alternatives often march to the beat of their own drummer, so to speak. Real estate can do well when stock markets are falling, private equity feeds on new ideas, and commodities, like gold, tend to move up when uncertainty is in the air.

In other words, alternatives do not always move with the crowd, and this gives investors a bit of cushion during choppy times.

There’s the exclusivity, to say nothing of the stability. Lots of alternative investments are fairly tangible or private market-linked. From vineyards in France to Silicon Valley start-ups, they give investors a chance to own small pieces of stories unlike anything offered at the public stock exchange.

The most common alternative investment approaches

Let’s open the doors to that secret realm and take a tour of the most prominent tactics that can be found within.

1. Hedge Funds

Consider hedge funds the “chess masters” of investing. Traditional funds own — and hold onto — the products they buy, while hedge fund managers use complex strategies, such as short selling, derivatives and leverage, in an effort to make money whether markets go up or down.

Now picture a hedge fund the way some sailboat racers imagine it: small, fast, nimble and tactical. It is built to outmaneuver large ships (classic funds) but is more risky and demands a master at the helm.

Why investors like them: Hedge funds have the ability to make money by turning losses into gains, even when markets are bad. This is very enticing to high-net-worth individuals.

2. Private Equity

If hedge funds are the sailors, the private equity firms are the architects. They don’t just buy companies — they build them.

Private equity is investing directly in private businesses and helping companies grow, restructure and achieve new heights. For instance, a privately held manufacturing company owned by a family might team up with private equity to modernize its operations, take operations global and eventually go public.

The life span of private equity is long — typically 5 to 10 years — but it can be lucrative. When the company grows and is sold for a higher price, investors make money.

Why investors like them: Private equity allows investors to participate in turning around the business while potentially earning higher-than-normal returns.

3. Real Estate Investments

Take a walk through the streets of Manhattan, Singapore or Dubai and you are seeing the sky-high evidence of that strategy. In a nutshell, real estate investing is the act of purchasing properties to either rent out or sell for a profit.

Ranging from luxury apartments to commercial office buildings, industrial parks, and farmland—real estate is a tangible asset that not only appreciates in value but acts as a safeguard against inflation.

REITs dress this up and make it available to the “little guy”, while the big money usually wants to own the buildings outright.

Why investors like them: Real estate has long been considered a reliable source of wealth generation, offering the heady mix of regular income and long-term appreciation.

4. Commodities

Gold that glistens in a vault, barrels of oil stacked in a refinery, sacks of coffee beans transported across oceans, are more than trade goods: They are investments.

Commodities allow investors to profit from worldwide supply and demand. Gold is considered a safe haven in uncertain times, oil is linked to global growth, and other agricultural products move with consumption trends.

Why investors like them: Commodities tend to perform well as a hedge against inflation or market turmoil abroad.

5. Venture Capital

Just as private equity homes in on midsize firms, venture capital (VC) focuses on start-ups. Venture capitalists are the dream-merchants of the financial world, backing bold ideas and entrepreneurs — whether in healthcare innovation, green tech or next-generation apps.

They are high-stakes bets — many start-ups fail — but the rewards can be life-altering when one turns into the next global giant.

Why investors pick them: VC offers an opportunity to invest in the disruptive technologies that could define the future.

6. Collectibles and Luxury Assets

Not all investments wear suits or hail from spreadsheets. A few lie in hushed temperature-controlled rooms or in luxury vaults. Art, vintage cars, rare wines and collectible watches fall in this world.

When a Picasso painting goes for tens of millions at auction, or a 1960s Ferrari sells for more money than any car has ever sold for at auction, that is wealth preservation in its most beautiful form.

Why investors like them: These assets aren’t linked to the stock market — and they carry tremendous cultural and historical value, combining financial gains with personal passion in a way that is impossible in traditional investments.

Differences in Alternative Strategies and Traditional Schemes

A walk through the alternatives illustrates one difference clearly: complexity and exclusivity.

- Classical investments are available for most, are simple and are regulated.

- Other options usually have higher minimums, and if not patience and expertise and possibly even accreditation.

But that’s also what makes them powerful diversification instruments. In short, alternative strategies succeed by not swÿing to the same beat as the mainstream markets. This independence is what can lower the volatility of a broader portfolio.

Risks Investors Must Understand

Naturally, the sexy lure of alternatives also comes with caveats.

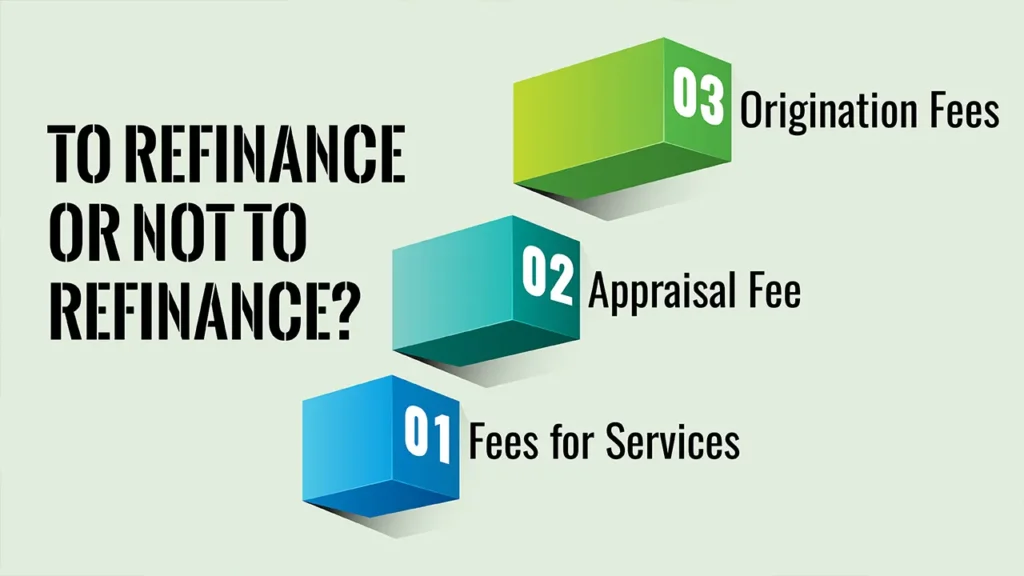

- Lack of liquidity: Many alternative investments — particularly private equity and venture capital funds — tie up investors’ money for years. Unlike stocks, it’s not as easy as pressing a button to cash out overnight.

- Advanced Structures: To navigate hedge funds and derivatives, it’s best to have a thoughtful guide.

- High Cost: Management fees can be high, as can performance-based fees.

- Financialing: Real estate, commodities and art are sensitive to the economy.

Put more simply, alternatives are strong, but unsparing. They are a ready reward, for preparation, for knowledge, for patience.

Who Should Consider Alternative Investments?

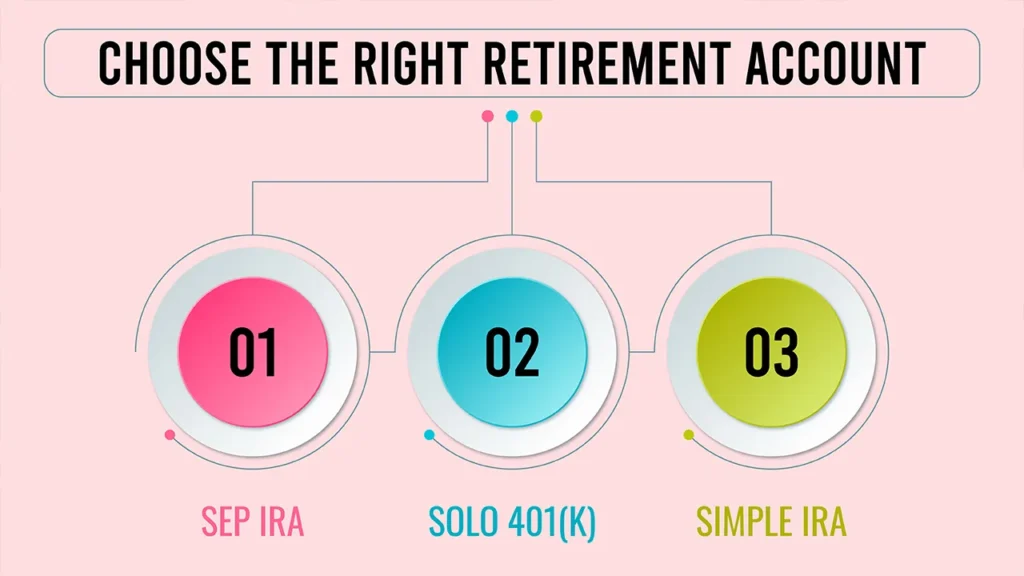

Alternative strategies aren’t for everyone. They are best suited for:

- Investors that already have strong core portfolios.

- Investors who are high-net-worth and want diversification in addition to stocks and bonds.

- Those comfortable with long-term commitments.

- Folks who love certain assets (think art or wine collectors who not only see value but love in their holdings).

Ordinary investors now have more and more access to alternatives via mutual funds, ETFs, or REITs—offering a way to participate without the complexity of direct ownership.

The Future of Alternative Investments

in the last few years, alternatives have gone from being the sole province of ultra-wealthy families to an increasingly popular option. Today technology platforms allow individuals to invest in private equity funds, take stakes in real estate deals — and even buy a share of a painting.

Global uncertainty, worries about inflation and volatile markets have stoked interest even further. Alternatives are no longer peripheral to portfolios, they are in many cases a principal strategy.”

Conclusion

An alternative investment strategy can be imagined as a treasure chest well off the commercial highway of finance. They’re less predictable, often harder to get at, but can also be highly rewarding.

From owning a piece of history in art, investing in tomorrow’s innovators or hedging uncertainty in commodities, alternatives remind us that investing isn’t just charts and reports, but stories and resilience, and that there is always creativity to be found.

To the curiosity-driven, the brave investor, they offer something lovely: a way of looking at wealth on whose dial are not just numbers in an account, but meaningful connections to the world’s most singular opportunities.

Frequently Asked Questions

1. How are alternative investments different from traditional ones?

Stocks, bonds and mutual funds, which are traditional investments, are publicly traded and superliquid and readily available. Alternative investments, on the contrary, refer to assets that are not traditional such as hedge funds, real estate, private equity, commodities, art or collectibles.

They also tend to be less liquid, have higher minimum investments and may also require specialized knowledge to manage. What makes them appealing is their potential to diversify a portfolio — and because they don’t always march in step with the stock markets.

2. Can beginners invest in alternative investments?

Even though beginners can also access the alternative universe through lower hurdles with products including Real Estate Investment Trusts (REITs), Commodity ETFs or crowdfunding platforms, the majority of alternative strategies traded without intermediaries interests more experienced or high-net worth investors.

They are used less frequently because they have longer lock-up periods, more risk and are more complicated in their strategy.

First and foremost I would say a conservative approach is best and starting with the traditional before getting into alternative would be ideal for beginners.

3. What are the primary dangers of alternative investing strategies?

Key risks include illiquidity (difficulty selling quickly), high costs (management and performance fees) and market volatility in sectors like real estate or commodities.

Some other options, like venture capital or start-up investing come with a high likelihood of loss in cases where the business does not succeed.

Due to these risks, investors considering a Coop membership are encouraged to review their financial objectives and their appetite for risk prior to doing so.