Are you neglecting your future without even knowing it? So many of us make money mistakes, and it’s not for lack of good intentions or ideas; it’s for lack of knowing any better. By understanding the “top 10 most common financial mistakes”, you can recognize and work to correct them, thereby creating a more solid financial foundation.

In order to put you on a path to long-term financial health, this article will help highlight those typical pitfalls, explain why they’re so terrible, and—above all—tell you “how to avoid common financial mistakes” and steer clear of them completely.

Part 1: The root of financial mistakes: Recognizing the pain is the first step to blame

Why We Make Financial Mistakes

Financial blunders are caused by a combination of psychological biases, a lack of financial literacy, and unforeseen life events. For example, the need for immediate gratification can also induce wasteful spending. The herd instinct causes people to jump on the bandwagon without doing due diligence. Also, people don’t understand it very well in financial terms.

“Everybody makes mistakes; we need to remember that.” The point is to learn from them and plan not to do them again.

Section 2: Top 10 Most Common Financial Mistakes

1. Not Budgeting (or Underbudgeting)

- The Mistake: Most people don’t know where their money is going, and so overspending occurs, and potential savings are lost.

- The Solution: Develop a reasonable budget that aligns with approaches like the 50/30/20 rule or zero-based budgeting. Monitor your costs closely and adjust your budget as needed. Learn about the 50/30/20 budgeting rule from NerdWallet

2. Not Establishing an Emergency Fund

- The Mistake: People with no financial cushion might resort to high-interest debt in an emergency or sell investments before they should during a downturn.

- The Solution: Aim to have 3-6 months’ worth of living costs squirrelled away in a separate, easy-to-access high-interest savings account or short-term fixed deposit.

3. Accumulating High-Interest Debt

- The Mistake: If you have carried balances on credit cards, personal loans or quick loans, you may find your wealth evaporating fast, as you fork out high interest payments.

- The Solution: Focus on paying down high-interest debt aggressively (with the snowball method or the avalanche approach), instead. Avoid making only minimum payments.

4. Not Starting to Invest Early Enough

- The Mistake: putting off tasks or succumbing to fear can result in missing one of the most powerful forces in investing: the power of compounding.

- The Solution: Begin investing as soon as you can, even with small amounts. Opt for instruments to invest: Opt for vehicles such as Systematic Investment Plans (SIPs) in mutual funds. For time in the market trumps timing the market, remember?

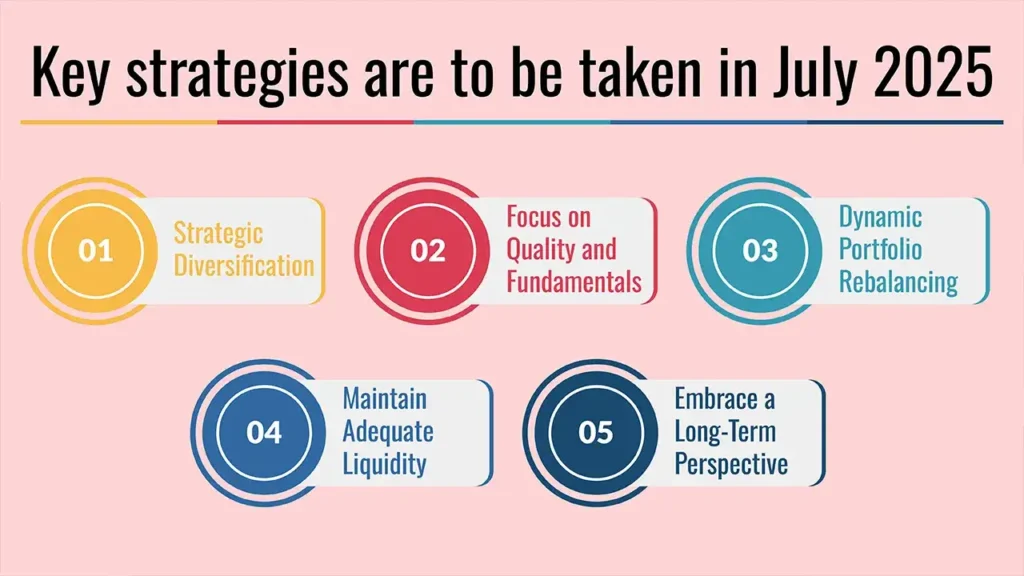

5. Missing Out the Diversification Factor While Investing

- The Mistake: You are taking on a concentrated risk when you invest everything you have in a single type of asset, sector or stock.

- The Solution: Diversify your investments across various asset classes (equities, debt, real estate, gold), industries and geographies. You might consider investing in diversified mutual funds or exchange-traded funds.

6. Investing Emotionally

- The Mistake: “You start buying when things get high (greed), and you start selling when things get low (fear), and obviously that’s a losing strategy most of the time.”

- The Solution: Stay the course with a clearly defined plan. Automate your investments (through SIPs) to cut down on emotions driving decisions. Remember, market volatility is par for the course.

7. Ignoring Retirement Planning

- The Mistake: Overlooking the importance of saving adequately for the long term or thinking future income will take care of it all or that it’s “too early” to start saving for retirement, which can result in a future of potential financial insecurity.

- The Solution: Save for retirement tenaciously. Make the fullest use of your tax-advantaged accounts, such as NPS (National Pension System) or PPF (Public Provident Fund) in India, or employer-sponsored plans.

8. Neglecting Insurance

- The Mistake: Not Accounting for Unforeseen Events: Failing to plan for life’s what-ifs – such as illness, disability or death – can leave dependents financially vulnerable.

- The Solution: Secure proper health, life, and disability insurance. Regularly review your policies to make sure there is enough coverage.

9. Failure to Review Financial Plans Periodically

- The Mistake: Creating a budget or investing plan and leaving it unchanged for life can result in a stale strategy that does not accommodate changes to life.

- The Solution: Set regular financial planning once a year or twice a year. Change budget, investment mix and goals as life requires (i.e., marriage, new job, baby, buying a house).

10. Falling for “Get Rich Quick” Pitfalls

- The Mistake: Falling for get-rich-quick-and-easy pitches usually results in big money losses or the discovery of scams.

- The Solution: Be sceptical. Recall that true wealth creation is a process, and it does not happen overnight. If something sounds too good to be true, it probably is. Invest only in regulated and well-understood instruments.

Conclusion: Empowering Your Financial Future

In short, the “top 10 most common mistakes” have the potential to do in your financial health. But these trips are inside everyone’s control. Your finances are unique, but the fundamentals of good money management are the same for everyone.

When you can avoid those mistakes and put some smart strategies in place now, you put yourself in a position to grow wealth that lasts and gives you real peace of mind.

Call to Action

Figure out what mistakes you could be making and start adjusting quickly. Perhaps discussing with a CFP could help keep you on track with your financial mindset.

Frequently Asked Questions

1. If I hate budgeting, how can I track my spending effectively?

You don’t have to be super strict in budgeting at first. Begin with the simple act of tracking every rupee you spend for a month or two. For a gradual but consistent strategy, use budgeting apps, a spreadsheet, or pen and paper.

After seeing where your money goes, you can decide what to cut back on and what to reallocate.

2. Should I pay down my home loan or invest more if I have extra money?

That depends on how interest rates on your home loan stack up. If loan interest rates are much higher than what you believe you can actually earn from investments, after taxes, wiping out the loan may be more advantageous.

But if you’re expecting to earn more on your investments, investing starts to make sense. You might consider taking a balance between the two options, especially when it comes to your long-term wealth goals.

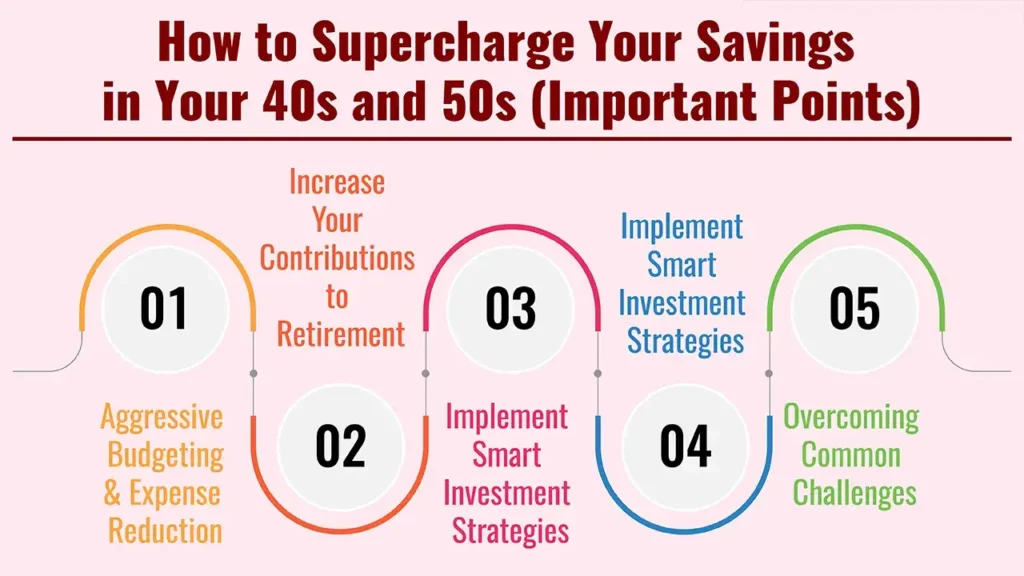

3. I’m already in my 40s/50s. Is it too late to fix financial mistakes and create wealth?

It’s never too late! “Compounding is most potent when started early, but even getting started in your 40s and 50s can have a big impact.”

Concentrate on aggressive saving, smart diversification and maximizing retirement contributions (including NPS) to compensate for lost time.

4. How can I determine what insurance I need and prevent under-insurance?

Consider your liability (loans), dependents’ requirements and potential loss of income. The general rule when you’re considering life insurance is 10-15 times your income.

When it comes to health insurance, make sure you’re covered for medical emergencies. Speak to an independent insurance broker for more information on all the options.

5. What’s one habit to establish for long-term financial success?

Consistent saving and investing. More than anything else about the markets, the act of habitually saving and investing a portion of your income, year in and year out, is the greatest indicator of long-term wealth.