Are you feeling overburdened by debt? There are solutions, and you’re not alone. Are you having trouble sleeping because of your outstanding bills? Debt plagues many people, but there are many different forms of debt relief tailored to that burden.

Knowing your choices is the key to financial freedom and empowerment. Explore our comprehensive guide on Debt Relief: What It Is, detailing different methods and how they can empower you to regain control of your finances today.

Debt Relief: What It Is (Defining the Concept)

Debt relief is a general category that encompasses various approaches and programs used to erase, manage, or minimize debt. The main objective in debt relief is to enable a debtor to escape a potential negative balance from excess borrowing and, in general, to dispose of the debt.

It’s finding a way to get in a place where you can pay a sustainable amount on what you owe or start over. Whereas “paying off debt” is geared toward repaying balances, debt relief has a broader focus on reducing stress surrounding your debt.

Typical objectives for debt relief are to reduce the debtor’s monthly payment, lower the interest rate being paid, and pay down the debt sooner. For a general overview of debt relief options, you can consult USA.gov’s section on getting help with debt.

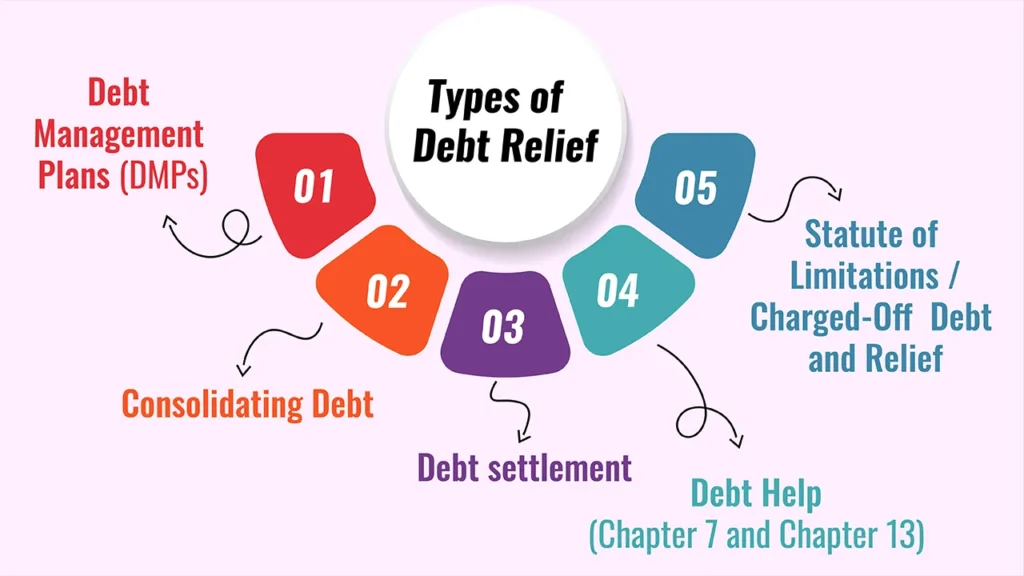

Know What You’re Dealing With: Types of Debt Relief

1. Debt Management Plans (DMPs)

Explanation: Non-profit credit counseling organizations facilitate DMPs to assist an individual in managing their debt more efficiently.

How it works: The agency works closely with your creditors to lower interest rates, waive fees, and consolidate your monthly payments into a single, consolidated monthly payment to the agency, which then divvies out the funds to your creditors. Accounts remain open, though they can be “closed to new charges.”

Pros and Cons of Debt Management Plans

| Pros | Cons |

|---|---|

| Lower interest rates | Must maintain steady payments (no misses) |

| Single monthly payment | Not all types of debt may be included |

| Structured repayment timeline | Existing credit accounts may be closed |

| Avoids taking new loans |

Best For: Consumers who have manageable credit card debt and are seeking lower interest rates and a structured payment plan.

2. Consolidating Debt (Loans and Balance Transfers)

The process of combining multiple debts into a single, new loan or credit facility.

How it Works (Personal Loan): Get a new (typically unsecured) loan to pay off higher interest debt. You then make a single monthly payment to the new lender.

What it is (Balance Transfer Credit Card): Pay off other high-interest credit card balances. Transfer high-interest credit card balances to a 0% introductory APR credit card for a set time.

Pros and Cons of Consolidating Debt

| Pros | Cons |

|---|---|

| Streamlined payments | Possible origination fees |

| Avoids multiple due dates | Balance transfer fees |

| Fixed repayment period | |

| May improve credit score |

Best For: People who have good credit and can get attractive rates, and people who are disciplined about their spending.

3. Debt settlement (Debt Negotiation)

Working with creditors to settle a debt by paying a lump sum that is less than the amount owed.

How It Works: Typically, you stop paying your creditors (which ruins credit) and instead save money in a special account until you have enough to negotiate with creditors. This is often done through a debt settlement company.

Pros and Cons of Debt Settlement

| Pros | Cons |

|---|---|

| Pay less than owed | Severe credit damage |

| Stop collection calls | Risk of creditor lawsuits |

| Avoids bankruptcy | |

| Stop collection calls |

Best For: People with high unsecured debt who are in financial hardship, and possibly considering bankruptcy.

4. Debt Help (Chapter 7 and Chapter 13)

A legal procedure for dealing with debt problems of individuals and businesses; specifically, a case filed under one of the chapters of title 11 of the United States Code (the Bankruptcy Code)

How it Works (Chapter 7 – Liquidation): Non-exempt assets are liquidated to satisfy creditors, and most unsecured debt is discharged (erased).

How it Works (Chapter 13 – Reorganization): You have a court-approved repayment plan for 3-5 years, and you are making payments to a trustee who, in turn, pays creditors. Any other unsecured debts are discharged after the plan.

Pros and Cons of Debt Help

| Pros | Cons |

|---|---|

| Ends creditor harassment | Ruins credit for 7–10 years |

| Wipes out many debts | Non-dischargeable debts remain |

| Legal protection from creditors | |

| Fresh financial start |

Best For: Those with the worst level of debt they can’t repay using other options, often as a last-ditch measure.

5. Statute of Limitations / Charged-Off Debt and Relief

Not a “relief program,” but the statute of limitations on debt collection is still important.

How it works: A credit agreement/contract with a creditor (whom you owe money) has a statute of limitations period, which is the limited time creditors can sue you to collect a debt. But the debt is still there and may be on your credit report. The clock can be reset by making a payment.

Pros and Cons of Statute of Limitations / Charged-Off Debt and Relief

| Pros | Cons |

|---|---|

| Creditors can’t sue to collect | Debt is still legally owed |

| Stops wage garnishment & lawsuits | Stays on credit report (7+ years) |

| Stop wage garnishment & lawsuits | No court judgments are possible |

Best For: Awareness, but not as a proactive “strategy.”

Factors To Consider Before Deciding on a Debt Relief Approach

The following are the things that you should know when weighing the debt relief options:

- Your Credit Score: The effect varies widely depending on which option.

- Your Finances: Review how steady your income is and whether you’re able to pay.

- Type of Debt: Some are better for unsecured debt.

- Tax Implications: A forgiven debt may be considered income in some cases.

- Charges and Costs: Know all the costs of relief programs.

- Spending issues at source: No debt relief method will work if you don’t change the underlying bad spending habits (budgeting, discipline).

- Long-Term Objectives: Think about where this choice falls within your overall financial planning.

Locating Real Debt Relief Help

Here’s how to find the best debt relief solutions to help resolve your financial troubles while avoiding a scam.

- Do Your Homework: Be cautious about “it’s too good to be true” guarantees.

- Non-Profit Credit Counseling: Be sure the company is accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

- Responsible Financial Advisers: What is a ‘Reputable’ Financial Adviser? Comprehensive financial advice on topics such as debt planning.

- Lawyers: Answer questions for bankruptcy or complicated legal debt issues.

- What to Look Out For Red Flags: Upfront fees, which are illegal in some states; guaranteed results; pressure tactics; advice to cease payments, without a clear plan for your debt.

- Look Up Reviews and Complaints: Utilize the Better Business Bureau (BBB) and consumer protection bureaus to check if they are a reputable company.

Conclusion

In conclusion, comprehension of the different forms of debt relief is necessary for people dealing with financial difficulties. Both choices have their own advantages and disadvantages, and understanding them can enable you to make decisions with full confidence. Debt is manageable, though remedies are not free.

Consider your predicament and carefully consider your alternatives. Check with an expert when necessary. Remember, taking back control of your finances is the first step to securing your future.

FAQs

1. What are the different forms of debt relief?

Some common ones are debt management plans, debt consolidation, debt settlement, and bankruptcy.

2. How does debt settlement function?

Debt settlement is a negotiation with creditors to pay a lump sum that is less than the full amount of what you owe, usually precluding payments for some period.

3. How does filing for bankruptcy affect your credit?

After all, bankruptcy damages your credit report for a very long time, usually 7-10 years!

Leave a Reply