When people hear what is wealth management? beyond just investing, many people picture a stockbroker on Wall Street with their only focus covering buying and selling stocks for the ultra-wealthy. Investment management is one important part of the equation, but it’s not the whole enchilada.

Real wealth management is a far more comprehensive and holistic offering that encompasses all elements of a clients financial life. It’s also about developing a comprehensive long-term strategy that transcends simply growing assets and that includes protecting them, minimizing taxes and planning for the future.

It’s a dedicated partnership, here specifically to help you meet your most important life goals, rather than generate market returns. So what if the current The financial situation is complex and the old days of pensions and Medicare are long gone; you may have multiple retirement accounts, not to mention real estate holdings and different kinds of debt — do-it-yourself is a great way to rack up monumental mistakes.

What Is Wealth Management? A Comprehensive Strategy

In essence, wealth management is a professional service which encompasses financial planning, investment management and a wide range of other forms of financial advice. It’s made for clients who need extra attention to their financial world because of their substantial assets or more complicated financial world.

Unlike a transaction-stock broker or a transaction-only financial planner, or a one-time financial planner, a wealth manager serves as the primary point of contact for all of a client’s financial needs. They act as trusted advisors who help preserve, protect and enhance a client’s wealth for generations to come.

It is a long-term and dynamic relationship that changes with job conditions and life events and with new patterns of economic thinking.

More Than Just Investing: Key Elements of Wealth Management

Ironically, (g) one of the most critical functions of the wealth manager is to be able to coordinate multiple disciplines into a comprehensive and synergistic strategy. Here are the main ingredients, which go far beyond purchasing and selling investments:

1. Financial Planning

This is the basis of a wealth management relationship. It is a forward-thinking exercise that helps you chart your financial future. But it is about far more than just the numbers; it’s also about translating your life goals into a numbers-based financial roadmap.

A wealth manager will help you define your financial goals, which can range from saving for a down payment on a house to funding a child’s education to retiring at age, say 55, 62, or 70. They will look at your current financial position – what you have in cash flow, assets and liabilities – to create a realistic, actionable plan that is the roadmap for your financial story.

2. Investment Management

Though not the sole ingredient in the mix, investment management is an essential service. This approach helps you construct a balanced portfolio that is appropriate for your goals, risk tolerance and time-frame. A wealth manager will take the monkey work of portfolio construction, asset allocation and security selection off your hands.

They track the performance of the portfolio and, if necessary, automatically rebalance it to remain on target. In times like these, you need an advisor who can offer invaluable emotional support, helping you take a ‘chill pill’ and resist panicking, selling low and abandoning your long-term game plan.

3. Retirement Planning

A wealth manager assists you in addressing the one most important question: “Will I have enough to retire?” They do a comprehensive plan for your retirement that includes both the accumulation phase (saving for retirement) and the decumulation phase (withdrawal of your assets).

They will assist you with the intricacies of various retirement accounts, including 401(k)s, individual retirement accounts (I.R.A.s) and Roth accounts, and create a plan for taking distributions in the most tax-efficient way. The objective is to make sure your savings last a lifetime and can sustain the lifestyle you want.

4. Tax Planning

This is an area where a good wealth manager will add huge value. A proactive tax approach can mean a lot more money in your pocket in the long run and this will also contribute to increasing your total returns.

A wealth manager collaborates with your tax accountant to execute strategies like tax-loss harvesting, in which losing investments are sold to write off gains. They also provide advice on asset location, which involves putting tax-efficient investments in taxable accounts and higher-tax-rate investments in tax-advantaged accounts to optimize after-tax returns.

5. Estate Planning

This is about your legacy. The benefit of estate planning It is estate planning that will help to make sure that your assets are transferred to the next generation rapidly and exactly as per your desire.

A wealth manager can help you through this messy job, and may collaborate with an estate attorney to establish important legal instruments like wills, trusts, and powers of attorney. They can advise you on a range of trusts to protect your assets, minimize estate taxes and provide for future generations.

6. Risk Management and Insurance

Life is full of uncertainties that can throw even the best financial plan off course. A wealth manager does this for you by helping you assess your risks, and mitigate them, through an analysis of your insurance needs.

They will review your life, disability and long-term care coverage to make sure that you and your family are protected from what life can throw your way. And they can even provide businesses owners with business-specific risk management advice.

7. Philanthropic Planning

For many wealthy individuals, giving back is a top priority. A wealth manager can also assist you with structuring your charitable contributions in the most tax-advantageous manner. They can help you establish a donor-advised fund or a private foundation, enabling you to plan strategically how to give as well as how to plant your legacy.

Who Is Wealth Management For?

And while “wealth management” may sound like something that only the very rich need, the peace of mind and financial clarity you’ll get from at least a consultation on your options can help anyone who’s reached a level of financial complexity that they can no longer easily manage on their own. This could include:

- Young professionals: who have stock options or a large bonus and appreciate assistance integrating this new wealth into their overall financial plan.

- Entrepreneurs: who are looking to balance their personal money with the intricacies of small-business business (including exit strategies).

- Families saving for several big life goals: It says, college tuition for numerous children — and want a coordinated savings strategy across various accounts.

- Individuals nearing or in retirement: Those who are approaching or already retired and need a plan for turning their nest egg into sustainable income.

- People who have inherited a large sum of money or received a sizable legal settlement, and are seeking advice on how to protect and grow it wisely.

At the end of the day, a wealth manager is for anyone who has ever tried to organize all of the moving parts of their financial life or house them in one cohesive, strategic plan.

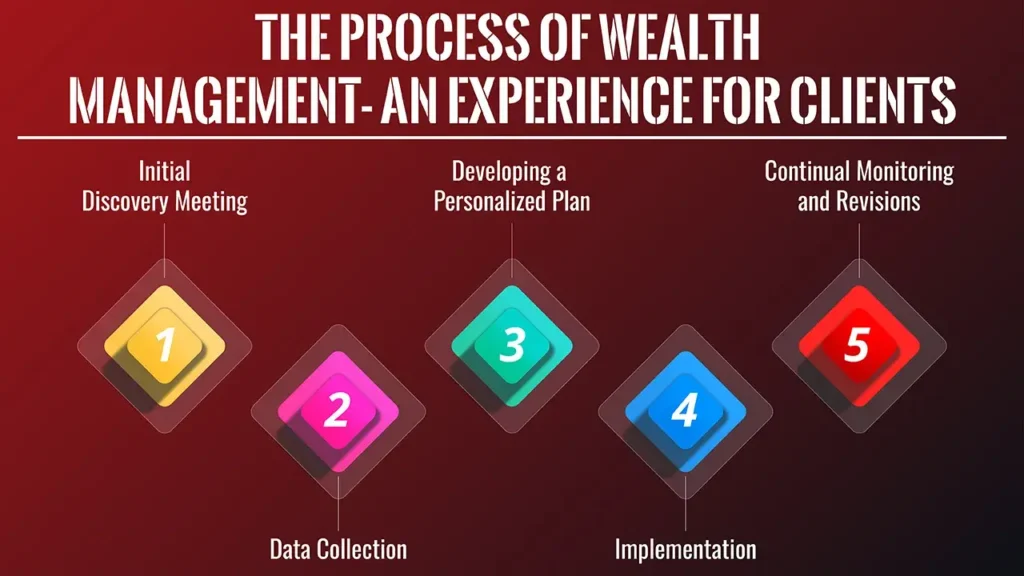

The Process of Wealth Management: An Experience for Clients

A relationship with a wealth manager is a continuous process of communication and trust. The process, in most of the cases, is as follows:

- Initial Discovery Meeting: This is just a get-to-know-each-other meetings. The advisor will inquire about your financial past and your future, your values and your worries. This is an essential part of trust and rapport.

- Data Collection: You provide us with all your financial, insurance, and legal documentation. Your wealth manager’s team will analyse this information to develop a full picture of your current financial position, and will highlight potential risks and opportunities.

- Developing a Personalized Plan: In analyzing all of your information, you will create a personalized, comprehensive financial plan. This model isn’t a template one-size-fits-all plan, but rather a customized plan with unique investment management, tax, and other financial strategies for you.

- Implementation: The plan is executed. That could include, for example, the opening of new investment accounts, the adjustment of your existing portfolio mix and working with other professionals such as a tax accountant or estate attorney to get the legal and tax aspects of the plan in place.

- Continual Monitoring and Revisions: Plans are living documents. The wealth manager keeps a close eye on your portfolio and financial affairs regularly to keep it on course with your goalposts and adjust for any changes in your life or the market. Frequent check-ins, sometimes on a quarterly, or even an annual level, mean you are never left out of step with your plans.

Conclusion: A New Wealth-Full Age

Wealth management is a discipline that is intended to provide clarity and control over your financial affairs. It’s a strategy that all your assets, from your investments and your retirement accounts, to your family’s future, are working together toward a common goal.

Knowing this more integrated view, you can be more enlightened in how you take care of your finance and construct a financial future that is genuinely robust.

Frequently Asked Questions

1. What’s the key distinction between a financial adviser and a wealth manager?

People tend to use the terms interchangeably, but a wealth manager is generally a more encompassing service.

A financial adviser might specialize in one or two areas in particular (retirement planning or investing, say), while a wealth manager encompasses every aspect of a client’s financial life, including estate planning, tax strategies and insurance.

2. What do wealth managers charge?

Generally speaking, wealth managers will have an annual fee as a percentage of assets under management (AUM).

That can be 0.5-2% or more, depending on what services you get and how big your profile is. Some may also assess a fixed fee or an hourly one.

3. When should you consider engaging a wealth manager?

There’s no one answer, but here’s a good rule of thumb: Consider hiring one when your financial life becomes too complicated for you to handle on your own.

Perhaps when you have more than one investment account, when you experience a big life event or when you have an explicit need for high-order tax and estate planning.

4. Can I just manage my wealth on my own?

Absolutely, lots of people can take care of their finances well. But as your wealth accumulates and your financial life becomes more nuanced, an expert can bring knowledge and a tactical perspective that can be difficult to replicate.

And, they can help you maintain a valuable objective perspective and keep you from making emotional decisions when markets swing.

Leave a Reply