Though many of us are savvy to the residential real estate market, the much larger and more vibrant commercial real estate (CRE) market does its own heavy lifting to keep the economy moving, providing the physical floorspace for the businesses that innovate and provide for each community.

In this piece, we will discuss the definition of commercial real estate and its categories as well as what makes it an attractive investment practice and the anchor of businesses.

What is CRE (Commercial Real Estate)?

Commercial Real Estate Commercial real estate is any property used for business purposes or brick-and-mortar businesses, whether to provide a working place, to offer merchandise or to provide manufacturing facilities.

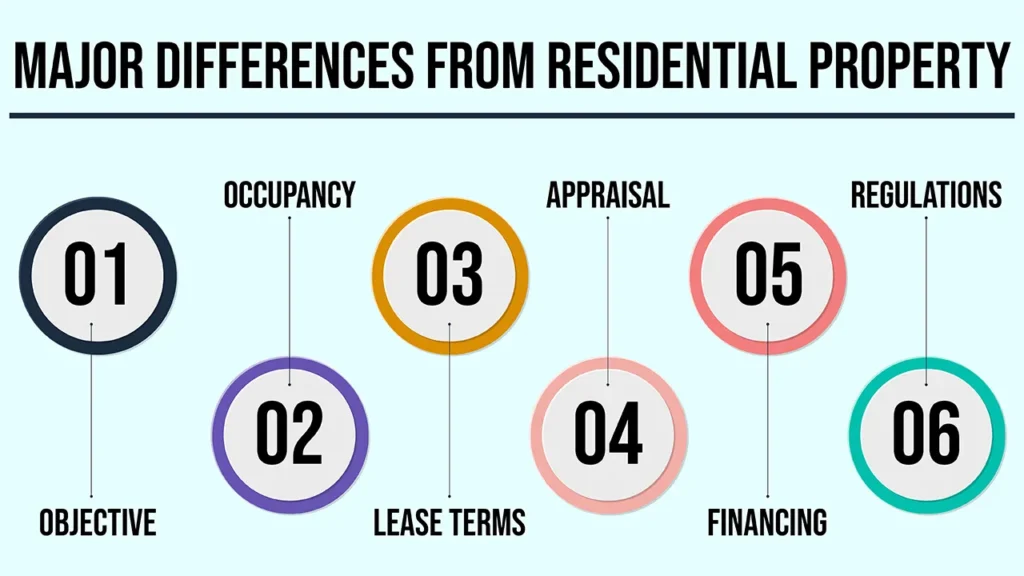

Major Differences from Residential Property

- Objective: Commercial enterprises are conducted from CRE, and people live in residential buildings.

- Occupancy: CRE tends to be occupied by business tenants, while residential tends to be owner-occupied or rented to individuals or families.

- Lease Terms: The typical commercial lease is much longer (often anywhere from 3 to 10+ years) and more complicated than a residential lease (usually 6 months to 1 year).

- Appraisal: In CRE, values are An appraiser might keep in mind the city’s projected revenue from property tax, with commercial property being a contributor.

- Financing: The loans for commercial real estate are generally more intricate and require a more substantial down payment than what is required from residential mortgages.

- Regulations: CRE is regulated by a set of commercial zoning rules.

How CRE Generates Profit

How do you make money with commercial real estate investment? CRE makes money mostly through rental income (charging businesses rent for using its space) and capital appreciation (increase in the value of the property over time).

Commercial Real Estate – Major Types

Commercial real estate is a large ecosystem involving various types of property, having its specific features and conditions. Here are the primary sectors:

1. Office Buildings

Buildings intended for commercial use, providing spaces for administrative work, meetings, and working.

Common Sub-types:

- Urban/CBD (Central Business District) Offices: These are the high-rise buildings you see in the heart of a city, potentially skyscrapers.

- Suburban Offices: Small to medium-sized buildings in office parks, outside of town/city centres.

- MOBs: Spaces built out for healthcare providers, such as clinics, labs, or hospitals.

Categories: Class A, B, and C divided by geography, age, amenities, and construction quality (Class A: high quality, premium; Class C: old, basic).

Typical Features: Open-plan layouts, individual offices, shared spaces and state-of-the-art facilities are common.

2. Retail Properties

Sites where commodities & services are exchanged with the final users.

Common Sub-types:

- Shopping Centres: Big complexes of closed shops, etc., along with restaurants and amusements, with large department stores as anchors (main stores).

- Strip Centres/Shopping Plazas: Open-air complexes comprised of a row of stores or service outlets and parking in front of the stores.

- High-Street Retail: An individual shop, or a series thereof, situated on urban streets that are sidewalk-crowded, for high visibility and high pedestrian traffic.

- Outlet Centres: Usually found on the outskirts of towns and cities with cheaper brand-named goods.

- Standalone Retail: Single structures rented by 1 retail tenant (for example, a fast-food restaurant or bank branch).

Key Attributes: The location needs to be prime, visible and have a high foot traffic. Leases usually involve a basic rent plus a % of sales (called a percentage lease).

3. Industrial Properties

Plants and centres for production, storage, manufacturing, logistics, and so on?

Common Sub-types:

- Warehouses: Big spaces for storage and distribution, important for e-commerce and logistics.

- Factories: Capable of producing merchandise, typically with machines primarily dedicated to that purpose.

- Flex Industrial: Buildings that house both industrial (warehouse/production type) and office.

- Research & Development (R&D) Buildings: Specialized structures for scientific and technological discovery.

- Cold Storage: Facilities that store temperature-controlled freight.

Traditionally positioned beyond city limits near transportation hubs (roads, rail, ports). The supply chain is driving demand.

4. Multifamily Properties

Residential buildings with a number of rental units to be rented to tenants. Residential, but if you own them for income from multiple units (usually 5+) – the real estate is considered commercial real estate.

Common Sub-types:

- Apartment Complexes: These can be garden (low-rise, with space) as well as mid- and high-rise blocks of flats.

- Duplexes, Triplexes, Quadplexes: A building comprising 2, 3, or 4 units, respectively.

- Student Residences: Buildings constructed for the sole use of university students.

- Senior/Assisted Living Facilities: Elderly housing with care options.

Key Features: Generate predictable streams of rental income. Valuation typically is based on the number of units and potential rental income.

5. Hospitality Properties (Hotels & Resorts)

Buildings, structures or buildings used for lodging or feeding of travellers and guests.

Common Sub-types:

- Full-Service Hotels: Amenities (dining, room service, concierge) are available.

- Low-budget/limited-service-type hotels: Most offer little more than a room to sleep in.

- Extended-Stay Hotels: Intended for extended stays, sometimes featuring kitchenettes.

- Boutique Hotels: One-of-a-kind experience, less than 100 rooms, full-service accommodations.

- Resorts: Huge, self-contained hotels with a full range of facilities (e.g., golf courses, spas).

Key Features: Performance is closely linked to tourism, economic patterns and events. Streams of revenue are room rates, food and beverage and so on.

6. Special Purpose Properties

Special-purpose properties intended for use by a very specific user that aren’t readily compatible with other uses are often difficult to adapt to other uses.

Examples: Amusement parks, churches and schools theaters, museums, self-storage facilities car washes, parking garages data centers sports arenas golf courses

Features: Typically very tailored to their function. Valuation tends to be more challenging as there are fewer comps available. May be resistant in certain niches.

7. Land

Raw land is undeveloped land that you can purchase for development, farming, or speculation.

Typical Sub-types: Raw land, farm and ranch land, infill land (within developed areas), and brownfield properties (previously developed, necessitating cleanup).

Key features: Required investments: None. High upside potential with zoning or development. Could be the riskiest (but also the most lucrative) depending on location and future development.

8. Mixed-Use Developments

Individual properties or mixed-use complexes (such as stores on the first floor, offices on a higher floor and residential units on top).

Hallmark Features: Strive to have vibrant communities that offer a complete lifestyle with living, working and shopping available in close proximity. Offer diversification within one project.

Why Investors Need to Understand CRE Types

- Tailored Investment Decisions: Property assets have different risk-return characteristics, rates of liquidity and management demands.

- Market Cycle Sensitivity: Some (hotels, retail, for example) are more economically sensitive than others (multifamily, industrial).

- Lease Structures: Knowing what standard lease types (Gross, Net, Triple Net) are is important because they can range greatly by property type and really define what a landlord’s responsibility is, as well as what net income will be.

- Financing Implications: Lenders see different types of CRE as carrying different levels of risk, affecting terms and the availability of loans.

Conclusion

Overall, commercial real estate is a broad and complicated asset class with different types of properties meeting different types of business demands and investment goals. To the layman, being able to tell these definitions and classes apart is every budding commercial investor’s first port of call.

Call to Action

Get to know more information: See our step-by-step resources for individual types of commercial property! Chat with a commercial estate expert…basically get into commercial real estate, bro!.

Frequently Asked Questions

1. What is the basic difference between residential and commercial property?

The main contrast is the residents are to live in residential properties, whereas commercial properties are for conducting business and earning rents.

2. When are apartment buildings considered commercial real estate?

Apartment buildings with five or more units (residential) are considered commercial real estate and thus are held for income, while buildings with four or fewer units are considered residential and thus are not held for income.

3. What is a “Class A” Office Building?

A “Class A” office building is a prime piece of property that features high-grade construction, desirable locations and premium amenities, which can result in higher rental rates.

Leave a Reply