In 2025, Finance reimagined Financial planning and analysis is the driver of modern business strategy, and leading organizations are looking up where to be so they can rewrite their future. With increased competition and changing markets, companies require strong mechanisms for understanding of their finances, planning for the future and taking important decision.

This article applies real-world examples to shed light on what financial planning and analysis 2025 is in real life and how its top priorities are being done in the present with sets of processes, tools, and evolving value.

Financial Planning and Analysis 2025 Definition

Financial planning and analysis 2025 Financial planning and analysis 2025 is a title for a set of processes that enable the Office of Finance to, Plan, Analyze, and Monitor its performance over time. This practice involves budgeting, forecasting, financial modeling and strategic planning as it pertains to the company’s financial health and to inform significant business decisions.

In contrast to old school accounting, which is predominantly about recording what has already occurred, financial planning and analysis 2025 is about the future. It leverages data-driven intelligence to predict market shifts, allocate resources, and point the organization in the right direction.

The Core Components and Processes

Contemporary enterprises depend on a handful of consolidated functions within the financial planning and analysis (FP&A) 2025:

- Budgeting: The detailed planning of how resources will be allocated over a period of time.

- Forecasting: Estimating future revenues, costs and other financial metrics based on historical trends and market conditions.

- Scenario Analysis: Looking at the business implications of various economic or industry conditions.

- Performance Monitoring: Observing to what extent the actual results for a specific project, program, or organizational line/comparison deviate from the budgets and forecasts as one step to recognize gaps and potentials.

It is these components that financial planning and analysis 2025 enables leaders to answer critical questions by asking whether to invest in new projects, expand geographically or change pricing strategies.

The Role of Strategy in Contemporary Organizations

In today’s highly volatile business environment and analysis 2025 is essential. By this role connects the boots on the ground work and the big picture thinking. It enables decision making based on true intelligence through leadership.

For example, CFOs and finance teams rely on financial planning and analysis 2025 to assess the implications of mergers and acquisitions, to assess the impact of market changes, and to analyze the finances behind long-term investments.

By having oversight into the entirety of the company’s finances and operations, the financial planning and analysis team can serve as a liaison to the business for all functions — enabling better alignment, more nimble decisions, and a joint focus on strategic opportunity.

The Evolution of Financial Planning and Analysis 2025

A new field is born in 2025 One of the fields which has advanced most under the influence of technological development, data analysis and shifting business needs is the field of practices, and the banking game in particular.

Cloud Financial Systems, Real-Time Data Dashboards, and Advanced Analytics have made financial planning and analysis 2025 more efficient and accurate and insightful than ever.

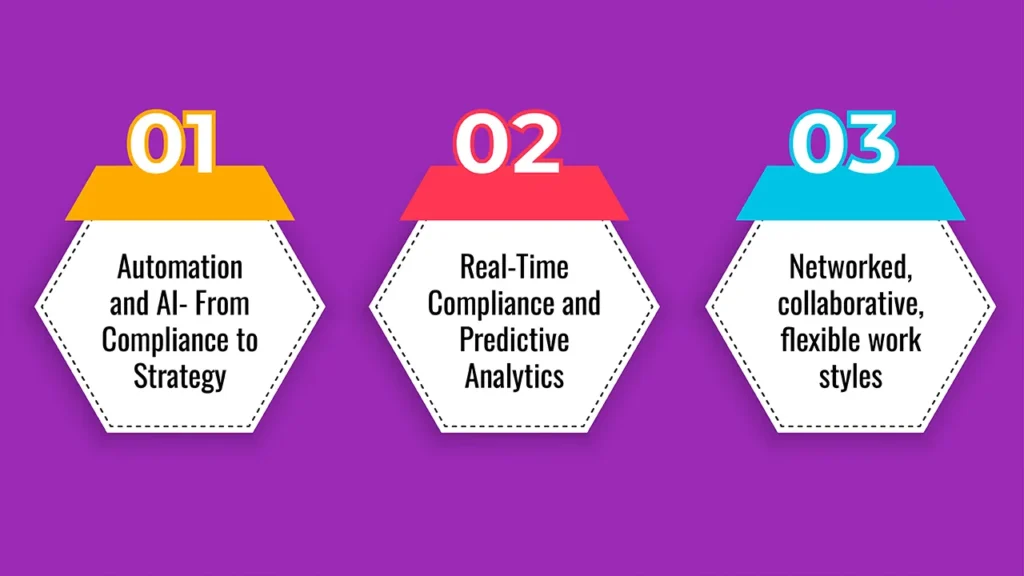

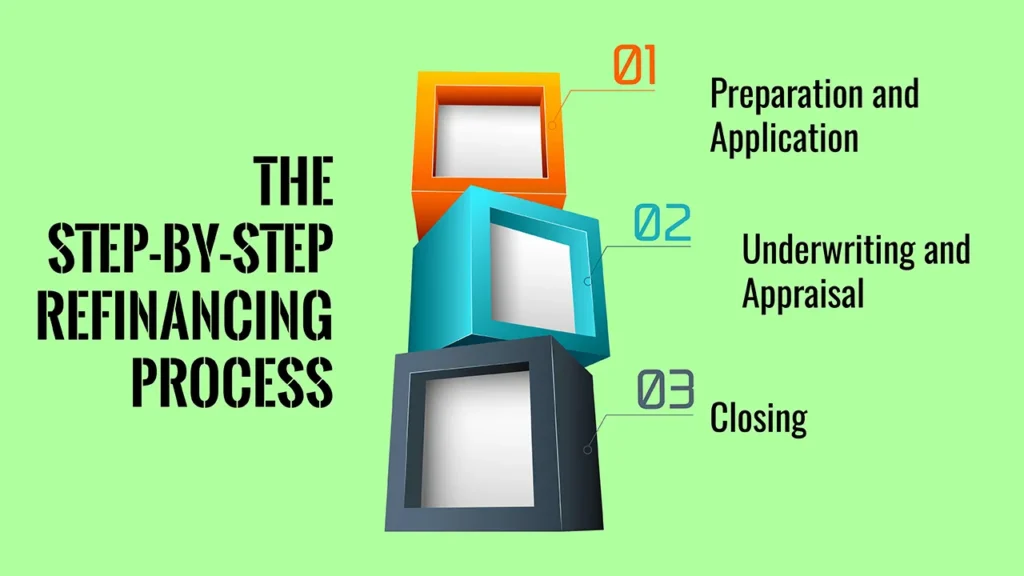

Key changes include:

- Automation Time consuming activities such as data merging have been automated, allowing the analysts to focus on more value add work.

- Integration FP&A solutions much more integrated than in the past, with the ability to bring in operational, financial and market data, providing a fuller view.

- Scenario modeling Sophisticated tools for scenario analysis are available for businesses to see how a market shock, regulatory change or supply chain disruption could affect them.

The answer: Collaboration: Contemporary systems are designed to facilitate cross departmental collaboration ensuring the entire business organization enjoys the benefits of agile, integrated planning.

The Necessary Levels of Financial Planning and Analysis (FPA 2.0) 2025

FP&A professionals 2025 are technically savvy and strategically oriented. They must master:

- Analytical skills (understanding financial and operating metrics)

- Communication (communicating what findings mean to non-financial audiences)

- c/Technical-competence (knowledge and use of modern planning tools and analytics)

- Problem-solving (creative thinking to approaching forecasting and budgeting issues)

- Delivery partnership (partnering with management and other teams to align resources and strategy).

Practical Benefits for Organizations

Findings Companies that were ahead in their financial planning and analysis 2025 investing into robust financial planning and analysis 2025 capabilities enjoy several advantages:

- Informed Decision-Making: The leadership receives clear info to help make complicated decisions.

- Resilience: Companies can quickly respond to changes in the market or regulatory environment with accurate forecast and scenario planning.

- Resource efficiency: Capital and labor are invested in the most valuable projects.

- Sustainability to profitability: Powerful analysis uncovers cost saving opportunities and revenue generating potential.

- Investor Trust: When investors and stakeholder see clear evidence of sound financial planning, they have confidence that your firm is highly reputable.

The Future of FP&A in 2025

Organizations face the challenges of a world shaped by widespread economic uncertainty, climate pressures, and digital disruption, and as these new global realities take hold, financial planning and analysis (FP&A) 2025 is responding. Coming years will see more developments:

- Broader deployment of artificial intelligence to create more predictive forecasting models to give managers earlier warnings about threats or opportunities.

- Integration with wider sources of data for forecasting, such as external market movements, social sentiment and geopolitical occurrences.

- More attention to sustainability and ESG (environmental, social and governance) metrics in financial planning.

- Businesses that adopt these are likely to experience more agility, better strategic focus and greater long-term success.

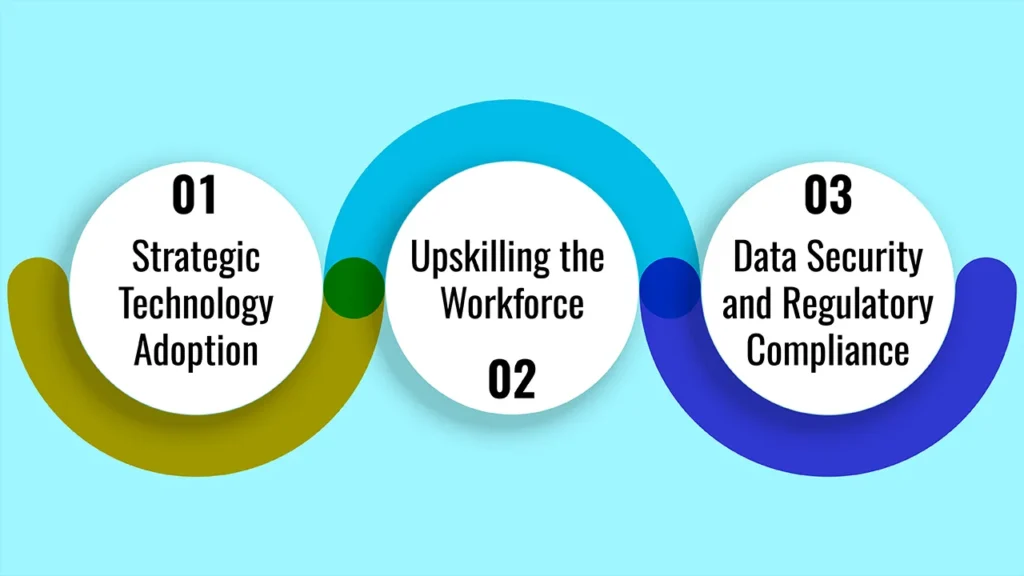

Acts to be taken towards Financial Planning and Analysis 2025

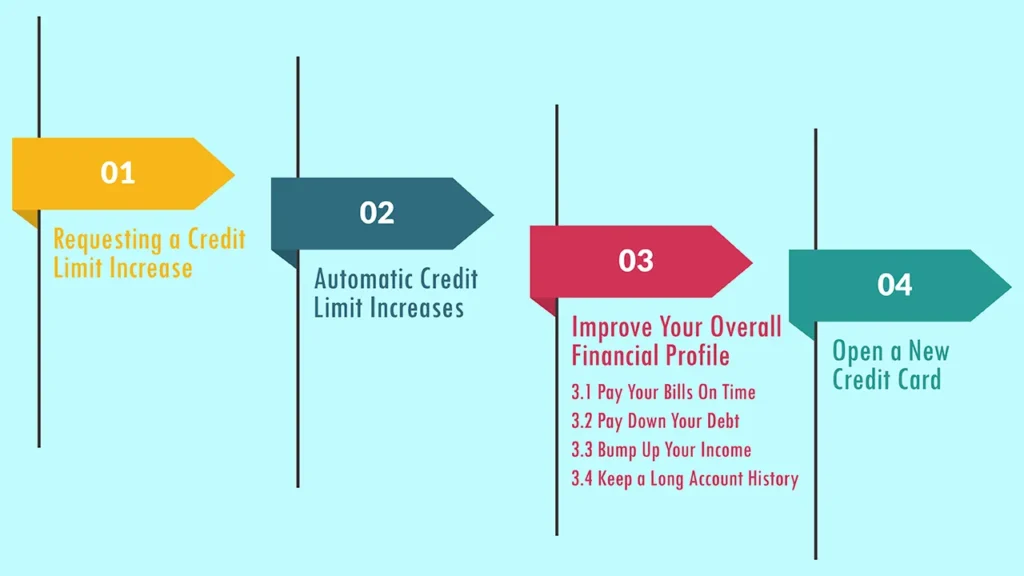

For companies wanting to improve an existing or establish a successful financial planning and analysis 2025 model, they should focus on these steps:

- Establish Clear Goals: Know the financial visibility and strategic results the company hopes to gain.

- Create Cross-Functional Teams: Make sure you involve finance, operations, sales, and marketing for a 360 view.

- Invest in Technology: Invest in a strong FP&A software solution that can automate, analyze and collaborate.

- Create Standardized Practices: Make sure that you have repeatable processes for budgeting, forecasting and reporting.

- Train Employees Non-Stop: Employees need to be the latest and greatest with the tools, regulations, and analytics.

- Watch and Tweak: Constantly re-check results, fine-tune artificial models, and adapt procedures when the environment shifts.

Actual Example: Financial Planning and Analysis 2025 in Practice

As the year 2025 unfolds, a major global retail organization is grappling with market velocity and uncertain consumer demand. Through financial planning and analysis 2025, its finance team constantly gathers sales and expense data from a broad range of regions, and directs automated forecasts to identify changes in demand sooner.

When a major supplier experiences a disruption, scenario analysis uncovers the extent of the financial damage to supply chains, and margins. The management are quick to react, shuffling resources and modifying pastoral plans to turn a profit, and forestall any damning losses.

That kind of agility available to companies only when financ ial planning and analysis 2025 becomes integral to the heart of business management shows the way for other organizations to move from surviving to thriving as they go forward.

Final Words

FP&A 2025 As we move forward, financial planning and analysis is not just a key finance function – it is a critical competitive driver and crucial contributor of long-term success.

Instituting financial planning and analysis 2025 as the epicenter of strategic planning enables companies to be better equipped to respond to the anticipated as well as the unanticipated, paving the way for smarter, healthier financial outlooks.

Frequently Asked Questions

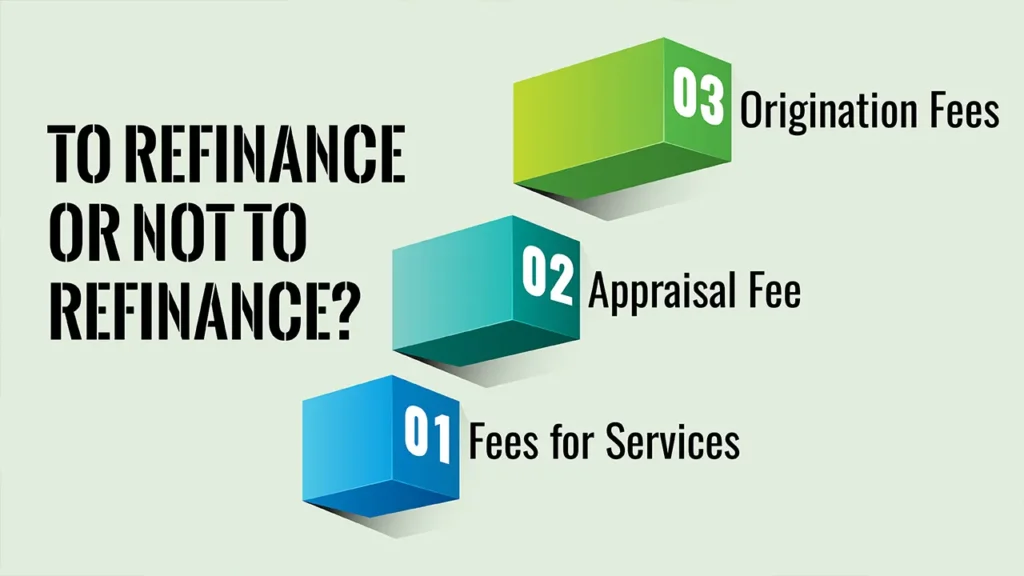

1. Difference between old vs. new accounting and financial planning and analysis 2025?

The traditional accounting is primarily concerned with the recording of past transactions and events, the preparation of financial statements on the basis of that data and regulatory concerns.

FP&A 2025 is anticipatory and strategic, focused on predicting future performance, planning around the allocation of resources, and driving business decisions.

Why FP&A 2025 matters to organisations?

Make smarter decisions, faster financial planning and analysis 2025 helps business leaders make the right decisions for the future of the business, by delivering secure, consistent, and accurate information.

It opens the door for organizations to react more easily to changes in market conditions and regulations, while driving resilience and long-term growth.

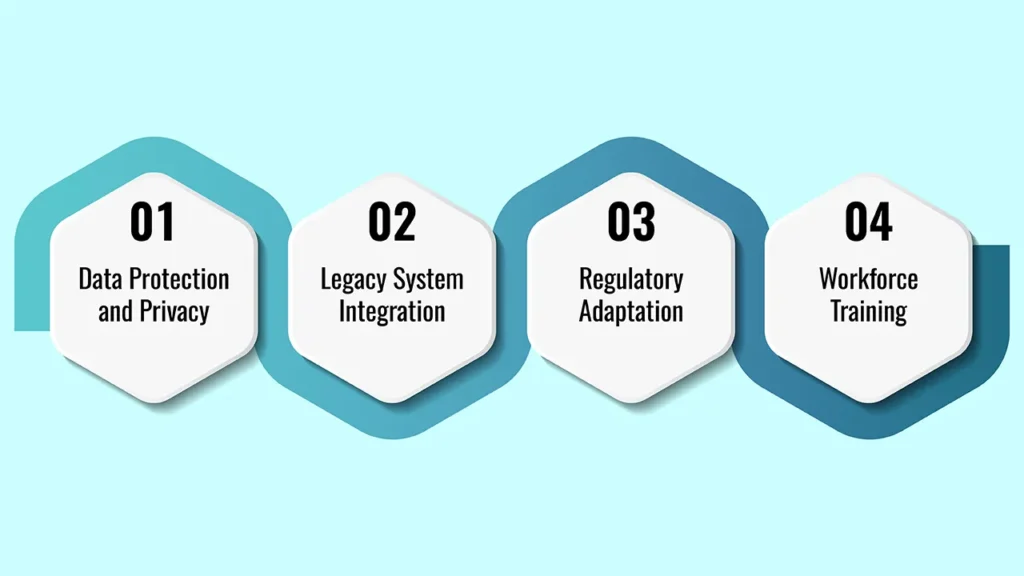

What are, in 2025, the technology trends that are affecting financial planning and analysis?

Technology is helping to modernize financial planning & analysis 2025 – faster, smarter, more collaborative.

Key trends involve use of cloud-based financial software, streamlining of manual tasks, increased use of advanced data analytics, real-time dashboards and integration of scenario planning tools.