You probably already know that your credit score is instrumental in everything from making a critical purchase (house or car) to scoring a good rate on a credit card. But there is another key score in play that you might not be aware of, a score that is also quietly influencing your insurance premiums. This much-misunderstood measure is your insurance score. Knowing it can be money in your pocket.

Learn about insurance scores, their role in the insurance industry, and see examples that illustrate their importance in premium calculations. By the time I’m finished, you’ll be equipped to make sense of this important element of your insurance bills.

Part 1: Understanding the Insurance Score – What It Is (and What It Is Not)

A shorthand for it: “credit-based insurance score.” An insurance score is a number insurance companies use to predict the likelihood a person might file an insurance claim and how much that claim would cost them.

Key Characteristics:

- It’s Predictive, Not Indicative of Creditworthiness: Your insurer’s credit-based insurance score is based on the contents of your credit report but the score isn’t designed to reflect how good you are at paying back money. Consider it a risk assessment tool specifically for insurers.

- Proprietary Models: There is no one-size-fits-all “insurance score.” Each insurance company, or the third-party scoring firm with which they collaborate (FICO or LexisNexis in some states, for instance), is likely to be using its own proprietary, and frequently mysterious, system. This means that your score can differ from one insurer to another.

- Sprung From Your Personal Score: Unlike a credit score that’s openly available for you to check as your FICO Score, VantageScore, or CIBIL Score (if you’re in India), the thing about insurance scores is that they tend to be locked away inside insurers and not shared in the same kind of open way. But you can usually ask your insurer whether a credit-based score was used to rate you and which “risk tier” that you are placed in.

How it’s different from a typical credit score:

- Purpose of a Credit Score: A credit score provides a glimpse into your creditworthiness and whether or not you are inclined to return the monies one borrows. An insurance score is a calculation that estimates your chances of filing an insurance claim and the cost of doing so for the insurance company.

- Emphasis on Factors Used: They both use your credit file, but models for insurance scoring might have a different emphasis on certain factors. For example, past payment history (actually paying your bills on time) is weighted heavily because it is skewed towards indicating overall financial responsibility and, statistically, lower insurance risk.

- Impact: Your credit rating impacts your loans, your mortgage, and terms for credit cards. Insurance Score Is Most Important For Insurance Rates & Coverage Your insurance score has a direct effect on insurance rates and, with some companies, whether or not you will actually get coverage.

- Inquiries: When an insurance company requests your credit information in order to calculate an insurance score, that generally counts as a “soft inquiry” (or “soft pull”). This type of search does not hurt your traditional credit score.

Part 2: The Reason: Why Your Insurance Score Is Used by Insurers

Insurance scores have emerged as a potent fact of life with which insurers write and price risks.

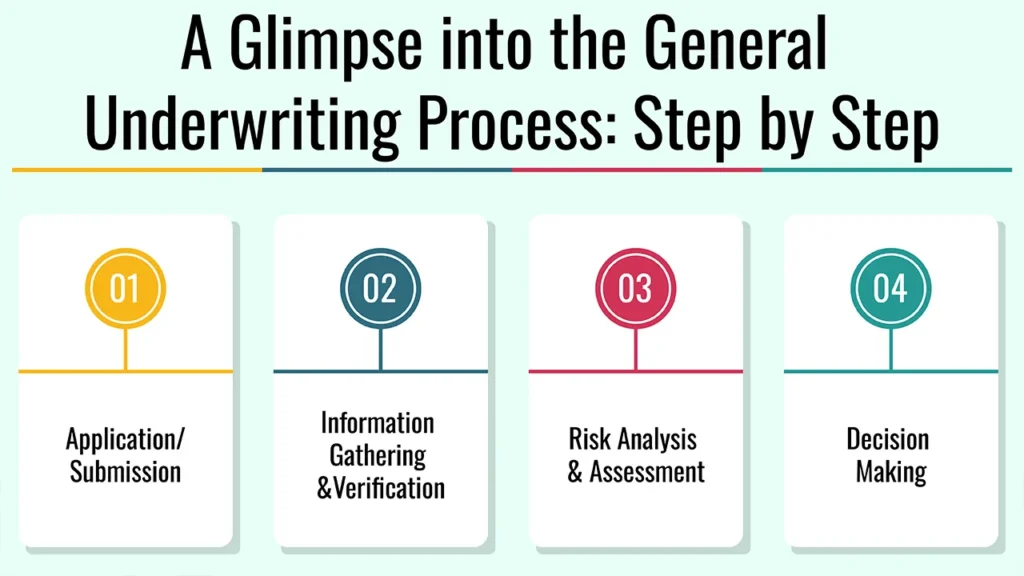

Risk Assessment and Underwriting:

Objective: The key aim is to evaluate the risk represented by a prospective insurance applicant. In terms of data, those with high insurance scores are less likely to make a claim (or make a very expensive claim) meaning less risk. It is the opposite: A lower score indicates a higher level of perceived risk. This enables insurers to assess a large volume of potential policyholders rapidly and uniformly.

Premiums that are Fairly Priced (from the Insurer’s Stand Point):

Research conducted in different markets (including by regulatory agencies in some areas) has shown a statistical link between credit-based insurance scores and the likelihood of future claims. Insurers say that scoring allows them to:

- Provide More Useful Premiums: By more accurately segmenting risk, they can more accurately match premiums to the expected cost of claims.

- Reward for Lower-Risk Customers: The low risk customers, who are unlikely to make any claims, then they can get lower premiums.

- Mitigate Financial Risk: Insurers can better manage financial liabilities and ensure that they hold enough money to pay claims by correctly pricing for the risk.

Eligibility for Coverage:

For some competitive markets – or some kinds of policies – a very low insurance credit score could even determine whether an insurer will even offer you coverage at all, or it may restrict the types of policies and discounts available to you.

Part 3: What Makes It Up?

Insurance scores, for all their gradations and nuance, account for many of the same categories as traditional credit scores, usually with adjusted weights: Your payment history, the total number of accounts you hold, the number of times you’ve applied for credit, the type of credit you have and the amount of credit you use, relative to your limits. These typically include:

- Payment History: History of paying bills on time (credit card bills, loans, utilities). This is frequently a major contributor.

- Outstanding Debt/Credit Utilization: The proportion of outstanding debt you’ve accumulated relative to your total available credit.

- Credit Length: The age of your credit accounts.

- New Credit: (accounts or inquiries) – (Number of recently opened accounts, and the number of inquiries for new credit)

- Credit Mix: What mix of credit accounts you have (credit cards, mortgages, car loans).

Personal information like your income, race, gender, marital status, nationality, or where you live (except to the extent that they are used in assessing the risk of localized occurrences like natural disasters) is typically NOT considered when creating your credit-based insurance score.

Part 4: What this looks like in the Wild & Impact

The “why” behind insurance scores helps put a face on their real impact to your pocketbook.

Impact on Premiums:

What is more directly affected by your insurance score is the premium you pay for a policy such as auto (car) and homeowners (property) insurance.

Example 1: Auto Insurance Consider two drivers with the exact same driving record, type of car and location. That same driver with a good insurance score might only pay $1,000 / €900 / ₹75,000 per-head per year for car insurance. Meanwhile, a driver who has an otherwise spotless record could pay several times (e.g., as much as $1,500 / €1,350 / ₹110,000 or even more) for the same coverage due to his or her deemed riskiness.

Example 2 (Homeowners Insurance): Homeowner with good insurance score may be eligible for more favorable rates or discounts on home insurance. On the other hand, a worse score might result in steeper premiums, or fewer options for coverage for their home.

Impact on Policy Eligibility:

In fiercely competitive insurance markets, a chronically poor insurance score might mean that company occasionally will not offer you its very best rates, or in rare cases, won’t take you on if they find that the hazards outweigh their acceptance criteria.

How to Increase Your Insurance Score (Indirectly):

Because insurance scores are based on your credit report, one of the best things you can do to potentially boost your insurance score is to practice sound financial habits that have a positive impact on your credit history overall. These include:

- Pay Your Bills Timely: And quite possibly the single MOST important thing you can do for a solid credit history. Paying on time, every time, shows you are responsible.

- Keep Low Balances on Your Credit Cards: A high credit utilization can drag your score down (how much of your credit you’re using). Strive for a much lower balance, far below the stated limit.

- Avoid Taking Too Much New Credit: When you attempt to borrow money too often over a short time frame, it will be considered risky behavior.

- Keep a Long Credit History: The longer you have successfully handled credit, the better. Don’t shut down old, well-controlled accounts when you don’t need to.

- Check Your Credit Report Regularly: Request your credit report annually (and often available free in most countries) and challenge inaccuracies. False information could be used to unfairly reduce your score.

Conclusion

The score may be an invisible thing, but when it comes to how much you’re paying for insurance, its impact is all too visible. It is a vital tool for insurers to use to evaluate risk and price policies.

Now, you can’t exactly “check” or even “work on” your insurance score per se, but fortunately, if you concentrate on good financial habits – paying bills on time, using credit responsibly and maintain a good credit history – you are making an impact on the underlying information insurers are using.

Taking this proactive approach not only serves your overall financial health, but can also prepare you for better rates and terms when it’s time to safeguard your most precious assets.

Wondering how your money behavior could be affecting your insurance premiums?

Frequently Asked Questions

1. May I review my insurance score?

Contrasting from a typical credit score, an “insurance score” is typically not something that insurers directly offer to consumers. However, you can review your base credit report (with bureaus like CIBIL, Experian, Equifax, or TransUnion, depending on your country), which is essentially what the auto insurance score is built upon.

2. How long do items on my credit report cause a negative to my insurance score?

Negative information (such as late payments, bankruptcy, or collections) is information that generally stays on your credit report for a number of years according to the law (in the US, up to 7 years; the period may be different in other countries) and may continue to affect your insurance score during that time. They become less effective the more they are used.

3. Will filing an insurance claim lower my insurance score?

In general, no. Filing a claim – say for an auto accident or property damage – directly affects your claims history at that particular insurer, which is a separate factor insurers use, sometimes with even greater weight than your insurance score. Your history of claims does not appear on your credit report.