Are you trying to keep track of investments, savings accounts, taxes and future goals and seeking if there’s a strategy that might pull it all together? What is comprehensive financial planning? is the first step towards gaining understanding and taking charge of your entire financial situation.

This blog is going to take the mystery out of the comprehensive financial planning process and explain what it really means, the different aspects of it, the benefits of comprehensive planning, and how this is your particular approach to financial freedom and security.

Part 1: What Is Comprehensive Financial Planning All About

A Definition of Your Whole Financial Picture, Together

- Simple Definition: Financial planning is a way of managing your money and assets so that you can achieve your life goals. It’s not about one thing (investing or budgeting) but bringing together all the pieces of your financial life.

- Differentiation from Focused Services: It transcends individual services (for example, just buying insurance or just investing in stocks). It’s about how every financial choice affects others.

- Core Principle: The aim is to develop a unified strategy that aligns your money with your life dreams.

Part 2: The Key Components of Comprehensive Financial Planning

1. Define Financial Goals

- Detail: The key to successful financial planning is to set specific, measurable, achievable, realistic and time-limited goals.

- Examples: retirement age and lifestyle, college funding, home purchase, starting a business, estate planning, and major purchases.

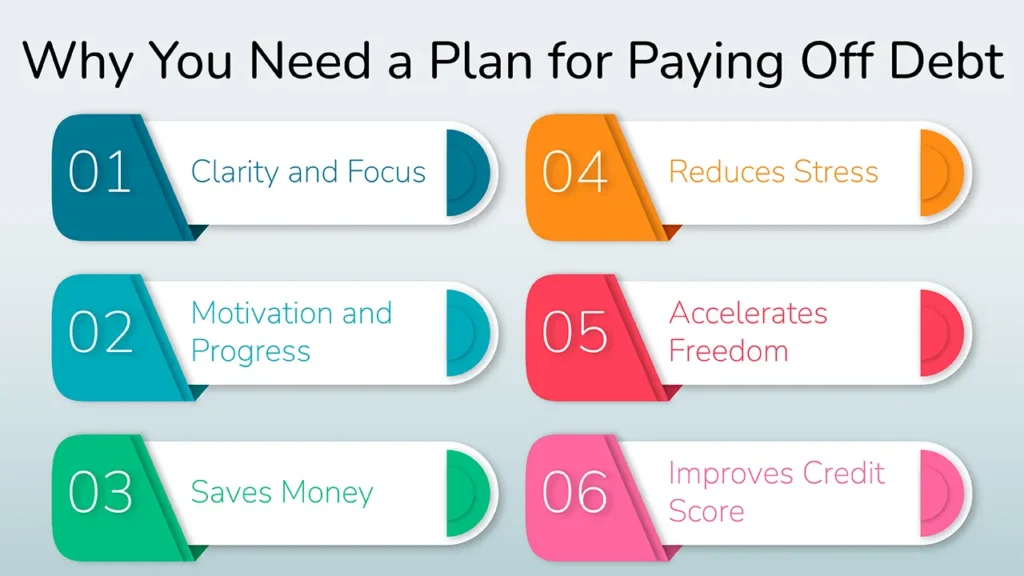

2. Controlling Your Cash Flow and Budgeting

- Detail: Gnitor Small money – how And I mean horrible, but true way – if you don’t know where your money is coming from and where it’s going, you need to know this so you can prepare where your money is going and for how long.

- What To Do: Establish a budget, monitor income and spending, minimize spending and zero in on savings opportunities.

3. Investing, Planning and Managing a Portfolio

- Detail: Establishing an investment plan that is suited to your needs, risk tolerance, and time frame is critical.

- What To Do: Asset allocation, investment vehicles (stocks, bonds, funds, and real estate), and portfolio reviews and rebalancing.

4. Retirement Planning

- Detail: Projecting retirement income required, planning for longevity and maximising retirement savings vehicles are important factors.

- What To Do: Estimate your costs, then use tax-favourable retirement plan accounts and withdrawal schedules to pull it out.

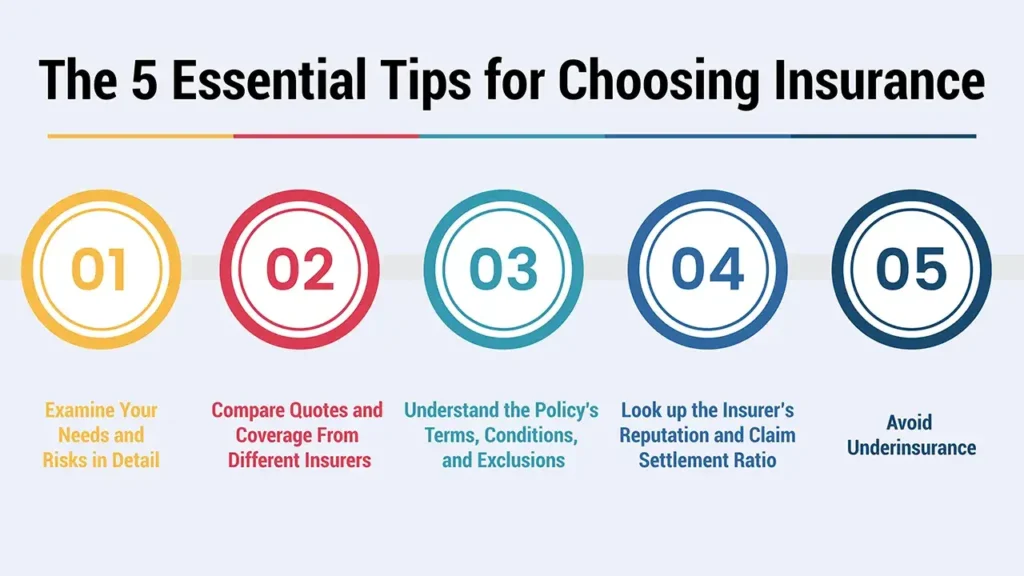

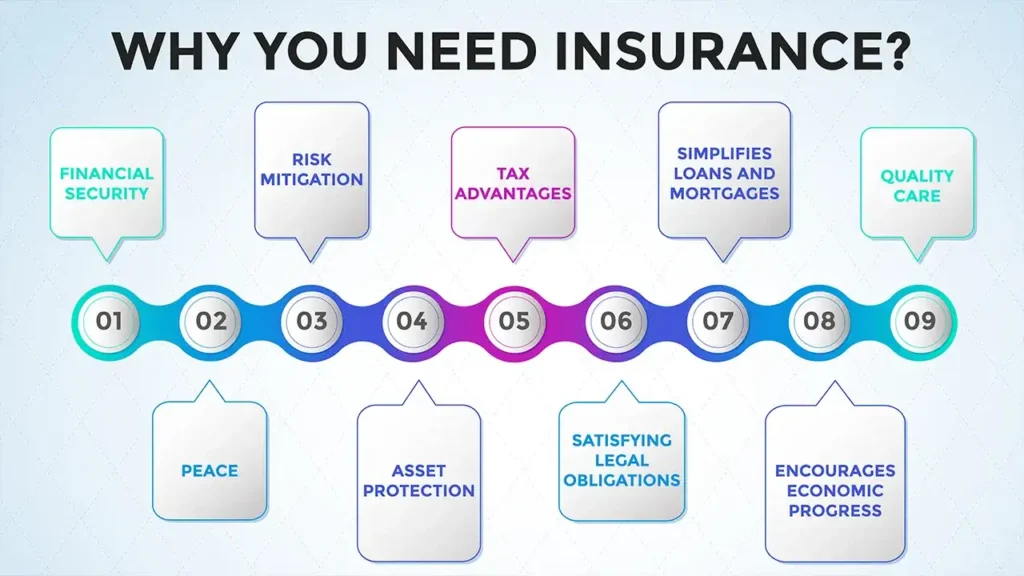

5. Insuring and Managing Risk

- Detail: Securing your money, your income, and your family in the event of the uncertainties in life is critical for your financial life.

- What To Do: Evaluate life, health, disability, long-term care, home and auto insurance needs; review existing policies periodically.

6. Tax Planning

- Detail: Having a plan to legally prevent taxes from being the roadblock to achieving or maintaining freedom should be high on your priority list.

- What To Do: Employ tax deductions, credits and tax-efficient investment structures to manage your taxable situation.

7. Estate Planning

- Detail: It’s important to make sure that your assets are distributed as you wish (and in a tax-efficient manner) in order to avoid probate costs.

- What To Do: Draft wills, trusts, powers of attorney and beneficiary designations and think through charitable giving strategies.

Learn the basics of estate planning from Nolo’s Essential Estate Planning documents.

Part 3: The Benefits of Comprehensive Financial Planning

Why You Should Have a Comprehensive Financial Plan.

- Know and Control: See exactly where your money goes and be confident that you’re making good financial decisions.

- Goal Attainment: Your money will work to achieve your goals and the life that you want to live.

- Peace of Mind: Decrease financial worry and stress in the knowledge that you have a plan.

- Capital Efficiency: Manage your capital effectively with aligning and tax benefits.

- Protection: A fortress against life’s surprises and downward market movement.

- Flexibility: Be flexible with your plans; allow them to change with your life and the market.

Part 4: Who Needs Comprehensive Financial Planning

Is It Right for You?

High Net Worth and Beyond: Essential for the wealthy, comprehensive planning is advantageous to anyone who’s serious about their future, irrespective of how wealthy he/she is.

Life Stages:

- Young Professionals: Getting off to a good start and handling debt.

- Families: Emphasising education funding and protection.

- Mid-Career: Focus is on building wealth and planning for retirement.

- Pre-Retirees: Managing wealth and preparing for retirement.

- Retirees: Income management with an eye toward legacy.

- Complex Issues: If you are a business owner, have inherited money, earn income from multiple sources or have foreign assets, comprehensive planning can be very beneficial.

Part 5: How to Engage in Comprehensive Financial Planning

Working with a Financial Planning Services Provider:

The role of a financial planner: your mediator, guide, and accountability partner through the financial process.

Choosing the Right Planner:

- Credentials: You want to see certificates, such as CFP® (Certified Financial Planner) or its equivalent.

- Fiduciary Duty: Make sure they are legally committed to acting in your best interest.

- Fee Structure: Consider their compensation structure (fee-only, fee-based, commission).

- Speciality: Check if they are experienced in a field related to your own circumstances.

- Client Relationships: Consider ease and style of communication.

- The Process: First meeting, gathering data, plan design and then follow-up reviews.

Conclusion: Empower Your Financial Future with a Comprehensive Plan

In conclusion, “What is comprehensive financial planning?” is a comprehensive and integrated management of your goals, cash flow, investments, retirement, risk, tax and estate. It’s a process, not an event. The greatest tool you have to achieving lasting financial freedom and security is a strong, elegantly structured, regularly reviewed comprehensive financial plan.

Call to Action

Insist they get started on planning for the future by taking simple steps today.

Frequently Asked Questions:

1. What is the primary difference between “comprehensive financial planning” and just “investment management”?

So investment management is all about how your money is invested. But comprehensive financial planning involves a broader lens that includes investments as just one piece of your financial life, alongside budgeting, taxes, retirement, insurance, estate planning and every other aspect of your financial life to attain those larger life goals.

2. Is financial planning only for the wealthy?

No. And though very high-net-worth individuals may use it due to their complex financial situations, comprehensive financial planning is helpful for anyone serious about effectively managing their money, reaching their financial dreams, and securing themselves for the long term, irrespective of their income or asset level right now.

3. How frequently should I have to review my full financial plan?

You should really sit down and do an in-depth review of your comprehensive financial plan at a minimum annually. Otherwise, you should be sitting down with your planner on an annual basis and reviewing the plan to ensure it still makes sense.

Along these lines, any major life event, such as marriage, a new child, a change in career, a large inheritance, health issues, etc., should also cause you to revisit the plan.

4. Can I ideally plan my financial life myself, or do I need a pro?

You should really sit down and do an in-depth review of your comprehensive financial plan at a minimum annually. Otherwise, you should be sitting down with your planner on an annual basis and reviewing the plan to ensure it still makes sense.

Along these lines, any major life event, such as marriage, a new child, a change in career, a large inheritance, health issues, etc., should also cause you to revisit the plan.

5. What qualifications should I look for in a holistic financial planner?

Find credentials like Certified Financial Planner™ (CFP®) or similar credentials which demonstrate a high level of education, experience and ethical behaviour.

And make sure they are a fiduciary, which would make them legally required to have your best financial interests at heart.