Imagine your favorite video game, only instead of simply playing it, you own a smidgen of the company that created it! That’s a bit like investing. With its magic of compounding returns, it is available to young people as a tool to make their money grow and work for the future that they want. Empower your financial future! Explore our guide on investing for teens, covering key concepts and strategies to help you make informed investment decisions.

Investing isn’t reserved for adults or the rich; it’s something that can be learned and practiced by anyone, young or old. By getting started early, teenagers can benefit from the power of compounding, learn important financial lessons, and put themselves on a path for a secure financial future.

Why Start Investing Now? The Superpower of Time and Compounding

1. The Power of Compounding

The power of compounding is one of the most compelling arguments for beginning to invest early. Compounding is when your money makes money, and then that money makes money, and so on. Which is often a euphemism for “money making money.”

For instance if you invest ₹100 today, and if it grows by 10% every year, then, next year it becomes ₹110. The following year, it grows on ₹110 (not just the original ₹100), so you get ₹121! That is, the longer you leave your money in place, the longer it has to potentially grow.

To paint the picture better, assume you invest ₹1,000 and earn a 10% annual return. A year later, after one year you would have ₹1,100. You would have about ₹1,610 at the end of five years. But if you wait until 30 to start investing that same ₹1,000, you would need to make an investment of ₹1,610 at 30 to have the same amount at 35. The sooner you begin, the less it will take to achieve your objectives.

2. Time is Your Biggest Advantage

With decades until retirement, teenagers have ample time for their investments to grow and recover from market volatility. By investing at an earlier age, your money has more time to compound over time.

Here’s something to think about: If you begin to invest ₹1,000 per month when you’re 15, and average an annual rate of return of 10%, you can have over ₹1.5 crore when you’re 65! But if you wait until 25 to begin investing that same sum, you’ll end up with only about ₹1 crore at age 65. This demonstrates how strong the element of time is in investing.

3. Achieving Future Goals

Investing can be the key to achieving actual teen goals like a college education, your first car, travel, starting a business or becoming financially independent. If you’re saving for college, say, the more time you have to invest, the more likely you are to have enough saved to cover tuition and other expenses.

You can make things happen by plotting out financial goals and investing for them. Whether it’s earning enough for a new phone, a weekend trip with friends or a place to live in the future, investing can make it happen faster.

4. Building Financial Discipline

When done right, investing also teaches good money habits. You achieve financial discipline as you learn how to handle your money and decide appropriately – something that will be useful for the rest of your life. You will learn to budget, save, and invest wisely — all important aspects of achieving financial freedom.

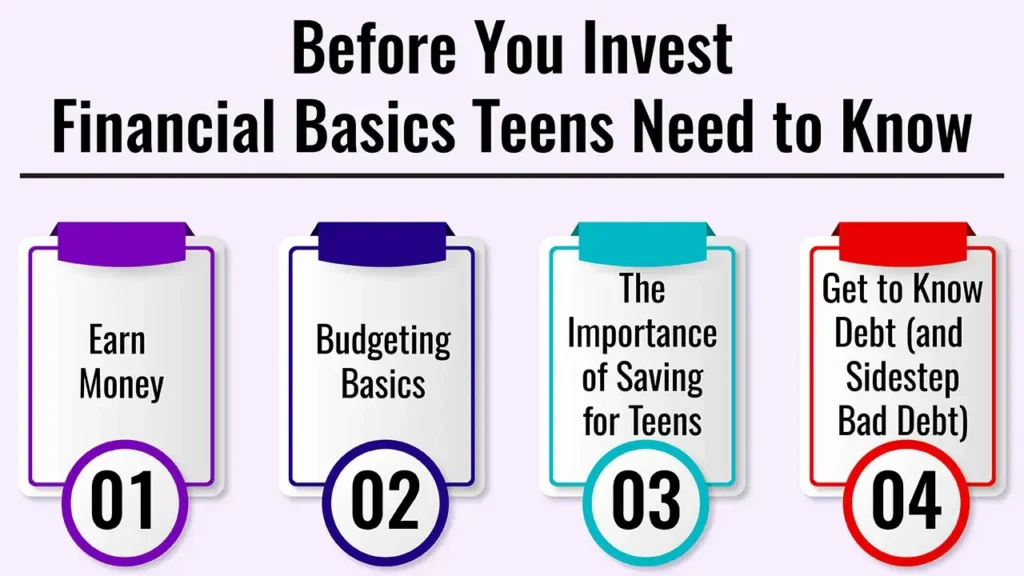

Before Investing for Teens: Financial Basics You Need to Know

1. Earn Money

Before you can invest money, you must make money. Teens can make money in a number of ways:

- Allowance: Most teenagers have an allowance from their parents based on chores or tasks completed.

- Part-Time Jobs: You can earn a fair amount working part-time in a store, restaurant, or at other businesses in your area.

- Freelancing: If you possess skills such as writing, graphic design or even computer programming, you can market your services online.

- Startup a Small Business: Other options might include starting a small business, perhaps in lawn care, tutoring or even making and selling crafts online.

2. Budgeting Basics

Once you begin to earn money, you need to learn the basics of how to manage it. Here are some budgeting basics:

- The “Spend, Save, Give” Jars/Accounts: Break your money into three categories — spending, saving and giving. This enables you to budget for different uses.

- Discussing “Needs” vs. “Wants”: Be able to distinguish between things you need (food, clothes, etc.) vs. things you want (the latest video game).

- Keeping Track of where money goes: Stay in touch with your money and see where it goes. This could help you focus on areas where you can save.

3. The Importance of Saving for Teens

Whether you have a short-term goal or a long-term objective, saving is important. Differentiate between saving for short-term goals (a new phone or concert tickets) and investing for long-term goals (college or a car).

Emphasise the practice of saving a part of each rupee earned. For instance, you can choose to set aside 20% of your income to invest later. This behavior will support you in creating a strong financial base.

4. Get to Know Debt (and Sidestep Bad Debt)

It’s necessary to comprehend debt and how to steer clear of bad debt. Provide a concise description of what interest is and how much it can grow if you let your guard down. Counsel caution with credit cards in later life and suggest steering clear of loans for items that lose value quickly — like pricey gadgets.

How Teens Can Invest: Options for Those Aged 13 to 19 (with Parental Help)

NOTE: For most investment accounts, a legal guardian is required (i.e. custodial account). Until they are 18,teenagers cannot fully invest on their own.

1. Stocks: A Piece of a Company Holder of Stocks

- What they are: Stocks are little ownership shares in companies. You become an owner of the company when you buy a stock.

- How to Invest (in the name of parents/guardians): You can invest through a demat and trading account that is opened in the name of child and guardian here s how to do it.

- Considerations: Stocks can be riskier and more volatile than other options, but they also have more potential for a higher return. Zero in on the companies you know about and are confident in.

2. Mutual Funds & ETFs: Diversification On The Fly

- What they are: Mutual funds and ETFs are a collection of many individual stocks or bonds, bundled and managed by a professional. ETFs and trade like stocks on an exchange.

- How to invest (via parents/guardians): You can invest through a demat account or directly with fund houses (using your guardian’s KYC). Focus on Systematic Investment Plans (SIPs) for consistent, disciplined investing.

- Factors to consider: These options tend to be lower-risk than single stocks because they’re diversified, which makes them a great option for beginners.

3. Public Provident Fund (PPF): It’s safe! And Time value

- What is it: The Public Provident Fund (PPF) is a government-supported long-term savings scheme with attractive interest rates and tax benefits.

- How to Invest (through parents/guardians): A guardian can open a PPF account in a minor’s name.

- Considerations: It’s a secure investment with tax-free interest, but it has a long straight-jacket period (15 years) and minimal liquidity. It’s perfect for long-term, low-risk saving.

4. Digital Gold: Modern Gold Investment

- What it is: Digital gold enables you to electronically purchase and sell gold that’s physically backed by vaults or other large swaps.

- How to Invest: There are many apps that allow tiny investments in digital gold.

- Considerations: It’s easy to buy and sell; guards against inflation; does not make you money in the form of dividends like some stocks or mutual funds.

5. Fractional Investing (Stocks/REITs and via guardian, if available and legal for minors)

- What it is: Investing fractions of shares to make expensive stocks more affordable. This can even be the case with Real Estate Investment Trusts (REITs).

- How to Invest: You can invest in shares through platforms that offer fractional shares.

- Factors: Low entry level but also make sure the platform you use is reputable and can be used for minors.

What You Should Know Before You Invest (Key Points)

1. Never Risk Money You Can’t Lose

Realize that investing contains risk, and that money needed soon for essentials should not be invested. You want to have a safety net before you start investing.

2. Research, Research, Research

Advise the teens to do their homework before committing. Don’t invest just because a friend did. Know what you are buying, including a company’s business model, its leadership and its financial health (in the case of stocks).

3. Diversification is Key

Few all the eggs in one basket. Diversify your investments among different companies or different types of investment to minimize risk.

4. Be Patient

Investing is a marathon, not a sprint, after all. It’s O.K. if values decline briefly. Markets have their ups and downs, and it can be helpful to keep the long-term in mind.

5. Avoid Get-Rich-Quick Schemes

We can warn against empty promises and scams. If it sounds too good to be true, it likely is.

6. Talk to a Trusted Adult/Expert

Urge teens to talk through investing strategies with parents, guardians or a financial adviser. Guidance can guide to help make those decisions.

7. Understand Taxes (Basic Awareness)

Very briefly, indicate that returns on investments may be taxed at a later stage in life, but don’t delve into complicated explanations. Potential tax consequences are important to consider as well.

Conclusion

In conclusion, investing the smart way means taking out and executing the game plan -develop a strategy, do your homework, seek out the available choices and staying to the course. Learning to handle money and investments is a critical life skill that enables teens to take control of their money.

Investing While still in their teens, they can also set themselves on a path to a lifetime of financial success by learning about investing on their own. The earlier you begin, the more compounding can do for you, and the more time you have to grow your investments.

Call to Action

Begin learning to invest now! And talk to your parents about your investing ideas, and open a savings account to get going!

Frequently Asked Questions

1. What is the age to invest in India?

Minors can invest help from guardian in India but they can not open the investment accounts on their own until they are 18.

2. Can a 16 year old invest in stock market of India?

A 16-year-old can invest in the stock market through a custodian account with a parent or legal guardian.

3. What is the best investment for a teenager?

Teenagers can invest in the PPF (Public Provident Fund) account and fixed deposit, which is considered a safe mode of investment with assured returns.

Leave a Reply