Do you feel like you’re stuck in debt? The road to financial freedom may seem far off, but it’s closer than you think. Debt management Lots of people struggle with debt, and it can be daunting.

Nevertheless, a system of paying back debt on time and regularly is also the most effective method of “How to Create a Debt Repayment Plan That Works” and securing your financial viability.

Not only does a solid plan alleviate some of the stress, but it also expedites your path to being debt-free. In this post, you can walk through exactly how to create an individualized and useful plan to knock out your debt.

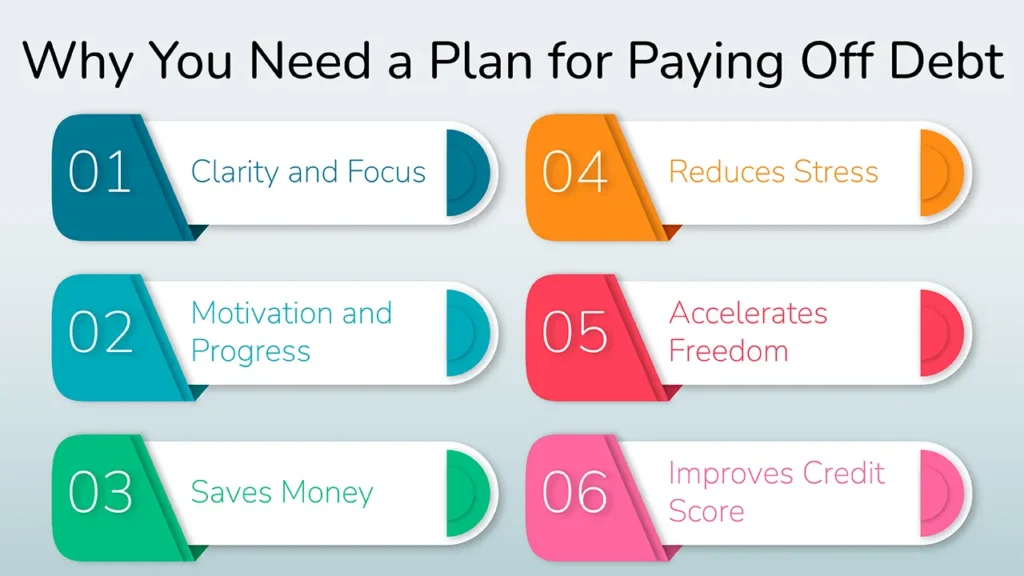

Why You Need a Plan for Paying Off Debt

Several reasons why you need a structure for a debt repayment plan:

1. Clarity and Focus

The guidance of a plan evenly distributes the payments and allows you to focus on what to tackle next, rather than making aimless payments.

2. Motivation and Progress

So to see the plan on a sheet of paper and to track your progress in such detail, allows you to be disciplined, it allows you to stay motivated and stick with your goals.

3. Saves Money

By choosing to pay off loans in the best order possible, you can cut back on the amount of interest you end up paying over time so that you will save some money in the long run.

4. Reduces Stress

A clear plan can turn feelings of being overwhelmed into a sense of being in control of your finances.

5. Accelerates Freedom

A plan will help you get out of debt faster, so you can move on to other goals.

6. Improves Credit Score

Credit cards are ideal for building your credit score since regular, on-time payments help increase your credit score and may grant you access to better financial services in the future. For detailed information on how payments affect your credit, see the Consumer Financial Protection Bureau (CFPB) on credit reports and scores.

Step 1: Know Your Debt Terrain (The Audit)

The first step toward formulating a debt repayment plan is realizing where you stand with your debt.

List All Debts

Make a complete list of your debts, including:

- Creditor: Who you are in debt to (like Visa, HDFC Bank, SBI, Student Loan Provider).

- Balance: Yes, the amount due down to the penny.

- Interest Rate (APR): Very important in how you plan to pay it back.

- Minimum Payment Due: The minimum payment is now due.

- Due Date: The timing of payments.

- Account: To help you keep track of things easily.

Categorize Debt Types

Categorize your debts into categories:

- High-interest debt: eg, credit cards and personal loans.

- Low-interest debt: eg, mortgage, select student loans.

- Secured vs. Unsecured debts.

Determine Your Total Debt Load

Total all the balances to get your total debt load.

Pro Tip For You!

Organize it neatly on a spreadsheet (Google Sheets/Excel).

Here’s a very simple table:

| Creditor | Current Balance | Interest Rate | Minimum Payment | Due Date |

|---|---|---|---|---|

| Visa | $2,000 | 18% | $50 | 15th |

| HDFC Bank | $5,000 | 12% | $100 | 20th |

| Student Loan | $10,000 | 5% | $150 | 25th |

Step 2: Evaluate Your Financial Life (The Budget Deep Dive)

Spend some time doing your financial homework, as this will help you come up with a plan that works to pay off your debt.

Know Your Income

Determine how much money you’ll take home each month, being sure to include everything from predictable side money streams.

Keep Track of Your Spending Closely

Categorize your expenses by:

- Fixed costs: Such as Rent, EMI, insurance, and subscriptions.

- Discretionary spending: Such as Groceries, dining out, Entertainment Travel.

You have to give yourself a sense of where every single dollar went over 30-60 days.

Create a Realistic Budget

Certainly, allocate money to all of your categories and identify “spending leaks” – places you can cut back without feeling major deprivation. The idea is to recapture extra money you can use to pay down debt.

Determine Your “Debt Acceleration Fund”

Find out how much extra cash you have available to throw at debt, over and above any monthly minimums. This reserve will be pivotal in repaying the credit.

Step 3: Determine How to Pay Off That Debt (The Game Plan)

The right approach is paramount to paying off debt.

The Power of Focus

An “in the pocket” strategy is also great for tuning in your motivation and clarity, focusing on one debt at a time (after minimums).

Method 1: The Debt Snowball Method

- How it works: You list your debts from smallest to largest balance. Pay the minimums on each, and throw everything else at the smallest debt. Once that debt is paid off, roll that same payment into the next smallest debt.

- Pros: It can give you psychological wins and strong motivation, especially if you’re in a camp that needs some quick wins.

- Cons: You could end up paying more interest overall.

Example: You may focus on paying the $500 loan first if you have three debts of $500, $1,000, and $2,000.

Method 2: Debt Avalanche Method

- How it works: You list your debts from highest to lowest interest rate. Pay minimums on all, and put all excess money toward the debt with the highest interest rate. Then roll whatever money you had been paying on that debt each month into the next highest rate debt.

- Pros: Leaves you with the most savings in interest over time.

- Cons: You may end up waiting longer to wipe out the first debt, which can be less motivating in the early stages.

Example: If you have 20%, 15%, or 10% interest debts, the 20% debt should be paid off first.

Choosing Your Method

Choose the system that’s best for you depending upon your financial profile and psychological preference.

Step 4: Executing Your Plan (Putting it into Action)

Now that you have a plan, it’s time to put it into action.

1. Set Up Automatic Payments

Never miss any minimum payments by enabling automatic payments. Also, establish transfers to the targeted debt to happen automatically each month from your “debt acceleration fund.” This minimizes a certain degree of human error and generates consistency.

2. Find Ways to Increase Income

Find ways to earn more money:

- Overtime

- Freelance work

- Selling unused items

- Temporary side gigs

Any extra rupee will be used for your targeted debt.

Aggressively Cut Expenses

Beyond any short-term contract, I would also expect temporary extreme measures, such as “no-spend challenges” or preparing every meal at home.

Think About Debt Consolidation (Carefully)

- Personal Loan: It could reduce your interest and simplify your payments. Verify that it is a real consolidation and not a matter of taking on more debt.

- Balance Transfer Credit Card: You’ll want to see if you qualify for a card with a 0% APR time period. You’ll want to pay down that balance before the intro period expires.

Warning: Only combine if you’ve dealt with the underlying spending issues.

Step 5: Monitor, Reflect, and Adjust (The Journey Continues)

Your debt payoff journey is a continuing process that needs frequent checks and balances.

1. Regular Check-ins

Set up a monthly or quarterly review to check in on your progress. Update your debt inventory spreadsheet and cheer each time you pay a debt off!

2. Budget Recalibration

As you pay off debts, your minimum payments also decrease, which will free up more money for your next debt. Be flexible and modify your budget as life changes happen (like job changes, and new family members).

3. Stay Motivated

Picture their freedom from debt and then tell an accountable friend or your spouse about what you just did. Don’t be daunted by setbacks; concentrate on getting back on track fast.

After Debt Freedom (Beyond the Plan)

When you hit debt freedom, it’s very important to stay on the right financial track.

1. Build a Robust Emergency Fund

Try to have at least 3-6 months of living expenses saved in order to avoid taking on new debt from unexcepted expenses.

2. Start Investing

Rechannel payments for old debt instead toward wealth-building investments, like retirement accounts or investment funds.

3. Set New Financial Goals

Concentrate on new goals, such as a home down payment or funding college.

4. Keep Up With Good Financial Habits

Keep budgeting, tracking expenses, and spending consciously to maintain your financial health in the long term.

Conclusion

In summary, having a debt pay-off plan is one of the most significant steps to ensure financial independence. Awareness of your debt, analysis of your financial planning, executing your plan, and constant review of your plan will keep you from getting buried in your financial future.

Debt is a journey, and just getting control is the most important part of it all. Begin building your plan now, even if Step 1 is all you can accomplish at the moment. The enjoyment of financial peace and the prospects that debt freedom offers is well worth the work.

FAQs

What is the debt repayment plan?

A debt repayment plan is a schedule for the payment of debts, which specifies how much you can pay and when you’ll make the payments.

What is the snowball method of paying off debt?

The snowball approach is all about breaking the smallest debts first (debt snowball) to gain motivation and momentum.

When is it time to consolidate debt?

Look into debt consolidation if you have multiple high-interest debts and can qualify for a lower interest rate.

How do you gain from a debt repayment plan?

A debt payment plan gives focus, determination, and an organized system for getting rid of debt, ending in financial freedom.

Leave a Reply