Reinsurance is an important instrument for bolstering the financial security of insurers and protecting policyholders in the end. Understanding how to properly explain the advantages of reinsurance is crucial for both financial planners and advisors, consultants and insurance specialists.

This article discusses How to guide clients concerning the benefits of reinsurance so that your discussions are both logical and appropriate for client situations. By explaining reinsurance well and how it works, professionals can help create trust and emphasise its value as a backstop for insurers – as well as clients.

Understanding Reinsurance

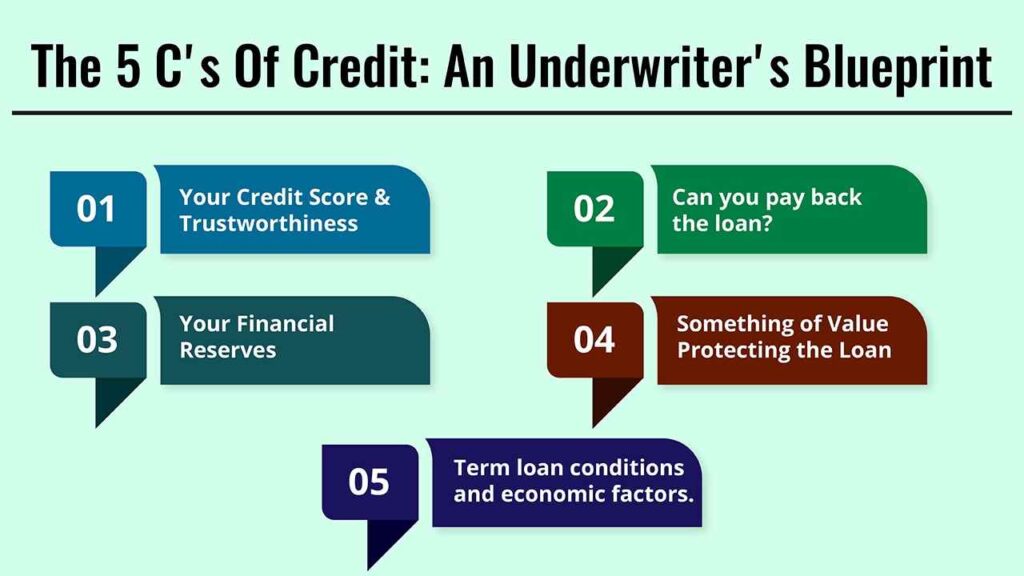

Reinsurance is, in effect, insurance for insurance companies. Just as policyholders depend on an insurance contract for protection against unforeseen risks, insurers turn to reinsurance to protect their businesses in the event of a loss. It is the process of spreading your risk between yourself and another insurer (reinsurer).

Large-scale events such as natural catastrophes, pandemics, economic downturns, and catastrophical disasters can be managed by the insurers via reinsurance.

When you try to explain this to clients, tell them reinsurance works as a stabiliser for the insurance world, keeping claims from breaking an entire company.

Why Clients Should Get Educated About The Benefits Of Reinsurance

If they did, reinsurance is out of sight but directly related to the financial security of our clients. Teaching them about reinsurance benefits will make it easier for them to understand why insurance companies are able to maintain their ability to pay out so many claims and stay afloat. Clients will feel confident knowing insurers have safety nets and backups.

Here are specific client-focused reasons:

- Financial Strength for Insurance: Clients win obliquely as well; insurers with reinsurance contracts appear more solvent during periods of unforeseen losses.

- Increased Claim Reliability: Reinsurance guarantees that insurers don’t get swamped by a large number of claims. This, in turn, ensures that claims are settled promptly for the policyholders.

- Lower Costs: With the risk distributed more effectively, insurers can now reduce their policy premiums to clients.

- Business Continuity: For corporate clients, the reinsurance provides large-scale coverage – providing companies with certainty in times of disaster.

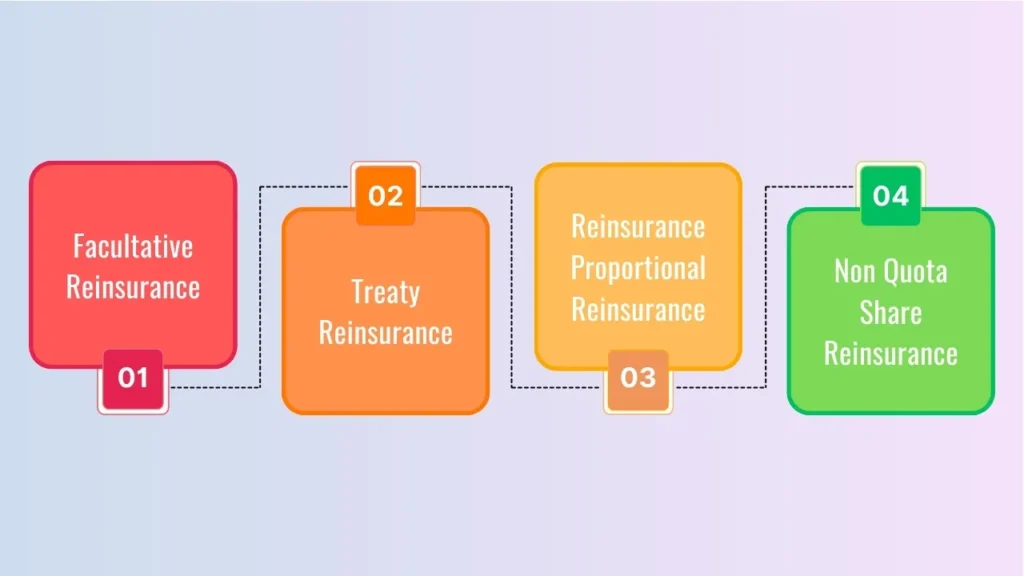

Essential Types of Reinsurance to Prospects

When advising customers in relation to reinsurance, it is important that you describe the main forms of structures and their ‘Reinsurance Benefits’.

| Type of Reinsurance | Description | Main Advantage for Clients |

|---|---|---|

| Treaty Reinsurance | Provides coverage over a group of policies via an agreement. | Broadens protection to cover clients’ claims against multiple risks. |

| Facultative Reinsurance | For individual high-risk policies. | Assists clients with specialised risks (e.g., aviation, marine) in obtaining insurance. |

| Proportional Reinsurance | Risk sharing between the insurer and reinsurer is proportionate. | Clients benefit as the insurer mitigates risk while maintaining full commitments. |

| Non-Proportional Retrocession | The reinsurer pays in excess of a specified limit. | Provides strong protection against catastrophic events like floods or hurricanes. |

By providing clients with simple analogies, you can help them understand how these gears work to keep insurance carriers healthy and able to pay claims.

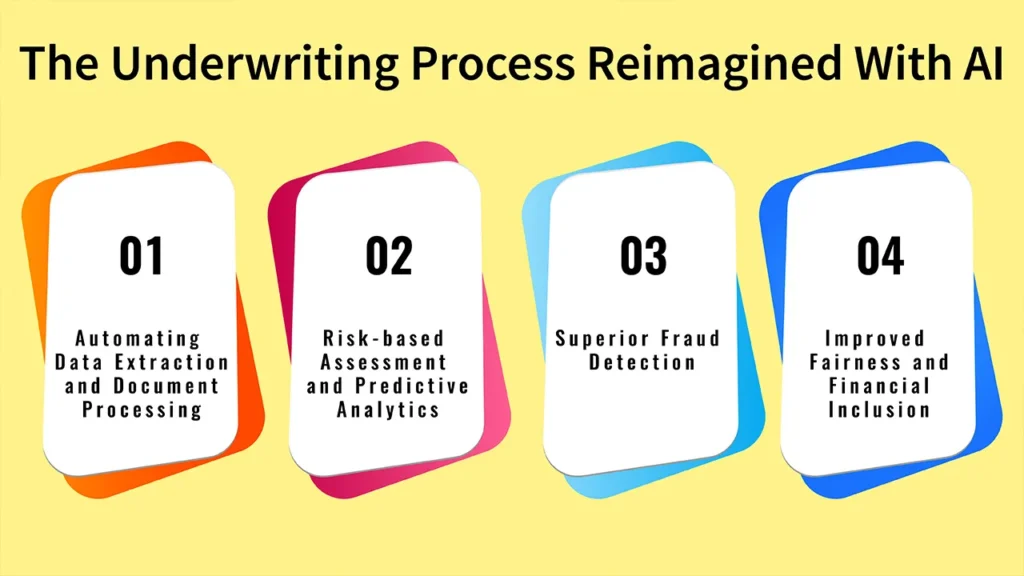

Strategies for Guiding Clients Effectively

Consultants need the ability to explain reinsurance effectively without all of that fancy speak. Think about these strategies as you plan your client education programme:

- Consistent Analogies: Try comparing reinsurance with home insurance. As families purchase coverage to protect their future, insurers buy reinsurance for theirs.

- Client-Specific Relevance: Customise this to the client’s business and personal policy and display reinsurance benefits in context.

- Transparency Risk Sharing: “Explain how reinsurance, as a risk-sharing machine, avoids insurers bearing alone the losses that provide for clients’ claims settlements.

- Use Real-World Examples: Case studies such as natural disasters where only reinsurance meant companies could afford to pay adequate claims.

This process makes complicated financial products seem comprehensible and instills trust and confidence in the client.

The Direct Impact on Clients

It’s worth adding the link between reinsurance and protection of clients in real-world terms:

- Reassurance that Coverage is Stable: Clients can have the peace of mind in knowing they are being supported by insurance firms with redundant systems.

- Derivative Role in Predictable Claims Resolution: During natural disasters, prompt response is due to the reinsurance contracts that work well.

- Innovation in the Policy Structures: With risks getting diversified and distributed, insurers start creating innovative and diverse products for their customers.

- One example: in health insurance, the costs of a large-scale epidemic could drive an insurer out of business. Without reinsurance backing, customers could encounter policy cancellations or claim rejections. Reinsuring keeps claim liabilities safe.

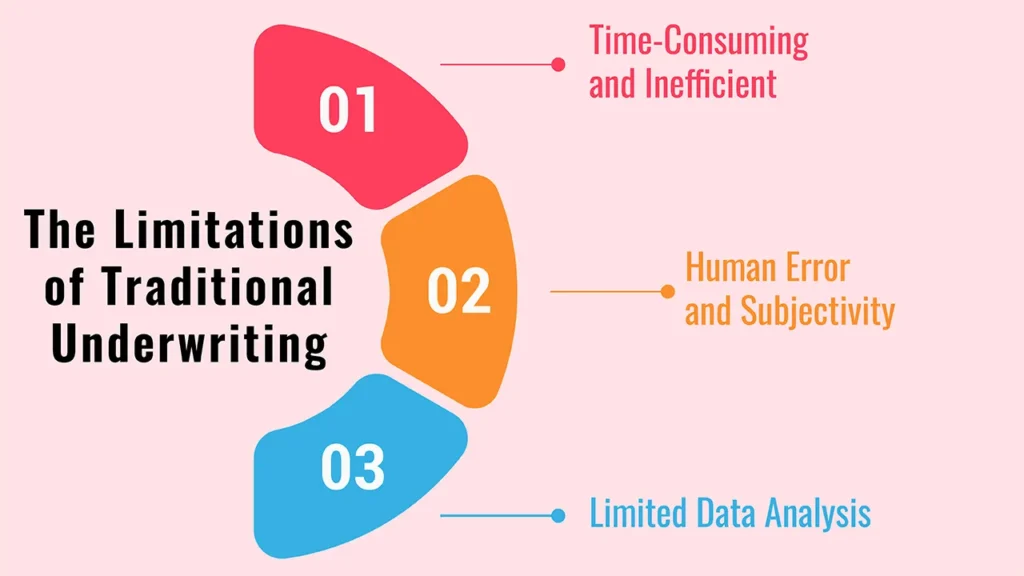

Challenges Clients Should Understand

In addition to explaining reinsurance benefits, you may also want to discuss potential difficulties:

- Reinsurance Expenses: Reinsurance includes costs that may have an indirect impact on the insurance premiums.

- Complexity for Clients: Because clients essentially never deal with reinsurers directly, the system can be difficult to understand.

- Global Event Exposures: Events such as global financial crises can be unprecedented even for reinsurance.

Realistically guiding your clients helps you build credibility and lets the client know that you stand committed to a ‘what-you-see-is-what-you-get’ relationship.

Communication Tips for Advisors

To ensure success in an educational session:

Do away with shop talk and use examples that relate to real life.

- Share about how insurers use reinsurance to ensure stability that clients rely on directly.

- Emphasise how reinsurance protects them in catastrophic situations.

- Present statistics or graphics that demonstrate the degree of dependence on reinsurance by industry.

Let us build awareness and trust by educating clients about reinsurance to give insurers the feedbackthey need.

Final Words

Reinsurance may not be visible to the client, but its advantages are passed on to clients in terms of providing safety, confidence and consistency in the insurance world.

For advisors, reinsurance has the power to instill confidence and reinforce client relationships when it can be explained in such a methodical and relatable fashion.

By customising explanations, providing useful analogies and demonstrating that insurers rely on reinsurance, you make it easier for clients to grasp why their policies are secure and sustainable.

Frequently Asked Questions

Q1. What is the easiest way to explain reinsurance to clients?

Reinsurance is insurance for insurance companies. If clients can hedge, insurers also need a hedge against large risks.

Q2. What does reinsurance matter to customers who never talk to reinsurers?

While this may seem like the ultimate “inside baseball”, clients are well advised to care – because it is impossible for claims to be promptly paid, premiums to be relatively low and an insurance company to be financially secure without proper reinsurance coverage.

Q3. What is the impact on clients’ premium costs of the reinsurance benefit?

By spreading the risks around, insurers are able to manage their costs more effectively, which in many cases translates into cheaper premiums for customers.

Q4. Can even reinsurance break down in its mission to safeguard clients?

If rare global shocks do hit, insurers and reinsurers are squeezed on both sides. But in general, reinsurance does make the system much more resilient.

Q5. Do all insurers have reinsurance?

Almost every insurance company in a common law-based legal system will, at some level, insure themselves against the risk of a large loss.