Making an investment in education is one of the most important actions a family can take toward financial empowerment. Education is not restricted to schooling any more but has spread to wider perspectives such as higher education, skill development programmes, professional courses and studying abroad.

Amid the high cost and demand for quality education, thought-out and ordered preparation is critical. But they also fall short for many people due to common missteps that short-circuit their intentions.

And the top mistakes to avoid in education planning (2025) will give families a way of providing for their child’s academic and career future without creating too much financial stress.

Why Does Education Planning Matter?

Education is the foundation of personal and professional development. Overview Veyromass is an educational fund that ensures you always have the money available when you need it for admission, tuition fees and related academic expenses.

But when that is not provided, families increasingly put off borrowing, rely too heavily on loans or scrimp on the education they offer their kids. Not making errors in education planning could mean not only that a family’s youth have access to greater opportunities but also that the parents are financially safe and sound.

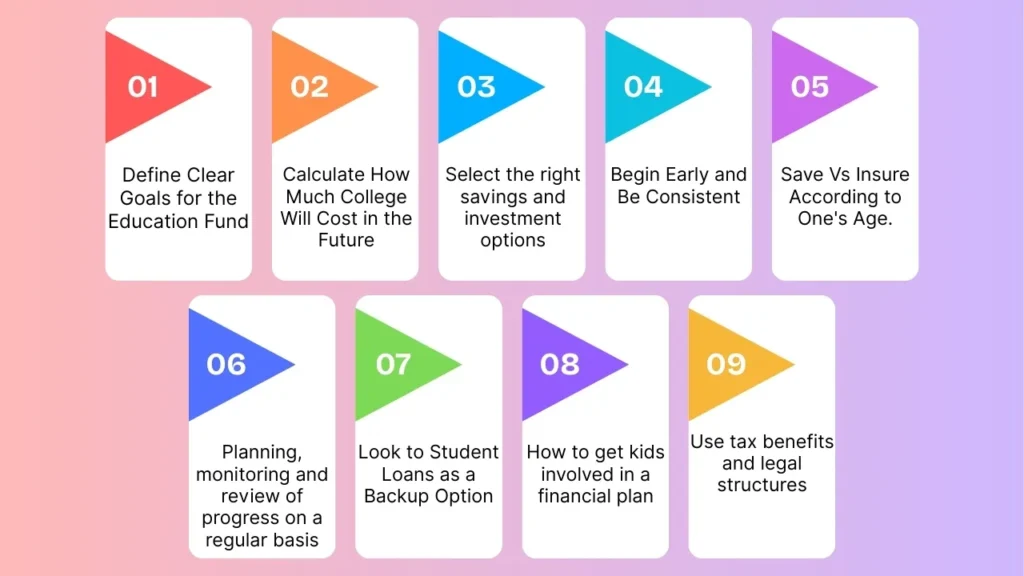

Here are the Top 10 Mistakes to Avoid in Education Planning

1. Ignoring Rising Education Costs

Among the biggest mistakes parents make is to underestimate the cost of an education. Tuition fees, books/hostels, coaching fees and foreign study expenses are ever-increasing (many times surpassing inflation).

For example, engineering, medical or management education in higher rungs could be in between a few thousand dollars over the years. Falling into this trap means that the savings that have been put aside can be insufficient in real terms when they are needed.

- Solution: Create education planning plans and assumptions based on realistic costs. Use financial planning for your saving goals, such as educational calculators to help you estimate future costs and modify savings goals accordingly.

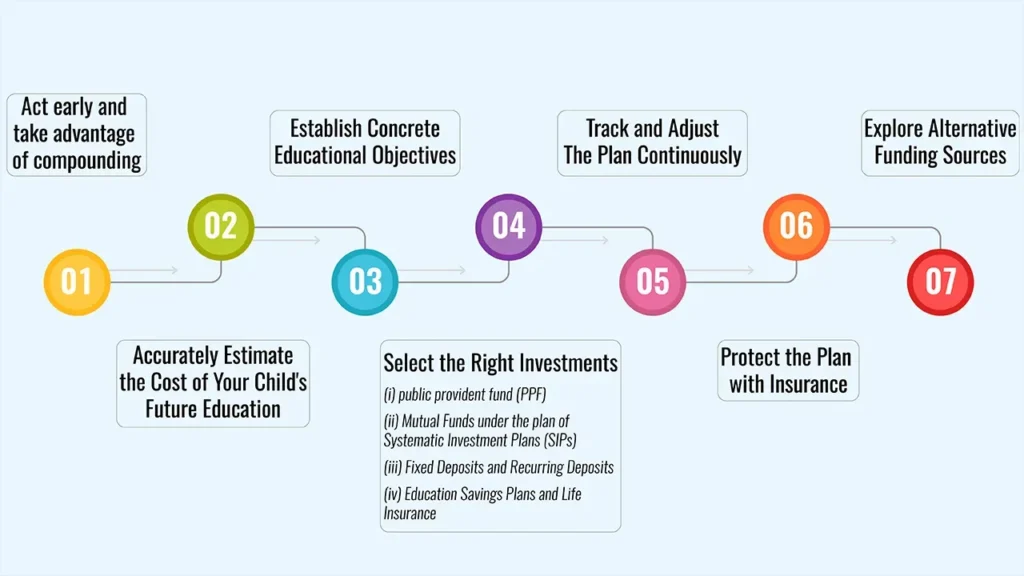

2. Starting Education Planning Too Late

One reason that so many parents put off planning for their child’s education is simply because they think it’s something which can be taken care of later. It’s simply the later you start, the more difficult it is to reach an adequate sum.

For instance, starting to invest at age 15 doesn’t provide much time to compound the money necessary for college expenses that will shortly come due at 18. That’s often a pretext for making the family dependent on financing loans at high interest.

- Solution: Get an early start! With time available, even small monthly amounts compound into something significant in 15–18 years. Advanced education planning also helps in better asset allocation and risk management.

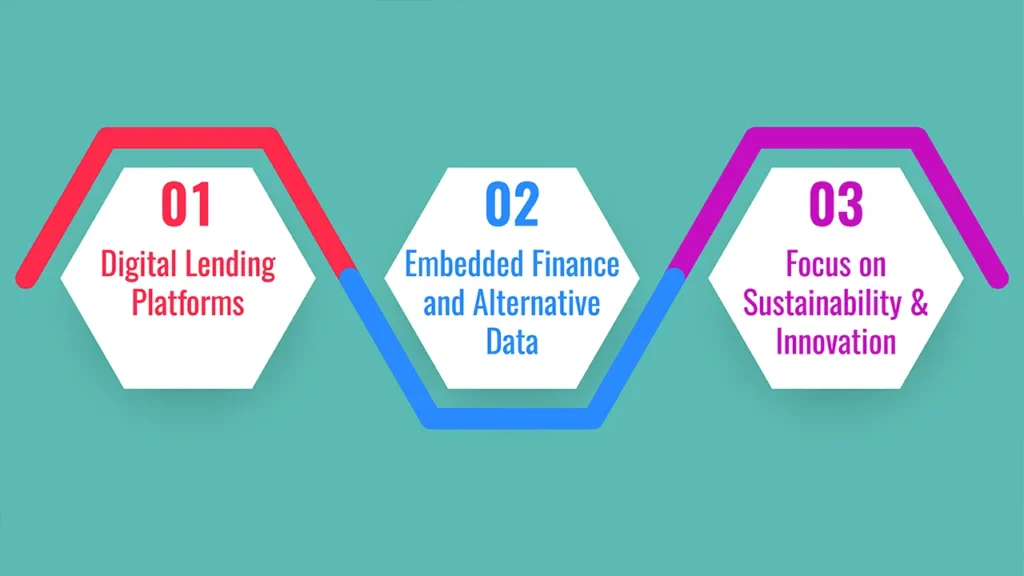

3. Over-Reliance on Loans

It’s easy to think of loans as the simple way to fill financing gaps, but overreliance on them can lead to lingering debt. Student loans do not only amplify interest expenses but also result in a lack of financial independence for the student when they’re out of school.

And it can crimp career options and push back other financial goals, such as owning a home or investing for retirement.

- Solution: Balance savings with loans. Loans are supposed to be the warp, not the woof, of education planning. The less the gap, the less you need to borrow. A healthy savings base – whether through ideas like SIPs or mutual funds, bonds or specific education funds – cuts down rampant borrowing.

4. Lack of Goal-Based Planning

Most families just sock money away without tying it to a specific goal. The general savings or fixed deposits may not fit in with the increasing cost of education and also the time frame involved.

Without a goal, there’s no clarity around what to save for, how much to save and over what period, or where to invest.

- Solution: Think of it like a financial goal with a specific timeline and dollar amount. Select investment products that are aligned to the horizon – equity mutual funds for long-term (10-15 years) and debt or bonds for short-term (education).

5. Ignoring International Education Possibilities

International education is more and more common in this age of globalization. Parents generally only consider the cost of local education, while they fail to consider the opportunities available in other parts of the world.

When a child subsequently dreams of going abroad to study, parents could be left scrambling to afford steep tuition fees, currency depreciation, hefty visa charges and living expenses.

- Solution: Integrate global perspectives in planning. Look into some universities and their general cost of living. If overseas education is a possibility, then saving in foreign-currency-based savings or ETFs might make more sense for future requirements.

6. Failure to Review and Update Education Plans

Education planning is not a single effort. Parents all jam on the savings in the early years but fail to check in periodically. Markets evolve, returns vary and the educational goals of children can change. Without periodic reviews, the plan can end up falling short or being too risky.

- Solution: Revisit education planning strategies annually. Match investments, raise contributions, and rebalance assets according to progress and goals.

7. Ignoring Insurance Protection

Unforeseen occurrences such as illness or loss of income can derail education plans. And, without sufficient insurance, the responsibility can fall to children or other family members – causing financial strain. It’s a choice many families make to invest but not take out life and health coverage.

- Solution: Secure education planning so as to ensure proper life cover for parents and a good health insurance policy. This guarantees that it won’t stop education due to life’s unpredictabilities.

8. Failing to pay attention to Tax Benefits on Education Planning

And yet parents can overlook the tax-saving possibilities of education planning. Invest in education saving plans or 80C instruments, or take an education loan if you are for it; it will be less taxing financially. And missing out on those doesn’t just cost more; it undermines the very premise of a save-more strategy.

- Solution: Maximize tax-savings concessions and plan accordingly for education. Leverage the tax benefits of legal deductions to maximize your savings and cash flow.

9. Depending Solely on Old Saving Instruments

Even today some families stick to traditional means of education planning, fixed deposits, recurring deposits or gold insecurities. Although these instruments are secure, they may not actually earn enough return to keep pace with education inflation. This obviously causes a funding gap over time.

- Solution: Diversify investments. While a combination of stocks, mutual funds, bonds and safer instruments will yield more returns with risk under control. There are many better strategies preferred than traditional saving for education in the modern investment world.

10. Disregarding the Child’s Interests and Dreams

Education is not about money alone; it’s about building a child’s career and future. In some cases, parents invest without knowing the child’s interests; education funds can be out of line with a college student’s career choices.

- Solution: Talk to children about their dreams, talents and aspirations. Cater your education planning not just to budgets but also to what long-term path you want to take in terms of career options (making sure that money or access is there for your chosen paths).

Final Words

Good education planning is a mix of foresight, discipline and flexibility. If they can avoid common pitfalls such as starting too late or underestimating the costs, ignoring insurance or relying on loans, families can help their children to achieve a sound financial footing for later life.

Nothing beats the gift of education that a parent can give, and with well-thought-out planning, it becomes attainable without stress. Start early, keep practising and stay focused on the goal – as the right education today leads to a better future.

Frequently Asked Questions

1. Why is education planning important?

It’s a means of keeping funds ready when they’re needed, such as for tuition, living and other academic expenses. It mitigates the financial strains on students and minimizes overdependence on loans.

2. I see, so is it too early to begin education planning?

The sooner the better, preferably before a child is even born. The earlier you begin, the more important compounding is.

3. Will education planning help to reduce the need for loans?

Yes. By saving and investing systematically, families can finance a substantial share of college costs from their income without resorting to loans.

4. Is global education a planning issue?

Yes, particularly if there is potential for study abroad. Since tuition costs are higher, including living expenses and currency risk in international education, a bigger amount is needed.

5. How frequently should educational planning be revisited?

At least once a year. Regular reviews enable you to correct course with your contributions, rebalance portfolios if necessary and adjust to changing education costs.