When you purchase insurance coverage – for a car, for your home, for your health – you’re buying it directly from an insurance company. But you might have wondered how such companies deal with the extraordinary risks they bear, especially following catastrophes.

The answer lies in “Reinsurance”. This complete reinsurance guide will help clear the fog surrounding “reinsurance”, giving you a straight “definition” and explaining the different “types” and detailing exactly “how it works”. We used it to balance the worldwide insurance system, safeguarding an insurance company and, ultimately, the policyholder.

What is reinsurance?

The Risk Management Foundation of Risk Management for Insurers

Reinsurance is essentially “insurance for insurance companies”. It’s a process in which an insurance company (the “ceding company” or “cedent”) cedes some of its risks to another insurer (the “reinsurer”).

Purpose:

- Risk mitigation: Primary insurers can get protection from large or catastrophic losses.

- Capital Management: Releases capital for primary writers, enabling them to write more business.

- Stabilization: Assumes that insurers could go bankrupt from unexpected big claims and makes sure that they have the money to pay their policyholders.

- Specialist domains: Reinsurers frequently bring expertise in specialist or complex risks.

Analogy: Consider it a financial shock absorber for the insurance sector.

Key Players: Reinsurer, Ceding company/Cedent, Policyholder.

2. Different Types of Reinsurance: Structuring the Risk Transfer

Facultative vs. Treaty Reinsurance (The Transaction Basis)

Facultative Reinsurance:

- Definition: Reinsurance for particular individual risks or certificates, established on a case-by-case basis.

- Use: With ABN For non-standard, hazardous or Ansqqbn risks not covered by the treaty.

- Benefit: Provides the ceding company with flexibility and the reinsurer the ability to pick and choose risks.

Treaty Reinsurance:

- Definition: An arrangement which applies to an agreed portfolio of risks (e.g., all motor business written during a certain period) for a defined period rather than to individual policies.

- When to Use: Continuous, periodic transfer for many policies.

- Advantage: Ensures automatic cover and administrative convenience for both.

- Reinsurance that is Proportionate and those that aren’t (The Payment Basis)

Proportional vs. Non-Proportional Reinsurance (The Payment Basis)

Proportional Reinsurance:

The reinsurer cedes a prorated percentage of the premiums and losses incurred by the ceding company.

Types:

- Quota Share: The reinsurer receives (pays) a fixed point percentage of each and every policy (premiums (losses).

- Surplus Share: A share of a policy above the ceding company’s retention limit, which is taken by the reinsurer.

- Benefit: Simple, consistent risk sharing.

Non-Proportional Reinsurance:

The reinsurer pays only to the extent that losses exceed a specified level for the ceding company known as a “retention” or a “priority”. Proportional sharing of premiums – the reinsurer does not share premiums.

Types:

- Excess of Loss (XoL): Purely the most common. Reinsurers will pay losses that exceed a certain dollar amount, up to a limit.

- Example: The ceding company retains the first 5M above that.

- Stop-Loss: The reinsurer is only responsible for paying when the accumulative loss ratio in a portfolio reaches a specific percentage or limit.

- Benefit: Insulates the ceding company against potential unanticipated highlosses, ,including natural and man-made disasters.

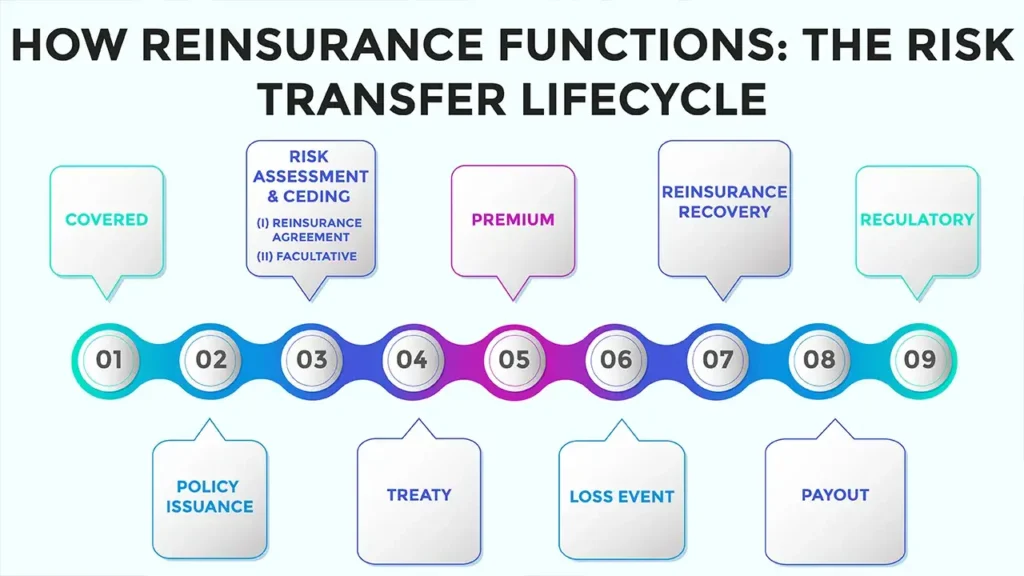

3. How Reinsurance Functions: The Risk Transfer Lifecycle

- Covered: How the Mechanics of Reinsurance Could Affect Climate Goals

- Policy Issuance: A policyholder who has a risk is issued a policy by a primary insurer of the risk.

- Risk Assessment & Ceding: The ceding company evaluates its risk. Then reinsurance kicks in: If the risk is too great or too far outside this comfort zone, the company elects to cede part of it to a reinsurer.

- Reinsurance Agreement:

- Facultative: The insurer approaches the reinsurer for obtaining reinsurance cover for a particular risk and negotiates terms, premium, and a share of risk.

- Treaty: A portfolio of risk is using an already negotiated contract to dictate how the risk is shared.

- Premium: The ceding company incurs a reinsurance premium to the reinsurer based on the portion of the risk that it transfers.

- Loss Event: The policyholder experiences a covered loss and the underlying insurer pays the claim.

- Reinsurance Recovery: An insurer gets indemnity from the reinsurer whenever a loss is above the ceding company’s retention (in the case of non-proportional) or the loss is within the shared proportion (for proportional).

- Payout: The reinsurer would then pay the agreed share of the loss to the ceding company. Thanks to this backend transaction, the policyholder is not impacted.

- Regulatory: Regulators (such as IRDAI in the Indian context and international regulators) supervise the reinsurance industry to avoid insolvency and ensure fair practices.

4. The Broader Impact: Benefits of Reinsurance for All

More Than Insurers: How Reinsurance and Its Modest Profit Helps the Economy and Consumers

For Primary Insurers:

- Increased ability to underwrite additional policies.

- Improved solvency and financial stability.

- Reduced volatility in earnings.

- Access to specialists in difficult risks.

For Policyholders:

- wider accessibility of covers for big or difficult risks.

- More security and assurance that damage would be paid, even after a major disaster.

- Possibly lower premiums (indirectly, as reinsurers stabilize the market and lower the primary insurer’s cost of capital).

For the Economy:

- It facilitates economic development by allowing firms to share risks.

- Enables mega projects (eg infrastructure) with a high volume of insurance being underwritten.

- Financial markets stabilize as catastrophic risk is spread globally.

You can find more benefits of reinsurance for both insurers and the broader economy in this article from OneAssure.

Conclusion

In essence, reinsurance is the vital “insurance for insurers” that enables insurers to manage risk efficiently. We discussed its “types” (to be facultative or treaty, proportional or non-proportional) and its basic “how it works” mechanism.

Frequently invisible to the general consumer, reinsurance is the cornerstone of the worldwide insurance industry, allowing it to assume massive risks and to deliver the crucial financial protection that is integral to people, companies and economies around the world. It is the one protecting us when nobody is looking – when the unthinkable occurs and claims are paid.

Call to Action

Understand all the complex layers of coverage in your own insurers. Knowledge of reinsurance can make you more informed of how the world of insurance works and the protections that are out there to provide security for your money.

Frequently Asked Questions

1. How does reinsurance affect my individual insurance coverage or claims?

No, not directly. Your contract is always with your original insurance company. Reinsurance is a backdoor arrangement between insurers.

You make claims against those underlying layers of insurance, and those layers’ ability to pay is enhanced by their own arrangements to purchase reinsurance.

2. What distinguishes an insurance company from a reinsurance company?

An insurance firm extracts premiums directly from consumers or companies seeking to insure themselves, taking on that risk.

A reinsurance company transacts business with other insurance companies, the effect being to cede a certain part of its aggregate risks.

3. Why would an insurer require reinsurance? Why not just keep all the premiums?

If they keep 100 per cent of premiums, they also have to absorb 100 per cent of losses. They reinsure in order to be able to transfer very large or catastrophic-type risks that could lead to their insolvency (e.g., a huge earthquake, a large industrial accident).

It allows them to write more risk and stay safe and financially solvent, offering critical capacity to the market.

4. Is reinsurance regulated?

Yes, reinsurance is very regulated, just perhaps not by the same entities as primary insurance. Reinsurers (IRDAI in India, NAIC in the US, PRA in the UK, etc.) are also regulated to be financially sound, to have enough capital to pay claims and to treat customers fairly because they are the bedrock on which the financial support is underwritten to the customers.

5. What are the biggest reinsurance companies in the world?

The biggest and best-known reinsurers globally will include Munich Re, Swiss Re, Hannover Re, SCOR and Berkshire Hathaway Reinsurance Group, some of the largest by premium receipts and size of risk they reinsure.

These businesses are carried out internationally, assuming risks from insurers in disparate continents.