“Financial independence” has long been a dream that seems out of reach, the privilege of the rich or the very lucky. But what if that strength is actually accumulated through the small, daily actions you take day in and day out?

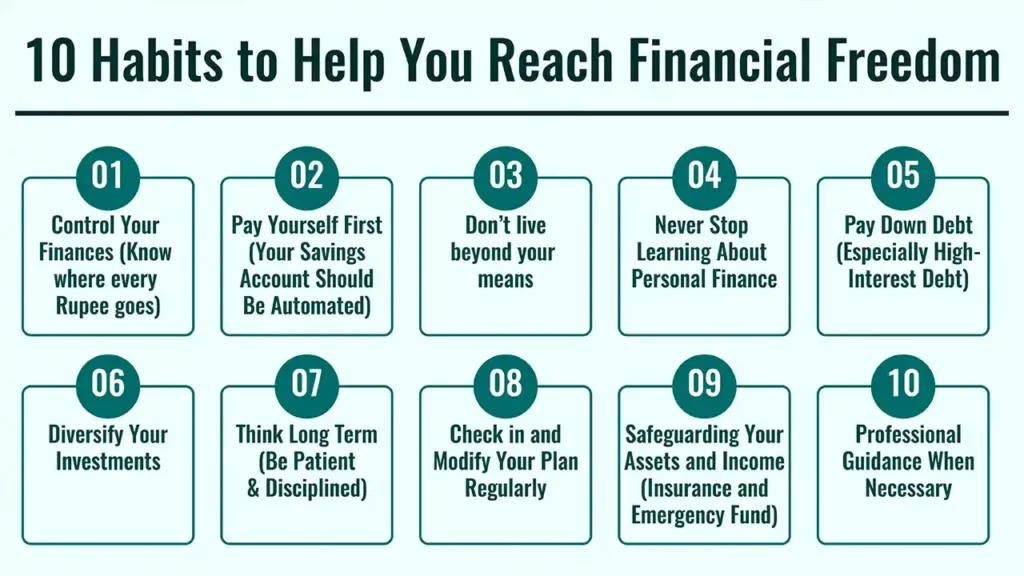

This article shows the “10 Habits to Help You Reach Financial Freedom”. Through the implementation of these foundational daily and weekly practices, you can change your relationship with money, jump-start your savings, and purposefully navigate your life toward an enduring financial independence.

1. Habits that boost Your Financial Goals

Why It’s Habits, Not Goals, That Will Get You To Your Financial Promised Land

Goals are objectives, but habits are the processes that allow you to reach those endpoints. Small repeatable right choices plus time equals anything. Strive to master these financial habits, and you’ll be well on your way to big results with your personal finances.

2. The Following 10 Habits to Help You Reach Financial Freedom

1. Control Your Finances (Know where every Rupee goes)

- The Habit: Continuously monitor your income and expenses. Know your cash flow.

- How to Grow: By using budgeting apps (cough, Wallet, cough, Expense Manager) or spreadsheets, or even just a plain old notebook. Review weekly to adjust.

- Why It Works: Identifies “money leaks”, permits intentional spending and exposes new saving opportunities.

2. Pay Yourself First (Your Savings Account Should Be Automated)

- The Habit: Make saving/investing a priority by setting money aside right after you get paid, even before you spend on anything else.

- How to Grow: Arrange for automatic transfers to an account set aside for savings or investment. Invest in mutual funds through SIPs.

- Why It Works: It takes willpower out of savings, automates good behavior and accumulates wealth without you thinking about it.

3. Don’t live beyond your means.

- The Habit: Consciously consume less than you earn — regardless of income bracket.

- How to Grow: Practice mindful spending, distinguish between needs and wants, and don’t start incorporating lifestyle creep as your income grows.

- Why It Works: It generates a surplus to save and invest, which shortens the time frame toward financial independence.

4. Never Stop Learning About Personal Finance

- The Habit: Get good at investing, taxes, managing debt, and the lay of the market land.

- How to Grow: reading books, following reliable financial blogs/news (ET Markets, Livemint), listening to podcasts, and attending webinars.

- Why It Helps: Enables you to take charge of your decisions, stay ahead of the scammers, and adjust to shifts in the financial landscape.

5. Pay Down Debt (Especially High-Interest Debt)

- The Habit: Make a conscious effort to pay off and eliminate expensive debt.

- How to Grow: Apply debt repayment strategies (snowball versus avalanche), pay more than the minimum and a new kind of try to stay away from new high debt.

- Why it Works: It allows for more money to be saved or invested and eliminates wealth-robbing interest payments.

6. Diversify Your Investments

- The Habit: Diversify your money among asset classes, industries and geographies.

- How to Grow: Put your money in a combination of equity and debt funds, gold (say via SGBs or ETFs), and maybe real estate (direct or REITs). Rebalance your portfolio periodically.

- Why It Works: It lowers your risk by avoiding any one investment underperforming and blowing up your entire portfolio.

7. Think Long Term (Be Patient & Disciplined)

- The Habit: Develop a laser focus on your long-term objectives and refuse to let short-term blips in the market turn you into a reactionary panicker.

- How to Grow: Recognize the power of compounding in a period of decades. Avoid market timing. Don’t check your portfolio daily.

- Why It Works: You allow your investments to weather market tumult and realize the true benefits of compounding.

8. Check in and Modify Your Plan Regularly

- The Habit: View your financial plan as a living document and not a one-time exercise.

- How to Grow: It Plan for one (or two) reviews per year to track progress, evolve goals, change budgets and rebalance investments as life shifts (new job, marriage, children).

- Why It Works: Secures the alignment of your plan with how your life and wealth have developed.

9. Safeguarding Your Assets and Income (Insurance and Emergency Fund)

- The Habit: Get sufficiently insured for the biggest financial risks of life.

- How to Grow: Keep a healthy emergency fund. Ensuring you have proper medical insurance, term life insurance and even disability insurance.

- Why it works: It keeps unexpected events – such as an illness, accident or job loss – from torpedoing your financial progress and forcing them to sell investments.

10. Professional Guidance When Necessary

- The Habit: Don’t be afraid to seek out expert advice when you need it.

- How to Grow: In case of a complex situation or personalized strategy, feel free to consult a SEBI-registered financial planner, tax advisor or investment expert.

- Why it Works: Cut through obscurity to make sure you’re hitting the right numbers, validating your plans, optimizing tactics and avoiding demoralising mistakes.

Conclusion

In short, the “10 habits that help you achieve financial freedom” stress the collective effect of routine. Financial freedom isn’t about some magical unicorn; it’s about small daily habits of consistency, discipline and wise choices.

And when you bring these “smart money habits” into your life, it’s no longer just about growing your account balance; it’s about building a life of security, choice, and peace of mind. Keep going and watch the story of your financial fate change.

Call to Action

Choose 1-2 habits in this guide to develop now and be committed to keeping them a permanent part of your life.

Frequently Asked Question

1. How long does it take to form these financial habits?

Research estimates it takes anywhere between 18 and 254 days for an action to become a habit. Consistency is key.

Begin with one to two habits that you find easiest to incorporate and grow from there. But do not strive for perfect progress.

2. I don’t make a tonne of money; can these practices still help me to achieve financial independence?

Absolutely. Okay, so being financially free isn’t too much about just having a lot of money – it’s really about managing what you have efficiently.

While budgeting, living below your means, eschewing high-interest debt and lifelong learning are more important for people with lesser means, well-to-do individuals can find value in these habits, too. They are there to make sure you make the most of each rupee you earn.

3. How can I get started on this list if I absolutely had to pick one?

Although related, the practice of PYF (automating savings) is generally the most impactful and immediate of all. It will create a steady stream of money towards your needs, using a mechanism that does not rely on willpower alone.

4. How can I continue being motivated to both develop and maintain these habits in the long run?

Regularly check in on your “why” – your specific financial goals. Visualise achieving them. Celebrate small milestones.

Through an accountability partner or a financial community. And keep in mind that it’s consistency – not intensity – that’s the key to the long term.

5. Can you be rich in means but not property-rich, with no inheritance?

Absolutely. Financial freedom is when you have enough passive income to pay for the lifestyle you desire – the point at which you have choices, flexibility and security.

This can be accomplished by investing in stocks, bonds, mutual funds or other income-generating investments, not necessarily property. It’s something many accomplish through years of disciplined saving and intelligent investing.