What Is Financial Planning? Financial planning is important because it allows you to manage your Personal finances and attain your desired goals in your life. It begins with carefully examining your present financial position, setting goals, and formulating a plan to attain the goals.

Financial planning gives you ways and tools to make great decisions, whether you are planning for retirement, buying a house, or planning your children’s education. You can take care of your financial future if you know what financial planning is and why you require it.

In this post, we are going to inform you of the most important things about financial planning and how it will assist you in making clear and confident financial decisions. If you have the proper plan, you can feel safe and stable while chasing your dreams.

Comprehending Financial Planning

The main reason why you require financial planning is to resolve your financial requirements and plan accordingly to achieve them. Budgeting, investing, saving, and planning for retirement are all essential components of this. Taking time out to understand your finances and declaring clear objectives, you give yourself the liberty to make intelligent decisions that benefit you towards your long-term objectives.

It is all about creating a customized plan to enable you to live the life you truly want! You can find your way with confidence and purpose if you are managing your financial life.

What Is Financial Planning? Definition, Meaning, and Purpose

One of the best ways of controlling your money is through financial planning. It’s a method of sitting down to go through your income, expenses, assets, or debts in a bid to arrive at an idea that will lead you to your financial destination. Generally, the process will involve a couple of significant steps that can lead you to financial success:

- Setting Goals: Starts with your short or long-term financial goals. The key to any money move is knowing where you are headed, be it retirement savings, buying a house, or paying fees for your kids’ college.

- Data Collection: Collect facts about your money next. These are facts about your income, spending, debts, and assets. You must know where you are.

- Analysis: Once you’ve collected your facts, take a few minutes and go over them. Consider your money strengths and weaknesses and where you can make things better. The analysis will tell you if you need to make changes.

- Strategy Development: Once you’ve completed your analysis, create a plan that states the steps you will follow to accomplish your financial goals. This plan will be your guide.

- Implementation: Now you can implement your plan! Make spending, saving, and investing changes as necessary to meet your goals.

- Monitoring and Review: Finally, track and review your progress by reviewing your financial plan from time to time. Your plan will change with life, so be ready to make changes accordingly.

The Significance of Financial Planning

Creating a financially secure future for yourself and your family is the objective of financial planning, something greater than money management. Making you understand the significance of making smart financial decisions, it brings you peace of mind and security.

You are the master of your financial destiny when you plan your finances. You are actively charting your course and not leaving it to fate. This step gives you the power to anticipate your potential failures and make changes to your ideas of action accordingly. It’s all about taking care of yourself and making the life you have always dreamed of!

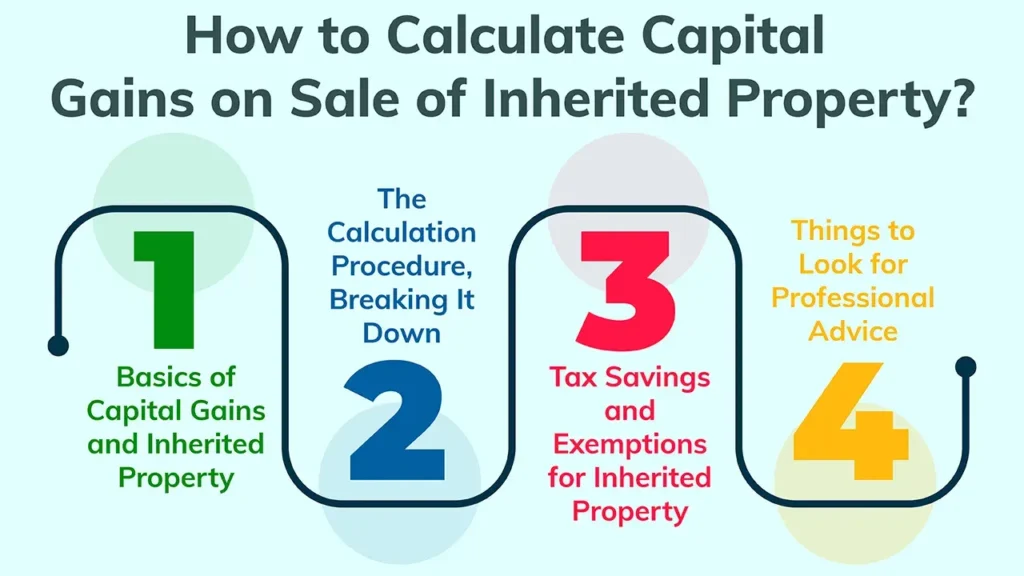

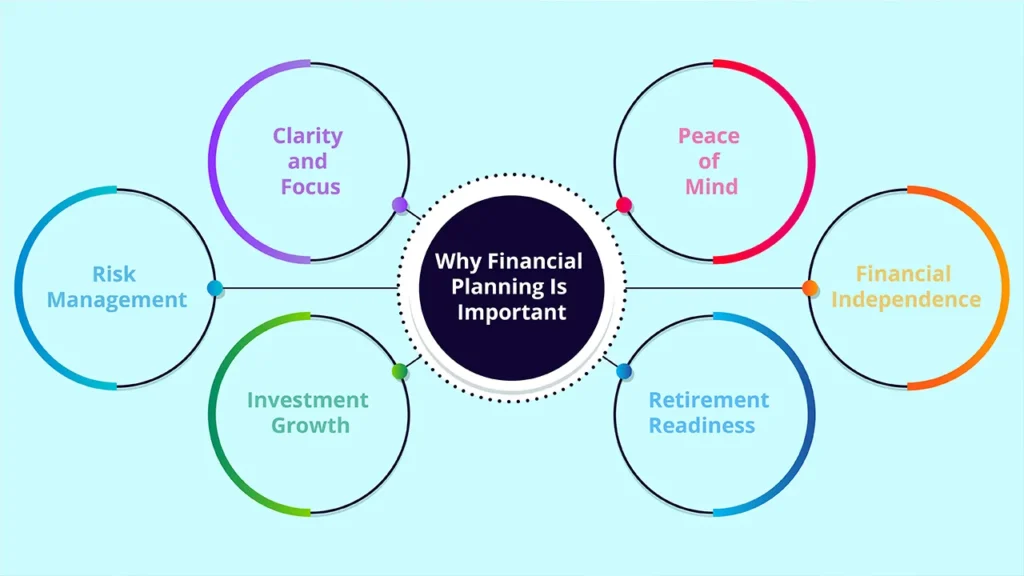

Why Financial Planning Is Important

Assisting you in reaching your financial objectives is the main goal of financial planning. Here are some main justifications for why you must have it:

- Clarity and Focus: Financial planning provides you with a clear understanding of your financial status, and this assists you in setting goals. You are actually able to plan your priorities of spending and saving effectively based on the clarity.

- Risk management: Emergency fund and insurance cover are two examples of risk management techniques that are included in a good financial plan. This planning safeguards you and your loved ones from unforeseen financial problems.

- Investment Growth: Financial planning makes you invest wisely, and this can greatly translate into wealth creation. You are able to make great decisions that help you in the achieve of your financial goals by determining your risk tolerance or carrying out research on your investment choice.

- Retirement Readiness: Retirement readiness is the most significant aspect of financial planning. If you save and invest wisely, you can secure your retirement.

- Financial Independence: With proper financial planning, you can achieve financial independence. You have enough money to live your life on your terms.

- Peace of Mind: Proper financial planning can give you confidence. With the assurance that you are doing something to ensure your financial future, you will start believing in it.

How to Make a Financial Strategy

Making a financial idea may seem intense at first, but it can be made simpler by breaking it down into compact, more manageable steps. This is how you can start:

- Take Stock of Your Current Financial Situation: Glance at your source of income, expenses, debts, or assets. This will offer you a clear image of where you stand financially today.

- Establish Measurable Objectives: Make your financial targets. Say “I want to save money,” but be specific: “I want to save $10,000 for EMI on a house in three years.” It will be simple to stay on track with this specificity.

- Develop a Budget: Make a budget that informs your monthly income or expenses. This will enable you to see where you can save more. The Federal Deposit Insurance Corporation (FDIC) offers a comprehensive Money Smart curriculum to help with budgeting and financial skills.

- Build an Emergency Fund: It is suggested that you save 3 to 6 months’ worth of living expenses in a simply accessible savings account. This fund will act as a cushion for unexpected expenses.

- Review Your Investment Options: Get to know the many types of investment products, for example, mutual funds, stocks, or bonds. Consider your investment time horizon and your tolerance for risk when making better investment decisions.

- Save for Retirement: Make sure that you will have a sufficient balance in your retirement. You should contribute to retirement plans, such as an IRA or 401(k).

- Conduct Regular Reviews and Revisions: A Daily review of your financial plan is important for you, as your aims and financial circumstances may change over time. By revising your ideas as necessary, you can remain consistent with your goals and gain an integrated approach to your finances.

The Role of a Financial Planner

You can create your own financial plan, but working with a financial planner provides invaluable information and guidance. A financial planner provides assistance through several key methods.

- Set Goals: A financial planner assists you both in establishing your financial goals and creating a workable plan to achieve them. Financial planners assist you in creating specific and achievable financial targets.

- Review Your Situation: Financial planners provide objective assessments of your finances, which help reveal potential growth opportunities you may have missed.

- Develop Strategies: Financial advisors develop targeted strategies designed to fulfill both your financial goals and personal circumstances. The personalized method used by financial advisors can significantly shape your financial trajectory.

- Keep Yourself in Check: By maintaining a planner, you can stay accountable and maintain control over your financial decisions and advancement. They will ensure that you remain focused on your objectives, which enables you to make necessary adjustments easily.

Final Words

The essential practice of financial planning enables you to fulfill your financial objectives and protect your future goals. An understanding of financial planning’s definition and purpose will lead you to successful financial management.

It is essential to start your financial plan today, regardless of whether you choose to hire a financial planner or handle the planning process yourself. Starting your financial planning strategy now will bring you closer to achieving your desired level of financial freedom and security. Your future self will appreciate it!

FAQs

1. What are the main purposes of financial planning and control?

Purpose of Financial Planning and Control Financial planning and control have several purposes, which include economic resource utilization, estimating, handling risk, measuring performance, planning long-term strategy, and making informed decisions.

These systems help to ensure that the money is spent in an effective manner in order to meet the company’s objectives of management of expenditures and creating profit.

2. What is the definition of finance?

Finance is the science and the art of managing money, including making, lending, investing, and saving. It includes tasks of raising capital, investing funds, tracking performance, and evaluating the risk involved in making financial decisions.

3. Why do I need financial planning?

It is important to plan financially, as it assists people and entities to clearly define financial targets and plan the process of adequately reaching them. It promotes the optimal use of resources, the anticipation of future financial needs, the regulation of cash flow and it establishes certain guidelines for making investment decisions.

More importantly, from a holistic perspective, the purpose of financial planning is to create an overall sense of financial security and stability to relieve possible anxiety about future uncertainties.