You’ve planned your financial future, built your investment portfolio, and watched it grow with great care. But have you considered what becomes of it when you’re no longer in a position to keep it in check or when you’re done altogether?

This is a guide to both “the soundness of your succession plan” and the important but frequently overlooked topic of “Future-Proof Your Portfolio”. We’ll explore why taking the time today will ensure your legacy as well as your loved ones’ future tomorrow.

Section 1: The Significance of Succession Planning in Protecting Your Portfolio

The End of Growth: Adapting to Our New Economic Reality

- What Is Succession Planning: For purposes of this post, succession planning is a strategic approach to how to prepare for the eventuality of your incapacity or death and having your financial assets and obligations administered by someone else.

- The Price of Not Having a Plan: Without a plan for how to hand over control, complications – potential delay, legal challenges, loss of wealth to taxes or mismanagement, and even family conflict – can occur.

- Sense of Security: There is much sense of psychological security when there is confidence that your assets are protected and your wishes will be honoured.

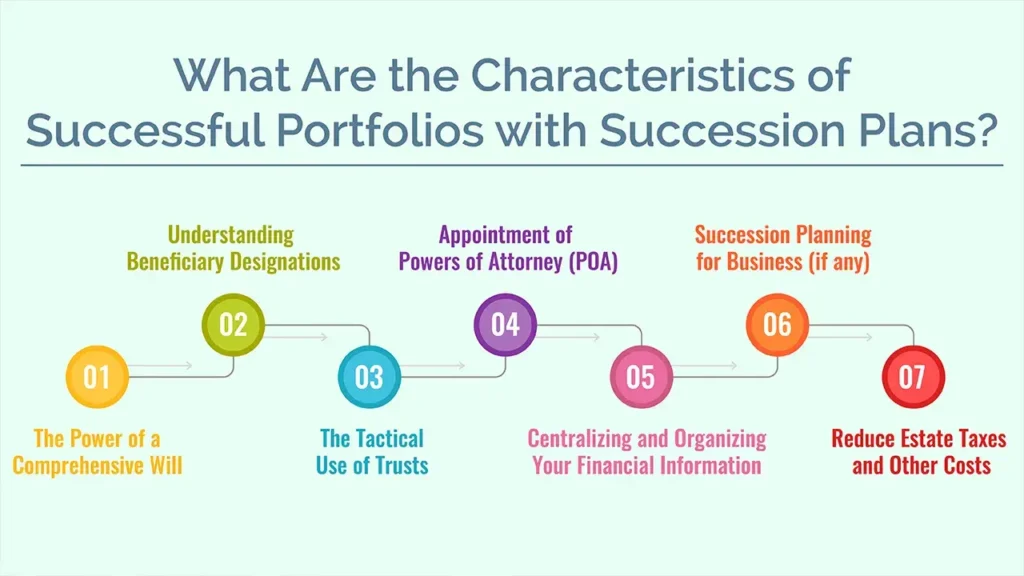

Section 2: The characteristics of a Future-Proof Your Portfolio

1. The Power of a Comprehensive Will

Detail: Your foundational legal document that tells who should get what.

Practical Suggestions:

- Designate Your Heirs Over All Assets.

- Select a reliable executor, one you trust.

- Nominate guardians for dependent children, if any.

- Don’t forget to revisit and revise your will from time to time, particularly after major life events.

2. Understanding Beneficiary Designations

Detail: For a lot of accounts (retirement funds, life insurance policies), beneficiary designations override your will.

Practical Suggestions:

- Verify and update beneficiaries on all investments (broking or pension/provident funds/insurance).

- Understand the differing “per stirpes” and “per capita” designations.

- Be aware of contingent beneficiaries.

3. The Tactical Use of Trusts

Detail: Trusts to swear by so assets can be held for the benefit of one’s favourite people – with a little control along the way.

Practical Suggestions:

- Living Trusts (Revocable/Irrevocable): Learn the benefits of avoiding probate, protecting confidentiality and tax benefits.

- Special Needs Trusts: If a dependant needs extra special consideration.

- Charitable Trusts: For philanthropic goals.

4. Appointment of Powers of Attorney (POA)

Detail: Legal documents naming a person to make decisions on your behalf about your money or health if for some reason you can no longer act for yourself.

Practical Suggestions:

- Power of Attorney for Financial Durability: To manage investments and bills.

- Medical POA/Advance Directive: Decisions about healthcare.

- Choose reliable and trustworthy individuals.

5. Centralizing and Organizing Your Financial Information

Detail: Making sure your named successors know where to find important documents.

Practical Suggestions:

- Create an online, secure record of assets, accounts, logins (stored securely), advisor contact information, and key documents.

- (Be sure to let your executor and someone you trust in your family know where to find this and other information.)

6. Succession Planning for Business (if any)

Detail: What’s arguably of equal or greater importance to business owners right now is how business continuation will coexist with personal wealth transfer.

Practical Suggestions:

- Create a business succession plan that covers how leadership will be transferred, the ownership sold or the organisation dissolved.

- Consider buy-sell agreements.

7. Reduce Estate Taxes and Other Costs

Details: There’s an obscure planning strategy that can mitigate the impact of taxes and legal fees.

Practical Suggestions:

- Utilize annual gift tax exclusions.

- Consider charitable giving strategies.

- Work with a tax adviser who is experienced in estate planning.

Section 3: Advice and Exit Planning for Professionals

Building Your Succession Team

- Finance Advisor/Wealth Manager: Integration of the plan with the investment planning.

- Estate Planning Attorney: To draft legally sound documents (wills, trusts, POAs).

- Tax Advisor/Accountant: For tax efficiency.

- Insurance Professional: For taxes or to become debt liquid. Understand the role of a financial advisor in estate planning from APW-IFA.

Section 4: Drawbacks Associated with Portfolio Succession Planning

Mistakes That Can Destroy Your Legacy

- Procrastination: The ultimate foe of good organisation.

- Stale Documents: Failing to refresh wills or beneficiaries upon major life changes.

- Non-Communication: Failure to Communicate with Family or Executors About the Plans.

- Assuming Family Knows Best: Trusting Family Knows Best.

- Ignoring Digital Assets: Forgetting online accounts, digital currencies, etc.

- Neglecting Incapacity: Ignoring disability Only thinking about death.

Conclusion

In short, “future proofing your portfolio” refers to having strong “succession plans” that include beneficiaries, trusts, wills, POAs, and orders for their draughting and professional assistance.

Your investment strategies are the result of years of hard work and planning. A rock-solid succession plan is the ultimate act of financial prudence – the ultimate common sense in ensuring that wealth does what it sets out to do and takes care of those who matter the most to you, many generations deep.

Call to Action

Encourage the reader to start their own review and enhancement of their succession plans.

Frequently Asked Questions:

1. What is the main objective of my investment portfolio’s succession plan?

The main goal is to make sure that your investment portfolio and other financial assets are handled and distributed according to your wishes if you become unable to do so or die.

It protects your legacy and takes care of your loved ones by cutting down on delays, possible disagreements, and extra taxes.

2. Do I still need a will if I have beneficiary designations?

Beneficiary designations are very important for some accounts, like retirement funds and life insurance, because they usually take precedence over a will for those assets.

But you still need a will to cover assets that don’t have specific beneficiaries, like real estate or personal property, name guardians for minor children, and name an executor for your whole estate. A full plan uses both.

3. What will happen to my portfolio if I become incapacitated and don’t have a power of attorney?

If you become incapacitated and do not have a valid power of attorney, your family may have to file for a conservator or guardian to be appointed by the court to handle your financial affairs.

It’s expensive and time-consuming, and they might not select the person you would have chosen.

4. How frequently must I review my plans for succession?

You’ll want to review your life and death plans every 3-5 years or when a big life event happens. These might include getting married or divorced, the birth or death of a beneficiary, major shifts in your financial situation, your child reaching adulthood or revisions in the tax laws

5. Can succession planning save me estate taxes?

Yes, absolutely. Strategic succession planning, usually involving trusts, charitable giving and an awareness of the tax laws for your place of residence (inheritance tax, estate tax, for example), can cut off those tax bites and ensure that more of your wealth reaches the people and causes that you would like to inherit your money after you die.

You need to speak with a good estate-planning attorney and a tax adviser to do this