Retirement, It’s a diversion for a lot of us, but making it so does demand some thoughtful planning – and, importantly, some “smart investment strategies for retirement savings”.

This article is going to reveal the best investment strategies to enhance your retirement savings, help you explore the changing markets and make sure you are well into your retirement, with take-home advice for wherever you are in your career.

1. The basics of investing for retirement

Why You Need to Invest for Retirement

- Inflation erosion: Inflation erodes the purchasing power of payment over time, leaving today’s cash savings inadequate for future needs.

- The Case for Compounding Power: The time-tested magic of earning returns on your returns can turbocharge your savings.

- Longevity Risk: We are living longer, so your savings needs to last potentially decades in retirement.

Define your risk tolerance and retirement goals

- Lifestyle Goals: What sort of retirement are you dreaming of having? (Travel, hobbies, relaxed living, or working part-time?)

- Timeline: How many years to retirement? This is very important for the investment you make yourself.

- Assess your risk: Get to know how much investment volatility you can handle and be guided by it in order to plan your strategy.

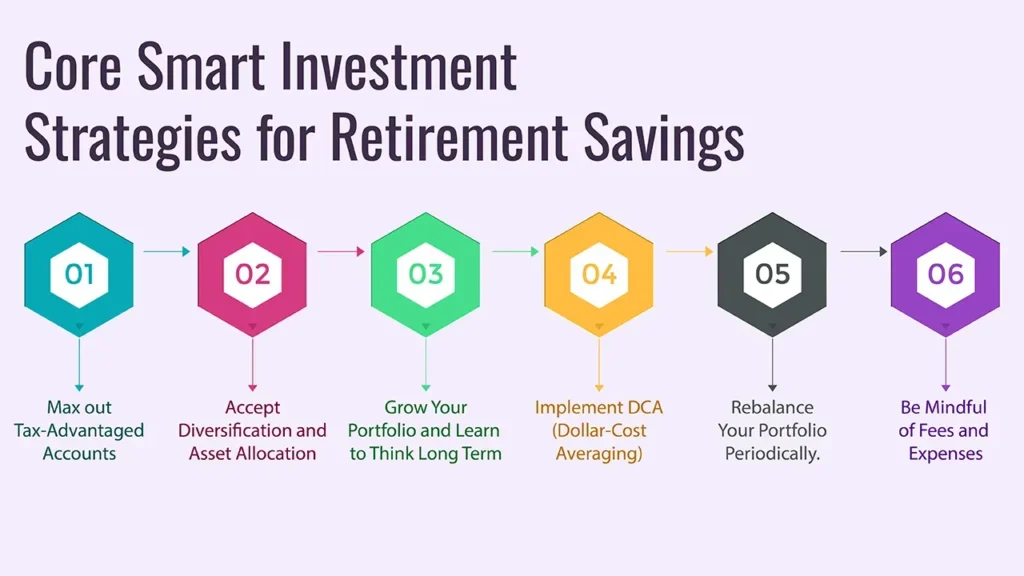

2. Core Smart Investment Strategies for Retirement Savings

Strategy 1: Max out Tax-Advantaged Accounts

Detail: These are the advantages you need to grow.

Actionable Advice:

- Employer-Sponsored Plans: Such as 401(k)s and 403(b)s – Take advantage of employer matching (free money!) and pre-tax contributions.

- Individual Retirement Accounts (such as Traditional vs. Roth IRAs) – Emphasise tax deduction or tax-free money in retirement.

Strategy 2: Accept Diversification and Asset Allocation

Detail: Risk management and portfolio optimisation are the building blocks of diversification.

Actionable Advice:

- Allocate across asset classes: Should have stocks (growth), bonds (stability/income), real estate (in the form of REITs), and commodities.

- Geographical Diversification: Diversify internationally to mitigate the risk associated with any one country.

- Age-Based Allocation: More and more equities when you’re young to more and more bonds as you near retirement.

Strategy 3: Grow Your Portfolio and Learn to Think Long Term

Detail: Retirement is many decades away for most; take advantage of market growth.

Actionable Advice:

- Equities (Stocks): Historically offer the best long-term returns.

- ETFs & Index Funds: Low-cost, diversified, and great for long-term growth.

- Avoid Market Timing: Focus on investing regularly rather than speculating on market performance. For an explanation of why low-cost index funds are effective for long-term growth, read Schwab’s guide to index funds.

Strategy 4: Implement DCA (Dollar-Cost Averaging)

Detail: The act of investing a fixed amount of money on a regular basis, regardless of the market’s fluctuations, which, over time, could lower your risk.

Actionable Advice:

- Automation Support Once you have 401(k) or equivalent retirement accounts set up, have contributions made automatically.

- Benefits: Limits the chance of purchasing at market tops and averages the purchase price over time.

Strategy 5: Rebalance Your Portfolio Periodically.

Detail: Make sure you still are in balance in terms of your asset allocation relative to your goals and risk tolerances.

Actionable Advice:

- Revisit your portfolio on an annual basis, or when there are significant changes in the market.

- Rebalance holdings to get percentages back to your target allocation (i.e., sell some winners, buy more of laggard securities).

Strategy 6: Be Mindful of Fees and Expenses

Detail: Loan repayments tend to be quite high and can significantly erode the long-term return.

Actionable Advice:

- Opt for cheap index funds and ETFs in favour of actively managed funds with expensive expense ratios.

- Know what your advisor is charging you (AUM percentage, flat fee, hourly) and make sure it isn’t eating you alive.

3. Adjusting Portfolios Close to Retirement

Switching Focus: From Accumulating to Preserving

- Risk Reduction: Slowly move into more conservative investments (bonds, cash equivalents) to safeguard profits.

- Income Generation: Place priority on investments that generate consistent income when it comes to retirement.

- Withdrawal Strategy: Determine how you will take money from your retirement accounts to last your life (the 4% rule, for example).

4. Mistakes to Avoid When Investing for Retirement

Retirement Plans Can Be Derailed by These Pitfalls

- Starting Too Late: The failure to take advantage of compounding.

- Not Contributing Max To Tax-Advantaged Accounts: Leaving “free money” (or tax breaks) on the table.

- Emotional investing: Includes trend-following and panic selling during emergencies.

- Undiversified: You have too much risk invested in one place.

- Overlooking Fees: Letting high expenses take too big a bite out of returns.

- Not Having a Plan: When you do not have identifiable objectives and goals for your investment, it may cause you to overlook potential opportunities.

Conclusion

To sum it up, the “smart investment strategies for retirement savings” are to seek tax favours while you can, go for a diversified but patient approach with dollar cost averaging, aim to rebalance periodically, and watch out for fees.” Retirement security is not luck but the cumulative effect of applying these smart investment strategies consistently, with discipline. You’ll thank yourself in the future.

Call to Action

Have readers go look at their current retirement planning or begin to implement these strategies today for a more financially secure future.

Frequently Asked Questions:

1. What percentage of my salary should I save for retirement?

There is a typical rule of thumb that you should try to save at least 10-15% of what you earn for the future – but everyone’s different, and depending on your age, your desired lifestyle in retirement and your financial situation right now will depend on how much you want to save. If you begin early, you can save less over a longer duration.

2. What is the best investment to save for retirement?

There isn’t one “best” investment. For most people, a diversified portfolio of low-cost index funds or ETFs that track broad market indices (like global stock and bond markets) is highly effective for long-term retirement savings due to their low fees and broad market exposure.

3. Do I need to be concerned about market setbacks when investing for retirement?

Declines in share price are a regular feature of investing. And for long-term retirement savings, they may even offer chances to buy assets at a reduced cost.

The secret is not to panic, not to make emotional decisions, to stay diversified and keep a long-term view of events. The object of your focus should be time in the market, not timing the market.”

Leave a Reply