If you guys want a breakdown on some insurance industry terminology, one of the common ‘askmes’ is How to Understand the Basics of Reinsurance’. Reinsurance, commonly referred to as “the insurance of insurers”, is a basic concept vital to the stability and solvency of insurers around the globe.

In simple terms, it’s a transaction in which an insurance company (the ceding company or cedent) passes part of its book of risk to another – usually third-party – entity, the reinsurer, which provides coverage for claims above certain loss limits.

In this article we will try to keep it light and simple and make your lives easier by demystifying reinsurance and breaking down its types, functions and benefits, as well as its importance in today’s insurance market.

What Is Reinsurance?

Reinsurance is a type of insurance that insurance companies purchase to share or transfer portions of risk with other insurers or reinsurers. Suppose an insurance company is underwriting a large number of risky policies.

And, to try to prevent losing everything in a single catastrophe or from multiple claims, it passes some of that exposure on to a reinsurer. In exchange for a premium, the reinsurer undertakes to indemnify the insurer against claims falling within the terms of that agreement.

In order to stay financially healthy, carry risk prudently and provide substantial coverage, reinsurance is essential for insurers. Without reinsurance, an insurer would have to maintain large reserves to pay for all possible losses, which would limit its capacity to write new policies.

Why Is Reinsurance Important? The Basics of Reinsurance

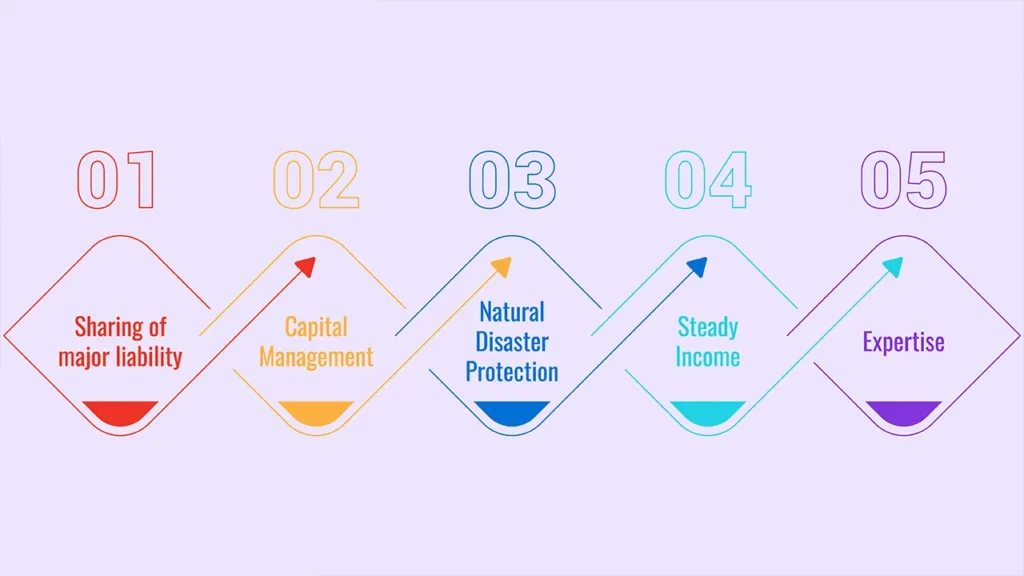

The fundamentals of reinsurance are all about managing risk, expanding capacity and maintaining financial stability. Some of the major reasons why insurers use reinsurance:

- Sharing of major liability: When you share a large sum, you can limit your exposure to big claims.

- Capital Management: Frees capital and enhances solvency margins, enabling insurers to underwrite more business.

- Natural Disaster Protection: Protects insurers from losses associated with significant disasters, such as hurricanes or earthquakes.

- Steady Income: Aids in levelling out the profit swings and surprises from large losses.

- Expertise: Generally, Reinsurers are more familiar with underwriting and claims processes in particular.

The insurance ecosystem can absorb bigger shocks through reinsurance, and policyholders are safeguarded as well as market confidence.

Types of Reinsurance

The knowledge of what reinsurance is all about starts with: + What are the main types of reinsurance?

| Type of Reinsurance | Description | Use Case |

|---|---|---|

| Facultative | Coverage for individual, specific risks is negotiated case-by-case. | High-value or unusual risks like a hospital or large industrial plant. |

| Treaty | Automatic agreement covering a whole portfolio or block of policies. | Covering all auto policies or property risks under an ongoing contract. |

Facultative is more flexible and can be controlled more but requires frequent bargaining. Treaty reinsurance affords efficiency to allocate many policies under negotiated terms, easing administration.

How Does Reinsurance Work?

When an insurer sells a policy, it agrees to pay claims. But if there are a lot of claims or one significant catastrophic loss, then it might struggle financially. In order to remain solvent, the company passes some of its risks to reinsurers in exchange for a premium. The reinsurer then compensates the insurer for losses covered in a cession.

For instance, an insurer would write $100 million in coverage for a factory. To remain gentle with its loss-carrying capital, it might cede $70 million of that risk to a reinsurer. If the factory takes a $50 million loss, the reinsurer would pay the insurer an agreed-upon portion (up to $70 million), allowing the insurer to meet the claim without depleting its resources.

Benefits and Importance of Reinsurance

The fundamentals of reinsurance Behind reinsurance stand its multiple advantages, which allow the insurance business to work.

- Increased Capacity: The ability of the insurer to write more or larger policies.

- Economic Protection: It shares the risk of exposure and minimizes resistance to bankruptcy.

- Better pricing: Makes for more accurate pricing and underwriting based on reinsurer expertise.

- Regulatory Compliance: Assists insurance companies to comply with solvency lines imposed by regulators.

- Fair market participants: spread the financial burden of loss across a large portion of the value-creation/real economy.

As a result, reinsurance promotes a fitter and sturdier insurance market in which both policyholders and insurers secure protection.

Common Reinsurance Structures

Forms of reinsurance treaties include:

- Proportional (or proportional) reinsurance: The reinsurer receives a share of premiums and losses written in the same proportion as its share.

- Non-Proportional (Excess of Loss) Reinsurance: The reinsurer covers losses in excess of a pre-arranged amount.

These arrangements provide some flexibility to adapt to different business requirements and tolerances for risk.

Given this modern insurance setting, what about in terms of reinsurance?

The fundamentals of reinsurance are changing with market conditions. New types of risks, including climate change, cybersecurity and pandemic losses, have made the volume and quality of reinsurance solutions even more important. Moreover, non-traditional risk transfer instruments such as cat bonds and ILS are a complement to the traditional reinsurance.

Reinsurers themselves invest heavily into analytics and risk modelling, which increases their ability to correctly price risks and manage portfolios more efficiently, so driving innovation in product design as well as risk transfer.

Summary of Reinsurance Types and Structures

| Reinsurance Type/Structure | Description | Key Features | Example |

|---|---|---|---|

| Facultative | Individual risk cover negotiated separately | Tailored, flexible | Factory fire coverage |

| Treaty | Covers entire portfolio based on agreement | Automatic, bulk coverage | All auto insurance policies |

| Proportional (Pro Rata) | Shares premiums and losses proportionally | Risk and profit sharing | 30% share of premiums and losses |

| Non-Proportional (Excess of Loss) | Covers losses above threshold | Catastrophe protection | Covers losses beyond $10 million |

Conclusion

Knowing how to read the fundamentals is crucial in knowing the backbone of insurance. The reinsurer spreads the risk, stabilizes the cedant’s finances and allows insurance markets to adequately absorb large losses.

Facultative or treaty, proportional or non-proportional reinsurance guarantees that insurers can provide broad coverage safely and with accountability. With risks shifting and new threats becoming apparent, today’s reinsurance principles are as crucial as ever to helping insurers protect themselves and their policyholders.

Knowledge in these fundamentals offers a glimpse into how the insurance sector continues to withstand and, in fact, benefit from all forces bearing on every corner of the financial environment.

Frequently Asked Questions (FAQs)

1. What is the fundamental purpose of reinsurance?

The main purpose of reinsurance is to transfer risk from a primary insurer to a reinsurer in order that the former might be able to cover large claims while maintaining financial soundness.

2. What is facultative reinsurance as compared to treaty?

Facultative reinsurance insures individual risks on a risk-by-risk and policy-by-policy basis, while treaty reinsurance operates under contracts that are renewable every year.

3. Why is reinsurance important to an insurance company?

It enables the insurance companies to underwrite more risks, absorb financial exposure of larger claims, achieve capital requirements and balance them in a statutory sense for solvency during catastrophes.

4. What does proportional reinsurance mean?

Under unlimited reinsurance, the reinsurer participates in premiums and losses and shares risk with the ceding company in an agreed proportion.

5. Can reinsurance help reduce insurance costs for consumers?

Indirectly, yes. Reinsurance helps stabilize insurers’ risk and frame their finances, which allows for competition in the insurance market as well as stability of the market, allowing for reasonable premium rates.

Leave a Reply