For the international insurance and risk management sector, it is an important question how to calculate premiums for reinsurance contracts. Reinsurance provides an opportunity for insurance companies to spread risks and mitigate the financial impacts of large claims on their balance sheet.

Where premium calculations are the heart of such contracts. If reinsurance premiums are not well constructed, an insurer can either pay too much and lose profit or too little and be at risk of significant loss.

This article explains how premiums are calculated under various reinsurance arrangements, the forces driving those prices and insurers’ approaches to developing equitable premium levels. By the end, you will have a full understanding of how reinsurance really works in practice.

What is Reinsurance?

The traditional method through which an insurance company (the ceding company) provides insurance to another party is known as reinsurance. In return for taking on certain risks, the cedant pays a fee (referred to as a premium) to the reinsurer. This structure shields against big or catastrophic losses, increases underwriting capacity, and smoothens financial results.

The amount paid under these agreements is the cost the ceding entity pays to achieve risk transfer. Fair premiums involve assessing exposure levels, past claims experience, actuarial assumptions and market conditions made by both the insurer and insured.

Why Premium Calculation Matters

The determination of the premium is an integral part of a reinsurance contract. The underwriting profit, solvency ratio and capital need are influenced by the premium charged to cedents. Premium income is what secures the right of reinsurers to take risk and those forms with strong balance sheets are now positioned for the battle.

If premiums are wrong, that creates risks:

- One of the ways in which overpayment decreases the competitive environment is by inflating costs in the insurance industry.

- Underprovisioning enhances the risk of reinsurers to serious losses.

- “Erroneous assumptions might sabotage long term relationships.

Therefore, a structured approach to the fair allocation of premiums is needed by the cedent and reinsurer.

Types of Reinsurance Contracts

Premiums Gross premiums written vary with the type of reinsurance treaty. The two main categories are:

- Proportional Reinsurance (Pro-Rata): The reinsurer shares premiums and losses based on a contractually specified percentage. It’s easy to follow the math after months, and you then calculate your agreed percentage.

- Non-Proportional Reinsurance (Excess of Loss): The reinsurer pays losses over a specified limit. Premiums are more subtle, depending on probability distributions, historical loss records and cat bonds.

Each kind of treaty structure, whether it be quota share, surplus, excess of loss or stop-loss, has different methods for dealing with premium flows.

Factors That Influence Premiums

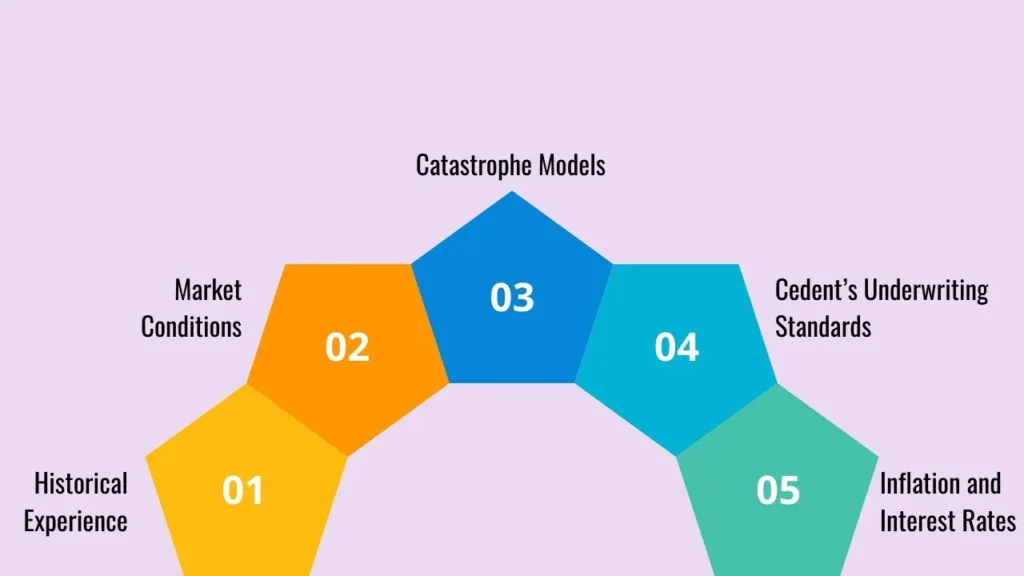

In order to determine appropriate premiums, reinsurers and cedents need to consider a multitude of factors that have an impact on the outcome:

Type of High Risk

- Historical Experience: Previous frequency and severity of claims form the foundation for rating estimates.

- Market Conditions: Competitive or difficult reinsurance markets affect price.

- Catastrophe Models: This is a model for floods, earthquakes and hurricanes used to price non-proportional treaties.

- Cedent’s Underwriting Standards: Good underwriting procedures provide less risk exposure for the reinsurer, resulting in possibly cheaper rates.

- Inflation and Interest Rates: The economy affects the severity of claims and hence the cost/price of cover.

Reinsurers aggregate all these variables and create risk-adjusted price models to accurately set premiums.

Methods Used to Calculate Premiums

Reinsurance premium pricing depends on actuarial science, statistical modelling of probability, and the structure of agreements. Here are the most popular ways:

Exposure Rating

This approach estimates premiums through projecting future losses using exposure information (sum insured, number of policies, coverage lengths). Reinsurers rely on models of catastrophes and history for forecasting.

Experience Rating

Amounts of premiums are calculated here according to the cedent’s past claim history. When there have been low past claims, the cedent can be in a position to negotiate favourable terms, and where claim ratios have been high, it may suffer increased premium charges.

Burning Cost Method

This much-employed method, especially with surplus loss treaties, is to calculate the premiums as a fraction or proportion of average losses over a certain period and an additional amount for varying risk (risk margin) and administration costs.

Pure Risk Premium + Loadings

The pure risk premium is the expected loss for the reinsurer. The premium amount is then adjusted for therapeutic and regional loadings, administrative loadings, profit margin and contingencies to produce the final premium amount.

Negotiated Approach

Often, the actuarially calculated premium is just the starting point in many reinsurance markets, and ultimate premiums negotiated between the cedent, broker and reinsurer are based upon market supply and demand.

By employing these methods, reinsurers uniformly compute premiums for various lines of business.

Premium Calculation in Proportional Reinsurance

Pro-rata / Quota share and additional reinsurance:

- Cession = Premium ceded = Direct premium X cession percentage.

- Net flows can also be grossed up for commission arrangements (ceding or profit commission).

For example: If an insurer writes $10 million of premiums and cedes 40%, the reinsurance premium is $4 million.

This structure is easy to compute premiums and a better option for insurers entering a new market or that have smaller books of business.

Premium Calculation in Non-Proportional Reinsurance

Non-proportional premiums rely to a lesser extent on the principle of proportionality and more on actuarial probability calculation. Factors considered include:

- Anticipated Loss Cost: Losses in the layer to be insured.

- Loading for Non-Idiosyncratic Risk: Risk margins and catastrophe risk charges.

Costs and Profit: Reinsurer expenses and margins.

Premiums tend to be higher in catastrophe-exposed areas such as the coast or in earthquake zones. Reinsurers will add a margin of safety to their premium calculations due to actuarial uncertainty.

Practical Example of Premium Calculation

If an insurer is willing to accept a non-proportional excess of loss treaty with the following conditions:

- Retention: $1 million

- Layer in surplus: $4m (losses between $1m but less than $5m)

- Indicative annual average loss in this layer: $2m

- Loadings: 25%

Here, the reinsurance premium

equals: Premium = Expected Loss + Loadings = 2,000,000 + (25% × 2,000,000) = 2,500,000. Premium = Expected Loss + Loadings = 2,000,000 + (25% × 2,000,000) = 2,500,000.

The reinsurance premium for this cover is $2.5 million, paid by the cedent. These worked examples demonstrate how reinsurers price premiums by quantifying expected losses and then adding suitable margins.

Challenges in Premium Calculation

Even if the theories are well posed, one has to face the real-world problems:

- Inaccurate data on historical losses.

- Low-frequency emerging risks (cybersecurity, pandemics) No / absence of long claims experience.

- Use of catastrophic models that lack reliable predictive value.

- Cyclical pricing due to volatility of the marketplace.

- Reinsurers are constantly improving models to get better premiums for changing conditions.

Guidelines for Equitable Premium Assessment

Pooling insurance companies and reinsurers must cooperate and follow best practices:

- Ensure the integrity of claims and exposure information.

- Apply both experience- and exposure-based rating styles for balance.

- Include loss estimates for high-severity events from catastrophe models.

- Frequently update actuarial models with recent claims experience.

- Lay out transparent terms with communication in both directions.

Then you get these things you do, which are “fair pricing” for reinsurance and successful partnerships.

Final Words

It is both science and negotiation to calculate premium in reinsurance. Whether pro-rata or non-pro-rata, the accuracy in the detail premium calculation is of interest for both cedants and reinsurers.

It shares risk fairly, keeps stability, and forms long-term market confidence. Knowing these premium calculation techniques is critical for insurers seeking to build more optimal reinsurance programs and greater financial resiliency.

Frequently Asked Questions

1. Why determining reinsurance premiums is a big deal

Accurate calculation is essential for cedents to not overpay and reinsurers to hold an adequate claim reserve. It encourages financial security on all participants’ parts.

2. How are reinsurance premiums calculated?

Typical methods include exposure rating, experience rating, burning cost and negotiated method -based on the type of contract and data availability.

3. What is the basis of premium computation in proportional and non- proportional reinsurance?

Proportional premiums are simple, a function of the percentage ceded of premiums. Non-divisible premia are calculated using actuarial statistics for probability, disaster risk and current/previous claim distributions.

4. How do the premium amounts calculated based on them come into play?

They model hypothetical losses from catastrophes and tell reinsurers how much they need to charge in premiums so risk can be covered.

5. Can Insurance Rates Be Changed After You Sign an Agreement?

Some treaties permit the adjustment of premiums for actual claims experience, typically in stop-loss programs. The others can’t be changed if and when renewed.”

Leave a Reply