Ever feel like your money is controlling you? Wish you had a better understanding of where your money is going and what will make it grow? If so, you’re not alone. It’s not unusual to find people feeling overwhelmed, stressed and anxious around their money. There is, however, one solution: Personal Finance Management (PFM).

PFM is a process of effectively managing your money to accomplish your financial goals. In this article, we’ll discuss what PFM is, key concepts related to PFM, the instruments that can be used and how it can be applied in everyday life. After tackling it all, you’ll know how to regain control of your financial future and feel empowered to take charge of your financial destiny.

1. What is PFM?

Personal Finance Management (PFM) is the act of planning, organising, directing and controlling monetary activities such as budgeting, personal financial planning, cash flow, savings and spending by an individual. It includes all your financial life, how you earn, spend, save, invest and protect your financial resources.

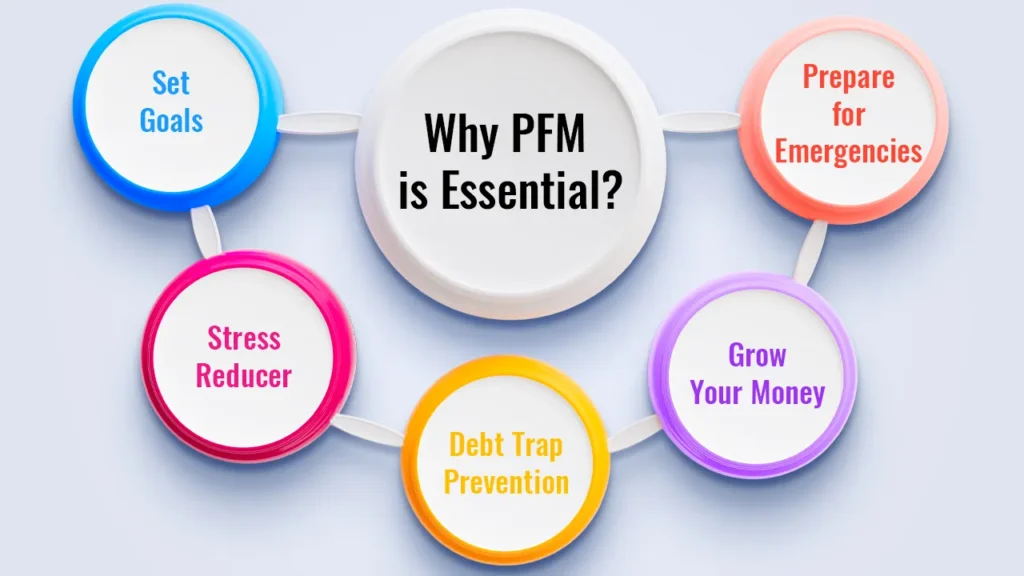

Why is PFM Essential?

- Set Goals: ‘PFM tooling provides a path to achieve short-term (e.g., holiday, new gadget), medium-term (e.g., down payment, education fund) and long-term goals (e.g., retirement, financial independence).’

- Stress Reducer: Gain financial clarity and control to cut money-related stress. Knowing where your money is going and having a plan in place can help relieve anxieties about surprise costs.

- Debt Trap Prevention: By keeping track of expenditure vs income, PFM avoids borrowing unnecessarily. It promotes living within one’s means and financial responsibility.

- Grow Your Money: PFM provides the structure for regular savings and smart investing, allowing for the accumulation of wealth over time. It further helps you figure out what you should be investing in that matches your money goals.

- Prepare for Emergencies: PFM gives you the cushion you need when life puts challenges in your way, whether it’s an accident or injury or losing a job. Being prepared with an emergency fund will help you feel secure and at peace about your financial life.

Key Principles of Effective PFM

- Goal Setting: The first and most effective part of PFM is thinking through what you want to accomplish financially. Clear objectives give motivation and direction to people.

- Tracking & Awareness: It’s all about knowing what’s coming in and what’s going out. Continuously monitoring your income and expenses keeps you aware of your monetary position.

- Budgets: Pre-planning your expenses helps you survive financially. If nothing else, a budget goes a long way in helping you prioritize the things you need and when you are able to save for future goals.

- Discipline: A plan has to be followed and choices have to be made for PFM to work. It’s a test of discipline against the urge to spend without thinking.

- Review & Adapt: It’s important to regularly review and adjust your position. Life is dynamic and situations change, so your financial plan should be a dynamic, living document.

2. How Personal Finance Management is Used – Main Components

RGS is not a single action but a loop that goes through many interconnected parts:

1. Income Management

Knowing all forms of income (wages, freelance gigs, investments, passive income) and optimizing earning potential.

How it’s Used:

- Finding Your Income Streams: Knowing where money is coming from tells your financial story.

- Scheming for More Money: Learning new skills, taking on side-hustles, or asking for raises to improve your cash flow.

- Knowing the Tax Impact: Knowing how different sources of income are taxed can help you plan better.

2. Expense Management & Budgeting

Being in charge of your money and establishing a plan for spending it.

How It’s Used:

- Tracking: Tracking every expense to see how and where you spend obviously helps you see where you are spending your money.

- Categorisation: Groupings of expenses (i.e., housing, food, clothing, transportation, and entertainment) lend to better analysis and control.

- Budgeting: Planning how much to spend in each category (for example, the 50/30/20 rule or zero-based budgeting) helps keep your spending in check.

- Saving Money: It’s easy to find places where you can reduce excessive spending.

3. Savings & Investment Planning

Setting money aside to be used for future needs and wants and allowing it to grow.

How It’s Used:

- Saving with a Purpose: Setting aside money for targeted goals to prepare for future expenses.

- Creating an Emergency Fund: Having an emergency funds goes a long way to financial safety.

- Investment Strategy: Investing through appropriate investment vehicles (stocks, bonds, mutual funds, real estate) based on your risk tolerance and the time frame you’re working with are the drivers of wealth growth.

- Compounding: Using returns to generate more returns can be a powerful way to boost your savings over the long term.

4. Debt Management

Tactically managing borrowed funds to reduce interest, as well as pay down debt faster.

How it’s Used:

- Debt Prioritization: Determining which debts to pay off first (e.g., high-interest debt like credit cards) reduces overall interest costs.

- Debt Payoff Tactics: Apply a variety of strategies, such as the debt snowball or debt avalanche, to speed up repayment.

- Monitoring Credit Scores: Knowing how debt affects credit scores and wanting to improve it for future borrowing is necessary.

- Preventing Detrimental Debt: Educated decisions about future borrowing are a way to avoid getting buried under the weight of debt.

5. Risk Management & Insurance

You would have protected you and yours from financial loss brought on by the unexpected.

How it’s Used:

- Insurance Needs Assessment: For both individuals and businesses, not all of our life and the life of our business is covered by insurance.

- Policy Choice: Selecting the right insurance policies and understanding their terms mitigates the risk.

- Backups: You need to be able to withstand potential job loss or big unexpected expenses to be in decent financial shape.

6. Tax Planning

Tactically manoeuvring the funds to either minimize tax or maximize for tax benefits.

How it’s Used:

- Knowledge Of Tax Laws: Keeping up-to-date with income tax, capital gains tax and other taxes that apply to you will allow you to effectively plan.

- Leveraging Deductions & Exemptions: Using what is legally at your disposal for reducing your taxable income can save you money.

- Tax-Sensitive Investments: Selecting investments that provide some tax advantages can add value to your overall plan.

3. Tools and resources to help you manage your money

Various tools make modern PFM easier:

PFM Software & Apps

- Features: budgeting, expense categorization, goal-setting, calculating net worth, bill reminders.

- Examples: Popular apps include Mint, YNAB (You Need A Budget) and Personal Capital, PocketGuard, or region-specific apps like Cred, ET Money and Groww.

Spreadsheets

- Features: Customisable for more detailed budgeting, tracking and financial modelling (e.g., Google Sheets, Excel).

- Benefit: Provide flexibility for people who like to work with numbers by giving them more control of their own financial planning.

Traditional Methods

- Notebooks/Ledgers: There’s no better way to track income and expenses than getting your hands dirty (but not really).

- Envelopes: For taming cash for flex spend categories, to keep spending in check.

Financial Advisors & Planners

- Role: Offer personalized advice, assist with complicated goal setting, create full financial plans and provide ongoing guidance.

- When to Use: Major life decisions Complex financial planningWhen you need to talk to an expert, unbiased person.

Educational Resources

Books, blogs, podcasts, online courses and workshops are full of great advice about managing personal finances.

Conclusion: Take Control of Your Financial Future with PFM

It is an all-inclusive and an ongoing process which includes everything from income, expenditures, savings and investments to debt, risk and tax planning. Smart PFM is not about strict stricture, but about making clear, intentional choices that serve your values and vision.

It’s the ultimate guide to money – not just the amount you need to learn and the amount you need to earn, but what you need to be in order to earn it and keep it. So take charge of your finances with PFM and set yourself up for a safe, prosperous future.

Call to Action

Get your PFM journey off the ground with our budget template! Discover powerful PFM apps that make it effortless to take control of your finances: start on the road to financial freedom!

Frequently Asked Questions

1. What are the 5 areas of personal finance?

Earnings Spending Saving & Investing Protecting Borrowing There are 5 pillars of personal finance.

2. What makes personal finance hard?

No, it can be difficult, especially when getting started, but once you adopt a routine, it gets easier, and you begin to use the appropriate tools.

3. What is the best starting PFM tool?

Software like Mint and YNAB (You Need A Budget) are relatively easy to use and work well for those who are just starting to manage their finances in a meaningful way.

Leave a Reply