In the current business environment, where compliance and global operations are crossing paths, tax management makes all the difference in sustainable growth. Businesses are facing growing pressure to walk a line between regulatory commitments and savvy financial planning.

Meanwhile, a lot of companies need specialized advice to deal with these issues—so tax consulting is an important tool in this area. Which brings me to an important topic: Best Practices for Building a Successful Corporate Tax Advisory & Strategy Practice.

Building a solid tax practice and good services for businesses is beyond just preparing returns. It requires knowledge of corporate organization, legal systems, accounting practices, international tax treaties, and forward-thinking strategies around the long-term objectives.

An effective tax advisory strategy not only improves efficiency and reduces costs; it also results in compliance, allowing businesses to look towards the global market.

Importance of Corporate Tax Advisory

Corporate tax advisory is the essential arm that connects compliance and planning. The tax is not a requirement only; however, it is also a business fee that, when one keeps in check, can improve the profitability.

Companies that employ corporate tax advisory are better prepared for complicated legislation, audit risks, and a constantly changing tax environment.

There are a number of reasons businesses want to source tax advisory:

- Ensuring compliance with statutory requirements

- Identifying legitimate tax-saving opportunities

- Hedging tax risks in the course of cross-border transactions

- Use better business structure for more money

- Increasing transparency for greater investor confidence

The work of a tax consultant ranges from consultation to implementation, and delivery of consultancy service leads to tangible financial results.

Guiding Principles in Constructing Tax Adviser Services

There are a few guiding principles that businesses need to bear in mind when designing corporate tax advisory solutions. These principles ensure the services provided are coherent, ethical, and value-based.

- Regulatory Compliance Heading: Keeping Abreast of Domestic and Global Tax Rules.

- Risk Analysis: Prudent consideration of tax impact is in the planning and forecasts.

- Customized Solutions: We understand that each corporate organization has specific systems.

- Transparency and Accountability: Through clear reporting and audit readiness.

- Business Planning Integration: Tax planning with growth strategy.

Creating Value for Tax Advice

Robust foundations are the key to building effective tax advisory services, for both consultancies and in-house teams. This guarantees that any advice being offered is going to be precise, viable, and suited to your overall strategy.

- Familiarity with corporate structures: (Although this point might be a bit broad, I believe it’s important to look into.) Before providing advice, one should have a deep dive into the company structure and nature if it is a partnership, private ltd., public ltd., or MNC.

- Understanding of Tax Jurisdictions: Due to the tax havens of companies and businesses across many nations, there are different tax rates and compliance, which businesses might consider. Tax advisers should be knowledgeable in cross-border tax systems.

- Leveraging Technology and Data Analytics: The use of tax automation software and analytics can help increase the accuracy and predict upcoming obligations.

- Cross-disciplinary: Tax planning intersects accounting, law, finance, and economics. Multidisciplinarity guarantees the viewpoint of the whole.

How to Develop Working Corporate Tax Strategies

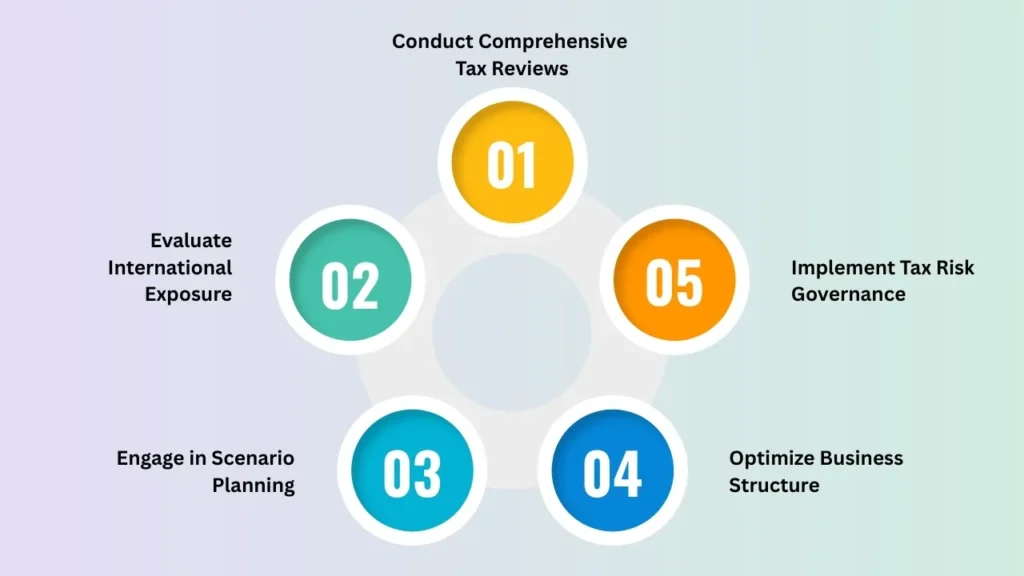

Moving beyond compliance and towards long-term sustainability is necessary for achieving effective strategies. Some of the fundamental procedures in developing strategies under Corporate Tax Advisory include:

1. Conduct Comprehensive Tax Reviews

Routine audits can help uncover inefficiencies, compliance gaps and other risks in company operations.

2. Evaluate International Exposure

Transfer pricing, withholding tax, and double taxation treaties are key design considerations for corporations with a cross-border footprint.

3. Engage in Scenario Planning

In addition, knowing what legislative and economic changes may be on the horizon builds resiliency into a tax strategy.

4. Optimize Business Structure

The tax-efficient structuring of entities and products, whilst ensuring compliance, is an important element of tax advisory.

5. Implement Tax Risk Governance

Establishing good governance that allows board directors and auditors to monitor tax practices increases investor confidence and protects against reputational damage.

Typical Issues in Corporate Tax Consulting

Tax advice is not without its complications. The following are among the most popular challenges:

- From time to time there are new tax laws both national and international

- Pressure to minimize the tax burden, and stay within the compliance lines

- Penalties from bad filings or interpretation errors

- Discrepancy between various accounting and operational functions

- Challenge to educate internal teams about best practices

Yet, with careful consideration and ongoing oversight, businesses can handle their corporate tax requirements more comfortably.

Corporate Tax Advisory, Focus Areas Source:

| Advisory Area | Description | Benefit to Corporations |

|---|---|---|

| Compliance Management | File returns, comply with laws & deadlines | Save penalty; Maintain investor confidence |

| Tax Structure Planning | Plan business structure for tax efficiency and liability saving | Cost savings through efficient structuring |

| International Taxation | Country-wise treatment of taxation within treaties | No double taxation; Ensure global compliance |

| Transfer Pricing | Guide on transactions between related parties | Globally compliant solutions; Minimize disputes; Regulatory acceptance |

| Tax Risk Governance | Reporting framework with transparency supporting regulations | Build regulatory and shareholder confidence |

How to Provide High-Quality Corporate Tax Advisory Services

Best practices for Corporate Tax Advisory Whatever an organization decides to introduce under the wings of Corporate Tax Advisory to ensure long-term impact, such new development is a valuable follow:

- Create Value: Consider tax and incidentals to the corporate plan, rather than merely a compliance back-office service.

- Keep Up To Date: Since laws shift, advisors and corporates must be kept informed and corporate teams trained.

- Work with Internal Departments: Finance, accounting, and operations departments should easily communicate.

- Involve External Auditors: Detached evaluations bring in objectivity and flag any possible blind spots.

- Be Ethical: Tax advisors should steer clear of aggressive tax planning that could tarnish the reputation.

The Influence of New Technology on Current Tax Advisory

Technology is changing the world of tax advisory. Outside of manual compliance, the tools available today build in cloud solutions, sophisticated business analytics, and AI-powered tax engines. Benefits include:

- Automatic tracking of tax compliance schedules

- Accuracy in multi-jurisdictional reporting

- Immediate tax consequences to business decisions

- Better document management for audits

Companies looking to remain competitive must invest in new and cutting-edge tax technologies.

Future of Corporate Tax Advisory

The world of US corporate tax has changed a lot in recent years. Governments are working across countries and borders to bring transparency while the digital reporting requirements spread its wings. The Future Corporate Tax Advisory should focus on:

- Increased reliance on digital tax filing systems

- Increased international cooperation in tax evasion.

- Real-time and forecasting tax analytics for decision support

- Transfer to sustainability and environmental based taxations

Companies that prepare for these changes now can be ahead of the curve in mitigating downside risk and maximizing financial effectiveness.

Final Words

In order to craft corporate tax advisory and strategy services, one needs to first delve into compliance risk management, legal structures, and inner workings of corporations. Filing returns is not sufficient: businesses need to align advisory services with their larger strategic goals.

If you concentrate on adding value, use technology, and maintain transparency, tax can change from being a compliance cost to a competitive weapon. Businesses that thought of tax advisory as an opportunity to grow will build more robust, trusted, and financially conducive futures.

Frequently Asked Questions

1. What is Corporate Tax Advisory?

Corporate Tax Advisory is a professional service to help corporations control tax obligations, maximize structures, and comply with regulations while mitigating risk.

2. What is the importance of corporate tax advisory?

It keeps companies in compliance, helps them save money through efficient tax structures, and provides risk management while enhancing investor confidence.

3. How might corporations create better tax strategies?

They can do this with regular tax reviews, structuring optimization, emphasis on international tax exposures, and by adopting risk governance models.

4. How does technology impact tax advisory?

They can do this with regular tax reviews, structuring optimization, emphasis on international tax exposures, and by adopting risk governance models.

5. How frequently should companies reassess tax strategies?

At the very least, reviews should be held annually, but companies operating internationally should hold one every quarter to keep pace with a rapidly changing environment.

Leave a Reply