One of the most critical financial responsibilities you will have as a parent is to plan for a child’s education. With college tuition skyrocketing and the increasingly confusing world of educational options, the question of saving for college early is a vital one.

“Parents can use the child education plan to guarantee that when it is time, they have money to channel into their kid’s curriculum costs, whether locally or internationally. This article provides clear, step-by-step advice on how to plan and pay for a child’s college education — from goal-setting and saving to investing to financial-planning options.

The Significance of Child Education Planning

Tuition inflation is always greater than price inflation, meaning future schooling will be pricier by the time a child reaches college age. Without the right plan, parents may find it increasingly difficult to afford these escalating costs, which can also affect the child’s opportunities.

A holistic child education planning solution doesn’t just take into account total expenses (tuition, accommodation, books, and living expenses) in view but also creates a handy pot over time which safeguards against unpredictable financial pressures.

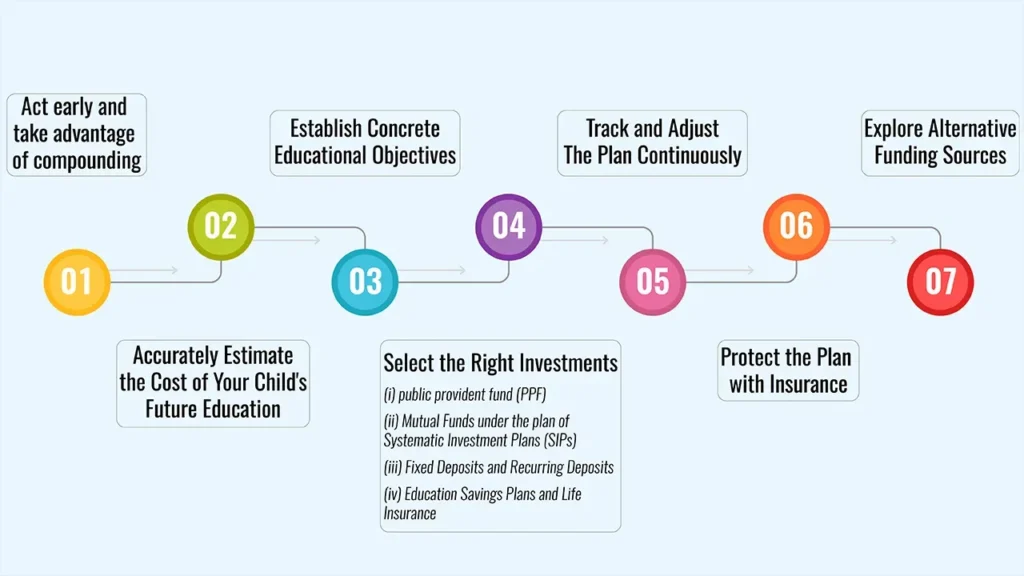

Here are the 7 steps for child education planning

Step 1: Act early and take advantage of compounding

The objective, they explain, is to save as soon as possible, because that way parents will benefit most from the power of compounding. And even small amounts contributed every month can build a decent corpus in 15-20 years if invested wisely. The benefits are greater when there’s a long-term investment and a regular pattern, such as periodic small contributions to an appropriate investment vehicle, instead of trying to save a huge amount in short-term periods.

The protection makes early planning possible, providing the family with a longer runway to reorient the investment portfolio as the child ages, matching it with the age-based education timeline.

Step 2: Accurately Estimate the Cost of Your Child’s Future Education

Planning for children’s education starts with estimating complete future cost. Parents should multiply fees by as much as 6-8% a year (that’s the rate of inflation for education on average, according to current inflation data) over the length of the course to calculate what they need to save.

There are online financial calculators and financial planners to assist with these cost estimates. All related costs, such as tuition, travel, extracurricular activities and living costs, should be included, particularly if the child is supposed to study abroad.

Step 3: Establish Concrete Educational Objectives

Where do parents see their children studying, and in which discipline and at what level? The preparation is different if the child goes to a local school, an international university or only wants to take courses.

Setting clear objectives facilitates the choice of the appropriate investments and timeframes. It’s possible some parents are saving for primary and secondary school without even counting those costs against their savings goals for higher education.

Step 4: Select the Right Investments

There are several financial instruments that you can use for child education planning. Some common options include:

- public provident fund (PPF): A government-created savings/investment instrument giving tax benefits and guaranteed return. Ideal for long-term, low-risk investment.

- Mutual Funds under the plan of Systematic Investment Plans (SIPs): It provides market-linked returns, having a relatively high growth potential over the long term.

- Fixed Deposits and Recurring Deposits: More secure alternatives for short-term financial aspirations or foreseeable needs such as school fee payments.

- Education Savings Plans and Life Insurance: Tailored products for saving money for education and protecting this investment in case of contingencies.

Investment of funds across the range of options moderates risk and ensures liquidity when funds are required.

Step 5: Track and Adjust The Plan Continuously

As education expenses and family finances grow, a periodic review of the child education planning becomes paramount. Adjustments could involve raising contributions, altering portfolio allocation according to risk profile, or taking into consideration new government schemes and taxation benefits. It supports target goals that reflect actual and expected levels.

Step 6: Protect the Plan with Insurance

It can stop an education plan in a major way, with uncertainties like losing that breadwinner’s income. They can protect the investment made toward an education by providing insurance coverage on risks that can affect savings through life insurance and health insurance policies. All this is a protective cover to receive money continuously, no matter what happens.

Step 7: Explore Alternative Funding Sources

In addition to personal savings, scholarships, grants and student loans can help finance a child’s education. Planning with these possibilities in mind, even if the lion’s share of costs are paid out of own-sourced funds, gets families ready for a nuanced approach to paying for college.

Final Words

Child education planning is not simply a matter of saving money; it is about the value of a child’s future hopes, dreams and accomplishments. Beginning early, establishing attainable goals, and picking the right combination of investment vehicles can enable parents to face rising educational expenses without the worry of financial ruin.

Consistent plan reviews and suitable insurance cover provide that extra layer of security, and that journey from early schooling to university graduation has that little more polish and is well funded. A thoughtful, disciplined approach today paves the way for a prosperous, opportunity-rich tomorrow for the next generation.

Frequently Asked Questions (FAQs)

1. What is the importance of child education planning early on?

Beginning early helps your savings to compound, which alleviates the pressure on your monthly savings requirement and the effect of education cost inflation.

2. How do I know how much my child’s education is going to cost in the future?

Determine the cost presently and the inflation factor (6-8% per year) every year. Web-based calculators and planning tools are systems that can help estimate overall costs, including tuition and living expenses for prospective students.

3. Which are the best child education planning investment options?

An optimal combination of long-term instruments such as PPF and mutual funds (SIPs) along with the safer instruments like fixed deposits can ensure a good equilibrium between capital protection and growth potential.

4. How frequently should I update my ED plan?

To ensure continued appropriateness and effectiveness of the college & university education planning strategy, it should be reviewed annually or whenever there is a major change in your finances and financial goals.

Leave a Reply