How to Get Started with Alternative Investments 2025? It’s a question professionals across the investment industry are urging investors to ask themselves as interest in various and alternative financial assets grows. Alternative investments are opportunities beyond stocks, bonds and cash that can give you exposure to different types of investment vehicles, including real estate, commodities, private equity, hedge funds and cryptocurrencies.

These investments can create greater portfolio diversification, boost potential returns, and better manage risk. But there is a learning curve, as it means understanding the basics, the types of alternative investments out there, the risks and rewards and how to incorporate them into your financial planning.

This article conveys that down really well and teaches the reader the way forward to smart investing in alternative assets in 2025.

What Are Alternative Investments?

Alternative investments are financial assets that don’t fall into traditional investment categories such as stocks, bonds and cash. Instead, they include a variety of asset classes, such as:

- Real property and REITs

- Like gold, oil and agricultural produce

- Private equity and venture capital

- Hedge funds and managed futures

- Collectibles, such as art, antiques and wine

- Cryptocurrencies and blockchain-based assets

These investments often have little correlation to more conventional markets, which can help lessen overall portfolio volatility and achieve better risk-return profiles. But they also usually come with longer investment time frames and less liquidity.

Why Consider Alternative Investments?

Some investors use alternative investments to break free from traditional asset classes. Key benefits include:

- Diversification: Alternative investments tend to follow a different path than stocks and bonds as markets shift.

- Potential for Bigger Returns: A few alternative investments can yield extra-big gains, particularly private equity and venture capital.

- Risk Management: Real estate and commodities are tangible assets that can serve as an inflation hedge.

- Unique Opportunities: Alternatives provide a direct investment into a startup, new technology, infrastructure, or a niche market segment.

Yet these benefits bring trade-offs of complexity, lack of liquidity, and increased fees. These are the things you need to know before you get started.

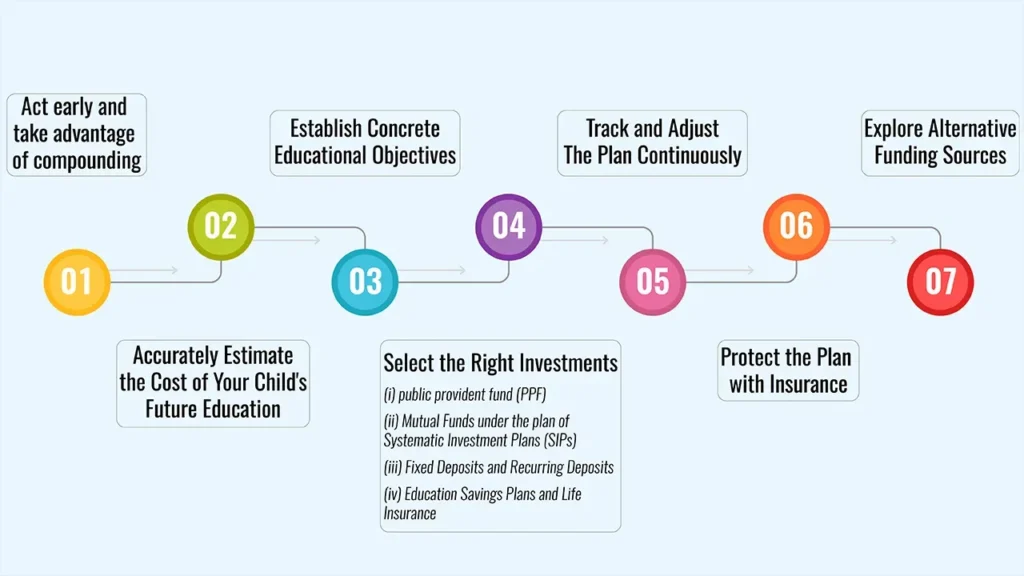

Getting Started: A Step-by-Step Guide

Step 1: Evaluate Your Financial Goals and Risk Tolerance

Hedge your bets – Before you invest any money into alternative assets, work out your investment objectives in terms of growth, income and diversification, and work out how much risk you can comfortably take. Not all of these investment alternatives may be appropriate for all investors and may be complex and lack liquidity.

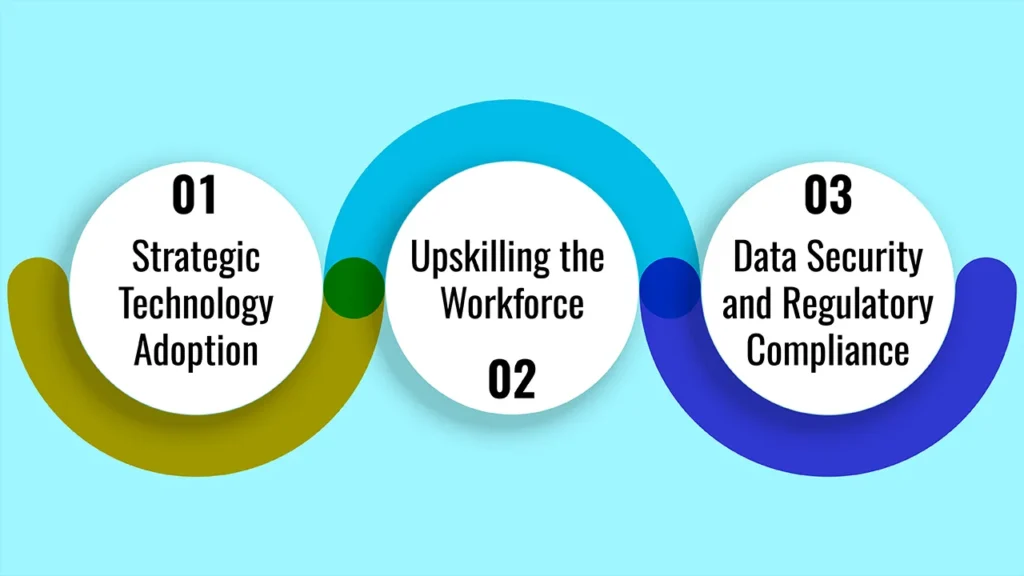

Step 2: Know What Kind of Alternative Investments Exist

Explore some of the features, risks, and potential returns of various alternative asset classes. Understanding the differences can be useful in terms of which investments to choose that are in line with your targets.

Step 3: Consult Financial Professionals

Connect with financial advisors that cater to alternative investments. They can also help you weigh the right choices and structure your portfolio efficiently.

Step 4. Start small and diversify

Start small with alternative investments, with traditional assets at the core of your portfolio. Diversifying within alternatives (real estate, commodities, private equity) helps further spread risk.

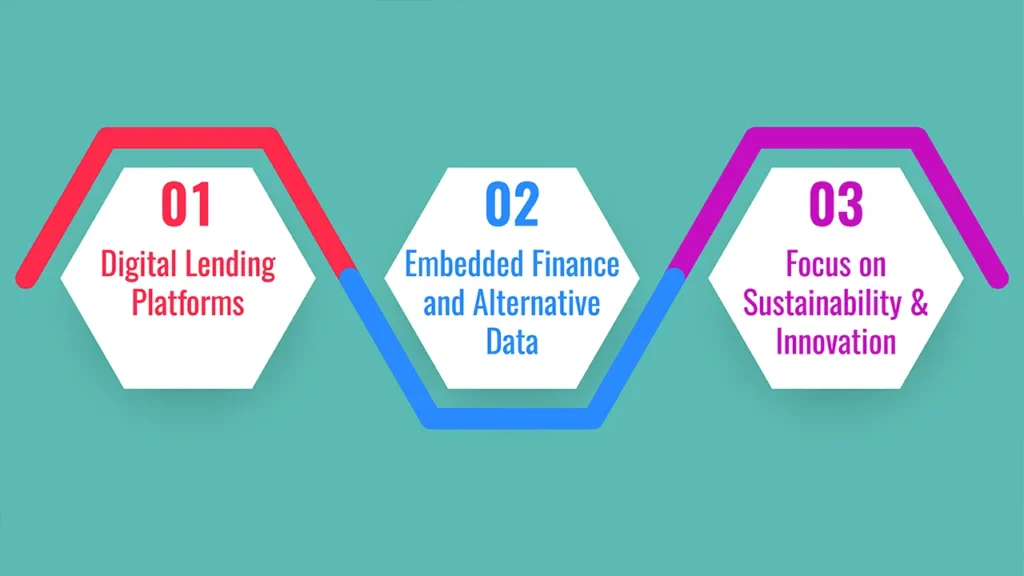

Step 5: Evaluate Fund Structures or Platforms

Much of the money in alternatives comes through funds or platforms that provide pooled vehicles investing in the way of, eg, private equity funds, hedge funds or real estate funds. These offer professional management and an easier form of access.

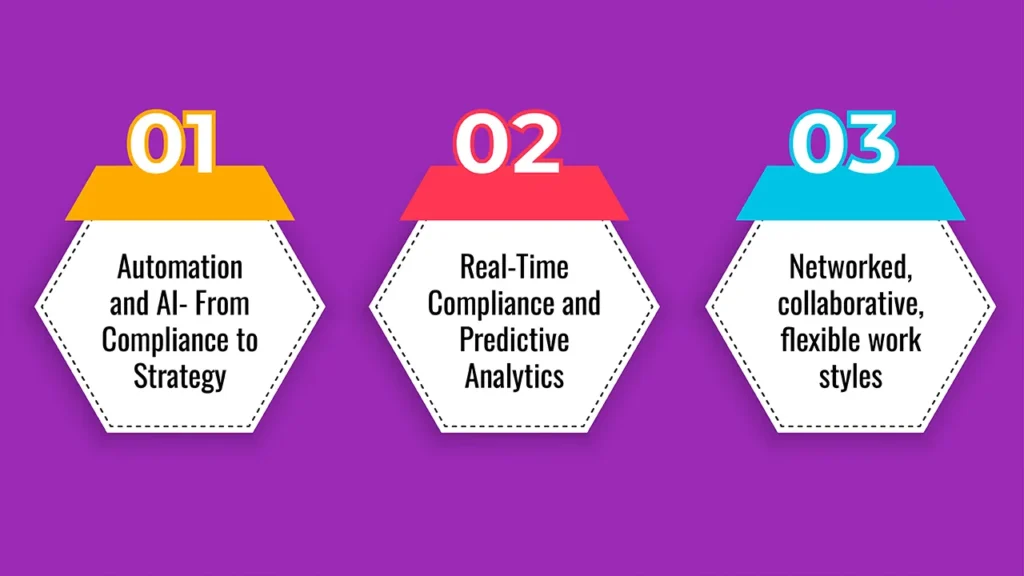

Step 6: Maintain and Review Regularly

Since alternative investments are an ever-changing arena, Rout says that you should monitor and review these assets on an ongoing basis to ensure they work for you and “adjust your investments as the markets change, your investing philosophy matures, or as your financial situation evolves.”

Types of Alternative Investments Explained

| Type | Description | Key Features | Risks and Considerations |

|---|---|---|---|

| Real Estate | Direct ownership or REITs of residential or commercial property | Income from rents; inflation hedge | Illiquidity; market/specific property risks |

| Commodities | Investments in physical goods like gold, oil, or crops | Tangible; diversifies portfolio | Price volatility; geopolitical impact |

| Private Equity | Capital invested in private companies or startups | High growth potential; long-term | High risk; illiquidity; high minimum investment |

| Hedge Funds | Pooled funds using strategies like leverage and derivatives | Active management; varied strategies | Complexity; high fees; performance variability |

| Cryptocurrencies | Digital currencies using blockchain technology | High potential returns; innovation-driven | Extreme volatility; regulatory uncertainty |

| Collectibles | Assets like art, antiques, or rare coins | Tangible potential appreciation | Illiquidity; valuation difficulties |

Understanding the Risks

Although alternative investment opportunities carry large potential benefits, they are not without risks:

- Illiquidity: A lot of alternative investments cannot readily be sold without incurring a loss.

- Complexity: There can be complexity and a need for specialist knowledge and due diligence.

- Valuation Challenges: Assets such as art or collectibles are difficult to value with precision.

- Regulatory Risks: Some cryptocurrencies and private investments have uncertain regulations.

- Greater Fees: Management and performance fees can eat into returns.

That doesn’t mean that investors should hike the risks they take with the hope of rising returns.

Tax Considerations and Regulatory Environment

Alternative investments can have varied tax regimes by jurisdiction and by type of investment. It’s important to know the tax systems when it comes to capital gains, income, inheritance as well as alternative investment-specific laws. Regulations also decide who is allowed to invest in certain types of alternatives, which can limit access to accredited or institutional investors.

Incorporating Alternative Investments into Your Portfolio

EC: What is the best way to use substitute products? article.concurrent6.description= oinsurtech The best use of alternatives is to supplement or diversify existing traditional assets in order to reduce volatility. Depending on the investor’s profile, an average asset allocation would devote 10–30% of the portfolio to alternating stocks. Different strategies are used:

- More conservative investors: It may look to real estate and commodities.

- Risk-tolerant investors: They may be interested in private equity, hedge funds or cryptocurrencies.

- Individual hedge funds: Invest in multiple alternative asset classes, while balanced approaches include more than one alternative asset class.

Final Words

How to Get Started with Alternative Investments 2025 is about one thing: realising what makes sense for you, exploring solutions that work, and investing responsibly. Alternative investments provide access to growth opportunities and portfolio protection beyond stocks and bonds, but they require patience, knowledge, and careful planning.

Taking steps, consulting with professionals, and continuously educating yourself will help you successfully venture on your journey into alternative investments. Strategically allocated and monitored, alternative investments can be powerful components of long-term wealth creation and financial resiliency.

Frequently Asked Questions (FAQs)

1. What are alternative investments?

Alternative investments are financial assets that don’t fall into traditional categories such as stocks, bonds or cash. They range from real estate, commodities and private equity to hedge funds and cryptocurrencies.

2. Why should I include non-traditional investments in my investments?

They offer the advantages of diversification, the potential for above-average returns and protection from inflation and market volatility.

3. Are alternative investments risky?

Yes, many alternative investments do have downsides, including higher risk of illiquidity, harder-to-value holdings, and regulatory uncertainty. You should really do your homework and seek professional advice.

4. How can I get my foot in the door of alternatives?

Take your investment objectives and risk profile, learn about what is out there, speak with financial planners, take small positions, and consider fund choices.

5. What fees are common to alternative investments?

Alternative investments typically have higher management and performance fees than traditional investments, in part because they are more complex and require active management.