Business doesn’t all come down to one variable: how fast sales and marketing strategy win the market. How your business is structured also has major implications for profitability, compliance and long-term sustainability. Startup founders put a large emphasis on operations but often miss out on the potential benefit of tax savings.

Understanding how to structure your business for tax savings can generate a large amount of money, reduce the risk you take, and allow your business to grow steadily over time. Knowing how to successfully handle business structure and tax effectiveness involves considering ownership types, liabilities, and tax obligations.

In this article I will break down different business structures, what the pros and cons are with each, and how businesses can make sure to not only reduce taxes but to do so in a compliant manner.

Why Business Structure Matters

The business entity you select has implications over the long term. It’s the arbiter of how profits are taxed, how much paperwork gets pushed around, and how liabilities are dealt with. The correct structure adds tax efficiency, while the wrong structure may add unnecessary obligations and risk personal assets.

There are several reasons why a business owner needs to focus on their structure:

- Tax liability variances: taxes are filed differently in each structure.

- Compliance Pressure: Certain business models carry a higher administrative burden.

- Investor attention: the correct mechanism brings the money.

- Risk Management: Liability is different in different structures.

- Scalability: Design that can handle expansion and growth.

Being able to make informed decisions will add value and optimize the tax efficiency of your business.

Basic Business Structures and how they are Taxed

Business structures There are various types of “business.” Let’s look at how each of those affects tax efficiency.

1. Sole Proprietorship

- Definition: The most basic level of business, wherein you can immediately be subject to personal liability for debts or obligations.

- Taxation: Owners report all income on personal tax returns and pay self-employment taxes.

- Pros: A snap to set up, total control, minimal paperwork.

- Cons: No liability protection and a small pool of tax planning strategies.

A sole proprietorship might make sense to some freelancers or micro-business owners, but as profits increase, the lack of flexibility could diminish tax outcomes.

2. Partnership

- Definition: A contract involving two or more parties who share ownership.

- Taxation: Profits and losses flow to partners’ tax returns.

- Pros: Simple reporting, profit-sharing flexibility.

- Cons: Personal risk, disagreements can muddy management.

For tax purposes, partnerships are more flexible than sole proprietorships, but the liability protections are still minimal.

3. Limited Liability Company (LLC)

- Definition: Combines the flexibility of a partnership with limited liability.

- Taxation: May elect pass-through entity or corporation taxation.

- Pros: Solid liability protection, multiple ways to be tax efficient.

- Cons: More expensive to establish, varies from state to state.

An LLC is a flexible type of business structure, and owners can gain tax benefits by choosing how their business will be taxed (as a pass-through entity or as a corporation if beneficial).

4. Corporation (C-Corp)

- Definition: A distinct legal existence in which ownership is held by shareholders.

- Taxation: Corporations are taxed on profits; shareholders are also taxed upon distribution (double taxation).

- Pros: Great growth potential, investor-friendly, and offers liability protections.

- Cons: Higher compliance, double taxation.

Whilst C-Corps are often met with double taxation, it’s also the corporation structure where you can deduct expenses, and they reinvest their own income quite effectively after paying out compensation in a tax-efficient manner.

5. S-Corporation (in applicable jurisdictions)

- Definition: Pass-through entity to avoid double tax.

- Tax treatment: Profits are passed through to owners’ personal taxes.

- Pros: Prevents a double tax, protects against liability, and employees receive benefits.

- Cons: There are limits on the type of ownership and number of shareholders.

Where you are permitted, S-Corps are a great choice, because they give you the best of both worlds—special structural benefits but without being locked into a profit treatment.

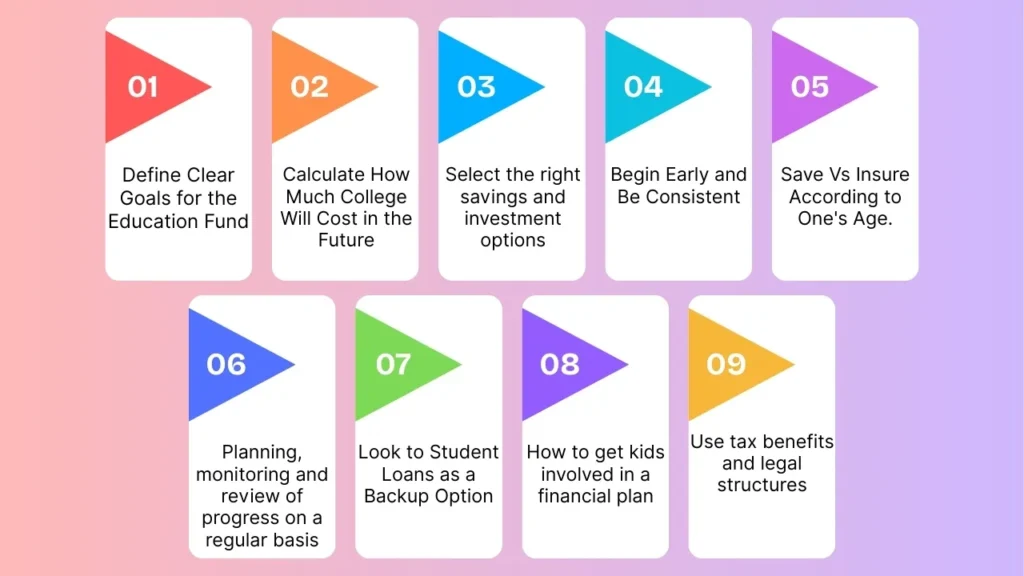

Comparison Table of Business Structures

| Business Growth Stage | Business Preference | Tax Efficiency Trend |

|---|---|---|

| Early Stage | Sole Proprietorship / Partnership | Low—simple structure but limited tax benefits |

| Growth Stage | Limited Liability Company (LLC) | Medium – balances liability protection and some tax efficiency |

| Expansion Stage | S Corporation | High pass-through taxation with growing efficiency |

| Mature Stage | C Corporation | Very High—scalable structure, corporate tax planning strategies |

Final Words

Selecting the appropriate type of business is not just a question of legalities but also effective tax planning and general success. The decision-making strategy needs to take into account liabilities, investor-friendliness, and scalability. Each form—sole proprietorship, partnership, LLC, or corporation—has its own advantages and disadvantages when it comes to taxes.

Through regular strategy review, thoughtful leverage of deductions, and structural modifications when necessary, any business can enhance performance and limit the drain on resources for taxes while additionally building towards sustainability over time.

Frequently Asked Questions

1. How does business form impact the tax-efficient enterprise?

A company’s structure affects how income is taxed, whether under personal or corporate rates, and the rules governing deductions.

2. What is the most tax-effective structure for a small business?

LLCs or S-Corporations are typical preferences due to their liability protection and tax-treatment options.

3. Can I convert to a different business structure in the future?

Often businesses can reorganize, but it may take legal paperwork, possible fees and in some cases, tax consequences.

4. How might companies minimize the effects of double taxation?

One method is not to pay high dividends but instead to give reasonable salaries or reinvest profits.

5. The best way to get the most out of your business is by hiring tax advisors?

Yes, professionals can assist with deductions, compliance and the best structure for tax efficiency.