While we struggle through July 2025, the world markets refuse to sit still. From changing interest rate expectations to geopolitical convolutions and technological leaps, investors grapple with a moving landscape.

The global economy is slowing; the inflation number becomes a concern. Central banks are shifting course, and geopolitical tensions are weighing on market sentiment. In such an environment, it is important for investors to stay nimble and on top of things.

This guide will show you “July 2025 Investment Strategies”. No matter how much you’ve invested or how long you’ve been investing, these strategies will help you exercise your brain and make better-informed decisions to maximize your portfolio’s performance.

You can use your knowledge of the current market conditions to rework your strategy and successfully navigate this changing world of finance.

1. The July 2025 global and local market pulse

Understanding the Macroeconomic Environment

- Slower world economic growth: Global GDP growth, at around three per cent again for 2025, following a period of several strong years. The U.S. is due to cool, and the Eurozone and China have particular challenges. For a detailed global economic outlook, refer to the OECD Economic Outlook, Volume 2025 Issue 1.

- Inflation landscape: Global inflation is still a source of worry and forecasted at about 2.9% (World Bank) or 4.2% (OECD) for 2025, still higher than in pre-pandemic times in some parts of the world. That could keep central banks on their toes.

Interest Rate Environment:

- Global: Many central banks (with the U.S. Federal Reserve the potential exception, which may wait until March 2026) have been engaging in a mild easing cycle since mid-2024, supporting growth as inflation moderates. Some major advanced economies are likely to cut rates further in 2025, provided that inflation expectations remain sufficiently anchored.

- India-specific: RBI has already cut the repo rate by a substantial 250 bps in April and June 2025 to 5.50 per cent. This indicates a level of assurance on stable inflation (3.7 per cent for FY2025-26) and an emphasis on growth acceleration (6.5 per cent for FY2025-26).

Geopolitical backdrop: The continuation of trade tensions and policy uncertainty (i.e., U.S. tariffs) remains a headwind for growth and supply chains. Geopolitical tensions also represent threats that must be watched closely.

Impact of Technology: The rapid advancement of AI and other technologies is altering industries, presenting both disruption and outsized investment opportunities.

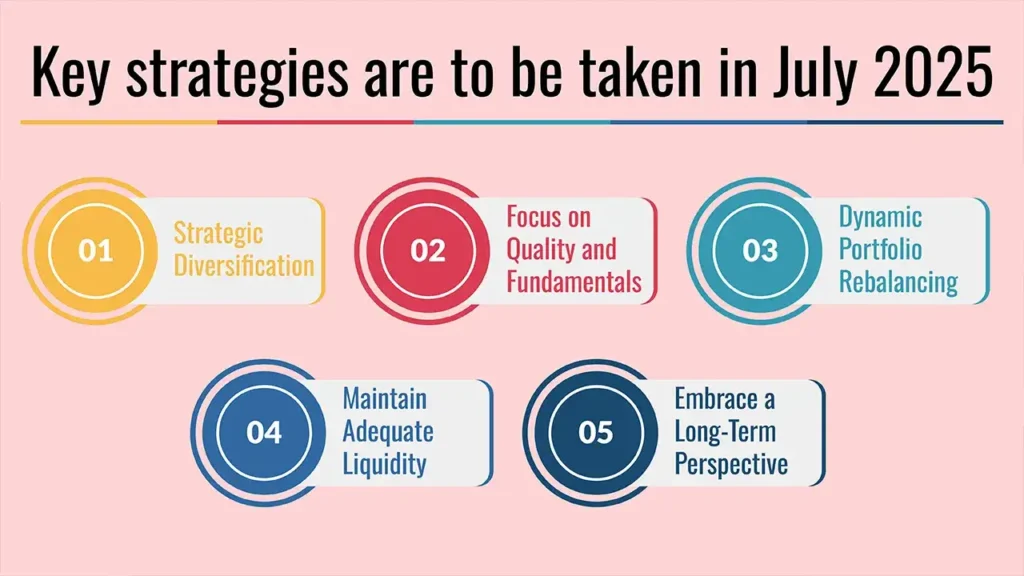

2. Key strategies are to be taken in July 2025

Building Resilience and Capturing Opportunity

1. Strategic Diversification

- Detail: It is the technique of investing across various asset classes (equities, fixed income, real estate, commodities), geographies and sectors in order to reduce the impact of decline in a market.

- Why now: With uneven global growth and trade uncertainty, diversification is now more crucial than ever — to protect against region-specific shocks.

2. Focus on Quality and Fundamentals

- Details: favouring corps that have healthy balance sheets, predictable earnings, moats & robust cash flow.

- Why now: With a slowdown in global growth, companies that hold up best during economic headwinds can offer more stable returns.

3. Dynamic Portfolio Rebalancing

- Detail: This is a strategy where you occasionally bring your portfolio into line with your desired asset allocation as market movements change its mix.

- Why now: With potential rate cuts in India (debt is an attractive investment) and diverse global growth, active rebalancing guarantees that your portfolio is still in line with your risk tolerance and objectives.

4. Maintain Adequate Liquidity

- Detail: Keeping a portion of your portfolio in cash or near cash-like investments.

- Why now: Offers flexibility to take advantage of sudden market drops (“buying opportunities”) or to pay for unexpected costs without being forced to sell assets at a loss.

5. Embrace a Long-Term Perspective

- Detail: Avoid acting viscerally in response to short-term market gyrations. Keep your long-term financial goals in mind.

- Why now: Volatility is expected. Adherence to a carefully considered long-term plan allows you to wait out market noise and compound interest over time.

3. The Key Sectors and Themes to Watch

Where Opportunity May Be in July 2025

1. Technology & AI Innovation:

- Detail: Still growth ahead in AI, cloud computing, cybersecurity and other niche tech categories that enable efficiency & transformation.

- Thing to Consider: Look for companies that have a sound business model, not just buzz.

2. Healthcare and Biotech:

- Detail: ageing global population, new drug innovation and higher health care spending.

- Thing to Consider: Resilient sector with exposure to regulatory change and R&D risks.

3. Renewable Energy & ESG:

- Detail: Strong tailwinds from global climate goals, government incentives, and increasing investor demand for sustainable investments.

- Thing to Consider: Long-term growth potential, but it can be subject to policy changes and commodity prices.

4. Indian Consumption & Infrastructure:

- Detail: With easing inflation and a supportive RBI, domestic consumption may pick up. Capital expenditure push by the government in India drives infrastructure development.

- Thing to Consider: Strong Indian GDP growth prognosis (6.5% for FY2025-26) makes domestically focused sectors appealing.

5. Fixed Income (Bonds):

- Detail: With potential rate cuts across the world and RBI’s recent cuts, bond yields could give attractive entry points, especially for longer-duration bonds as prices zoom.

- Thing to Consider: Balances portfolio risk, stable income.

4. Customizing Strategies for You as an Investor

Personalizing Your Investment Approach

- Conservative Investors: Prioritize capital preservation. Consider high-quality bonds, dividend-paying stocks and more-stable sectors.

- Moderate Investors: It is when you are (Me: I’m going to make some money) – This person has a mixed approach with his investments focusing on growth, but work can also be done on the risk you are exposed to. Spread across asset classes and sectors.

- Speculative Investors: more on the line/for more upside. “Concentrate on the high-growth stocks, on new emerging technologies, on maybe higher-risk/higher-reward sectors, but legs, work it really really well.”

- The Financial Adviser: Emphasize the importance of an advisor who will provide you with an individualised plan.

5. Things to Watch Out for in This Incredible Marketplace

Avoiding the Most Common Investment Mistakes

- Market Timing: Trying to time the market highs and lows is generally not a good idea.

- Emotional Investing: Based on headlines or fear/greed as opposed to your plan.

- Herd Mentality: Go with the masses, without your own study.

- Failure Of Due Diligence: Investing in unknown ventures or industries without research.

- Over-Leveraging: Excessive debt, particularly in real estate, that may magnify losses.

Conclusion

By July 2025, adaptable “investment strategies” are necessary to manage market shifts. Focusing on diversification, quality, rebalancing and taking the long-term view will enable you to find the marquee names in attractive areas.

We need to be alert and responsive to the markets. By being informed and having a disciplined approach, you’re able to manage market shifts with confidence and position your portfolio to succeed over the long term.

Call to Action

Go back over your holdings and seek expert help to customize strategies to your situation.

Frequently Asked Questions

1. Given all of the global uncertainties, should I consider making an investment in the stock market in July 2025?

Although there are some global uncertainties (trade tensions, uneven growth), markets are inherently dynamic creatures. If India has a tailwind at home from strong domestic data that show signs of moderating inflation and supportive monetary policy, there are opportunities.

The secret, they say, is to practise discipline by concentrating on diversification, quality companies and a long-term horizon instead of attempting to time the market.

2. How should I be incorporating AI into my 2025 investment plan?

The repo rate has been reduced by the RBI to 5.50 per cent. That tends to make borrowing cheaper, potentially revving up consumption and corporate investment, which can be a plus for stocks.

For fixed-income investments such as bonds, existing bond prices would increase with falling yields, but new fixed deposit rates could be lowered. It could also lead to expansion in industries such as real estate.

3. How should I be incorporating AI into my 2025 investment plan?

AI is a game changer. If you’re an investor, you might want to look into the top AI companies or companies that are leading the way using the technology to improve their businesses.

But it’s important to separate hype from viable business models. Artificial intelligence can also help investors by giving them more advanced data analysis and even predictive power, but human judgement is still necessary.

Leave a Reply