The decision to select a wealth management firm is among the most important choices anyone and their family members will ever make with regard to ensuring their financial future. A wealth management company offers a collection of services that go beyond just investment management and include retirement planning, estate planning, tax efficiency and risk management.

There are so many vendors today that it can be very confusing if you don’t know what you’re looking for in terms of your financial needs, lifetime aspirations and the characteristics to target in a professional partner.

This article explains how to choose the right wealth management firm and considerations to look for, as well as steps you can take to ensure you make a wise decision.

Understanding Wealth Management

What is wealth management? It goes beyond investment advice to offer personalized financial planning, estate planning, philanthropy, retirement coverage, tax strategies and risk management. Unlike old-fashioned financial services, wealth management is holistic: rather than concentrate on specific products like an individual financial product or service, it considers all areas of the client’s financial life.

The right wealth management firm is critical for long-term success because, if you lead a complex financial life (or are planning to), including owning your own business, having a high net worth, or, most importantly, having family multi-generational wealth transference, at some point you will benefit from having access to a professional viewpoint that can bring clarity and vision.

The Importance of Selecting the Correct Wealth Management Firm

When you have a working relationship with a wealth management company, you are entrusting them with your future and that of your family, as well as the most personal areas of your life—finances. The right firm ensures that your wealth creation is in line with investment strategies and also provides customized tax and estate planning.

Selecting the wrong firm, however, could mean bad decisions or too-high costs or strategies not in harmony with your risk-taking and/or principles.

Here are a few reasons why it’s such an important choice:

- Safeguarding your long-term wealth growth.

- Stabilizing the volatile financial markets.

- Optimizing tax-efficient strategies for better return on your investment.

- Constructing a bucketed financial plan appropriate for personal and family goals.

- Preventing conflicts of interest by contracting with transparent firms.

Key Factors to Consider

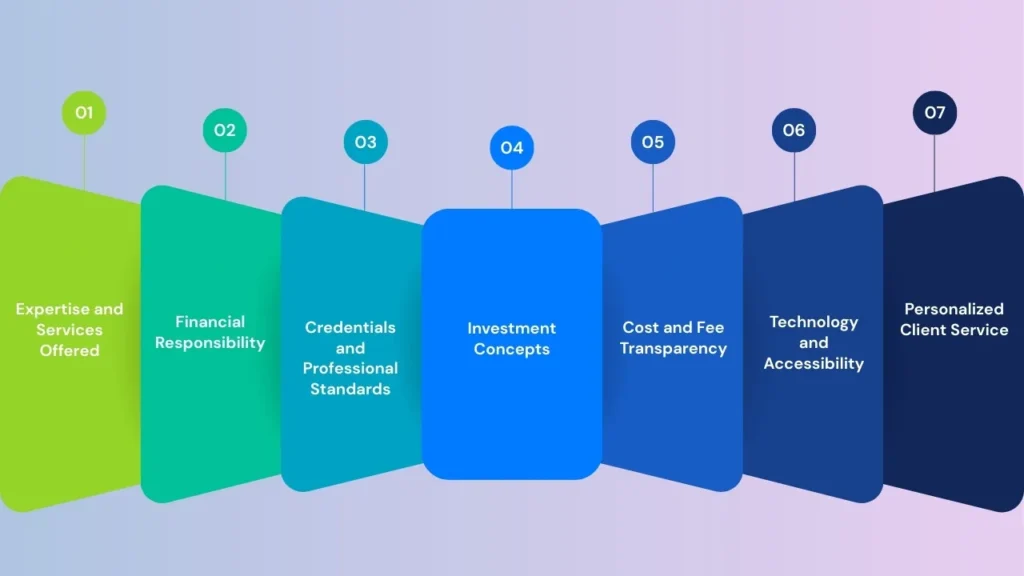

There are several key issues you need to consider when assessing a wealth management firm:

1. Expertise and Services Offered

Each wealth management firm does things differently. Some may concentrate more on investments, while others might have a more robust offering, including tax planning, estate planning, insurance analysis or business succession strategies. Inquire if the firm focuses on serving clients with needs similar to yours.

2. Financial Responsibility

The top factor to look for in a money management firm is if it works as a fiduciary. A fiduciary has a legal duty to act in your best interest, not theirs or their firm’s. This is so product recommendations aren’t motivated by commissions but instead are in your best interest.

3. Credentials and Professional Standards

Find companies with advisors that hold reputable designations like CFP, CFA, or CIMA. These titles reflect expertise, education, and ethical responsibility.

4. Investment Concepts

Every financial advisor has its own investment philosophy. Some can be aggressive in nature, geared toward growth-oriented strategies; others may promote risk mitigation and stable growth for the longer term. Realizing if the strategy they purport to follow is in line with your risk level is very important.

5. Cost and Fee Transparency

Wealth management fees vary. Some do it as a percentage of assets under management (AUM), others as flat fees, and still others via commissions. Compare costs and make sure you understand all existing charges before signing anything.

6. Technology and Accessibility

A modern approach to wealth management also means the use of digital dashboards and data analytics in financial planning with information available online. A company with sound technology brings you the ability to monitor your portfolio and financial planning in a more effective manner.

7. Personalized Client Service

Wealth management is not “one-size-fits-all.” A great firm spends time getting to know your unique goals, values and lifestyle. Evaluate if the firm is providing personalized strategies and enabling regular communication with an advisor.

Wealth Management Fee Models Compared

| Fee Model | Description | Pros | Cons |

|---|---|---|---|

| Assets under Management (AUM) | A percent on what’s in their portfolio charged annually | Same success as the firm with your portfolio growth | May get expensive as you grow |

| Flat Fee | Fixed amount paid annually/quarterly | Predictable and easy to understand | Bodyguard against size of wealth changing |

| Hourly Fee | Pays only for time and advice | Open and fair, no hidden commissions | Can be unpredictable based on issues |

| Commission-Based | Advisors earn from selling products. | Might seem cheaper upfront | Risk of pushing product, conflict of interest |

Here, you can get a good feel for why we consider it so important to know how much fees are going to cost.

Choosing the Best Wealth Management Firm—A Step-By-Step Approach

Instead of jumping, consider taking these steps for some clarity:

1. Identify Your Needs

Start with some clarity: estate planning, retirement planning, tax efficiency or plain old investment management? Your need determines the firm you select.

2. Research Potential Firms

Check out online reviews, industry rankings and peer recommendations to narrow down your list of firms. Be sure to watch for specialization, types of service & focus on clients.

3. Interview Shortlisted Firms

Treat this process like hiring. Inquire about experience, the financial planning process, and wealth management philosophy. Focus on transparency and responsiveness.

4. Assess the Advisor-Client Relationship

Since wealth management is so much about clarity of communication, meet the advisor and find out if they understand and sympathize with all your requirements.

5. Check Regulatory Compliance

Ensure that the company is registered with all regulatory authorities and it complies with regulated standards. This protects your financial interests.

6. Evaluate Technology and Innovation

Leading-edge wealth management firms tend to offer sophisticated performance dashboards, timely reporting and proactive analytics.

7. Understand Succession and Continuity Plans

Wealth management is a long-term commitment. Make sure the practice has a succession plan in place so your strategy stays intact even when your lead advisor retires.

Common Mistakes to Avoid

- Selecting on reputation, rather than fit.

- Failing to account for hidden charges or commission rates.

- Neglecting to consider how much the firm lines up with your personal financial philosophies.

- Failing to require the firm to be held to fiduciary standards.

- Not comparing at least three financial firms to select the one that best meets your wealth management needs.

Final Words

When you partner with a wealth management firm, you don’t just give them your portfolio—you trust that they are helping to secure your financial future for generations to come.

Having clarity on your FPU/financial goals along with doing proper research would have prevented you from choosing a partner who does not share the same values as you do. Thinking about fiduciary responsibility, fee transparency, investment philosophy and personalized service prepares you for long-term financial success.

Frequently Asked Questions

1. What does a wealth management firm do?

A financial advisory firm that offers comprehensive financial services such as investment advice, retirement planning, tax and estate planning, or specific goal-based solutions for individuals or families.

2. How can I tell if a wealth management firm is reputable?

Seek fiduciary status, professional designations, regulatory scrutiny and favorable reviews. Another aspect of trustworthiness is communication and fee transparency.

3. How much money do you need to have for wealth management services?

Enter different companies at various points. Some serve high-net-worth individuals; others provide services for professionals just starting to accumulate wealth. In general, most companies have minimum investment amounts that can be as low as a few hundred thousand dollars.

4. What is the distinction between a financial advisor and a wealth management firm?

An investment counselor usually provides investment advice. A good wealth management firm offers a wide range of services with the full spectrum of financial categories—investments, taxes, estate planning, philanthropy, and legacy planning.

5. How can a wealth management firm assist with tax planning?

Yes. More than a few provide tax-planning-oriented wealth management solutions aimed at helping you save income, capital gains, and estate taxes in the most effective way possible.

Leave a Reply