With the rising awareness of investing with a conscious mind, sustainability has become an integral aspect of financial planning. Now with the immediacy of climate change, the strict environmental controls and consumers who demand responsible businesses will only encourage individuals to reconsider their endless desire for investing.

To succeed, the best way to align financial goals with global responsibility is what we call a ‘green portfolio’. If you want to learn from a basic level, How to Build a Green Portfolio in 2025: This is the guide you need. We will cover all the most trivial details and give you our top choices and, of course, how to build your portfolio!

By the time you finish this article, you’ll know what constitutes sustainable investing and how to choose the right assets for a green portfolio, as well as the risks and rewards involved in green investing and tactics for finding the right balance of profit with purpose.

What is a green portfolio?

A green portfolio is a portfolio of investments to achieve good investment returns as well as consideration of ESG (Environment, Society and Governance) issues.

As opposed to the only search for profit, in 2025 investors will be going for green-orientated portfolios and environmentally friendly technology that has ethics as its basis, in addition to companies that have made a commitment to reducing environmental harm.

The sole objective of the Green Portfolio is to:

- Cut exposure to industries driving climate change.

- Invest in companies with sustainability and renewable energy themes.

- Build wealth for the long term, and bring positive social change at the same time.

Why Green Portfolios Will Matter In 2025

2025 is the year we need to save for sustainability. There are more rigorous carbon emission regulations in place globally, the world is adopting renewable energy at an accelerated pace, and companies are accountable to a greater degree. A green portfolio is not only good for the environment, but it also keeps investors in tune with industries of the future.

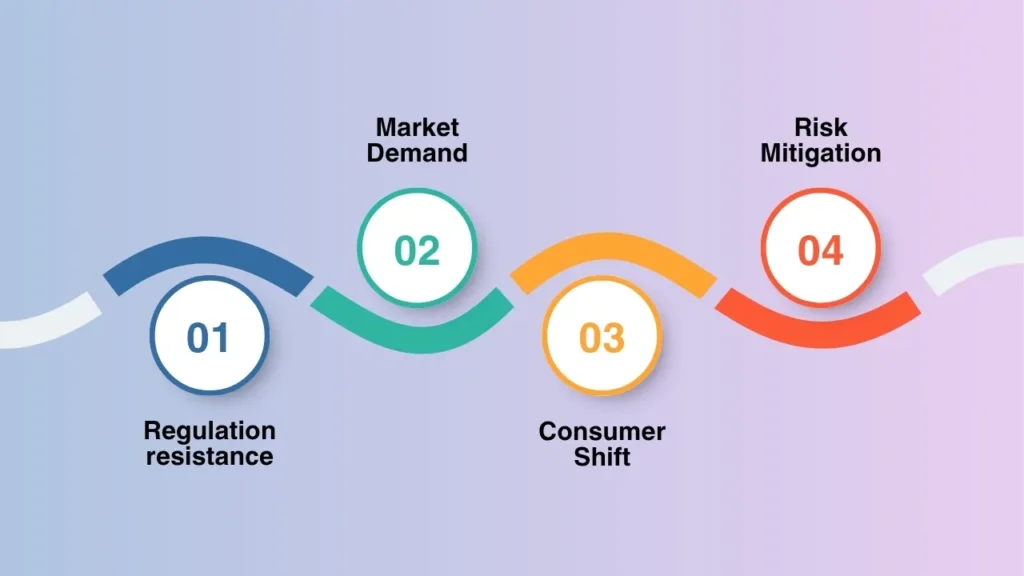

Here are a few major reasons why Green Portfolios is trending right now:

- Regulation resistance: Companies with dirty environmental records pay huge fines, while environmentally friendly companies receive tax breaks and grants.

- Market Demand: The world market for green energy, electric vehicles, and sustainable manufacturing is growing rapidly.

- Values and Consumer Shift: Customers are increasingly favouring businesses that reflect their ethical values and paying socially responsible companies the dividend of higher sales.

- Risk Mitigation: Compared to traditional portfolios, the fossil fuel and pollution industries carry a higher level of risk.

Priority Sectors for a Green Portfolio

When figuring out how to construct a green portfolio, you need to know which industries are important. Here are some hot segments to keep an eye on in 2025:

1. Renewable Energy

Solar, wind, and hydro firms are leading the charge for the energy revolution. Investing in these funds provides exposure to sectors poised for continued global growth.

2. Electric Vehicles and Green Mobility

As car manufacturers are in full wholesale adoption of electrification, EV companies as well as the battery storage makers are crucial parts of the mix.

3. Sustainable Agriculture

Eco-friendly agriculture is the future. Organic farming, wise irrigation systems and the production of plant-based food are causing a revolution in agriculture.

4. Technology for Sustainability

Tech firms offering energy-efficient solutions, carbon capture and green cloud computing are proving popular.

5. Real Estate and Green Infrastructure

Environmentally friendly construction and intelligent cities will be the focus of urban development.

How to Build a Green Portfolio in 2025

To build a well-constructed portfolio, you need to plan it and research it. Here are the steps to follow:

Step 1: Establish What You’re Investing For

Before you add any assets, it is important to be clear on whether you are looking for growth, income, and long-term retirement planning. Ensure these objectives are sustainable as a priority.

Step 2: Assess ESG Ratings

Look at the ESG (Environmental, Social, Governance) scores for companies. These scores document the extent to which a business is environmentally friendly and socially responsible.

Step 3: Mix Up Your Green Portfolio

Don’t be too overly exposed to just one area, such as renewable energy. Diversify your investments across a range of green industries to spread risk.

Step 4: Mix in Stocks and Bonds

Individuals may choose between:

- Direct investments in green companies.

- Sustainability-focused Exchange-Traded Funds (ETFs) and Mutual Funds.

Step 5: Monitor Performance Regularly

Sustainable companies are fast-evolving. Conducting a regular review of your green portfolio can allow you to rebalance it to ensure ongoing strong performance and alignment with new prospects.

Example Green Portfolio Investment

Here is a basic table of how you might allocate assets in your green portfolio for 2025:

| Asset Types | Allocations | Examples |

|---|---|---|

| Renewable Energy Stocks | 30% | Solar, Wind, Hydro |

| Electric Vehicles & Batteries | 20% | EV manufacturers, Charging |

| Green Technology | 20% | Energy efficiency, Carbon capture |

| Sustainable Agriculture | 15% | Organic farming, Plant-based food |

| Green Real Estate/ETFs | 15% | Tech cities and Cloud-based opportunities |

This construction balances diversification with the integrity of the Green Portfolio theme.

Dealing With Risks in a Green Portfolio

There are risks to every investment—even sustainable investments. A well-orchestrated green portfolio takes these problems into consideration and provides the answers as appropriate.

- High Volatility in Newer Sectors: The renewables and EV sectors are both still emerging, which can lead to shorter-term price swings.

- Regulatory Changes: Government subsidies may change, influencing returns.

- Greenwashing Risks: Many companies overstate their sustainability efforts. As with all investing, be sure to check the ESG credentials of any investment before pulling the trigger.

- Currency and market risk: Investments of international clean energy may be subject to risks such as currency exchange rate fluctuation and market policies.

- Risk Mitigation: This simply means diversification, due diligence of green claims and setting a sensible strategy that matches your financial goals.

Long-Run Gains of the Green Portfolio

There are some near-term risks, but there are also tremendous long-term opportunities in maintaining a green portfolio.

- Green Growth Industries: Sustainable Profit Green industries are predicted to grow faster than the old because they satisfy new, global demands.

- Social Impact: Invested capital is used to offset environmental damage.

- Boosted Reputation: Those who focus on green investing as individuals and companies often achieve credibility.

- Future-Proofing Wealth: Global economies will keep moving towards eco-driven industries in 2025 and beyond.

Common Mistakes to Avoid

Here are the pitfalls to avoid when learning how to construct a green portfolio:

- Investing without thorough ESG research.

- Getting too concentrated in one industry to the detriment of diversification.

- Overshooting conventional financial measures in pursuit of sustainability.

- Getting duped by greenwashing without thinking too hard about it.

Final Words

Knowing how to construct a green portfolio in 2025 isn’t just about maximising profits—it’s an investment mindset that has everything to do with a world in which wealth generation is bound up tightly with sustainability and responsibilities.

By spreading your investment to renewable energy, green technology, sustainable agriculture and eco-friendly infrastructure, you can find a balance that enables financial rewards while contributing to the impact on our planet.

Constructing a green portfolio enables market resiliency and fosters the industries that are forming the future of mankind. Whether you are getting started or stretching your investments further, it’s an ideal time to build a green portfolio that grows wealth and protects the planet at the same time.

Frequently Asked Questions:

1. What is a green portfolio?

A green portfolio is a type of investing that revolves around companies and industries that place as much emphasis on sustainability, environmental responsibility and ethical governance as they do on profits.

2. How do I begin a green portfolio in 2025?

You may be an investor who wants to focus on companies that are the best corporate citizens and have strong prospects for returns but don’t exactly know where to start.

You can begin by articulating your investment goals, looking at ESG ratings across different sectors, diversifying across a handful of industries with sustainable practices and including both direct stocks and ETFs in your portfolio.

3. Are green portfolios profitable?

Indeed, green portfolios can be lucrative since the clean energy, electric transport and green technology industries are booming sectors which often outperform traditional ones.

4. What are the risks associated with green portfolios?

Challenges are concentrated in early and growth sectors, evolving government incentives, and company greenwashing, as well as global market risk.

5. Can you make a green portfolio work for retirement planning?

Absolutely. Individuals can develop a secure retirement plan and back environmental objectives through diversified long-term sustainability-focused investment options.

Leave a Reply