Financial independence is a journey, not a race. But for those in the early years of How to Supercharge Your Savings in Your 40s and 50s, the decades are a pivotal period – a combination of a final sprint and a graceful victory lap where time remains to build substantial retirement savings and achieve some ambitious goals.

Odds are that you are in your peak earning years, that you have a wealth of experience and perhaps fewer short-term financial obligations than you did when you were younger.

If you’re not sure how to navigate this key saving period, you’ve landed on the right page. This guide will give you practical strategies to increase your savings and enable you to build a strong fortune as you confidently approach your golden years. For an overall perspective on financial planning in your 40s and 50s, see Investopedia’s guide to saving in your 60s.

Why Your 40s and 50s Are Prime Time for Saving

Though sooner is always smarter, there are some special advantages of midlife for improving your financial planning:

1. Peak Earning Potential

For many, their peak earning years are in their 40s and 50s. This leaves you with more money that you can put towards savings.

2. Closer to Retirement

The retirement end-of-the-rainbow is just around the corner, so, there’s no better motivation than that sense of urgency to get your financial plan fixed up.

3. Reduced Early-Life Expenses

For many, some of their largest expenses — like child care or first-home down payments — may be in the rear view mirror, freeing up cash flow.

4. Financial Wisdom

What do you learn after suing and being sued by everyone from your most trusted adviser to your landlord? You pick up a few things that you would have liked to have known 10 to 20 years ago.

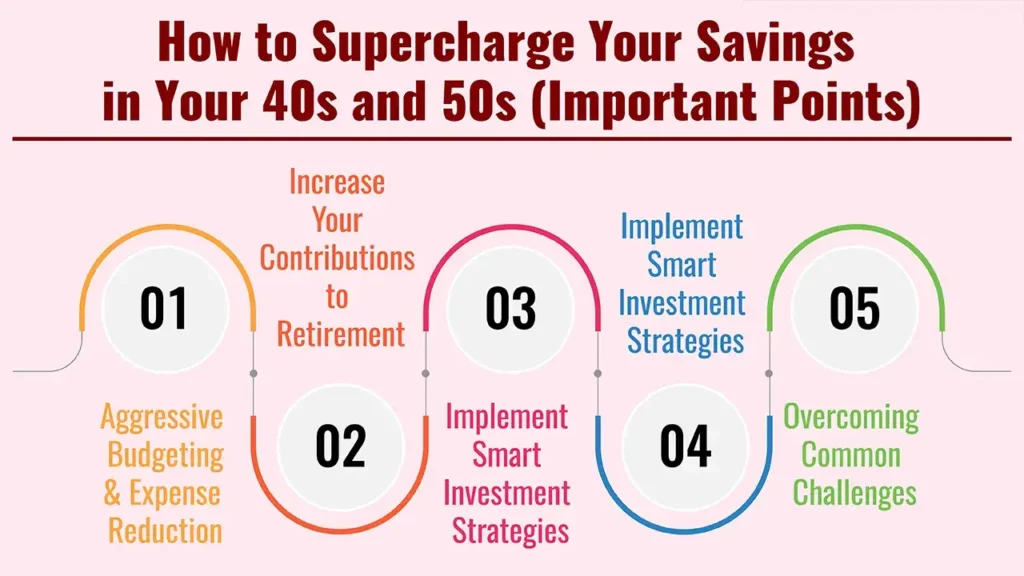

How to Supercharge Your Savings in Your 40s and 50s (Important Points)

It’s time to get strategic. What follows are the best strategies for crushing your savings goals in your 40s and 50s:

1. Aggressive Budgeting & Expense Reduction

Even if you’ve budgeted in the past, a deep dive is in order.

- Conduct a Spending Audit: Carefully track all your spending for a month or two. You may be surprised how your money is spent.

- Identify and Eliminate Non-Essentials: Consider any recurring subscriptions or unused memberships or any discretionary expenses that you can reduce or cut completely. Small, consistent savings snowball into something significant over time.

- Optimize Recurring Bills: Research for lower rates of insurance (home, auto, life), internet, phone plans and utilities.

- Reduce High-Interest Debt: Focus on paying back credit card debt, personal loans, or other high-interest debts first. The amount of money saved on interest can then be diverted into savings.

2. Increase Your Contributions to Retirement

It’s debatable, but one of the most important things you can do here.

- Max Out Employer-Sponsored Plans: If your employer has a 401(k), 403(b) or other such plan, contribute up to the maximum at which an employer match is available. This is essentially free money.

- Utilize Catch-Up Contributions: Someone who is aged 50 or older can usually take advantage of tax laws that also permit higher extra contributions to retirement accounts (such as 401(k) and IRA). Use them to speed up your savings.

- Use of a Traditional/Roth IRA or Roth/Traditional Account(s) (ROTH AND/OR IRA): If you’re maxing out your employer plan or don’t have an employer plan, you should be contributing to an I.R.A. or Roth I.R.A., depending on where you’ll be eligible for tax incentives.

- Understand and Optimize Pension Plans: If you have a defined benefit pension, know what its payout options are and how it fits with your other savings.

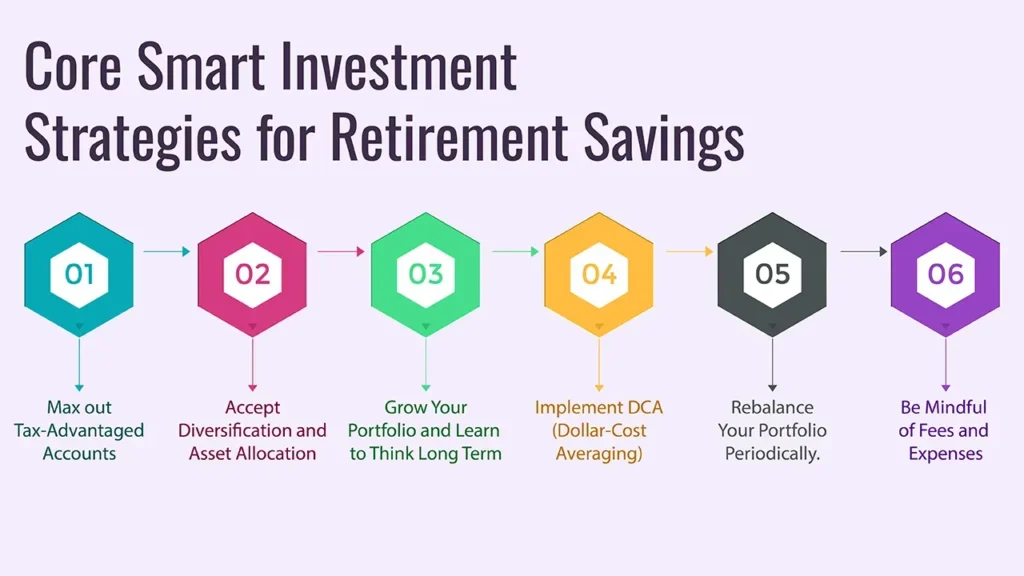

3. Implement Smart Investment Strategies

Your investments should be earning their keep.

- Review and Adjust Asset Allocation: As you get near retirement, your ability to prioritize one goal over another changes. And make sure the assets in your portfolio (the mix of stocks, bonds, and so on) are appropriate for your timeline and tolerance. And while you can mitigate risk, just keep in mind that you still have to have growth to fight inflation.

- Increase Investment Contributions: Money from raises, bonuses or spending cuts should go directly to your investment accounts.

- Diversify Your Portfolio: Diversify money across asset classes, sectors and geographies to reduce risk.

- Consider Professional Financial Advice: A certified financial planner can help you develop a personalized investment strategy, maximize your portfolio and handle difficult financial decisions.

- Boost Your Income: More money means more to save.

- Explore Side Hustles: Put your experience and skills to use on freelancing, consulting or a part-time project.

- Negotiate Salary and Promotions: Advocate for yourself at work. Being in your 40s and 50s is valuable.

- Monetize Hobbies or Skills: Turn a passion into a source of income.

- Consider Rental Income: If you have some extra space, you might be able to rent out a room or property.

4. Optimize Major Expenses

Some of the largest expenses you face may have the potential for great savings.

- Mortgage Strategy: Think about putting more money down on your mortgage to own your home that much faster and free up substantial cash flow in retirement. Refinancing at a lower interest rate may also save you money.

- Children’s Education Planning: “If you can, try out for selective universities and win scholarships and grants, or look around for a less expensive school, such as a community college. Balance their interests against your own retirement security.

- Downsize Your Home: If you find your current residence is larger than you need and there are substantial maintenance costs involved, think about selling and downsizing. And the equity freed up can make quite a difference in your retirement savings.

- Healthcare Planning: Outside of insurance, look at Health Savings Accounts (if you can get one), which offer a triple tax whammy (deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses).

5. Overcoming Common Challenges

Hurdles are bound to happen, but you can work through them.

- The “Too Late” Mindset: You can never be too deep into improving your financial future. A string of aggressive saving, even just a few years’ worth, can have a significant effect thanks to compounding.

- Competing Financial Priorities: Manageing retirement savings alongside other goals (like your kids’ education or caring for ageing parents) takes thoughtful planning and prioritizing. Ensure a balanced message by consulting with the selling agent.

- Market Volatility: Avoid letting short-term swings in the market knock you off your long-term course. Stay the course with your diversified investment approach and do not make any emotional decisions.

Conclusion

Your 40s and 50s provide a significant window to reset your financial future. Two other solid vote-getters were small potatoes – paying yourself a portion of everything you earn and squeezing every bit of cost out of a recurring expense.

Get a handle on things, be consistent and get peace of mind from ensuring your retirement is established on a strong foundation – one that will lead to financial freedom and fulfilment.

Frequently Asked Questions

1. What are retirement “catch-up contributions” accounts?

Catch-up contributions refer to extra amounts that people 50 and older can contribute to retirement accounts (such as 401(k)s, 403(b)s and IRAs) beyond the regular annual limits. This is intended to enable older workers to save more for retirement.

2. How much should I be saving each month in my 40s and 50s?

It depends on your income, expenses and retirement goals. Yet a lot of money gurus would advise you to save 15% to 20% or more.

Even if you began saving late or are aiming to retire early during these years. Run a retirement calculator to get a personalized target.

3. Debt repayment versus savings in your 40s and 50s

It really does depend on the nature of the debt. You should probably tackle high-interest debt (such as credit card debt) first, as it is the most corrosive to your financial situation.

Low-interest debt (say, a mortgage) generally comes with advice to take a balanced approach, for instance, paying it down while continuing to save for retirement.