College and university life is a dream come true for many, offering up excitement and challenges – as well as new financial responsibilities. This is the first time for many students to be on their own and with money. Create financial goals from freedom, not deprivation.

This is the difference between simply surviving and genuinely thriving. Setting goals makes it easier to spend your money while lowering the stress and helping you realise truly impactful things, both little and big.

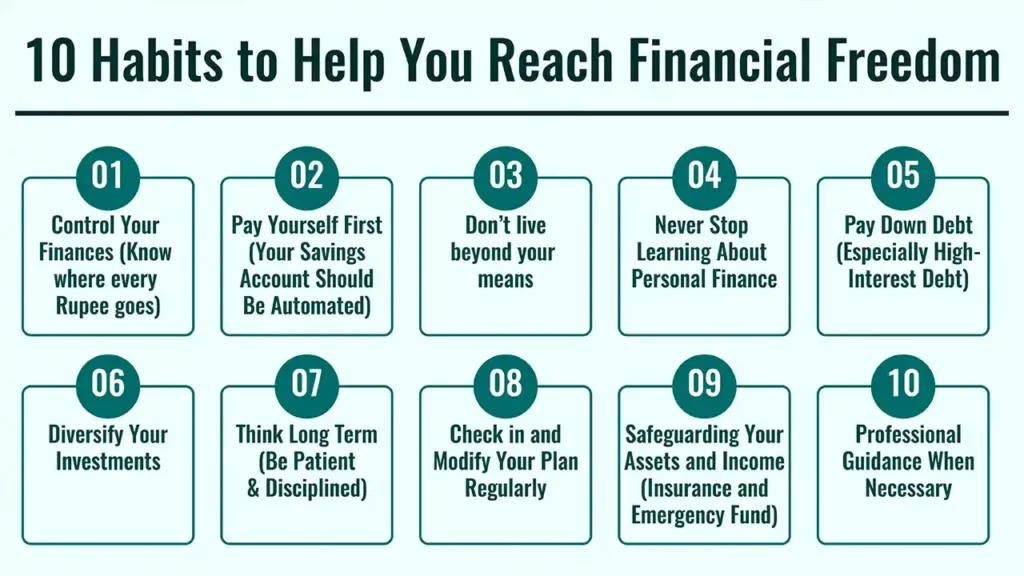

Discover essential financial goals for students to achieve financial independence. Learn budgeting, saving, and investing strategies tailored for your success.

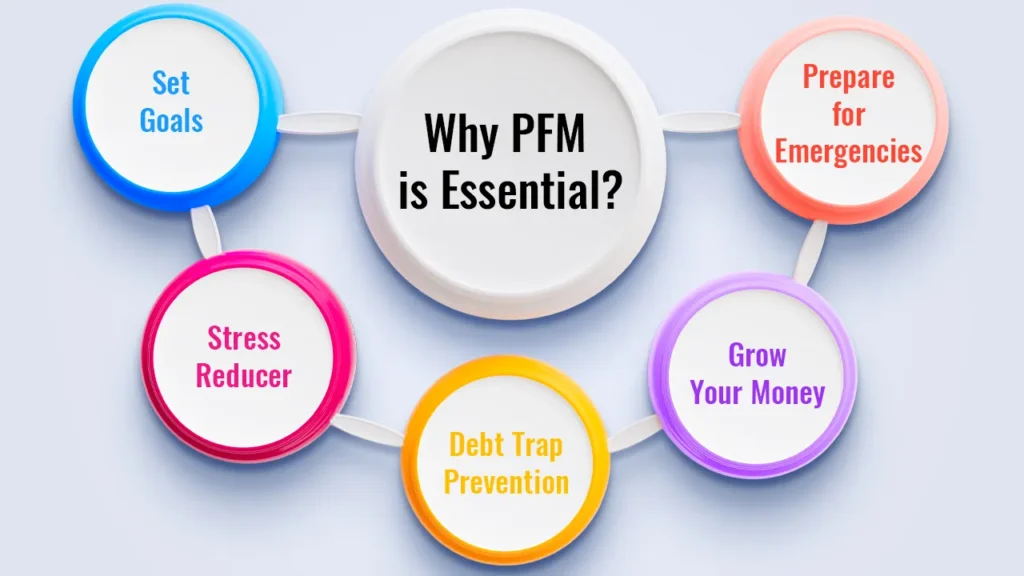

Part 1: Why bother having financial goals?

Financial Peace of Mind

Goals and a plan for money relieve anxiety and tension. You can see where your money is going, which helps you feel more in control. Like, you know you have a portion of money for textbooks or to fix your car in case it breaks down—so no need to panic if either one happens.

Motivation and Discipline

Goals make high-level concepts like saving money something real, concrete and actionable. Progress Tracking is Bit of a Reward Being able to see that savings account number rise for a study abroad or new laptop is motivation enough to learn how to say no to small, unnecessary expenses.

Establishing a Framework Going Forward

Budgeting, saving and not getting deep into debt are habits that we wish to continue for the rest of our lives. Now, learning to keep a credit card in good standing is setting you up now to be able to secure a car loan or an apartment later.

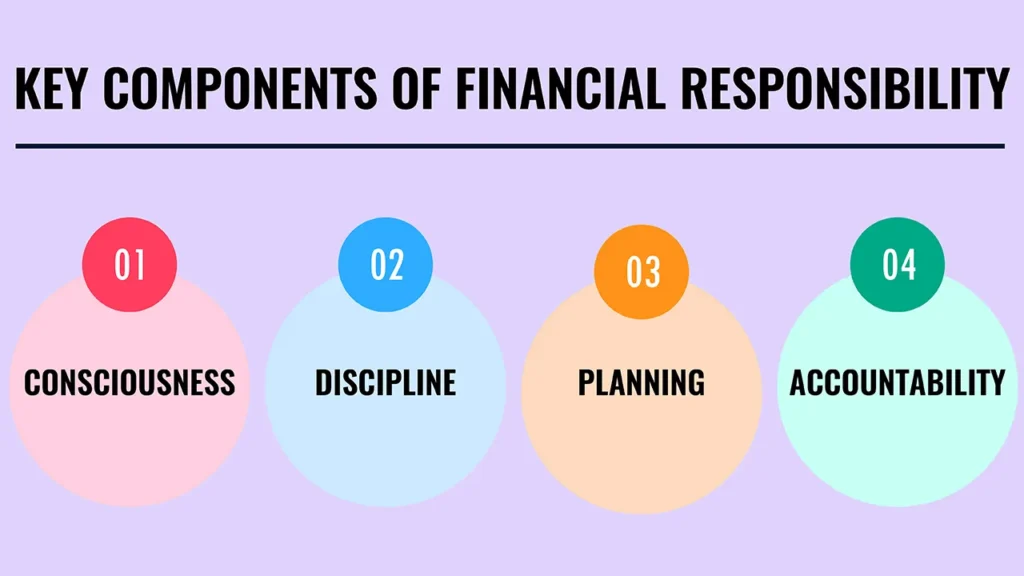

Part 2: How to Set Goals (A Step-by-Step Guide)

The SMART Framework

- Smart: an acronym that is used in a famous technique in goal setting

- Remember: What exactly is it you want? One specific goal (I want to save $500 for a new laptop) is clearer than the very vague :I want to save money

- Measurable: In what way can you measure your progress? For example: “I will save $50/month.”

- Attainable: Does this goal really work for you? Saving 50 over 10 months is really true, hey.

- Relevant: Do you need that new laptop for school, or is it another way to avoid paying down a high-interest-rate credit card?

- Time-based: What is the deadline? They could be something along the lines of “by the end of the semester” or “by December 1.

Create a Financial Snapshot

It is essential to clarify your present financial condition before enumerating goals. This involves:

- Listing any income you have (i.e., a part-time job, allowance, etc.).

- Tracking all your expenses for a month (rent, food, subscriptions, etc.).

Thanks to helpful tools like budgeting apps or simple spreadsheets, this task should not be all that difficult.

Prioritize and Categorize

Redefine your targets in accordance with short-term, medium-term and long-term so that they do not appear as a burden.

Part 3: Specific Financial Goals for Students

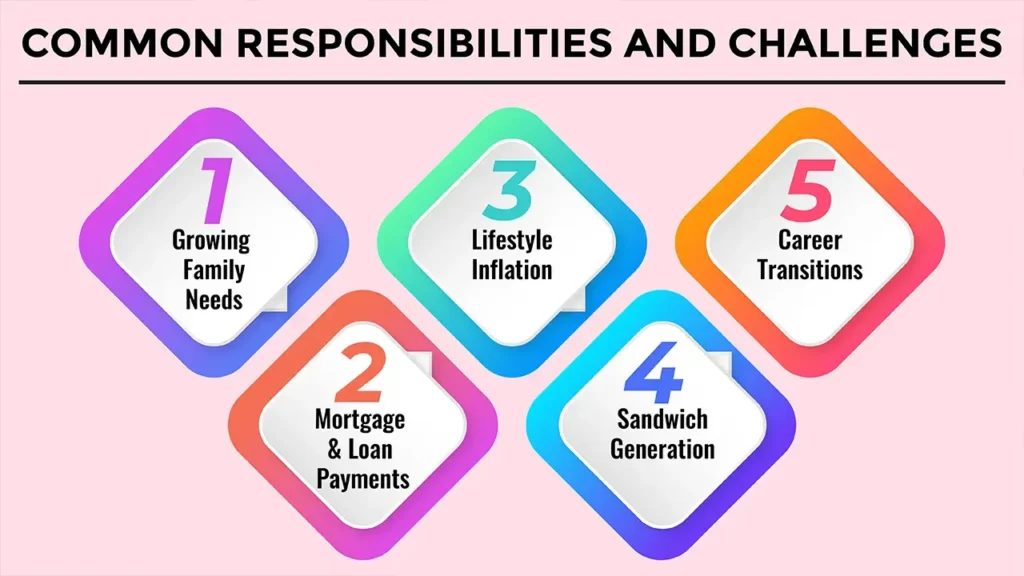

Goals for the Next 12 Months or Less

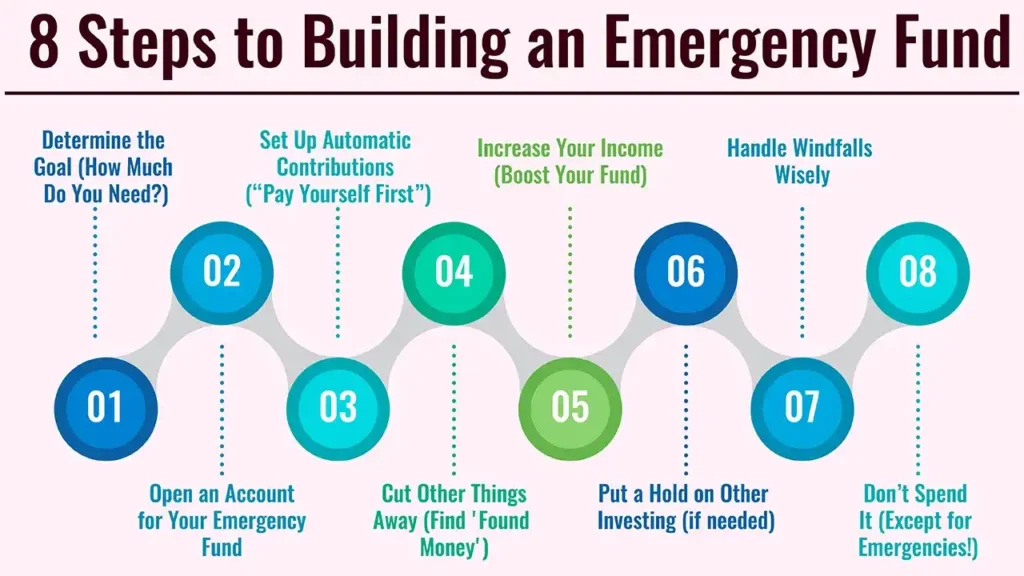

- Building a baby emergency fund ($1,000 for unexpected expenses)

- Textbook and School Supply Savings

- Saving with a specific goal or purchase intention (phone, concert ticket, clothes)

- Reunification Visit or Holiday Weekend Save for

Medium-Term Goals (1-3 years)

- Summer internship or a semester abroad savings.

- Making a down payment on a pre-owned car.

- Other examples include payment of a certain student loan or paying off credit card balance(s).

- Setting aside money to put down a security deposit on your first apartment post-graduation.

Long-Term Goals (3+ years)

- Down payment on a house

- Creating a retirement fund (such as an IRA)

- Majorly paying down or paying off student loans

Part 4: Real Items and Actual Tools for Genuine Results

“Pay Yourself First”

Separate savings account: Set up an automatic transfer of a portion of each pay cheque to another account before ever spending. This ensures you prioritise saving.

Budgeting Apps and Tools

Check out apps tailored for students that are popular, such as Mint, PocketGuard, or YNAB, so everyone knows how much they’re spending, and Splitwise to not only help people in 50/50 situations but also in shared arrangements. These tools allow for simplifying budgeting and tracking.

Student Discounts and Smart Spending

Students can save money by utilising student discounts, cooking at home more often and taking care to avoid “lifestyle creep”.

Track Your Progress

Keep your eyes on the prize and check in on those goals often to remind yourself of where you are headed. This way you keep on the hook and in line with your goal.

Conclusion: Begin Your Financial Future Today

Financial goals go a long way in helping you stay stress-free and motivated and also help build a strong financial foundation for the future. Every tiny advancement you make now – even if it is just your first $100 saved or your very first budget created – is serious leverage on you in 10,000 days. Choose one target and start immediately!

Frequently Asked Questions

1. How do I create monetary objectives when I have unpredictability about my earnings?

You can still have financial goals even without a pay cheque. Put your efforts into tracking your spending – this will give you insights into where your money leaks.

Maybe you have a goal to cut a specific amount of money from your monthly costs, or maybe it is saving $10 from every gift & odd job you get.

2. I have student loans. Do I need to pay them off first, or is that another type of saving?

What can people do to take care of their mental health in the meantime? A: To keep away from going into additional debt, begin a small emergency fund for any surprises.

From there, concentrate on high-interest debt like credit cards ahead of more student loan obliteration. You could make an objective to pay just a little more than the minimum payment each month in order to lower the total interest you’re on track to repay over time.

3. What happens when one falls off the track and fails to meet a goal?

Don’t beat yourself up! Financial setbacks happen to everyone. But the key is this – getting RIGHT back on track.

Take another look at your budget, give yourself more time to reach this goal if you need it and try again. Each morning is a chance to do something right.