You’ve advanced in your career, you have experience, and your income is probably at its highest. In these challenging times, it’s time to speed up your financial dreams and provide for your future!!! Mid-career is a time when strategic personal finance planning can make a big impact, as you leverage both higher income and years of experience to improve your finances.

This column is for professional women in their 30s, 40s and early 50s who want to learn about money and be better investors both for themselves and for their families. Unlock your financial potential with expert mid-career planning tips. Accelerate your wealth goals and secure a prosperous future now!

The Mid-Career Financial Terrain: Opportunities and Obligations

Key Opportunities

- Peak Earning Potential: Higher income provides more opportunity to save and invest.

- Experience/Network: Use your experience & network for more income.

- Longer Time Horizon than Late Career System: There is great time left for compounding to affect wealth.

- Established financial habits (hopefully): Creating habits based on current budgeting and saving discipline.

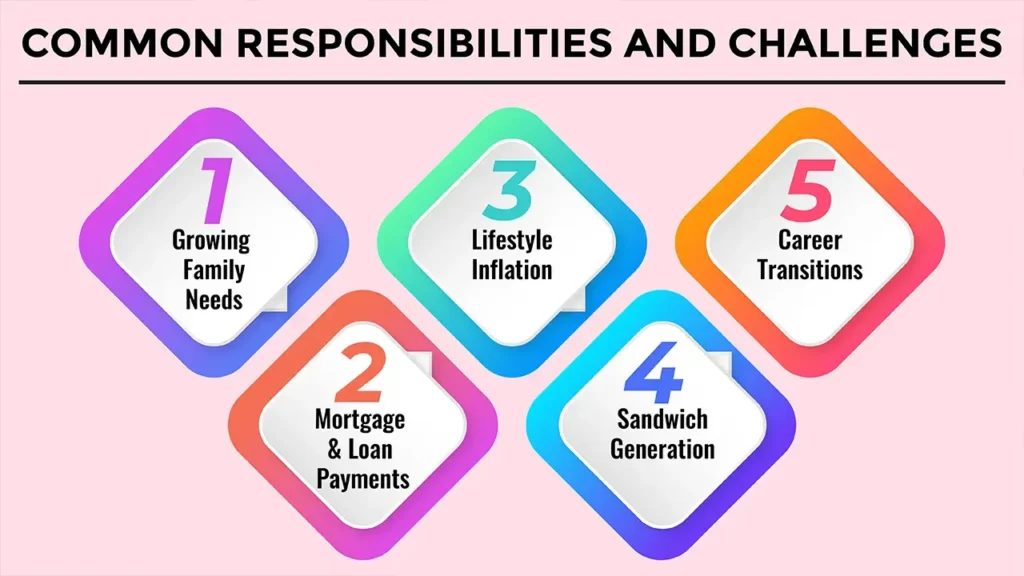

Common Responsibilities and Challenges

- Growing Family Needs: Child’s education, wedding, medical expenses.

- Mortgage & Loan Payments: Usually high debt loads.

- Lifestyle Inflation: When you spend more money as you earn more money.

- Sandwich Generation: Could be taking care of kids and elderly family members.

- Career Transitions: Transitioning jobs or starting a new business venture.

Pillar 1: Cash Flow and Savings Optimization

Deep Dive into Budgeting (Revisited)

Take tracking a step further: Learn how to turn spending categories on their head for big savings. Locate “cost leaks” and how to slash them.

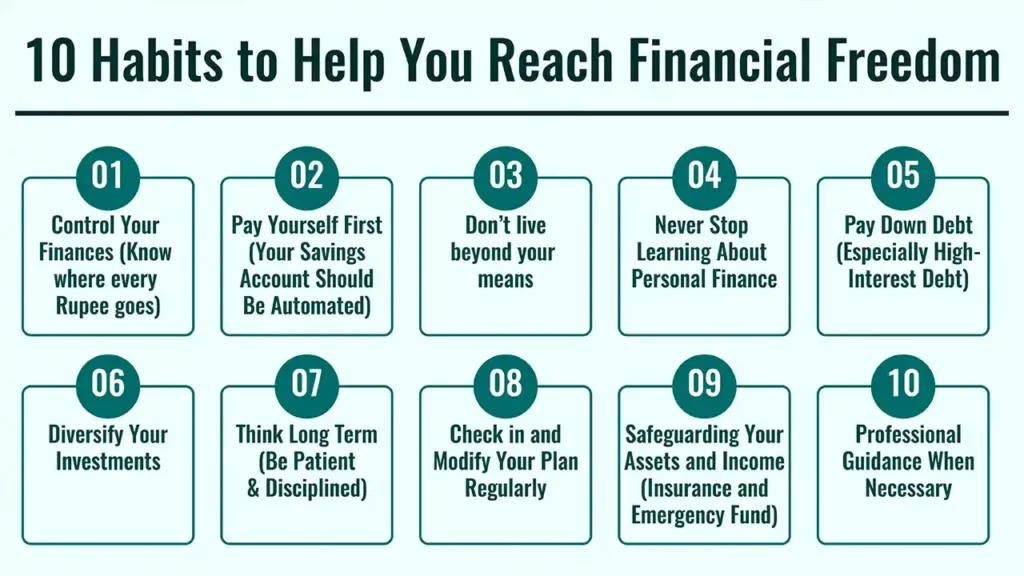

Aggressive Savings Strategies

- “Pay Yourself First”: Set up automated savings upon income crediting.

- Goal-Oriented Savings: Set aside money for specific goals (like your child’s education, your second home down payment and retirement).

- Use Bonuses & Raises to Your Advantage: Personally save i.e invest a major percentage of any surprise money or raises.

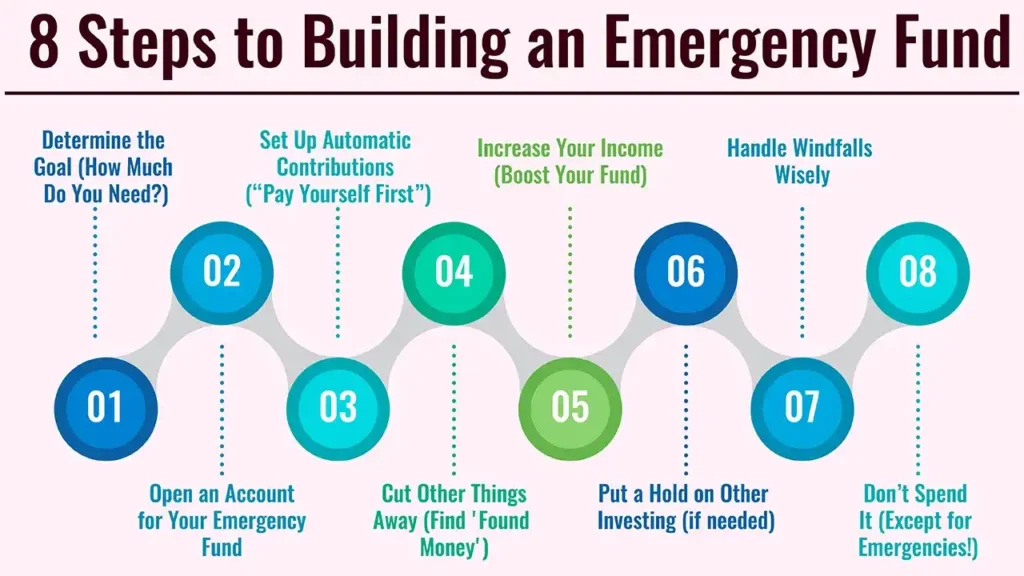

Emergency Fund Reinforcement

Make sure you have a good-sized emergency fund with 6-12 months’ worth of essential living expenses aside, especially if you have growing dependants or less job security.

Pillar 2: Dealing With And Using Our Debt Wisely

Prioritize High-Interest Debt Elimination

Concentrate hard on eradicating all credit card debt, personal loans and any other borrowing at a high cost.

Mortgage Acceleration

Think of ways in which you can prepay your home loan (say, pay extra EMIs, increase your EMIs a little) and try to become debt-free faster. Explain the virtues of arriving at retirement day debt free.

Distinguishing Good vs. Bad Debt

Point out that some types of debt (a home loan, an education loan that allows you to earn more, for instance) can be a tool, while high-interest consumer debt is destructive.

Strategic Use of Debt (Cautiously)

For which it will be used to invest (raid) in such things as real estate or business expansion, etc., and only after fully assessing the risk involved.

Pillar 3: Sophisticated Growth Strategies

Reviewing Your Asset Allocation

Re-evaluate your risk appetite in relation to time until retirement and growing wealth. Realign the balance ratio between stocks and debt in your portfolio based on your new objectives and current market realities.

Diversification Beyond Basics

- Equities: Contribute to a mix of sectors, market caps (large, mid, and small), and geographic locations (international exposure).

- Debt Instruments: Consider fixed deposits, government bonds, corporate bonds and debt mutual funds for stability.

- Real Estate: Direct property, REITs, or commercial real estate for diversification and income.

- Alternative Investments (With Care): Give a passing nod to private equity, venture capital or gold for even greater diversification, but stress doing your homework and incurring more risks.

Maximizing Retirement Savings

- Employer-Sponsored Plans (EPF, VPF, NPS): Invest more, especially if you get an employer match. Look at VPF for more tax-efficient savings.

- PPF: Keep investing maximum yearly amount for tax free growth.

- ELSS (Equity Linked Savings Schemes): If you want to save tax invoking Section 80C, with an element of equity in your investment.

- Direct Equity/Mutual Funds (Without Retirement Accounts): To build wealth outside of retirement.

- Investing Tax Efficiently: Plan to mitigate the impact of taxes on your investment gains and income.

Pillar 4: Protect Yourself, Your Wealth and Your Legacy

Comprehensive Insurance Review

- Insurance Needs: Consider whether the family has enough life insurance considering family responsibilities, debts and future needs. Consider adequate term life insurance.

- Health Insurance: Have adequate cover for you and your family, because health costs are shooting up, and critical illnesses are now `younger too! Explore super top-up plans.

- Disability Insurance: Safeguard your greatest asset – your income – if you are unable to work.

- Property & Asset Insurance: Cover your home, vehicles and other valuable assets sufficiently.

Estate Planning Essentials

- Will & Nomination: Make sure that a valid will is in place and is kept up to date. Designate beneficiaries for all financial advisors.

- Power of Attorney: Choose those you trust to make financial and medical decisions.

- Territorial Imperative Succession Planning: Think about how to transfer wealth to the next generation in the most tax-efficient way.

Children’s Future Planning

- Education Planning: Have separate funds (using SIP in an equity mutual fund) for higher education.

- Wedding Fund: If you know you will eventually be getting married, save for it now!

Pillar 5: Monitoring and Continuous Adjustment

Regular Financial Reviews

Have an annual or bi-annual meeting with yourself, or your advisor, to do a “comprehensive financial review.” Track progress towards your goals.

Adapt to Life Changes

Modify your strategy for career changes, new dependents, health concerns or major market fluctuations.

Stay Informed

Stay current on the economy, changing tax laws, and investment opportunities.

Professional Guidance

You may also hire an SEBI-registered RIA or a CFP to get unbiased, thorough advice. They can help you steer through intricacies and remain on course.

Conclusion: Create Your Legacy, Protect Your Future

In short, mid-career financial planning is a combination of accumulation, protection and having a strategic growth plan. This phase provides a unique opportunity to establish financial independence and position the latter years for a comfortable retirement and beyond.

Call to Action

There is no time like now to step into your mid-career money. Get our financial planning checklist and meet with a financial professional who can help you confidently achieve your goals.

Frequently Asked Questions

1. What are some typical investing mistakes that young savers make?

Mistakes include not spreading investments around, underestimating the importance of retirement saving and not changing your financial plans as your life changes.

2. When should I start planning for my child’s college education?

It is best to start thinking about these costs as early as possible, ideally when your child is in the early years, with the opportunity of compounding growth in special education savings accounts.

3. Is it too late to change careers mid-career from a financial standpoint?

Changing careers may be tough to do, but it is possible and can pay off financially if it is strategically planned to account for potential income shifts and the need to invest in education or training.