TOKYO/HONG KONG: Asian stock markets were mixed Thursday as investors tried to digest the latest US inflation data and navigate shifting trade policies while technology companies pushed higher on Wall Street.

Particularly in the semiconductor sector, for pockets of optimism. Explore the latest market movements as Asian stocks dip after CPI data while tech gains: markets wrap, while tech stocks gain traction. Get the full analysis in our market.

CPI Data Takes Wind Out of Rate Cut Bets, Pharma’s Dropание

By and large, Asian shares inched down as traders adjusted the degree of interest rate cuts that the Federal Reserve would make. The US Consumer Price Index (CPI) minus volatile food and energy categories rose 0.2% from May – a modest figure, but one that provided a sign that some US companies are raising their prices to counter cost pressures due to new tariffs.

“While any tariff-induced jump to inflation is expected to be temporary, more higher tariffs being imposed means the Fed should still refrain from raising interest rates for a few months at least,” said Seema Shah at Principal Asset Management.

The cautious outlook encouraged traders to chip away at the odds of multiple Fed rate cuts this year, with the likelihood of a September cut now barely better than a coin flip, less than a 20% chance of two rate cuts this year. These revised policy bets typically bear down on riskier assets in Asia.

In a similar sector-specific drag, Asian pharma stocks fell following renewed threats by US President Donald Trump to impose tariffs on pharmaceuticals by the end of the month.

(Tech Outperforms as Chip Export Expectation Lifts Seoul)

Tech stocks across Asia, in turn, bucked the broader market decline, supported by favourable developments in the semiconductor sector. The Hang Seng Index in Hong Kong added 0.3 per cent, largely on the back of tech companies.

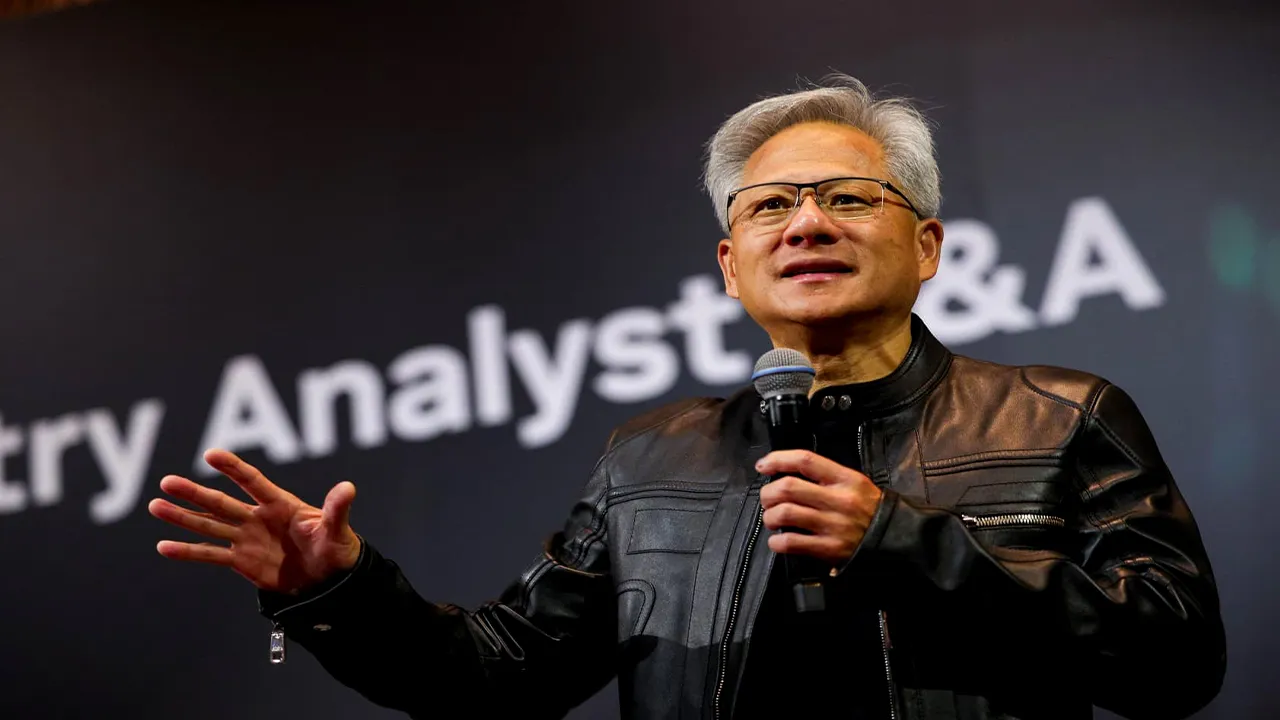

One big catalyst was word that US chip behemoth NVIDIA has received assurances from the US government that it will be able to resume exporting its H20 artificial intelligence accelerator chips to China.

This radical shift from an earlier position held by the Trump administration is considered quite bullish for the AI semiconductor supply chain and general US-China relations, especially when the two sides are negotiating levels of tariff amounts, which is a very positive development.

Taiwan Semiconductor Manufacturing Co. (TSMC), a critical NVIDIA partner and one of the largest global manufacturers of chips, TSMC, TSMC, Copper Tubes, TYO, 2330 c1, rose as much as 1.8% in Taipei after a media report suggested the company intends to build a second chip plant in Japan to diversify its production, including for chips used in the automotive sector.

South Korean tech companies including Samsung Electronics (005930.KS) and SK hynix (000660.KS) are also riding the wave, as Samsung Electronics ended 1.57% higher on Monday, a sign of broader optimism across the semiconductor sector.

Regional Performance Snapshot

Japan’s Topix was little changed as the Nikkei 225 edged 0.58% higher on July 15, supported by tech advances amid broader market wariness.

- Australia’s S&P/ASX 200 lost 0.8 per cent, with the broader index weighed down by inflation worries.

- Hong Kong’s Hang Seng index rose 0.3 per cent, boosted by its tech component. Chinese mainland markets, including the Shanghai Composite, fell slightly, down 0.1%.

- South Korea’s Kospi fell 0.73% as broader worries about the economy overwhelmed technology sector optimism for the overall index.

Meanwhile the Japanese yen was 0.2% weaker versus the dollar, close to levels not seen since April, as the market considered the possibility of divergent monetary policy stances in the US and Japan. Gold, another traditional safe haven, nudged higher.

As global financial markets grapple with the prospect of inflation, interest rate assumptions and the changing world of trade, the gap between general market sentiment and the success of AI-powered tech stocks illustrates the themes dominating investment strategy decisions in mid-2025.