Opening and growing a small business can take more than just an idea and some elbow grease. Financing provides organizations with the capital to fund growth, equipment acquisitions, salaries, or operating expenses. The difficulty for any entrepreneur is that there exists a minefield of different lending options, and it’s incredibly difficult to know which one suits the company best.

We dissect How to Choose Small Business Loans (2025)—key considerations, types of loans available, eligibility criteria, and the process—on this page. The borrowing landscape is evolving, and small business owners have to be smart with their finances.

Through deliberate due diligence in comparing the expenses associated with different loans for small business in 2025, entrepreneurs can make sure that money actually helps to foster growth instead of causing them more financial stress.

Why Small Business Loans Matter

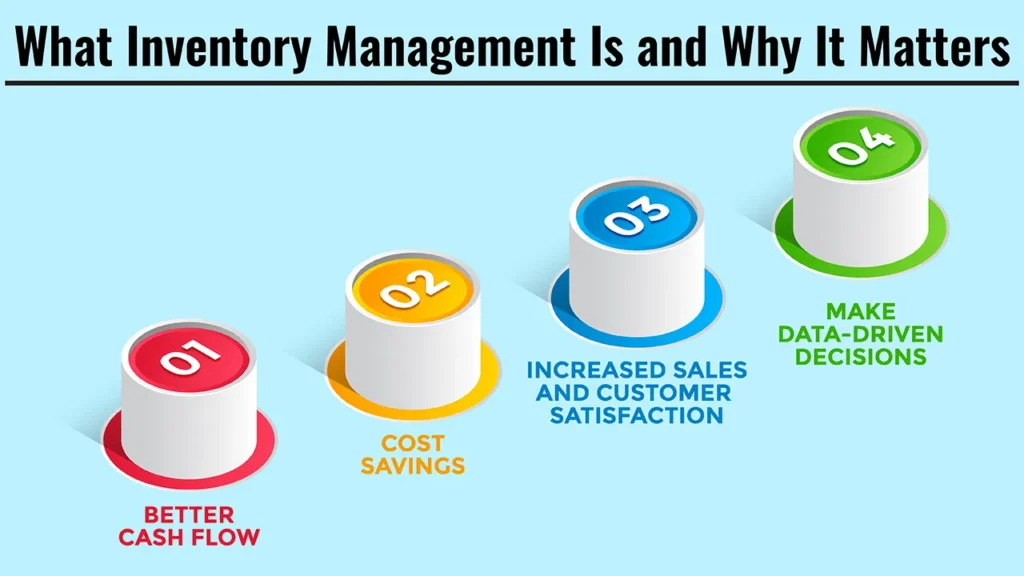

Small business loans are not just short-term solutions. They are enablers for infrastructure construction, as well as for bridging short-term cash flow gaps and realizing growth strategies. From the local bank down the street to online lenders or government-backed organizations, there are several paths small businesses can take to get a loan—and in some places, access to those loans could mean the difference between closing up shop and growing business well into the future.

Lenders in 2025 provide tailor-made loan products that are suited to industries, such as retail, technology, health care, and manufacturing. This allows the small business to see loan structures to match up with business models without overextending them financially.

Some Key Points to consider before you apply

Selecting the best small business loans requires examining all aspects. Here are important factors all owners should consider:

- Purpose of Loan: Specify whether the loan will go toward working capital, expansion, equipment purchase, or debt refinancing.

- Ability From Revenue: Check your small business’s incoming revenue to ensure a steady repayment of the loan.

- Costs and Fees: Compare APRs, both origination fees, and penalty fees; hidden costs can add significantly to the total cost of the loan.

- Collateral: Certain lenders set a business asset or an individual personal asset as a requirement to secure the small business loan.

- Approvals: Needs like meeting payroll may get you a faster approval online than at the bank.

- Credit Profile: Good credit offers better choices, while a poor profile might limit the pool of products.

No reviewing of these areas can cause financial stress as opposed to promoting long-term growth.

Types of Small Business Loans

In order to find the best funding solution, small business owners need to know the various types of small business loans that can help them:

- Term Loans: A fixed amount of capital that will be paid back over an agreed-upon time period.

- Line of Business Credit: A flexible loan where funds are accessed only when needed.

- SBA Loans (Government-Backed): The Small Business Administration (SBA) partners with banks to offer government-guaranteed loans to viable small businesses that would otherwise be declined for a loan. Great option if you’re in need of longer repayment terms and low interest rates.

- Equipment financing: (This is only for machinery or technology equipment, collateralized by asset.)

- Merchant Cash Advances: Fast cash, but aggressive efforts to repay out of future sales can constrict cash flow.

- Invoice Financing: Assists businesses to free up funds tied up in unpaid customer invoices.

And each one has its benefits, depending on the size and ambitions of a small business.

Types of Small Business Loans Compared

| Loan Type | Best For | Repayment Terms | Key Consideration |

|---|---|---|---|

| Term Loans | Funding expansion, big projects | Fixed monthly payments | Predictable repayment; secured borrowing |

| Business Line of Credit | Managing cash flow | Flexible spending and repaying | Only pay interest on what you borrow |

| SBA Loans | Long-term investment or startups | Protracted terms (up to 25 years) | Requires strong documentation |

| Equipment Financing | Machinery or technology | Asset-secured terms | Risk losing equipment if business defaults |

| Merchant Cash Advance | Quick capital needs | Daily/weekly deductions | Costly |

| Invoice Financing | Enhancing liquidity | Based on your customer invoice history | Dependent on clients’ payment habits |

This table offers a sample of your lending options, so entrepreneurs can compare small business loans before diving in.

Creditworthiness’s Function

When they determine small business loans, lenders evaluate the repayment risks. A good credit history and solid business records can increase approval odds.

By 2025, lenders are also examining a business’s real-time cash flow by integrating software that plugs into the business accounting systems.

Business owners need to have current balance sheets, proven ability to control expenses, and be ready, willing, and able to repay their existing debts in order to become stronger profiles.

Creditworthiness is not about scores, but about how responsibly a small business uses money.

Collateral vs. Unsecured Options

One of the hardest decisions business owners have is whether to take out a secured or unsecured small business loan.

- Secured loans: Offer larger loan amounts with lower interest rates, but require assets such as real estate, equipment, or personal savings.

- Unsecured Loans: Have no collateral requirement, and they generally have higher interest rates with shorter terms that can be suitable for smaller financial needs.

It ultimately comes down to how much risk the small business owner can tolerate and their financial fortitude.

Comparing Lenders

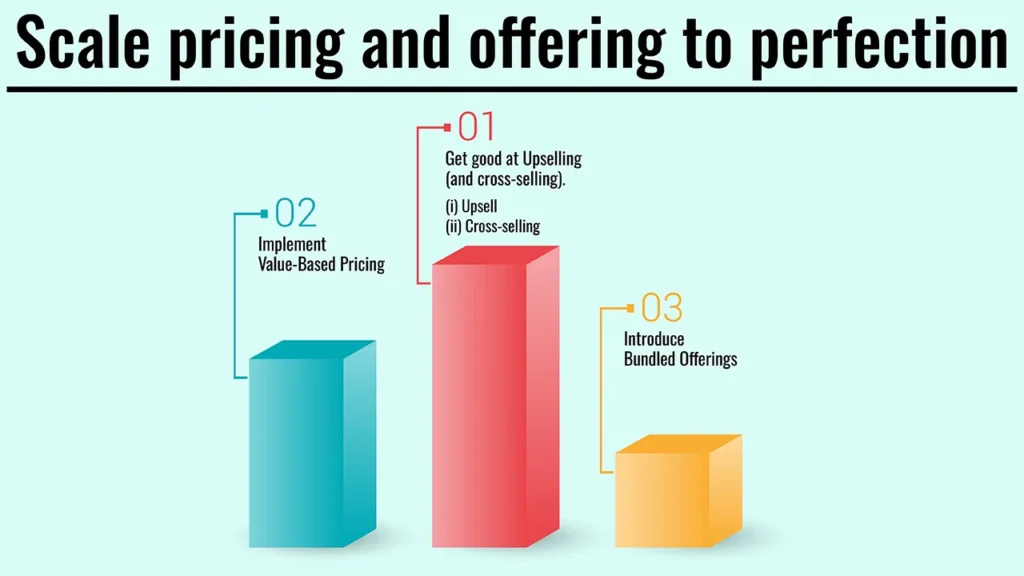

Lenders are not created equal. 2025 Banks, credit unions, and fintech businesses are battling each other. Comparing lenders should involve:

- Charges other than interest rates, like processing or late payment charges.

- Download customer service for payback.

- Credit score, time in business, and revenue eligibility.

- Flexibility in repayment schedules.

- Comparison shopping guarantees small business loans are a value without surprises.

Application Process in (2025)

The process for getting small business loans has certainly evolved, and it’s more streamlined now than ever—but preparation is key. These are the documents entrepreneurs should have on hand:

- frameworks (income statement, balance sheet, cash flow)

- Business plan with growth projections

- Tax returns (usually two to three years)

- Credit reports (business and personal)

- Legal paperwork such as business license and incorporation certificate

The availability of clear documents expedites the loan process and adds credibility in the eyes of lenders. The vast majority of SMB loan (2025) applications are semi-digital; they still require human checks to verify compliance with lending laws.

Common Mistakes to Avoid

Entrepreneurs put approval and the ability to repay at risk by making unnecessary errors:

- Applying for the Wrong Loan without an Explicit Reason.

- Neglecting minor fees, which turn into substantial sums in the long run

- Exaggerating revenue expectations, so your monthly payments are at risk

- Poor relations with lenders for future requirements

By bypassing pitfalls like these, there’s a better chance that you can get low-cost funding.

Final Words

Get to know How to Pick Small Company Lendings (2025). Every entrepreneur aiming for development requires comprehension? For small businesses, the most appropriate loan structure can be found by taking into account purpose, repayment capability, lender type, and collateral agreements.

In a competitive loan market, insight and foresight enable businesses to translate borrowed money into lasting change. The right decisions you make now are the ones that will lay the groundwork for financial resilience and long-term success.

Frequently Asked Questions:

1. What is the minimum credit score to get a small business loan?

Most lenders want credit scores above 650, though some programs will consider borrowers with lower credit if they have solid business plans, such as SBA loans.

2. How long does it take in 2025?

Bank loans can take weeks, but these days online small business loans tend to approve applications in a few days.

3. Can startups qualify for funding?

Yes. Newer businesses have fewer choices, but secured loans, SBA-backed funding, or microloans are typically options for startups.

4. What determines loan repayment terms?

Payment terms are based on type of loan, amount borrowed, direct deposit, and other factors. Terms can be as short as months or as long as decades.

5. What is the best small business loan for 2025?

The “right” choice will vary depending on the business needs. SBA loans might fit for longer-term growth, and merchant cash advances or lines of credit suit quick cash needs.