Many of the business owners think the only way to grow is to get more customers. Yes, customer acquisition is critical, but it’s not the whole equation. Yet the most lucrative growth often stems from a far less dramatic origin: plugging the small leaks and missed opportunities already present in your own business.

This is the way of maximizing your revenue — through a strategic process that maximises the value of your existing operations, products and customer base — so that you are getting every dollar you’ve worked so hard for. This article will guide you through real-world tactics to find and plaster those leaks, so you can start building a stronger, more sustainable business.

Step 1: Scale pricing and offering to perfection

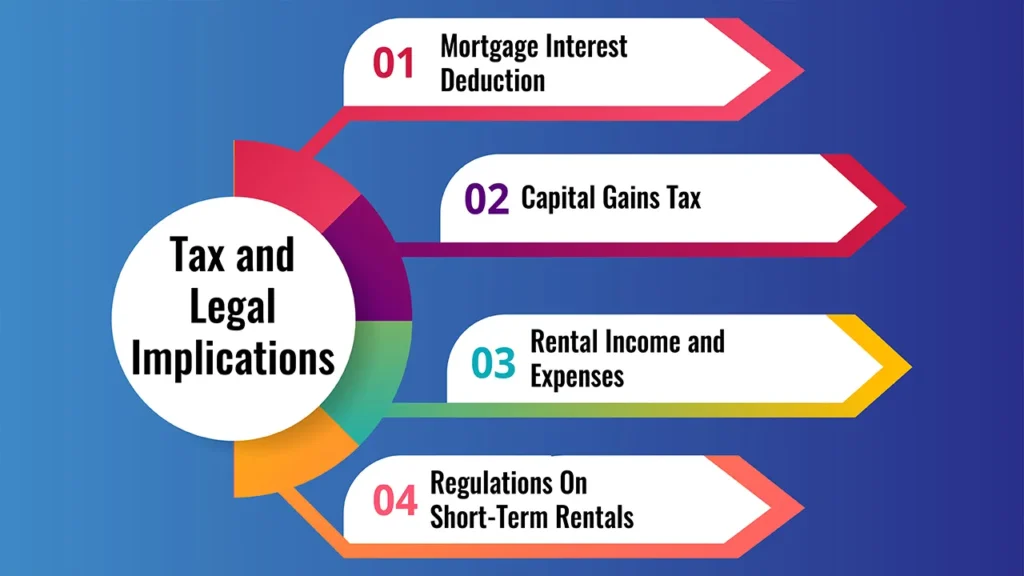

You can usually use your pricing strategy in the most direct way to increase revenue. It’s not an issue of just setting the number; it’s an issue of understanding what you bring to the table and shaping offers around that.

Implement Value-Based Pricing

Are you setting your prices according to the cost to you or what the customer is willing to pay? That is a massive mistake, called cost-plus pricing, which is made way too often.

Instead, know what your solution is worth in terms of direct and indirect benefits, and price it that way. This takes a huge amount of understanding of the customer and the guts to charge what you’re worth.

Get good at Upselling (and cross-selling).

Your best customer is the customer you already have.

- Upsell: Upselling is encouraging a customer to buy an extended (and usually more expensive) version of the product being bought. Such as upgrading from a free software plan to a pro plan.

- Cross-selling: Is trying to upsell a customer to a related or complementary product. For instance, if a customer is purchasing a camera, the customer also might be sold a lens or a tripod. In either case, it’s not about winning new business but extracting every penny’s worth so the return on investment is high.

Introduce Bundled Offerings

Doing offer bundling can be a great way to increase the average transaction value by making a bundle discount deal and just combining together multiple products or services into a package.

It makes it easier for the customer to make a decision on purchasing and also enables you to sell less popular items alongside best sellers (making a little on a lot vs. a lot on a little).

Step 2: Make the most of your Customer base

In general, it is less expensive to retain customers than to obtain new ones. The happy customer is a river of gold.

Prioritize Customer Retention and Loyalty

A little more customer retention can cause a giant increase in profits. Concentrate on excellent customer service, address feedback immediately, and make your brand feel like a community.

Try a loyalty plan where repeat customers get a percentage off, exclusive access or early entrance.

Leverage Customer Data and Feedback

Your customers are saying what they want. Are you listening? Look at your customer data for purchase patterns, popular products or common challenges. Poll and talk directly with people to ask for feedback.

It’s this knowledge that will unveil new product ideas, opportunities for cross-selling, and weaknesses to tighten up, ultimately making for happier customers who are more likely to spend money.

Reactivate Inactive Customers

Don’t lose touch with old customers. People stop buying for all sorts of reasons — they could have forgotten about you, gone to a competitor or no longer require your product.

A well-timed email blast, personalised phone call or special offer can win back dormant customers for a small fraction of the cost to acquire a new one.

Step 3: Operation Optimisation and Leak Reduction

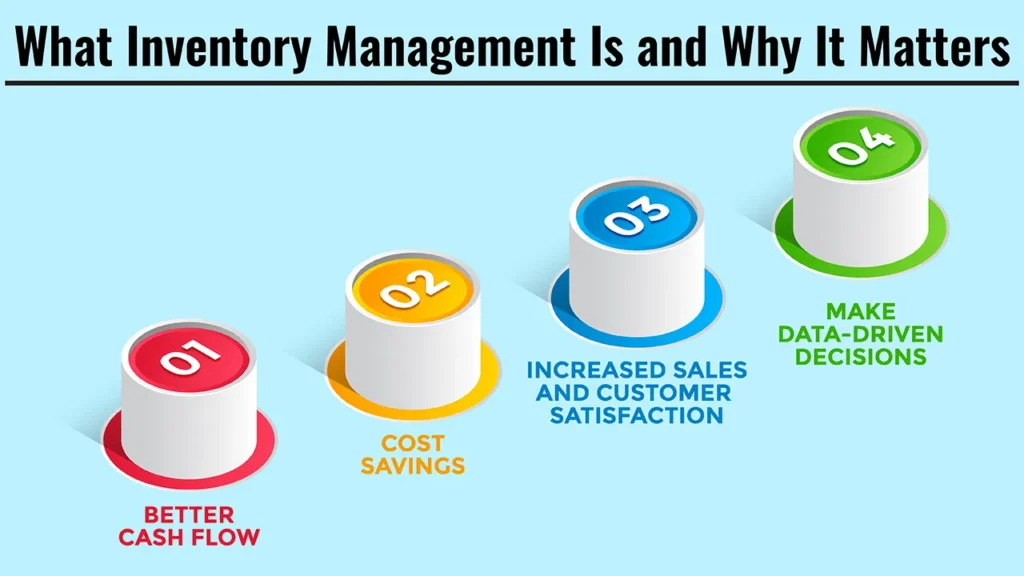

Revenue is not only what comes in; it’s also what you keep. Ineffective processes may separate money from your small business without you even knowing it.

Audit Your Billing and Invoicing

Billing errors and un-invoiced work and subscriptions we forgot we had are quietly killing us. Regularly review how you bill for work to make sure all the services and products you sell are being invoiced and collected properly.

Leverage billing automation software to reduce the potential for human error, and automatically send reminders to anyone who’s overdue.

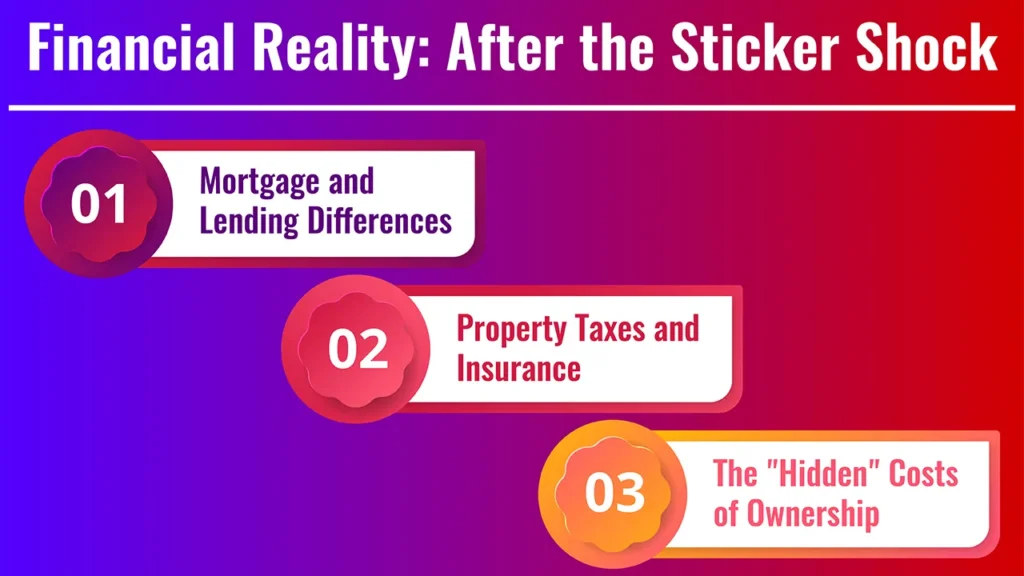

Optimize Your Pricing Tiers and Payment Options

Could your payment experience be a barrier? Simplify it. Provide several options for how you can accept payment, and ensure your price points or plans are straightforward to understand.

An intricate or perplexing pricing page can scare away a potential customer.

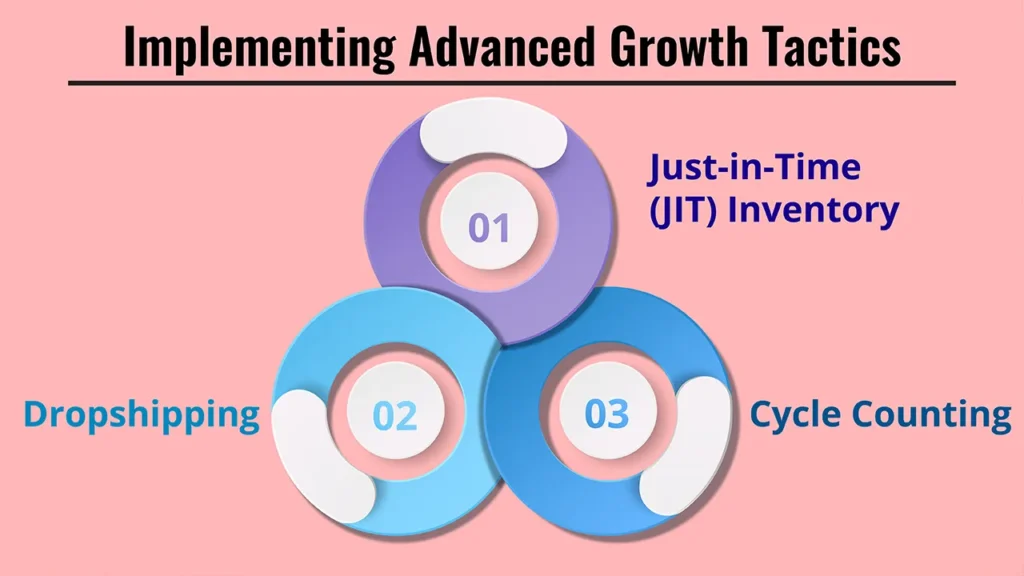

Adopt Lean Operations and Minimisation of Waste

Efficiency is but a phase of greatest income. If only a single hour or one bad product is wasted, it is a loss; an avoidable cost. Take a look around you at your processes and see where you can automate, reduce or eliminate stupidity.

This might be done through the use of project management software, optimising your supply chain, or getting better deals with suppliers.

Conclusion: From Good to Great

So you see, revenue maximisation isn’t a case of getting lucky; it’s one of being methodical. But by investing checkout time to audit your business, listen to your customers better and optimise your offerings, you can deliver businesses from simply existing to prospering. It’s about constructing a smarter, leaner and more profitable engine for growth.

Frequently Asked Questions

1. How does revenue maximisation differ from cost reduction?

All about increasing the flow of money coming in. Both are essential to profitability, but revenue maximisation is a game of growth and opportunity, not just retrenchment.

Strategies in this guide are about making more from the things you’re already doing — not just cost-cutting.

2. How can I tell if I am leaving money on the table?

You likely are. The data audit is the best way to figure this out. Consider your average transaction value, customer lifetime value and customer churn rate.

If these numbers are below what you’d prefer, there, no doubt, is room for improvement. Ask your customers directly why they decided to buy from you and what almost stopped them.

3. Do these strategies apply to any business?

Yes. Whether you are a small service-based business, a bricks-and-mortar retail store or an e-commerce outlet, the core tenets of price optimisation, customer retention and waste reduction are the same, and they apply to every business model.

The trick is to apply the right approach for your business and industry.