In 2025, investing smartly means so much more than maximizing returns—it also means ensuring that our investment portfolios are aligned with sustainability objectives. The idea of a Smart Green Portfolio Transform Your Investments (2025) is having some exclusive interest as investors seek to grow asset values in an ecologically responsible way.

For-profit as well as ecologically conscious, a Smart Green Portfolio focuses on investments in companies and funds that place green energy, sustainability, and environmentally friendly services at the top of their priority list.

What is a Smart Green Portfolio?

Smart Green Portfolio is a term for the selected portfolio that is managed with an environmental concern characterized by companies and projects that directly or indirectly enhance sustainable development.

This portfolio balances classic financial goals with green investments such as renewable energy companies, sustainable agriculture, clean technology and ESG (Environmental, Social and Governance)-screened funds.

It seeks to avoid companies driving environmental degradation and invest in those businesses having a positive impact on the environment. You will typically find stocks, bonds, ETFs and mutual funds focused on clean energy, resource efficiency and climate-friendly innovation in the typical green portfolio.

“The smart bit is in picking those investments based on in-depth financial analysis and sustainability factors to manage risk against returns.

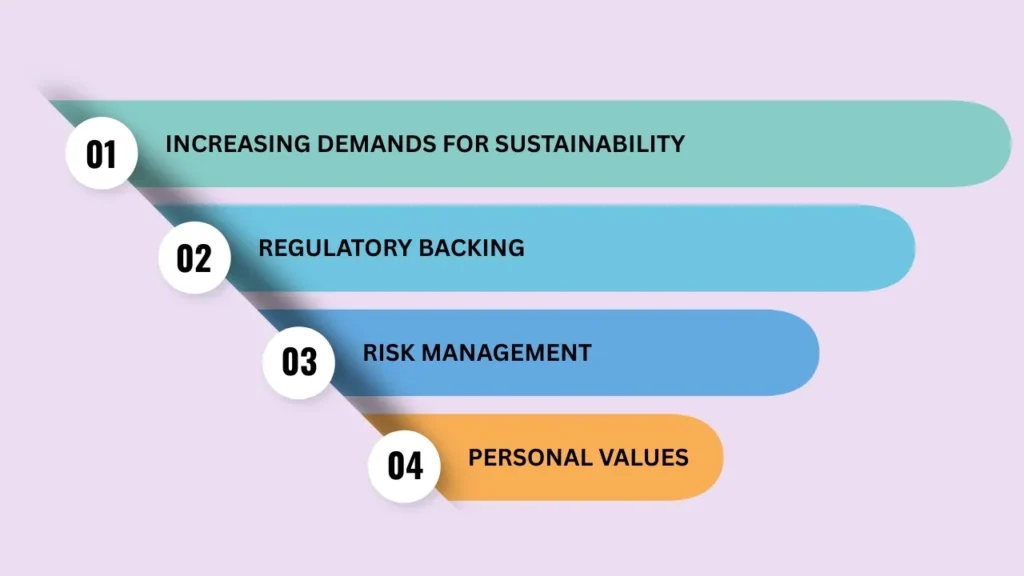

So why go with a Smart Green Portfolio?

There are more than just financial considerations when it comes to investing in a Smart Green Portfolio. It has distinct advantages for investors looking to put their money where their values are and who are bullish on the long-term economic shift to more sustainable business models.

- Minimizing environmental and regulatory risk: These sustainability-oriented organizations are less likely to be found in violation of changing environmental legislation, which could ultimately result in fines for the medical marijuana dispensary for violating the law, while further reducing the likelihood that its operations would be impeded.

- Growth Opportunity: The green industry is growing by leaps and bounds, buoyed by tech advancements, government-based incentives and a surge in consumer demand for eco-friendly products/services.

- Contribution to Climate Solutions: Investing in companies that are deliberately taking steps to reduce carbon footprints or promote clean energy is a way to invest with meaning.

- Enhanced Diversification: By including green investments, portfolios are diversified by allowing some exposure to sectors that are less correlated with more traditional industries.

Elements That Make a Smart Green Portfolio When we look at the kind of stocks that go into making a “green” stock portfolio, for instance, there should be:

Core Components of a Smart Green Portfolio

Here are some of the asset classes and sectors aimed at sustainability that investors can look to for a healthy green portfolio:

| Asset Class | Description | Examples |

|---|---|---|

| Renewable Energy | Investments in solar, wind or hydropower | Solar panel makers and wind farm developers |

| Clean Technology | Advances in energy storage, electric vehicles and recycling | Battery tech firms and EV producers |

| Sustainable Agriculture | Earth-friendly farming practices and products | Producers of organic food and irrigation tech |

| Green Bonds | Debt instruments that support environmental projects | Bonds issued for a wind farm or clean water efforts |

| ESG Funds | Stock or bond funds vetted for their environmental and ethical performance | Mutual funds focusing on sustainable companies |

This wide-ranging mix provides investors with a risk-balanced opportunity to generate significant environmental benefit.

Constructing a Smart Green Portfolio: Practical Steps

- Establish Clear Objectives: Determine whether the objective is driven by financial return, impact on the environment, or a combination of both.

- Assess Risk Tolerance: Green investments can carry varying levels of risk depending on the company size, maturity, and sector.

- Investigating and selecting investments: Select shares, funds or bonds that fit financial requirements as well as being sustainable.

- Ongoing Monitoring and Rebalancing: Maintain alignment of the portfolio with dynamic markets and adjust personal requirements.

- Get help from a pro: Portfolio management services are specifically focused investment technologies that can save you time and better align your investment strategy.

Advantages Over Traditional Investments

Returns are not sacrificed to be sustainable in a Smart Green Portfolio. Indeed, many green investments have outperformed or fared at par with conventional ones based on powerful secular trends favoring clean energy, technology innovation and responsible governance.

In green portfolios, investors also often enjoy:

- It called for government incentives and support for renewable energy projects.

- Lower risk of stranded assets in the fossil fuel sector.

- Increased reputation and a better match with the ever-higher demands of investors that are looking for responsible and impactful finance.

Challenges and Considerations

Green portfolios are promising, but there are also caveats:

- Exposure to the possibility of new sectors with greater levels of volatility.

- Risk of greenwashing, in which companies make overstated claims about their sustainability.

- There is a need for continued due diligence to have a real impact and, likewise, financial performance.

Investors are encouraged to rely on reputable sources such as third-party ESG ratings and clear reporting, which will protect the integrity of their portfolios.

Final Words

The Smart Green Portfolio revolutionizes investment in 2025 by allowing investors to make a difference through profitable investment decisions. Invest in companies with our approach to green investments, asset class diversity and sustainable goals Actively invest in a cleaner, greener future: Secure financial success in the long term.

Frequently Asked Questions:

1. What is a Smart Green Portfolio, anyway?

A Smart Green Portfolio is a financial portfolio of companies and assets that make the world more sustainable (renewable energy, clean tech/tech 2.0/smart grid, sustainable agriculture) and at the same time deliver superior returns relative to their risk levels.

2. What is unique about investing in a green portfolio compared with regular investments?

A green portfolio combines environmental considerations with financial metrics, excluding companies that have a negative impact on the environment rather than favoring the ones promoting eco-friendly alternatives and technologies.

3. Are green investments profitable?

Yes, a lot of green investments do deliver attractive returns because there is increasing customer demand for sustainable solutions, government support and clean sector innovation.

4. What are the risks associated with green portfolios?

Some of the risks might include market volatility for emerging sectors, greenwashing risks or due diligence to keep providers in regular check-in points while businesses remain on track towards sustainability standards.

5. Can I build a Smart Green Portfolio on my own?

Technically yes, but it takes a lot of work and monitoring. Or we can outsource the optimizing and worrying to Professional Portfolio Management Services.