When it comes to investing, there are good reasons why you should know how to decide between mutual funds and ETFs. Let’s face it: You need to align your investments with your overall financial objectives and risk tolerance for the type of investment style that will be best for you.

There are two ways to diversify your portfolio using mutual funds or ETFs, though the vehicles work differently and can fit different types of investors. This primer will walk you through these two popular investment choices, outlining their details, benefits and considerations for 2025.

What Are Mutual Funds?

Mutual funds combine the money of many investors to purchase a broad range of stocks managed by professional fund managers. The primary investment of these funds is shares, whether actively or passively managed, stocks, bonds, or other types of securities, depending on the fund objectives.

Shares are generally priced daily at the NAV after the close of trading. Mutual funds provide convenience, professional management, and broad diversification and are a popular choice for those who prefer an investment approach that requires little more than monthly contributions to their 401(k) account.

What Are ETFs?

ETFs, which stands for exchange-traded funds, are pools of investments that trade like stocks on an exchange. These funds are typically indexed and passive, following particular indices or sectors, giving them transparency and low cost.

Unlike mutual funds, which can only be purchased or sold at the end of the trading day at net asset value, ETFs trade in much the same way as regular stocks, and they can be bought or sold anytime during a market day. This intraday trading ability is another reason ETFs are popular with investors who want more control over when and at what price they buy or sell.

What’s the Difference between Mutual Funds and ETFs

Comparing how mutual funds and ETFs operate and are structured can help you decide which is a better fit for you.

| Feature | Mutual Funds | ETFs |

|---|---|---|

| Trading | Once a day at end of market; traded based on its NAV | Throughout the trading day by NAV |

| Management Style | Often actively managed | Typically passively managed |

| Minimum Investment | Higher minimum investment can be required | Can buy as few as one share |

| Expense Ratios | Tend to have higher expense ratios because they are actively managed | Generally lower costs due to passive tracking |

| Liquidity | Limited and more like end-of-day transactions | High liquidity—can trade anytime the market is open |

| Tax Efficiency | Less tax-efficient, taxable capital gains distribution may be passed on | More tax-efficient for buyers; ETF has “in-kind” redemptions |

| Diversification | Offering across asset types | Fund that mirrors a specific index or sector |

Factors to Consider When Choosing

- Investing Goals: If you’re interested in specific index exposure on the cheap, ETFs might hold the answer. Mutual funds may be better for active strategy and professional selection.

- Flexibility of Trading: ETFs are tradeable during market hours which is useful if you want the price during the day time. Mutual funds are settled one time a day, better for regular long term buying.

- Costs: ETFs typically have much lower expense ratios, but certain types of mutual funds can make sense in some strategies despite higher fees.

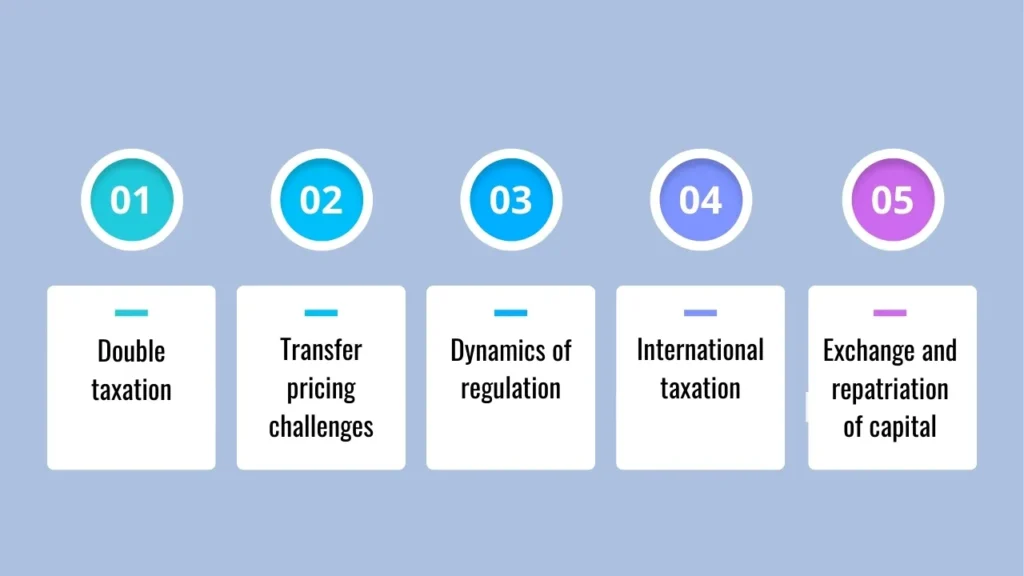

- Tax Considerations: ETFs have fewer taxable events associated with their tax structure. Mutual funds may make more frequent capital gains distributions.

- Lowest Minimum Investment: ETFs make it possible to get started with smaller amounts compared to mutual funds, which typically come with high minimum investment requirements.

Advantages of Mutual Funds:

- Active management and specialisation at your fingertips

- Larger variety and established options

- Appropriate For SIPs

Advantages of ETFs:

- Lower expense ratios and costs

- Trade like any other stock during market hours

- Greater tax efficiency

Which One Should You Choose?

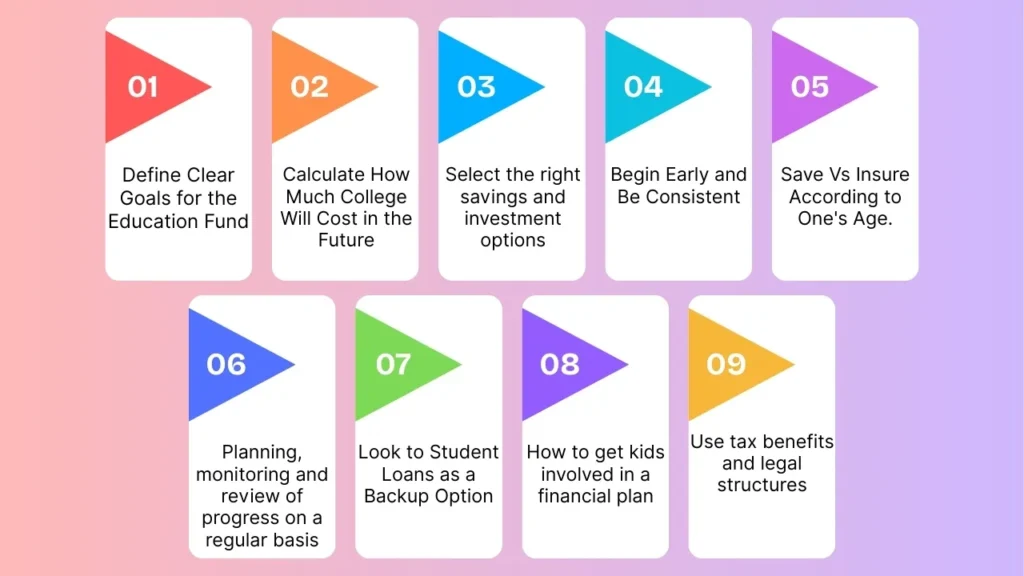

That’s up to you and your goals. For those investors who appreciate optionality, lower costs, and tax efficiency, we believe ETFs can be attractive. If you desire professional oversight and disciplined investment selection, mutual funds may be the better match.

Final Words

Which mutual vs ETF decision to make How you decide between mutual funds and ETFs comes down to your investment strategies, sensitivity to costs, and desire for trading flexibility. Both can help you diversify your investment portfolio and grow your investments over time.

By balancing the pros and cons discussed above and factoring them against your financial goals, you’ll be able to make an informed decision on choosing between what makes the most sense for you in 2025 and beyond.

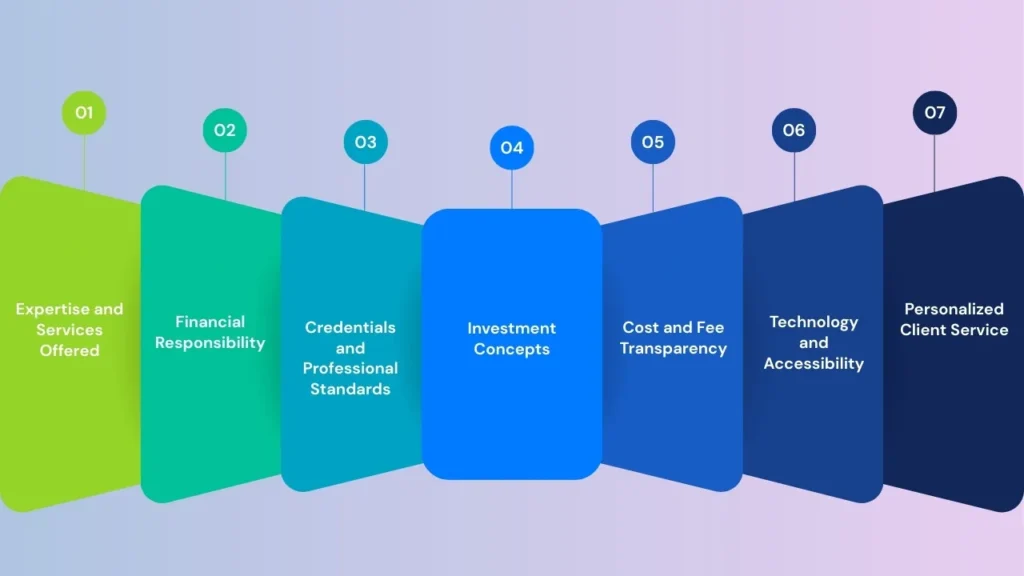

And don’t forget that speaking with a financial advisor or planner can generate personalized strategies to also use mutual funds and ETFs in tandem as building blocks for an even more holistic portfolio.

Frequently Asked Questions:

1. Can I invest in both mutual funds and ETFs together?

Yes, a lot of investors use both to achieve the right balance between flexibility and active portfolio management.

2. Are ETFs riskier than mutual funds?

Both are subject to market risk, but funds’ intraday trading can leave investors more open to short-term volatility than they may realize.

3. How do the fees on mutual funds and ETFs compare?

Expense ratios for ETFs are generally lower since they operate on a passively managed basis, while mutual funds can charge more for active strategies.

4. Can I purchase a fraction of an ETF share?

Unlike mutual funds, which generally have minimum investment requirements, some brokers offer access to fractional shares of ETFs, so you can get started investing with far less money.

5. Are mutual funds available with automatic investment programs?

Yes, mutual funds frequently work for Systematic Investment Plans (SIPs), making sure the investment is regular in nature.