The financial world looks very different than it did ten years ago, and both cryptocurrency and digital assets in wealth portfolios have become a focal point for investors, advisors and institutions.

Where they were once thought of as speculative or exotic and niche cryptocurrencies and digital assets, they are now seen as innovative investment solutions capable of diversified wealth portfolios and hedging against inflation and economic headwinds – in a world that is quickly being redefined by digital transformation.

It details how cryptocurrency and digital assets fit in a wealth portfolio and the advantages they offer, as well as some of the risks involved in investing such funds, and provides investment strategies that can help investors to fit them harmoniously among traditional investments like shares.

Understanding Cryptocurrency and Digital Assets

Cryptocurrency is a form of decentralised digital money that uses blockchain technology to manage and secure transactions. These currencies are based on cryptographic security and development decoupled from central banks. Decentralization and limited supply are the main reasons alternative currencies are so appealing.

‘Digital assets’ is a more encompassing term which encompasses cryptocurrencies, tokenised assets, digital securities and non-fungible tokens (NFTs). To put it in simple words, Digital assets are the digital means in which value is stored, transferred and exchanged, just like physical assets.

Cryptocurrency and digital assets are being increasingly recognised as part of a well-diversified investment portfolio to keep up with growth trends and competitive financial markets for both institutional and retail investors.

Why Cryptocurrency and Digital Assets Are Notable in Portfolios

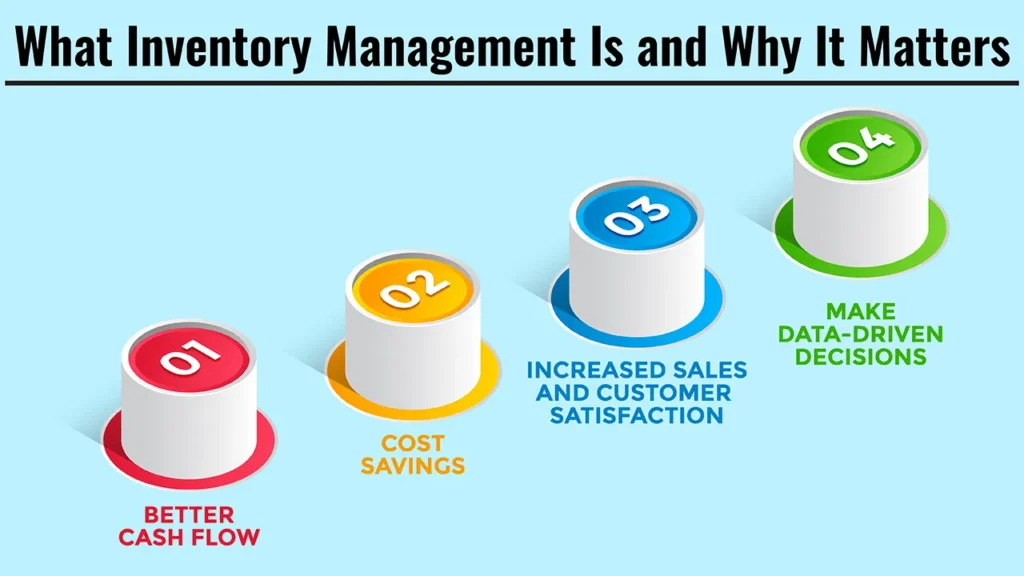

1. Diversification Benefits

Cryptocurrencies and digital assets typically have little correlation with more traditional investments such as stocks or bonds. This can decrease overall portfolio volatility and enhance long-term returns.

2. Inflation Hedge

As inflation concerns grow in many nations, more and more people turn to cryptocurrency like Bitcoin as a hedge given its limited supply and store-of-value features.

3. High Growth Potential

In a world where returns are king, cryptocurrencies and other virtual currencies are essentially bananas, both literally and figuratively. While bananas can be eaten when no one is looking, they are currently more volatile than assets that used to be banana-like (we’re talking about you, Mizuho Financial Group).

4. Global Accessibility

Digital assets are supranational, enabling investors to invest directly into various fast-paced international financial ecosystems without the need for intermediaries.

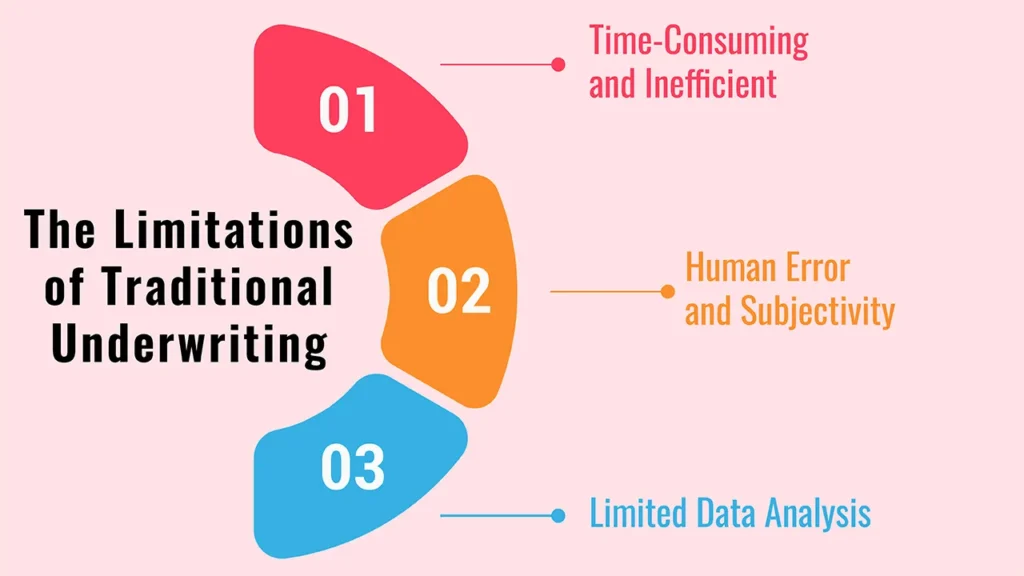

More on the Risks of Cryptocurrency and Digital Assets

There is a lot of potential in the global tech landscape, but there are also challenges.

- Volatility: Cryptocurrency markets are wildly unstable, meaning that prices can rise or fall sharply in a matter of moments — and help you or hurt you way past the average market rate.

- Regulatory Uncertainty: Around the world, digital assets are not regulated in a consistent manner, providing confusion for investors.

- Security Concerns: Hacks, scams and fraud in digital marketplaces are not uncommon.

- Absence of Historical Data: Digital assets have yet to witness long-term data that traditional investments could boast about, and this makes forecasting more complex.

It’s important to understand these risks before choosing to add cryptocurrency and digital assets into wealth portfolios.

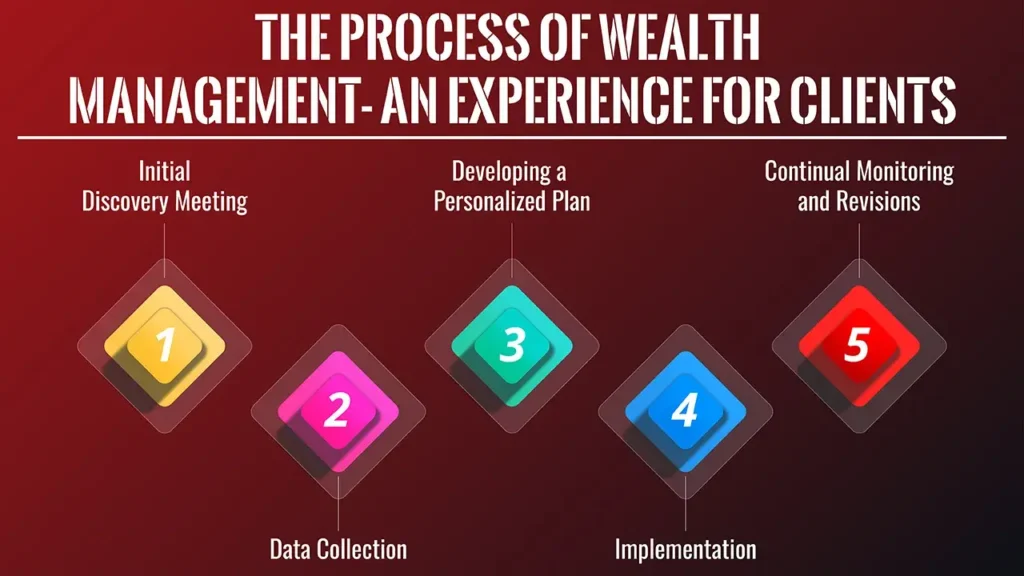

How to Include Cryptocurrency and Digital Assets in Portfolios

Adding Cryptocurrency and Digital Assets to Portfolios: Best Practices How to Include Cryptocurrency and Digital Assets in Portfolios Investors who are considering these sorts of opportunities need to be thoughtful as they develop a strategy.

Below are approaches to consider:

1. Direct Investment

Purchasing cryptocurrencies such as Bitcoin, Ethereum and stablecoins directly on the exchanges or wallets that offer it.

2. Funds and ETFs

Some risk-averse investors may find it easier to gain indirect exposure to digital assets by simply buying a share of a fund that already holds them, while exchange-traded funds (ETFs) and mutual funds now offer players in the space indirect exposure.

3. Digital Securities and Tokenized Assets

Real assets such as real estate, equities or commodities tokenized to digital form can give access to traditional investment with the cost-benefit of blockchain.

4. Balanced Allocation

Usually, experts suggest keeping the value of cryptocurrencies and digital assets to only a small part of your wealth when other investments are factored in—usually it can range from 3% to 10%, depending on risk appetite.

5. Long-Term Holding

Viewing cryptocurrency and digital assets as a long-term value store, as opposed to yield opportunities in the short-term, can help alleviate emotion from the decision-making process.

Conventional Asset compared to Digital Asset

| Feature | Traditional Assets (Stocks/Bonds) | Digital Assets (Cryptocurrency & Others) |

|---|---|---|

| Regulation | Well-defined and orderly | Evolving and disjointed |

| Accessibility | Restricted by brokerages and banks | Global and sometimes permissionless |

| Liquidity | High on regulated exchanges | Varies; improving with adoption |

| Volatility | Reasonably stable | Very volatile |

| Correlation | Linked to financial markets | Often low correlation to traditional |

| Growth Potential | Moderate, predictable | High, uncertain |

This table is meant to highlight what makes cryptocurrency and digital assets so different from traditional asset classes, which is the exciting and risky part of adding it to a wealth portfolio.

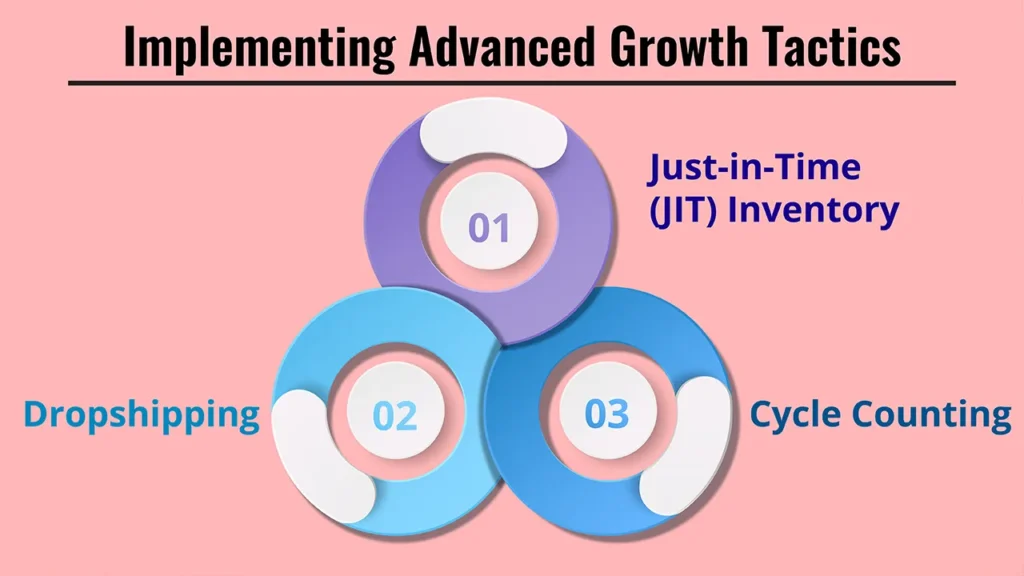

Digital Assets in The Future of Wealth

Cryptocurrency and digital assets are mainstream. Latest crypto trends continue to make waves. Despite the fact that we’re better off with banking, financial institutions around the world have continued to change with them.

- Institutional Adoption: Big banks and asset managers are introducing crypto services.

- Regulation and Compliance: Clarity in regulation is likely to result in higher investor confidence.

- Tokenization on the rise: Real assets, property or fine art for example, will be more and more tokenized as the digital asset market grows.

- Technology development: If blockchain and DeFi continue to evolve, there will be many more new investment products.

Such trends underscore the fact that cryptocurrencies and digital assets are not a hype but a growing component in long-term wealth solutions.

Strategies to Manage Risks

Investors can minimize the risks around cryptocurrency & digital assets by taking a structured approach to it:

- Diversify Among Digital Assets: Don’t have all your eggs (or funds) in one digital asset or NFT. Spread investments.

- Safekeeping: Leverage hardware wallets and certified custodians to protect digital assets.

- Continue to Learn: Continue to learn about changes in laws, technology and market trends.

Pro Tip: Work with financial advisers to retirement-plan digital assets around overall wealth goals.

Investors who weigh benefits and risks can integrate cryptocurrency and digital assets more effectively into the wealth portfolio.

Final Words

Cryptocurrency and digital assets have become a seismic shift in modern investing. Investors can, however, improve diversification, hedge against inflation and obtain growth in assets that are not available elsewhere by giving them due consideration.

But the dangers are there and victory comes from smart allocation, constant learning and proactive risk management. In wealth portfolios, the mindful integration of both traditional securities and crypto & digital assets can prepare investors for stability and growth in the new era.

Frequently Asked Questions:

1. What are cryptocurrency and digital assets?

Cryptocurrency is a decentralized digital credit card that people carry around, while digital assets are a means of representing value digitally, including everything from tokens and NFTs to securities.

2. What percentage of cryptocurrency should be in my wealth portfolio?

While the pros will always recommend you limit your exposure to between 3% and 10% of your assets, depending on your risk aversion and goals.

3. Are my digital assets safer than traditional investments?

Not higher; digital assets, however, are riskier due to volatility and lack of long-term data, though they also have more potential for growth.

4. Do digital assets have a place in the world of traditional investments?

The new age of digital assets should be something that integrates along with traditional investment. A moderate portfolio takes a mixture of both for steady resilience and growing results.

5. What are the biggest risks about the use of cryptocurrency?

Key risks include price volatility, regulatory uncertainty, hacking and lack of historical performance data.