Think of being able to make money as you sleep, travel, or even when you’re doing what you love. Your minor child, too, can be your ticket to unpaid labour (yours or someone else’s), and you may be acquitted of any sense of moral compromise, according to these passive income investment strategies.

This is not make-believe – it’s the key selling point of “passive income investment strategies”. In today’s day and age, the concept of earning money without working tirelessly is highly appealing. This ultimate guide will dive into what passive income really is and different methods to earn it, as well as the pros and cons of this type of income, and give you some actionable tips to “make your money work for you” and gain further financial freedom.

So if you figure out multiple ways to earn passive income, you can be well on your way to financial independence.

1. What Is Passive Income? (Beyond the Hype)

Defining Income with Minimal Ongoing Effort

- Meaning: Passive income is income you earn that requires little to no ongoing effort to maintain after you set it up or make your investment. It’s different from active income (say, a salary or an hourly wage).

- The “Effortless” Nuance: Push on the fact that “effortless” often means a large upfront effort (time, capital, skill), or it means using assets you have lying around to be productive. It’s not a get-rich-quick scheme.

- Passive vs. Active: Use examples to explain it (e.g., write a book once vs. work a job every day; buying a rental property vs. running a retail store).

2. Different Passive Income Investment Strategies

High-Capital/Low-Effort Strategies (Using What You Already Have)

Dividend Stocks & ETFs/Mutual Funds:

- Specifics: Investing in stocks that pay dividends on a regular basis. ETFs and mutual funds provide diversification among several dividend-paying stocks.

- How it is passive: Once the money is invested, Hermes will begin receiving income automatically.

- Consideration: Requires capital, market risk.

Rental Real Estate (Direct Ownership):

- Detail: Buying (either residential or commercial) properties for the purpose of renting them out to get monthly income.

- How it’s passive (with management): Can be extremely passive if a property manager is hired; less so if self-managed.

- Consideration: high upfront capital, possibility for active management, market volatility, tenant problems.

Real Estate Investment Trusts (REITs):

- Detail: Firms that possess, operate and/or fund real estate that generates revenue. You buy shares of these businesses, which pay out a significant portion of their taxable profit to investors in the form of dividends.

- How it’s passive: No landlord duties; liquidity akin to stocks.

- Consideration: Market risk, which is linked to real estate industry performance. For an in-depth guide on REITs, visit NAREIT (National Association of Real Estate Investment Trusts).

Bonds & FDs/RDs:

- Detail: Loaning money to governments, for a predetermined period, in exchange for periodic interest OR to banks (FDs, RDs) Detail: when you lend to the Govt.

- How it’s passive: Interest is received automatically once the capital has been invested.

- Consideration: Lower returns relative to equities, risk of inflation, interest rate risk of bonds.

Peer-to-Peer (P2P) Lending:

- Detail: Offering loans directly to individuals or small businesses through online platforms and earning interest on these loans.

- How it’s passive: Platforms make the loan for you.

- Consideration: More high risk (risk of defaulters); need to be convinced and do the due diligence of the platform.

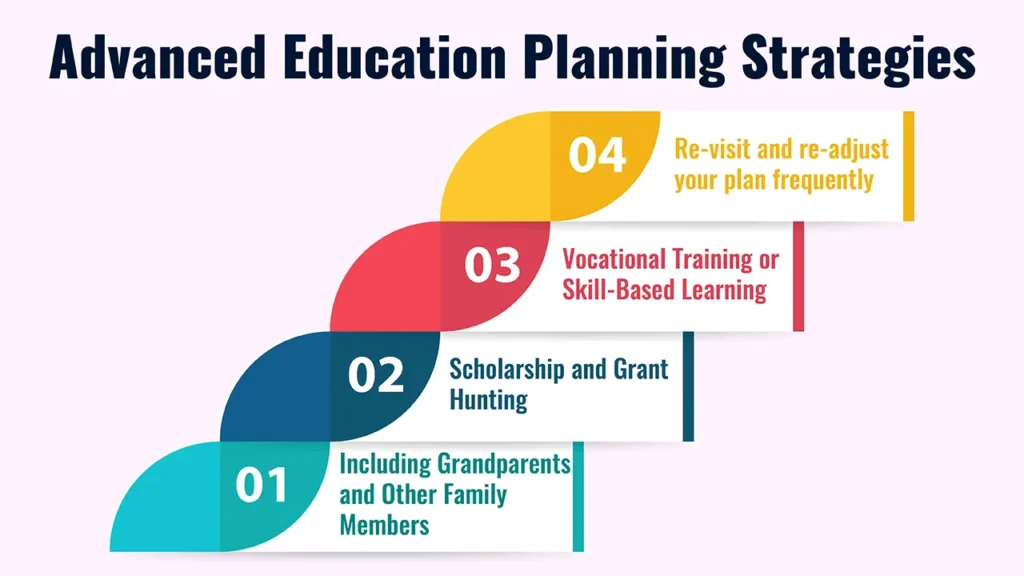

Lower-Capital, Higher-Upfront-Effort Strategies (Leveraging Skills/Time)

Creating and Selling Digital Products:

- Specifics: e-books, online courses, templates, software, stock photos/videos. Create once, sell many times.

- How it’s passive: Creation and marketing need to be front-loaded, but you can turn it into a productised service or offer automated sales once you have a product to sell.

- Factors: It needs to have the skills, marketing, and maintenance.

Affiliate Marketing:

- Specifics: To sell without a store! Detail: Share a product or service with your readers using special links; get paid when your readers find success with the vendor.

- How it’s passive: You have to build an audience (blog, social media, YouTube) and create content once, but then the commissions roll in.

- Consideration: Audience building, content creation, dependence on product/platform changes needed.

YouTube Channel / Blog (With Ads/Sponsorships)

- Detail: You create content that drags readers in, either advertising against it, finding sponsors to help you monetise, or just, like all those “buy my (ridiculously overpriced) T-shirts” pitchmen, selling merchandise.

- How it’s passive: Heavy lifting of content creation and audience building up front; older content is still valuable and earns background income.

- Consideration: Upfront time investment, creativity, engagement.

Renting Out Unused Assets/Space:

- Detail: Renting excess space (like a room, a parking spot, a car, equipment, storage, etc.) out to strangers can earn you money in cash.

- How it’s passive: Requires use of existing assets; it’s some work, though platforms can significantly streamline.

- Consideration: wear and tear, maintenance, local laws, customer service.

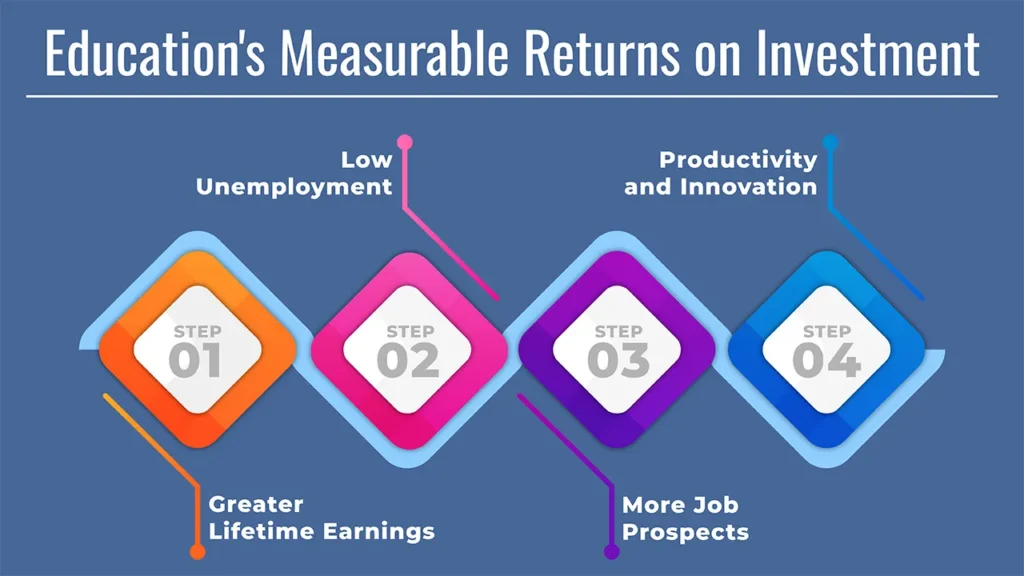

3. Why Building a Passive Income Is Good For You

The Benefits of Intelligent Financial Planning

- Financial freedom: Decreases reliance on an active, single source of income.

- The Magic of Compounding: Your money works FOR you, and often, it can grow.

- Time Freedom: Provides more free time to spend with family, hobbies, or other pursuits.

- Diversify: Introduces new sources of income, which allows you to withstand economic blows.

- Early Retirement: Excellent prospects for retirement.

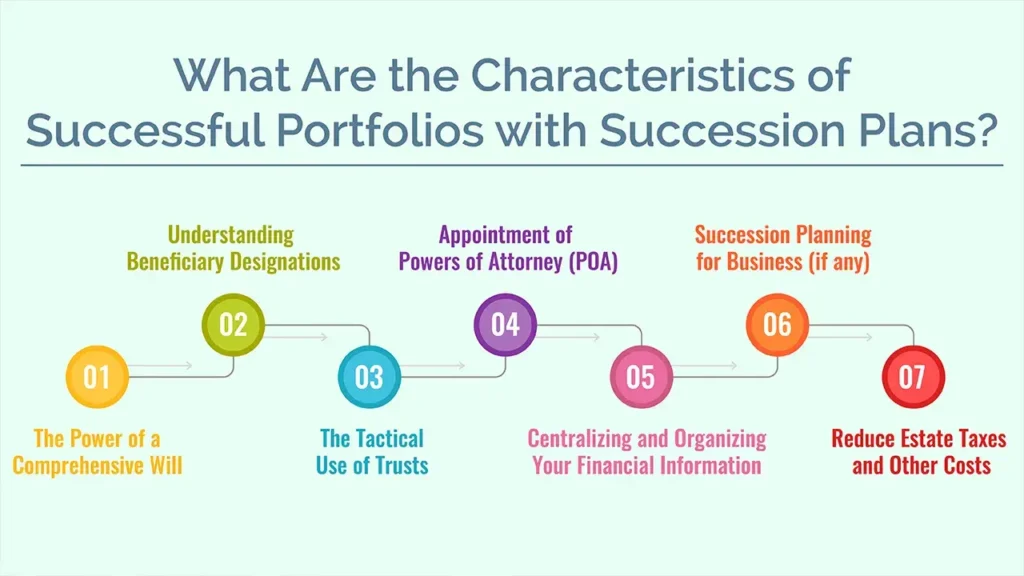

4. Risks and Considerations for Passive Income Investments

Navigating the Downsides and Challenges

- Not Actually “Passive” Upfront: Most of them involve a lot of work and upfront investment or continual upkeep.

- Market Volatility: Assets such as equities and real estate fluctuate with the market movements.

- Liquidity: Other investments (like physical real estate) cannot be quickly turned to cash.

- Regulatory & Tax Change: Laws may change that affect the profitability or tax benefit of an investment.

- Management & Maintenance: Even if it’s “passive” income, you may still need to attend to your property, make repairs or trades, or field customer service calls.

- Scams and Fantasy: Be on the lookout for programmes that guarantee quick, huge profits for no work.

5. Getting Started with Passive Income

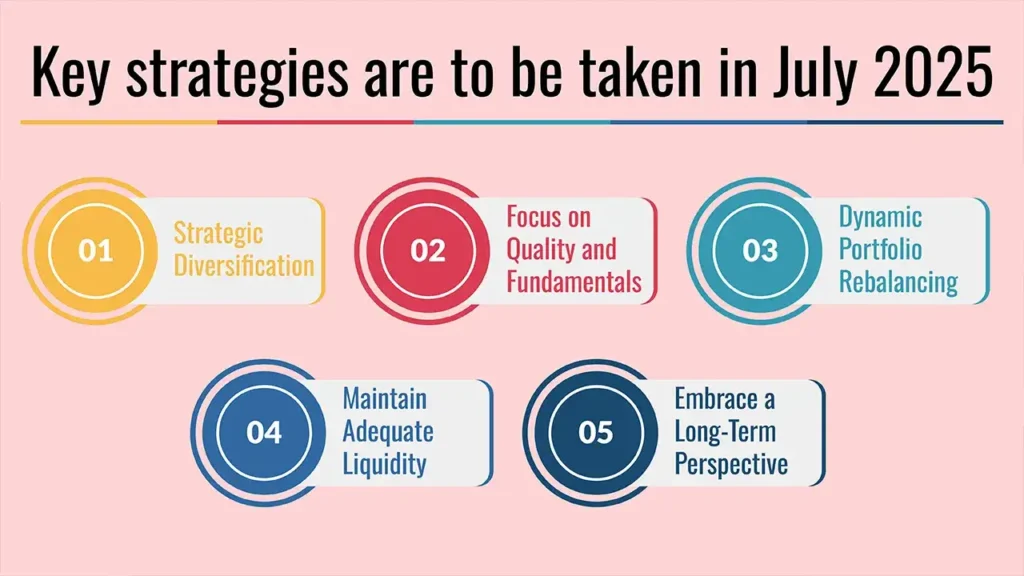

Your Roadmap to Effortless Earnings

- Evaluate Your Resources: What resources in terms of capital, skills, and time do you have?

- Determine Your Purpose: What are you after the passive income for? (e.g., additional income, retirement, financial independence).

- Do Your Research: Know your selected strategy, market and risks.

- Begin Small: Forget about putting all your eggs in one basket. Test strategies with manageable investments.

- Automate and Delegate: Rely on technology (think robo-advisors and payment apps) or professionals (like property managers) to limit hands-on involvement.

- Monitor and Optimize: Frequent optimization of the performance and adjustments as needed.

- Just in Case: Passive income stream number 3 Diversify Your Streams: Establish several passive income streams for flexibility.

Conclusion

So “passive income investment strategies” can be many different ways that you can make money without putting up too much consistent effort. From old-school businesses to new-age digital products, passive-income opportunities are everywhere. But please recall that “effortless” actually means “smart effort”.

This is a marathon, not a sprint, to build these streams. It takes planning and often the initial investment and creativity, but in the long run, the freedom and financial security are priceless. Begin to imagine today how your money really can work for you.

Call to Action

Pick what you’re able to do and get started on your passive income path.

Frequently Asked Questions

Q1: Is passive income really “passive”, or do you have to work for it?

Most forms of passive income require a really large commitment (time, money, skill acquisition) up front. After which they want to make the money with little active management.

Q2: What’s the best passive income strategy with low capital?

If you have limited capital, then start with using your skills or time; for example, create digital products and sell them (e-books, online courses) OR affiliate marketing (yes, you need content to create) or try blogging/YouTube (monetised by ads). You might also consider peer-to-peer lending or investing small amounts in diversified dividend-paying ETFs.

3. How much passive income will I earn?

There’s no fixed amount. It’s 100% dependent on strategy, how much you’ve invested,the actuall quality of your work in the first place (for creativeassets), and, how you’re actually doing in the market (as it’s ongoing with limited duration time slots).

Some might earn a couple of hundredrupeess in a month, and others might bring in quite a bit of money.