Have you ever looked at the word “indemnity” in a contract or in an insurance policy and thought: What’s really behind this?” Indemnity is more than a legal concept – it is also a fundamental basis of financial protection, whether in law or contract.

This guide will do things like help take “indemnity” out of the mystery black box and explain “what it means in insurance and the law”, get to its “core principles”, show you how it actually “works in the wild” and explain why it’s important for fair dealings and being able to sleep at night without waking up in a cold sweat thinking someone has taken out a second mortgage on your dog.

1. What Is Indemnity: The Fundamental of Making Whole

Restoring to the Original Position: The Essence of Indemnity

Core Meaning:

In general insurance terminology, indemnity (from Latin ‘indmenis’, meaning ‘unhurt’, ‘uninjured’ or ‘damage’) is an agreement whereby a party (indemnitor) promises to compensate for the loss or harm sustained by another party (indemnitee).

The “Making Whole” Principle:

Recover should place the indemnitee (the party who is indemnified) in the same economic position as before the loss or damage and may neither enrich nor impoverish the indemnitee.

Distinction from Guarantee:

A guarantee is for the purpose of assuring the performance of a third party, whereas indemnity relates to making good a loss.

2. The Indemnity Principle in Insurance – The Basis of Cover

The Role of Indemnity in Insurance Policies

Core Principle: Indemnity is based on the principle that an insurance contract is signed to indemnify (pay back or make whole) the insured in the event of the loss. The insured can receive only the actual amount of the loss.

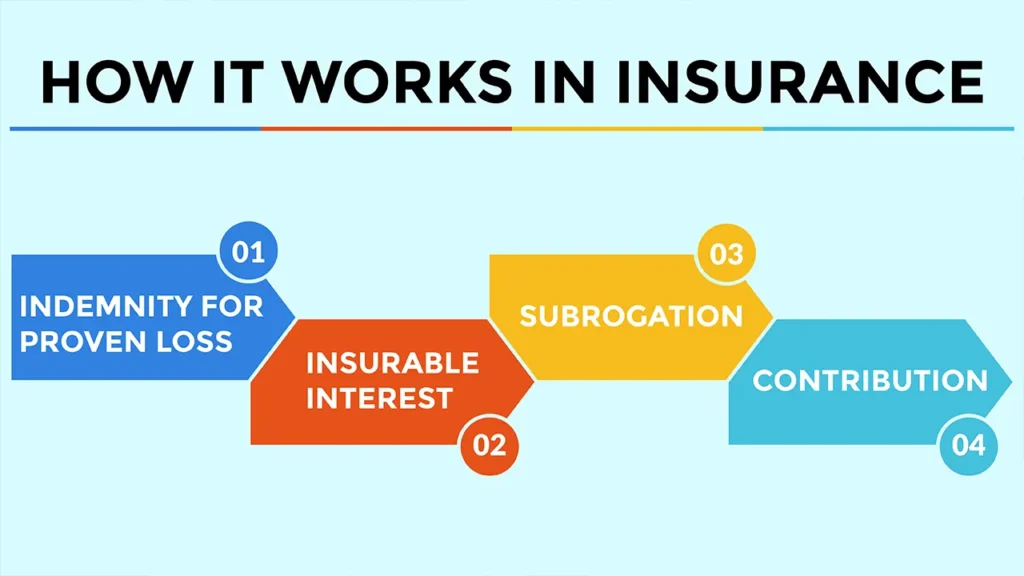

How It Works in Insurance:

- Indemnity for proven loss: An insurer is liable to cover only the actual documented financial loss sustained by the named insured up to the limit of the policy.

- Insurable interest: The insured typically must directly suffer from the loss. And for adverse news, it must be ascertained if the insured actually has a commerce that will be affected by the loss (may even have changed). No “dual-instraints”, meaning this: the insurer should be unable to put themselves in a position to profit from loss. And this should also deter what is termed “moral hazard” – deliberately causing loss (or otherwise) to get a payoff.

- Subrogation: Condition by which an insurer who has taken over another’s loss also has the right to legally pursue a remedy from a third party who may be responsible for the loss. This is to prevent the insured from receiving double indemnity and to allow the insurer to recover any payment made.

- Contribution: When the same risk is covered by different insurance companies, each insurer contributes in proportion to the amount insured, and all the insured amounts will be prevented from exceeding the actual loss.

Key Considerations in Insurance Indemnity:

- Insurable Interest: The insured needs to be financially involved with the thing that is being insured.

- Actual Cash Value (ACV) vs. Replacement Cost (RC): ACV is the cost minus depreciation, whereas RC is the new replacement cost, and both are based on the indemnity principle.

- Deductibles/Excess: These are meant to make sure the policyholder suffers a portion of the loss in line with the principle.

Indian Insurance Scenario: Concepts of indemnity and subrogation form an integral part of Indian insurance law and practice, and there is no ambiguity in the insurance law with regard to the principles of fairness to form the basis of claims settlement being laid down under the insurance acts. For details on the principle of indemnity in Indian insurance, refer to this legal overview by iPleaders.

3. Indemnity at Law: A Wider Legal Remedy

Outtake: Indemnity Provisions in Contracts & Legal Duties that Can’t Be Covered by Insurance

Contractual Indemnity:

Definition: A contract provision in which one party (usually person) agrees to assume a product’s future liability What It Means: A (contractual) provision under which one party (the indemnifying party) agrees to take on certain liabilities of the other party (the indemnified party) under particular circumstances.

Common Uses:

- Service Contracts: A vendor may indemnify a customer for any claims resulting from their own negligence.

- Construction Contracts: A contractor may agree to indemnify the owner for a slip and fall on-site.

- Mergers & Acquisitions: A seller could indemnify the buyer against unidentified liabilities.

- Intellectual Property: A licensee could be indemnified by a licensor for patent infringement.

Importance: Indemnity clauses allocate risk between parties, promote legal certainty, and may limit exposure.

Statutory/Implied Indemnity:

- Definition: Indemnity that is paid by law, even if there is no express contractual provision.

- Illustrations: Indemnity of an agent acting within the scope of his authority or contribution between joint tort-feasors (persons jointly responsible for a wrong).

- Indian Legal Perspective: In Indian law, the term “contract of indemnity” has specifically been defined under Section 124 of the Indian Contract Act, 1872, showing the importance of the concept in the Indian legal system.

4. INDEMNITY RESTRICTIONS AND COMPLEXITIES

When Indemnity Isn’t Absolute

- Policy Limits / Caps: In insurance, compensation will never exceed the sum insured or the policy limits. In contracts, there may be agreed-upon caps on liability.

- Exclusions: There are certain exclusions in insurance policies (i.e., willful misconduct, war) for which there will be no indemnity. Contractual indemnity provisions are also circumscribed.

- Fraud / Illegal Acts: Losses due to the indemnitee’s own fraud or illegal acts are typically not covered by indemnity.

- Duty to Mitigate: The indemnitee is under a duty to mitigate its loss even when it anticipates being indemnified.

- “All or Nothing” vs. Proportional: An indemnity could be triggered only for certain claims or share losses in proportions.

- Interpretation issues: The exact language used in indemnity clauses can cause confusion and become a source of legal battles, so draughting is key.

Conclusion

In conclusion, indemnity is an important principle that we certainly will understand and can use to do the following: be fair to those injured place the risk with the appropriate party, and offer financial protection that is essential.

It performs an “insurance” role by breaking the link between loss and profit so that insurers can subrogate, and it is widely used “in law” through contracts and statutes. Indemnity is so much more than a word—it is a critical concept that serves as the power behind equity and is a critical component of addressing and assigning the risk and important financial protection.

By comprehending its intricacies, people and businesses are able to take better control of risks, protect their assets, and do business with more confidence in an uncertain world.

Call to Action

Check your insurance and legal coverage for indemnity clauses, and get professional help if necessary to ensure you are covered.

Frequently Asked Questions

1. Is indemnity identical with compensation?

They’re related, though not exactly the same. Compensation Compensation is a term that refers to payment for loss or injury.

Indemnities refer to making an injured party whole by restoring them to the financial condition they were in prior to the loss (no more, no less). Indemnity is compensation, but it also makes one whole again.

2. I can gain from an insurance claim due to the principle of indemnity?

No. Insurance’s principle of indemnity operates to ensure that you do not make a profit from a loss.

The insurer will pay you only to the extent of the financial loss you actually sustained, up to the limits of your policy: you are to be “made whole”, not better off than you were to begin with.

3. | What does the term “indemnity clause” mean in a contract?

An indemnity clause is a clause in a contract in which one party agrees to secure the other against the potential loss or damage that may be incurred in the future due to the user’s behaviour.

It’s employed to shift risk from one party to another, and it delineates who pays for certain types of claims or liabilities in a business agreement.