Stock market investing is one of these places, and striking the proper balance of strong growth without the high price swings can be a difficult challenge. This is where large-cap funds come into play. They are a cornerstone of a good balanced portfolio, giving you that great point of growth and stability in the market.

In this post, invest wisely with large-cap funds that offer stability and growth potential. Learn how to build a resilient portfolio that withstands market fluctuations. If you are a new investor or just looking to reduce your risk while still building wealth, these funds are perfect for going down that less volatile path.

Part 1: What are large-cap funds? So, Who are the Giants of the market?

Large-cap funds are mutual fund schemes which predominantly invest in the shares of well-known, stable large-capital companies. A “large-cap” is a large market capitalization (the total dollar market value of a company’s outstanding shares). This list varies by country/market, but generally speaking, the S&P 100–200 of a given country’s most valuable companies.

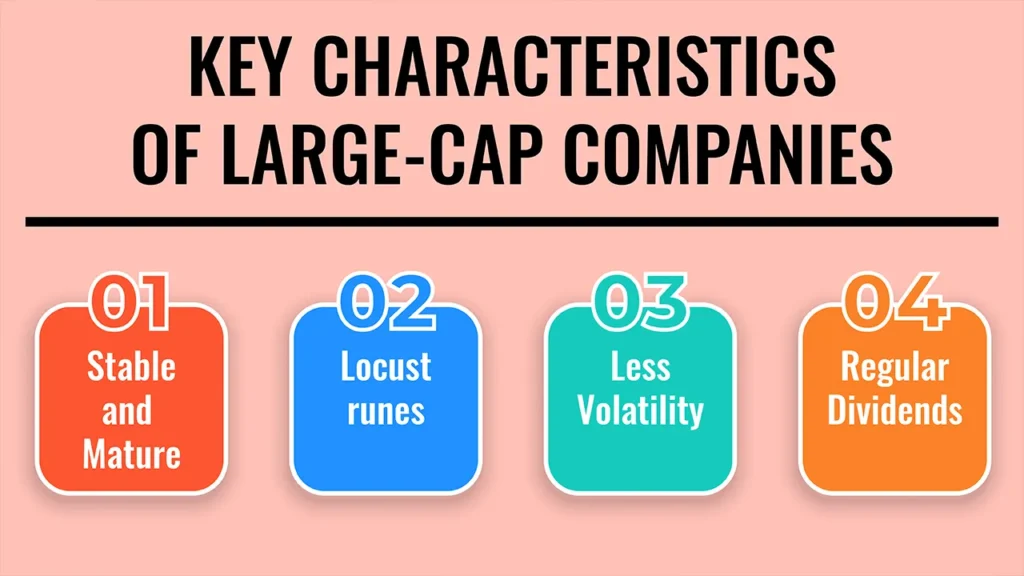

Key Characteristics of Large-Cap Companies

Most times, they belong to top players in their sectors with good brand pull (Apple, Amazon, Tata or Reliance).

- Stable & Mature: These firms have a history of performance that has been tested over time, are less exposed to downturns in the economy than smaller companies, and frequently have revenues from various sources.

- Locust runes: the fact that they are larger and more frequently exchanged makes them easier to buy or sell without being hit in a big way.

- Less Volatility: They do not have a complete immunisation to market movements but should be less volatile than mid- and small-cap companies, mostly due to their size and stability.

- Regular Dividends: Large caps often distribute dividends; this provides consistent cash flows to the investors.

Part 2: The Dual Advantage, Stability and Growth

Because of their specific investment attributes, large-cap funds are an essential part of any long-term portfolio.

A Foundation of Stability

- Resilient in Downturns: Many can also better weather economic recessions than smaller firms given their solid balance sheets, market share and geographical reach. Provides a similar sort of protection in more volatile times.

- Relatively Lower Risk: Although no investment is risk-free, the performance of these large-cap funds is generally less volatile and more predictable than those of smaller, more speculative companies (a snowflake crashing).

- Large Cap Funds are suitable for investors with moderate and conservative risk profiles: If you look at this word, it looks simple that if you have moderate or conservative risk, but what it actually means is smaller volatility in the NAV, which reflects that if the benchmark declines by 100 points, your NAV will fall within the range of that performance.

The Engine of Growth

- Secure form of appreciation: Large caps may not offer the kind of explosive growth that many small-cap companies might be able to, but they consistently provide a positive appreciation over the long term driven by continued business expansion and profitability.

- Many large-cap companies are innovative, and that requires substantial investment in R&D to remain at the top of their respective markets well after generations.

- Investing with Investors who have Captured Global Trends at Scale: This is a matter of scale, as having captured major global/economic trends and providing sustained growth over the long term.

Part 3: Strategic Integration, Investment In Large Cap Funds

Beginner: A Great Place to Start

- Why it stands out: Large-cap funds have stability and are managed by professionals, which makes them a great starting point for first-time stock market investors.

- Proper Strategy: Begin With a SIP, i.e., Those Who Have To Invest In Regular (Systematic Investment Plan). That way you end up buying at an average cost over time.

Advanced Investors: Portfolio Core

- Why it’s a winner: Large-cap funds are the anchor to any portfolio, and this focused offering shows that core options can do more than hold their own.

- Strategy: Buy large-cap funds for stability and ‘satellite’ mid-cap and small-cap funds (depending on risk tolerance) for higher growth potential and diversification.

Selection of a Large-Cap Fund

- Quality Fund Manager: An experienced fund is generally the one whose manager can deliver returns over a period of time.

- Choose funds with lower expenses: Ratio because this is the direct impact to your return

- Performance History: Learn about the fund’s historical earnings and how it has performed through different market trends.

- Is the fund well diversified: See if the portfolio of the fund across sectors is looking to minimize sector risk

Conclusion: The Wise Wealth Building Route

In short, large-cap funds invest in stable market leaders, which provide a powerful mix of stability via their antifragile nature and steady long-term growth.

Balance is key when it comes to these financial goals. Large-cap funds contribute that much-needed equilibrium and hence are a secure weapon in your hand to make you financially strong, which will also further increase returns.

Call to Action

Check out large-cap funds according to your requirements. Consult a financial advisor on what role large-cap funds can play in your portfolio and download the app to pick a mutual fund for beginners!

Frequently Asked Questions

1. Are large-cap funds tax-free?

It all depends on the tax laws in each jurisdiction and the lengths of time you were holding. For specific guidance, a tax advisor would be needed.

2. Large-cap funds or direct stocks of large companies?

It all depends on the tax laws in each jurisdiction and the lengths of time you were holding. For specific guidance, a tax advisor would be needed.

3. Large-cap funds or direct stocks of large companies?

Large-cap funds are better than direct investment in stocks for the reasons of diversification and professional management being possible, which adds a neat additional layer of security for most investors into other things being equal.