“Funding future education costs is fast becoming one of the key financial objectives for families in this day and age. Third, because of the high cost of tuition and school fees, college degrees, professional qualifications and going to study abroad, parents are seeking systematic ways to ensure their children’s future education.

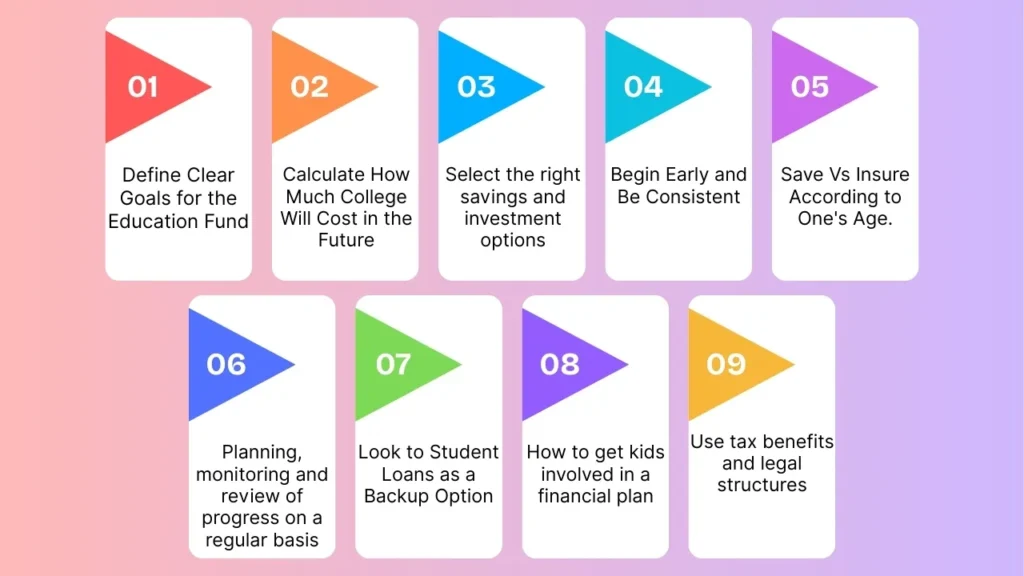

In the following article, listed as Key Steps in Building a Solid Education Fund (2025), we dissect a specific process that eases the burden for families by offering clear direction to a firm education plan.

Why an Education Fund Matters

Education is an investment in a child’s career, financial planning and overall well-being that offers tremendous returns with few downsides. But tuition is inflating at a rate faster than regular cost of living increases. Creating a dedicated education fund not only ensures the funds are there, but it also relieves stress related to debt in life.

With an education fund, families are essentially constructing a financial safety net. This guarantees that when such costs as admission fees, tuition, and overseas educational expenses are due, you will be able to pay those bills!

Here are the Key Steps in Building a Solid Education Fund (2025)

Step 1: Define Clear Goals for the Education Fund

Defining the objectives – The basics to set up a potent Education Fund Parents should consider the following:

- The child will continue his/her studies at a domestic or foreign university?

- What kinds of courses or schools are being baited – the private, public and international universities?

How many years of education spending will be needed?

By asking these questions, families can get an idea of how much they will need to have saved. The clearer the picture, the easier one can plan and invest for it.

Step 2: Calculate How Much College Will Cost in the Future

After establishing goals, the next step is to estimate future costs. It’s just above 5-8% per year in “economically developed” countries. For instance, a college education that costs $20,000 now could cost close to double in 10 years because of inflation.

In order to make an accurate forecast, parents can use online cost calculators and financial planning tools. This projection helps to determine the pace at which the Education Fund must grow each year to reach the target.

Step 3: Select the right savings and investment options

An education fund is only as good as the way you invest it. Common options include:

- Fixed Deposit Accounts: Non-profitable, but safe. Good for any short-term goal of up to 3 years.

- Systematic Investment Plans (Mutual Funds): Provides long-term growth and potential inflation-beating returns.

- Stocks and ETFs: Riskier but beneficial for the long term.

- Gov’t Bonds or Einstein’s College Fund: Sound and tax-effective.

- Insurance-linked Savings Plans: Get sound protection and raise long-term funding.

The selected mix needs to match risk appetite, time horizon and financial stability.

Step 4: Begin Early and Be Consistent

The sooner families can begin accumulating an education fund, the better. Compounding growth has more time to make the most out of investment returns when you start early. For instance, putting $300 into a fund each month from when a child is 3 years old will result in a significantly larger fund by age 18 than if the deposit starts at 10 with the same amount.

Consistency is vital. Consider the education fund a recurring expense, the same as rent, food or utilities. This brings discipline and growth year on year.

Step 5: Save Vs Insure According to One’s Age.

Loading Having shock absorbers is also a large part of financial security. Parents need to create an education fund along with life insurance and health coverage. This way, if something out of the box happens, it will not change anything with the child’s education.

Education plans backed by insurance also serve the dual purpose of long-term saving tools for two important needs: protection and investment.

Step 6: Planning, monitoring and review of progress on a regular basis

A sizeable education fund does not just happen once but through an ongoing process of establishing. Families should… Families should take time every year to review their plan and see if contributions accomplish what a family wishes.

Factors to evaluate:

Has the price of education gone up?

Those investments that have been made, are they providing the return you expected them to give?

Is it necessary to rewrite contributions?

And thus, timely adjustments ensure that the fund is never too little or too much when required.

Step 7: Look to Student Loans as a Backup Option

Though the primary objective is to build a self-reliant education fund, an education loan can be your plan B. Loans: They should be secondary weapons, not the prime movers. The emphasis here is that loans can be kept lower and “manageable”, giving your child the opportunity to graduate debt-free or with little debt.

Step 8: How to get kids involved in a financial plan

And as children mature, talking to them about the Education Fund can be a way to teach personal finance concepts. This teaches children about the work and worth of their education, so they value the resources they consume.

Step 9: Use tax benefits and legal structures

There are also tax incentives in place in various countries for investment into education-specific investment vehicles. Families should maximize these benefits to save more effectively. For example:

- Tax relief for money invested in certain financial products.

- Exemptions on withdrawals when the money is used exclusively for education.

Benefits under child education allowances

By applying tax structures that are legally based, savings can be multiplied, and the Education Fund becomes more effective.

- Building Approach: Short-Term vs Long-Term Foundation This is in regards to the Education Fund

To distinguish between short-term and long-term Education Fund planning, a quick table:

| Approach | Time Horizon | Appropriate Tools | Risk Level | Examples |

|---|---|---|---|---|

| Short-Term Education Fund | 1–3 years | Fixed Deposits, Liquid Funds, Savings Accounts | Low | School fees, certification courses |

| Long-Term Education Fund | 5–15 years | Mutual Funds, Bonds, ETFs | Moderate to High | College tuition, overseas education |

This table shows that matching investment products to time horizon is the critical element in creating funds for education.

Final Words

The Solid Education Fund is born of vision, consistency and strategic financial discipline. Financial planning is no longer a matter of choice; these days education comes at a cost, and parents are the only ones concerned when it comes to securing the future of their child’s education.

With some guidance and habit, families can alleviate the pressure of cost by breaking down these steps and checking in along the way so their children may have a wealth of opportunities academically without selling themselves short.

Frequently Asked Questions

1. Why should you open an education fund?

Beginning early can also help you get the most from a phenomenon known as compounding, which helps investments grow by contributing to any investment they produce. This lowers the monthly amount you’ll need down the road.

2. Can I safely use only savings accounts to fund education?

No: the return is low on savings accounts. For long-term education fund building, you’ll require higher-yield vehicles such as mutual funds or bonds.

3. What if I am not saving enough for education?

In such circumstances, education loans can be a saviour. But the end goal should always be to minimize loan dependence.

4. How should I estimate education costs in the future?

You can use online calculators or multiply the estimated cost of education today by a factor (6%–10%) in order to calculate how much you will need with inflation.

5. Do we need insurance while saving an education fund?

Yes, the insurance protects in the event of one-off unforeseen eventualities and means your child’s education is not interrupted.

Leave a Reply