When you get a new credit card, one of the first things you notice is the credit limit. This figure is also the most you can borrow on the particular card. It may sound like just a number, but your credit limit is also a powerful force and an increasingly important component of your financial life. It is a direct reflection of a lender’s confidence in your capacity to repay debt, and it helps determine your overall credit health.

Knowing how your credit limit is calculated, what it means for your financial life and how you can work to raise it sooner rather than later, is a life skill for anyone who’s building a solid financial foundation. This ultimate guide to both topics will give you all the understanding and practical steps you need to make your credit limit a tool to work with rather than against.

What Is a Credit Limit?

To put it simply, a credit limit is the most you can borrow on a credit card, line of credit or other revolving credit account. When you swipe your card, you reduce the available credit, and when you make the payment, all or some of that available credit is added back, up to the credit limit.

For instance, if you have a credit card with a $5,000 credit limit and make a $500 purchase, you would now have $4,500 available credit. Once you have paid off the $500 balance, you will again have $5,000 of available credit. It’s a flexible borrowing tool, but it’s not a set amount of cash that you have available; it’s the maximum amount you can borrow at any given time.

Accounts with an available credit limit The most popular accounts with an available credit limit are:

- Credit cards: Best known of the type, each card has a discrete limit.

- Lines of Credit: A loan with a predetermined amount of funds made available to you as needed.

- Home Equity Lines of Credit (HELOCs): A line of credit secured by your home’s equity.

How Your Credit Limit Is Decided

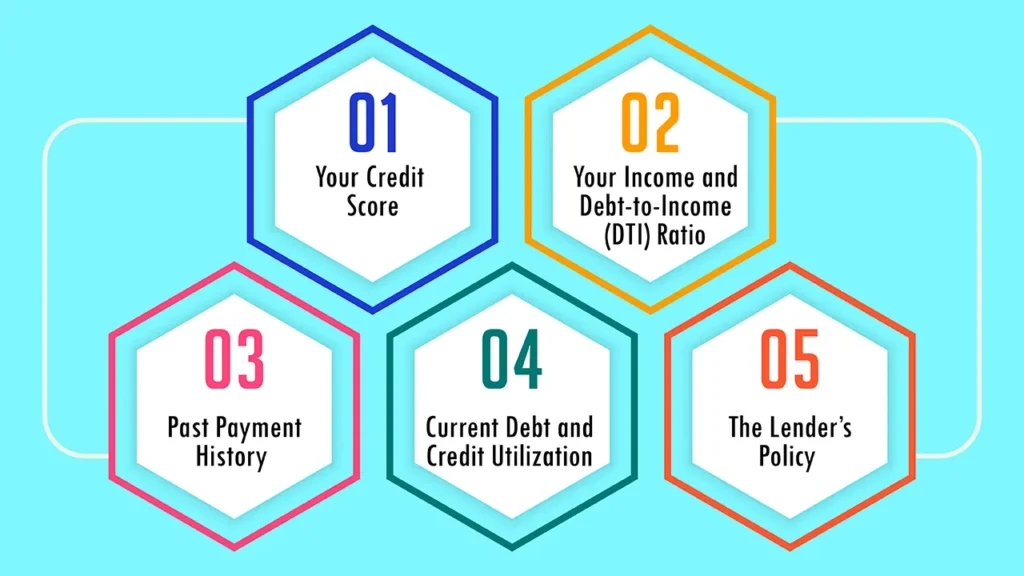

Credit limits aren’t just pulled out of a hat. They also nearly all use a thorough process called underwriting to gauge your level of financial health and calculate the amount of risk they’re taking on. This entails considering a number of important factors when determining how much credit you will extend.

- Your Credit Score: This is the 800-pound gorilla. Your credit score is a three-digit number that reflects your creditworthiness. A high score (say, above 740) tells lenders that you are a safe bet, a responsible borrower who has a history of paying debts on time. This, in turn, makes lenders far more willing to give you a higher credit limit. A lower score, on the other hand, indicates a higher risk of default and could result in a lower limit — or outright denial — of your application.

- Your Income and Debt-to-Income (DTI) Ratio: Lenders do not want to see that you have a regular, stable income that allows you to make your monthly payments. Your gross monthly income is the most important factor. They also evaluate your Debt-to-Income (DTI) ratio, a percentage representing your total monthly debt payments divided by your gross monthly income. Low DTI ratio Your debt-to-income ratio is typically a key indicator of financial health and a low DTI ratio (generally less than 36%) tells a lender that you’re not over leveraged in borrowing and that you can likely afford to borrow more if a lender is willing to lend you more money.

- Past Payment History: The banks will examine your credit report to see how regularly and timely you have paid your past as well as current loans. One of the biggest drivers of a credit score is a history of on-time payments, and it is an effective signal of your abilities as a borrower. But a history of tardy or missed payments will probably lead to a lower credit limit.

- Current Debt and Credit Utilization: A lender will consider how much you owe on all credit accounts. One indicator they look at is your credit utilization ratio (CUR), or the percentage of your total available credit you are currently using. For instance, if your total line of credit is $20,000 and you owe $2,000, your CUR is 10%. Low CUR (preferably below 30%) is a positive signal. If you are using the majority of your available credit, a lender might not want to extend your credit further.

- The Lender’s Policy: Each lender has its own risk appetite. Two different lenders might look at the same financial numbers, but one may offer you a $5,000 limit while the other might offer you $7,500. It’s a good idea to apply for a personal loan with multiple lenders so you can compare offers.

Why Your Credit Limit Matters

Your line of credit is significant for two key reasons: how much financial flexibility it affords you, and, more importantly, how it affects your credit score.

Impact on Your Credit Score

Your credit limit plays a direct role in your credit utilization ratio (CUR), which is one of the most significant factors in your credit score — representing about 30 percent of your total score. The higher your CUR, the worse. “By having a high credit line and a low balance, you have a very low utilization ratio,” says Ulzheimer.

Someone with a $1,000 credit limit and a $500 balance would have a 50% utilization ratio, which is high. Another person with a credit limit of $5,000 and the same $500 balance has a 10 percent utilization ratio. Even with the same debt, the higher limiter would score better, because he or she is using a lower percentage of their credit available.

Financial Flexibility and Emergency Fund

The higher the credit limit, the more financial leeway and a safety net you have. Emergency fund — It can serve as a fund for emergency expenses such as an unforeseen major car repair or sudden home repair. So having a high limit allows you to manage those expenses without maxing out your card or needing to take on more expensive loans.

How to Raise Your Credit Limit

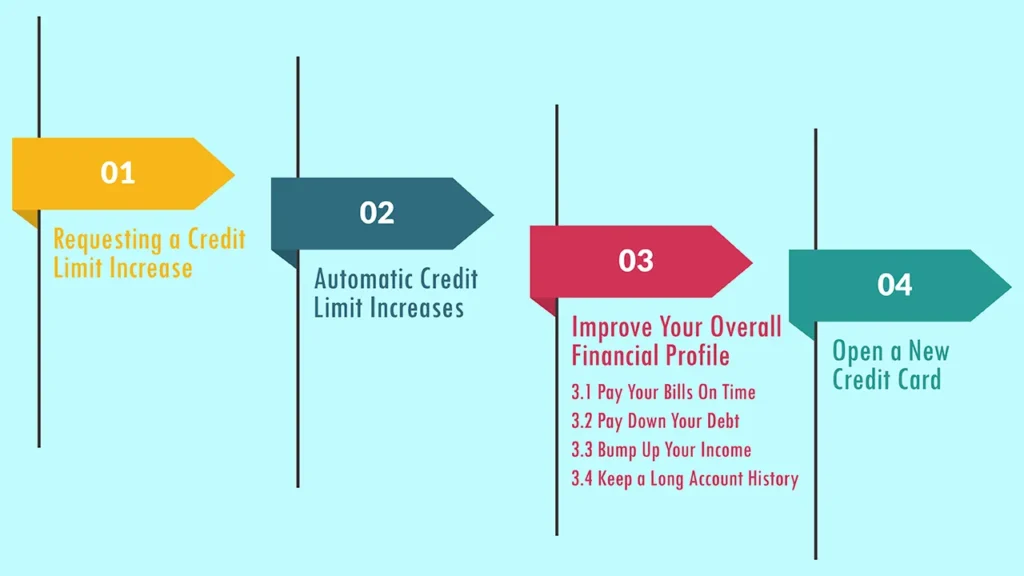

Bumping up your credit limit is a wise financial decision, and it can be approached in a few different ways.

1. Requesting a Credit Limit Increase

This is the simplest way to raise a limit. After you get the card, you can ask your credit card issuer to increase your credit limit after you’ve had the card for a few months (six months to a year). Some banks now let you make this request online or on their mobile app, or you can call their customer service phone line. Before you apply, make sure you’ve the got the following:

- You’ve had a history of on-time payments with that card.

- You’ve been using the card regularly, but responsibly.

- You now make more than when you first applied for the card.

- Your credit score has improved.

The lender will probably do a hard pull on your credit report when you ask to borrow more. That can lead to a temporary, small dip in your credit score, but the long-term benefit of having a higher limit almost always surpasses this very small drop.

2. Automatic Credit Limit Increases

Many credit card issuers will periodically review your account and give you a credit limit increase without you having to request one. These are known as soft inquiries, and they do not dent your credit score.

Such automatic increases are frequently a reward for good behavior. The lender can tell from your track record of timely bill payments and responsible card use that you’re a good credit risk, and they choose to give you more credit in that spirit of trust. To activate that, just keep managing your credit well over time.

3. Improve Your Overall Financial Profile

This may be the most impactful long-term strategy for boosting your credit limit and your financial health. When you give attention to those, you simply end up being a more appealing borrower for just about any loan provider.

- Pay Your Bills On Time: This is the number one most important factor with regards to your credit score. Having a perfect payment history shows lenders that you are a good risk as a borrower.

- Pay Down Your Debt: The less you owe compared with what you earn, the greater your capacity for new credit. Especially concentrate on getting rid of your high-interest debt first.

- Bump Up Your Income: If you’ve received a pay raise, you should let your credit card issuer know. They have a higher income, which would show an ability to handle more credit.

- Keep a Long Account History: The older a credit account is and the more positive history there is, the better. This demonstrates to lenders a consistent long-term practice of responsible financial behavior.

4. Open a New Credit Card

A new credit card will also add to your total available credit, so your credit utilization ratio overall will be lower. If you have, for example, 1 card with a limit of $2,000 and a $1,000 balance (50% CUR), then you would get a new card with a limit of $3,000 bringing up your new credit to $5,000. Your $1,000 debt would then be an ultra-ultra-low 20% CUR and your credit score would jump right away.

Just be aware that opening a new account generates a hard inquiry and can lower slightly the average age of your credit accounts, which are low-level negatives on your credit score. It is a strategic move that one should engage in responsibly, and not too often.

Conclusion: Your Road to Financial Independence

Your credit limit is a big part of your financial identity. It’s more than just a limit on spending; it’s a snapshot of your financial health that’s a significant factor in the formula used to calculate your credit score. By learning what factors affect your credit limit, by adopting responsible financial behavior, and by asking for specific increases, you can turn your credit limit from a number on a card to a tool you can use to build your wealth and gain financial security.

Credit limit management is not only about debt management, it’s also about building a trustful relationship with creditors and your financial future.

Frequently Asked Questions

1. What is a high credit limit?

There is no one “good” credit limit. Even more important is your credit utilization ratio. You’ll only benefit from a high limit if you carry a low balance. A limit that is high enough that you can keep your CUR below 30% — and ideally less than 10% — is the right limit for you.

2. How frequently can I request a credit limit increase?

Many lenders will let you ask for an increase every six months to a year. But you should probably avoid it until you have a very good reason: a huge increase in income or a recent history of paying down a large debt.

3. Can a credit limit be decreased?

Yes, a creditor can reduce your credit limit. This may occur if you have been habitually late with your payments or stop using your card, or if your credit score undergoes a significant drop. The lender may be doing this to hedge their own risk.

Q: What is a high credit limit?

A: There is no one “good” credit limit. Even more important is your credit utilization ratio. You’ll only benefit from a high limit if you carry a low balance. A limit that is high enough that you can keep your CUR below 30% — and ideally less than 10% — is the right limit for you.

Q: How frequently can I request a credit limit increase?

A: Many lenders will let you ask for an increase every six months to a year. But you should probably avoid it until you have a very good reason: a huge increase in income or a recent history of paying down a large debt.

Q: Can a credit limit be decreased?

A: Yes, a creditor can reduce your credit limit. This may occur if you have been habitually late with your payments or stop using your card, or if your credit score undergoes a significant drop. The lender may be doing this to hedge their own risk.

Q: Will closing a credit card lower my credit limit?

A: Yes, it would reduce your total available credit to close a credit card. This could push your credit utilization ratio up, which could hurt you in credit scoring. That is why financial experts often advise us to keep our old, unused credit cards open, particularly if they come with no annual fee.

Is it better for my credit score to have one card with a high limit or several low limit cards?

Both can be beneficial. A high-limit card makes it easier to maintain low utilization. But more than one card can act as a safety net and boost your total available credit. The key is using all of your accounts responsibly and keeping balances low.

Leave a Reply