Enjoying the advantages that come with being self-employed, but there are also large financial responsibilities you may not have as a traditional employee. You are not just the CEO of your own business but also its accountant, HR department and financial planner.

With no regular pay cheque, employer-provided benefits, or automatic tax withholding, strong financial planning isn’t just a nice thing to have — it’s a must. The purpose of this guide is to provide you with the information and tools necessary to develop a solid financial plan while dealing with the peaks and flows of irregular income and help you confidently manage the solitude and uncertainty that comes with being self-employed.

Step 1: Laying the Foundation – The Cover of Cash Flow

Before you can make a financial plan, you need to know where your money’s been going. This is particularly important for the self-employed, as your income could be inconsistent.

1. Separate Business and Personal Finances

This is non-negotiable. Open a business payment account and secure a business credit card. It’s that simple — you’ll save yourself tonnes of headaches come tax time.

won’t commingle funds, and you’ll have a concise understanding of how much money your business made (or lost) when it comes time to assess your profitability. All your income should flow into your business account, and every business expense should be made from it.

2. Becoming a Pro at Variable Budgeting

Forget the fixed monthly budget. In the topsy-turvy realm of income variation, you want an adjustable system. This “pay yourself first” model really works. Every time you receive a payment, apply proportions to various financial buckets:

- Taxes: Dedicate a portion (such as 25-35%) for estimated taxes.

- Emergency Fund: Shoot for 6-12 months of living expenses.

- Operating and software expenses, supplies.

- Personal Pay cheque: You can pay yourself a regular “pay cheque”; even if it’s negligible, it can represent living expenses.

- Savings and Investments: Stick some in a retirement or broking account.

Step 2: Creating Your Safety Blanket and Savings

Now that you know your cash flow cold, you’re ready to craft the core of your financial safety net.

1. Prioritize Your Emergency Fund

An emergency fund is the first line of defence in the event of income lulls, unanticipated business-related expenses or personal emergencies. You should aim to have at least 6 months’ worth of your living expenses in a high-yield savings account.

For the self-employed, 9 to 12 months is even better to accommodate longer stretches of low or no income. This is the fund that lets you ride out a slow season without going into debt.

2. Get Health, Disability, and Life Insurance

As an independent contractor, the benefits are all up to you. Do not overlook this.

- Health Insurance: Check your state marketplace or the AAMC website for resources like professional organisations and private plans. Shop around to find a plan that fits your budget and your needs.

- Disability Insurance: This is probably the most neglected area of insurance for freelancers. It pays a portion of your income if injury or illness prevents you from working. A long-term disability policy is a necessity for protecting your financial bottom line.

- Life Insurance: A term life insurance policy is a must if you’ve got dependants who need to be financially secure in case anything happens to you.

Step 3: The Long-Term Plan – Retirement and Investment

Then you should work on building long-term financial security.

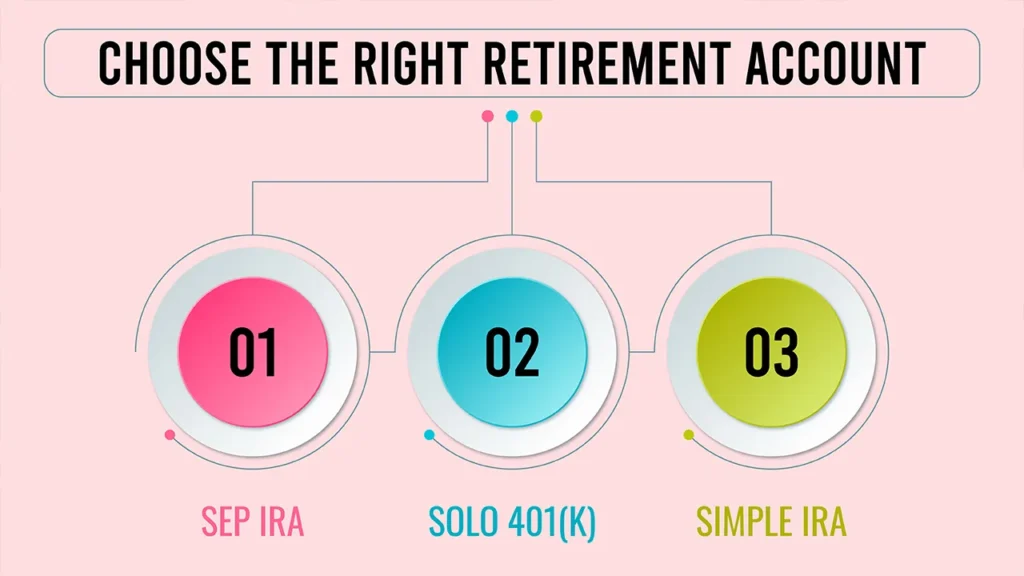

1. Choose the Right Retirement Account

Here’s where self-employment can really shine. You have access to powerful, high-contribution retirement plans available only to employers.

- SEP IRA (Simplified Employee Pension): Simple to establish and permits high contributions — up to 25 per cent of your net self-employment earnings, with an annual limit.

- Solo 401(k): Best for self-employed individuals with no employees other than a spouse. You can contribute as an employee and as an employer, so your total contribution can potentially be much greater than with a SEP IRA.

- Simple IRA: Decent if you have just a few employees, as it has lower employer contributions.

- Traditional or Roth IRA: If your business is new or has low profits, consider beginning with a standard IRA.

2. Invest Beyond Retirement

Don’t stop at retirement accounts. For buying stocks, bonds or ETFs, consider opening a regular broking account. That will enable you to build a diversified portfolio that you can access at any time for goals that will be many years away, like buying a home, funding a child’s education or saving for early retirement.

Step 4: The Tax Strategy

Taxes are perhaps the scariest segment of financial planning for the majority of self-employed people. But they don’t have to be.

1. Set Aside Money for Taxes

As I covered in the budgeting section, the simplest way to deal with taxes is to save a percentage from every payment you receive. This avoids the frantic rush at the last moment and ribbons that are always ready.

2. Pay Estimated Quarterly Taxes

Four times a year, you have to remit income tax payments as a business owner. Penalties can be incurred by missing these deadlines. Circle those due dates on your calendar and put in those payments on time.

3. Maximize Your Deductions

Track every business-related expense. From office supplies and software subscriptions to mileage and home office expenses, those deductions can add up to a sizable reduction in your taxable income. Use accounting software to make this task automatic and save yourself a huge headache come tax time.

Conclusion: Your Journey To Financial Independence

The reality is, you’re on a path to financial planning as a self-employed professional, not a race. It begins with basic steps — dividing your finances, establishing a flexible budget, and building a rock-solid safety net.

From there, you can move on to smart investments, long-term retirement planning and a streamlined tax strategy. And, by mastering these essentials, you’re not only managing your money — you’re setting up a sustainable, secure future for yourself — one free from the stress of financial insecurity that can accompany self-employment.

Frequently Asked Questions

1. What’s the most successful way to manage money where income isn’t the same each month?

You just have to budget for that or budget for the low end, whatever your lowest month is on average. The same goes for a high-income month—use the surplus to save and pre-fund your lower-income months. This provides a layer of support.

2. Should I be a sole proprietor or set up an LLC?

A sole proprietorship will be the easiest to start but offers no liability protection. An LLC (Limited Liability Company) offers you legal protection by creating a barrier between your personal and business obligations. It depends on the size and risk of your business.

3. What’s a good percentage of my income to save?

The old rule of thumb of saving 15% of your income to support yourself in old age still stands. You’ll probably want to target even more than that, maybe 20% or more, as a self-employed person to also cover your savings for insurance and other benefits an employer typically offers.

4. Can I run my business from a personal account?

Technically yes, but it’s highly discouraged. It makes the accounting a nightmare and can lead to legal and tax headaches. It also makes your business appear not as professional. It’s never too early to start with business and personal finances being separate from day one.

Leave a Reply