Taking out a loan is a significant financial step, yet the process from applying to approval may seem overwhelming. A central part of this process is underwriting — that critical step in which lenders analyse your financial history and judge whether or not you are good credit.

Knowing what an underwriter looks for is the most important way to get your application ready—and make it more attractive in getting approved.

This in-depth article will shed some light on the process underwriters go through and the variables that are considered, along with talking about what to be aware of and how it can differ from person to person.

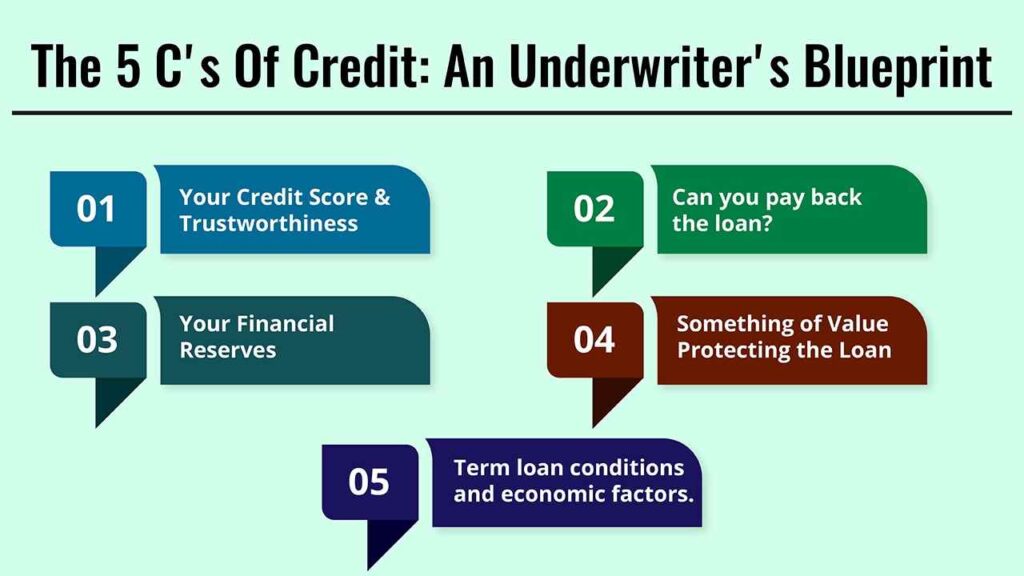

The 5 C’s Of Credit: An Underwriter’s Blueprint

Most creditors will evaluate the application to approve or deny a loan under some framework around what is known as the 5 C’s of Credit. Following and focusing on these five pillars will help you build a watertight case about how you are a low-risk borrower.

1. Character: Your Credit Score & Trustworthiness

- What Do Underwriters Look For: Your credit score and your credit report are the paces that mark your financial character. An underwriter will evaluate your track record of on-time payment, your use of credit, and the age of your credit. They want to see a history of responsible borrowing.

- What to do before applying: Get your credit reports from the 3 major bureaus and fix any errors. Concentrate on how to get rid of your current debt, thereby lessening the usage of credit.

2. Capability: Can you pay back the loan?

- What Underwriters Look For: Issuers want to see where this is automatically measured by your Debt-to-Income (DTI) ratio. That means if you owe payments on a credit card, car loan or any type of debt, underwriters will total up your monthly obligations and divide that by your gross monthly salary. A lower DTI ratio means that you have more income from which to pay for new items. They will also seek consistent employment, at a minimum two years with the same employer or in the same industry.

- Getting Ready to be Reviewed: Raising your income could help you, or better said, reducing what debt you have already. Bring pay stubs, W-2 forms, and tax returns to prove your income.

3. Capital: Your Financial Reserves

- What Underwriters Look For: The Lender’s View Lenders want to know that, in your moment of need, a sudden job loss, for example, you have some sort of cushion to fall back on. This means the money you’ve saved/invested elsewhere. In addition to checking your ability to cover the down payment and closing costs with liquid assets, there are typically 3-6 months of mortgage payments required in cash reserves for mortgages.

- Prepping for Review: Over the last few months leading up to your application, steer clear of major, unexplainable deposits or withdrawals in your bank accounts. The underwriter considers this a red flag.

4. Collateral: Something of Value Protecting the Loan

- Collateral: The asset is collateral in secured loans such as home mortgages or auto loans; your Loan-to-Value (LTV) ratio is vital to this step. This is a simple ratio that compares the loan amount to the value of the asset according to its appraisal. And you will be considered less risky to the lender with a lower LTV, typically by making a larger down payment.

- Home Loans: New Regulation on Appraisals In the case of an auto loan, it will be a percentage of the market value of your vehicle known as LTV.

5. Term loan conditions and economic factors.

What Underwriters Look For: C- Credit (This “C” applies to the terms of the loan, as with your interest rate and amount, as well as societal factors such as inflation and interest trends.) Underwriters will check to make sure that all of the loan conditions are satisfactory given the current market and your financial planning.

The Underwriting Process

After you submit your loan application, the underwriting process generally begins and can take a few days to a few weeks. It involves several key steps:

- Document Verification: the underwriter will look at all of the documents you provided: pay stubs, bank statements…

- Credit and History Analysis: This involves conducting a “hard pull” on your credit to ascertain as much detail about your financial history as possible.

- Appraisal: A lender will hire an independent appraiser to determine the current value of a property.

- Final Decision: The underwriter will make a final decision and either issue a conditional approval or an outright approval.

Majority Reason For Loan Application Rejection

If you have a solid application, there are actually certain problems that can still result in denial. These include:

Final Words: How Do I Get There From Here?

Underwriting should not be feared as an obstacle but an organised evaluation to make a right and just decision of lenders. Concentrate on the five C’s of credit and get as much documentation organised beforehand to keep everything orderly, proving that you are trustworthy and beneficial.

Armed with this roadmap, you are now prepared to sail through the underwriting stage and confidently set foot on your land of financial dreams.

Frequently Asked Questions (FAQs)

1. How Long Does the Underwriting Process Take?

The loan process can be as simple or complex as your financial situation and the type of loan require it to be. Typically this takes between a few days and two weeks, on average.

In the case of a mortgage application, it usually takes longer in light of the property appraisal and title search.

2. Many consumers ask, “What is a ‘hard inquiry’, and how will it affect my credit score?”

What is a hard inquiry, or “hard pull”, and how does it impact your credit? It will lower your credit score by a couple of points for 30 days.

For identical loans (such as multiple mortgage applications), credit bureaus typically cluster enquiries performed together within a short timeframe into one, if not one, to limit the impact on your score.

3. Can I change jobs while my loan is in underwriting?

A job change, especially if it includes a drop in pay or transitioning to a new field, can result in the underwriter reassessing your qualifications and potentially denying coverage.

4. How important is it to review your credit just before you do that?

Then you can dispute them with credit bureaus. Sometimes, it can take time, which is why it can be a good idea to try and be proactive.

Leave a Reply