You dutifully pay those insurance premiums each month, but do you actually know what happens when it comes time to use it? The term insurance claim gives reference to the time that the contractual obligations are executed, when you will make the most out of the financial security our insurance policies provide you.

This post will explain what insurance claims are and how the claims process works, including the most common types of claims. Easier said than done. For additional claims support, Learn about insurance claims, including their definition, operational process, and the different types, to ensure you understand your coverage options.

What is an insurance claim? The Core Definition

An insurance claim is a formal request by a policyholder to an insurance company for coverage or compensation for a covered loss or policy event. This demand is usually made after a covered event or disaster has taken place.

Purpose

As stated in the policy or contract, the insurer will pay the policyholder (or beneficiary) if the policyholder makes a claim against the insurer for payment on a covered loss or event as defined in the policy.

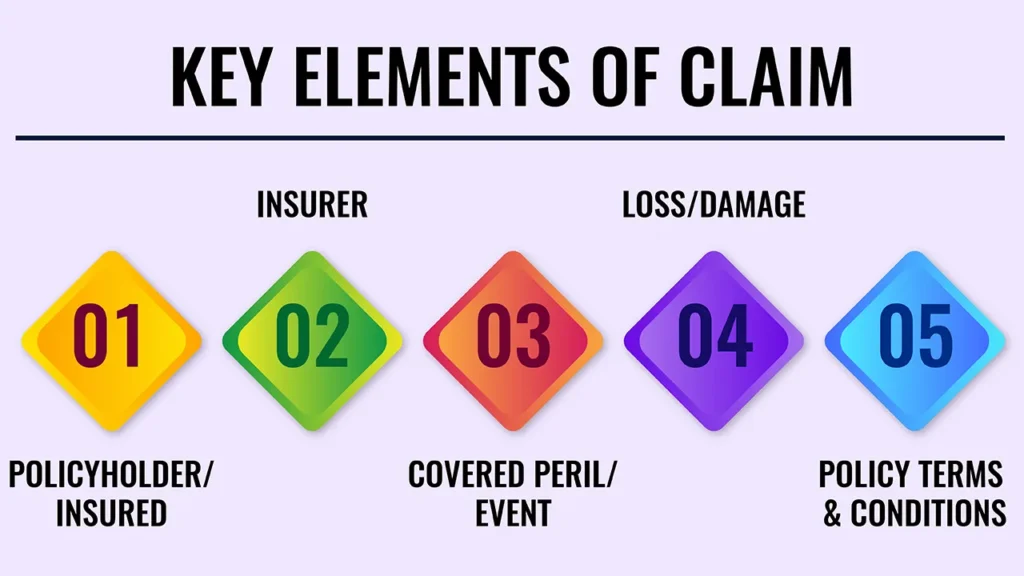

Key Elements of claim

- Policyholder/Insured: The person or organisation that has a contract (insurance policy) that provides insurance coverage.

- Insurer: The company that provides the insurance.

- Covered Peril/Event: The event or risk that the policy states that it covers (accident, illness, theft, natural disaster, death).

- Loss/Damage: The financial or physical loss sustained because of the covered event.

- Policy Terms & Conditions: The rules and limitations, deductibles, exclusions and procedures that are described in an insurance policy.

How an Insurance Claim Works: Step-by-Step Process

Key words and phrases Although insurance policies and carriers vary in details, the general steps to be taken in the claims process are as follows:

Incident Occurs & Policy Review

Then an ‘event’ occurs that you think your insurance plan should cover (you’re involved in a car wreck, get hospitalised, or your property is damaged).

Action for Policyholder: Check your policy document now to find out what is covered, any deadlines for reporting, and the first steps to take.

Intimation/Notification to the Insurer

Report the accident to your insurance company right away. Most policies have a specified time frame for intimation (in some cases within 24 to 48 hours for the death of a person in the case of a health or motor claim).

- Methods: This is typically done through a toll-free hotline, website, mobile application or through your insurance agent.

- What’s Needed: Membership number, date/time and description of events, contact information.

Claim Form Submission & Documentation

The insurer will leave you with either a paper or online claim form.

Policyholder Action: Complete and submit the claim application form along with all documentary proofs. This is a critical step.

Common documents listing (according to types of claims):

- Original policy document

- Claim form (completely filled and signed)

- Identity and address proof

- FIR or Police Report (in case of accidents, theft)

- Health Claims (doctor’s reports, medical bills, discharge summary)

- Estimate of Repairs, Invoice, Photo (in case of Motor/Property Damage compensation)

- Death certificate, nomination details (for life claims)

Investigation & Assessment (Surveyor/Adjudicator)

The insurance company assesses the submitted documents and, as soon as it has verified the details, may appoint a surveyor or loss assessor (in the case of claims pertaining to motor insurance) or contact a Third Party Administrator (TPA) to process the claim (in the case of health insurance).

Purpose: To verify the claim, ascertain its coverage and calculate the eligible claim amount.

Claim Approval/Rejection & Settlement

- State commission determination: The insurer will approve the claim if the claim is deemed reasonable and necessary.

- Rejection: A claim can be rejected for being outside policy coverage, lack of sufficient documentation or if fraud is suspected. Insurers must give reasons for denial.

- Resolution: If settlement is reached, the insurance and the person charged will pay.

Settlement Methods:

- Cashless Settlement: With health insurance, it is the insurer who directly settles the dues to the network hospital.

- Reimbursement: The policyholder makes payment up front and is reimbursed by the insurer after claims are processed.

- Direct Debit: Money is paid to the policyholder’s bank account.

- Fixing/Replacement: What the insurance company does to fix or replace your property.

- Important points: deductibles/excess (what you pay first), waiting period, exclusions, and why the fact of full disclosure at policy sale is important.

Common Types of Insurance Claims

The type of claim may also be influenced by the type of insurance you have. Some of the most popular are:

Health Insurance Claims

Claims for medical expenses attributed to illness, injury, hospitalisation or medical services.

Typical Cases: hospital bill, doctor’s fee, lab tests, surgical fee, medicine charges.

Claim Types:

- Cashless: At a network hospital, the insurer settles bills directly.

- Reimbursement Claim: Policyholder pays upfront and submits bills for reimbursement.

Life Insurance Claims

Meaning: Claims for payment of the sum assured to the beneficiary of the policy (in the event of death of the policyholder) or to the policyholder himself (on maturity of the policy, i.e., in endowment/plans).

Typical Scenarios: Death of the insured, maturity of the policy, critical illness (if rider is chosen).

Claim Types:

- Death Claim: Claim filed by nominee/beneficiary after death of the insured.

- Maturity claim: Submitted by the policyholder at the time of maturity of the policy, when benefits become payable.

- Rider Claim: Applicability of riders like AD, CI, etc., if any opted for.

Motor Insurance Claims (Car/Bike Insurance)

Meaning: Compensation requests for damage to the vehicle insured, injury/damage to a 3rd party from the vehicle, or theft of the vehicle.

Typical Scenarios: accidents, theft, damage from natural occurrences, and fire.

Claim Types:

OD Claim: Repairs/replacement of your own vehicle.

TPL Claim Looking up to those legal or financial liabilities arising from any injury or damage to any other person or their goods.

Theft Claim: Filed in the event of the theft of your insured vehicle.

Property Insurance Claims (Home/Fire/Commercial Property)

- Term: Claims for damage or monetary loss to insured residential or commercial property caused by covered perils.

- Typical Scenarios: fire, flood, earthquake, break-in, vandalism, structural damage.

- Types of claims: as per policy, i.e., Home Insurance, Fire Insurance, Shopkeeper’s policy, etc.

Travel Insurance Claims

Petitions for financial aid in response to emergencies or unexpected events that have taken place during travel.

Typical Coverage: Medical transport while travelling, cancellation/interruption, baggage lost/delayed, lost passport, and flight delay.

Personal Accident Insurance Claims

Application for payment for accidental death, disablement (total/partial) or injury due to accidental occurrence.

Common Causes: Road traffic accidents, falls, industrial accidents, sports injuries.

Suggestions for a Successful Claim Process

- Read Your Policy Document: Know what’s covered, what’s not, and what you’re responsible for.

- Take Action Quickly: Report incidents to your insurer at the earliest moment.

- Compile All Documents: Keep all documents, bills, reports, and photos separated and organised.

- Honesty and Foresight: Be truthful in the information you supply; false statements of facts can result in denial of claim.

- Keep the Lines Open: Establish ongoing dialogue with your insurance company or its assigned surveyor/adjuster.

- Know Deductibles/Excess: Know how much you will have to pay out of your pocket.

- Verify Claim Status: Insurance companies have online platforms or helpline numbers to monitor the status of your claim.

Conclusion: Activating Your Insurance Protection

So what, exactly, is a claim, and how does it differ among various types of insurance products? Part of financial responsibility is to know this key element of your insurance terms to leverage your policy when you are most in need.

Call to Action

Do you have any insurance policies in place? Review them today! Ready to learn about the claim process that you need to follow? Want to schedule a personalised insurance consultation?

Frequently Asked Questions

1. What if my claim is denied?

You have the right to a detailed reason for the denial of your claim. You may wish to contest the determination or submit additional documents, if possible.

2. How long does insurance take to pay out a claim in India?

This is a broad question, as claims settling time can be very different from one type of claim to the next and from one insurer to the next, but in general, it can take anywhere from several days to several weeks to get through the process.

3. Will my insurance go up if I make a claim?

Claiming, in most instances, will cause your premiums to rise – especially if you claimed for a large amount or have a history of frequent claims.

Leave a Reply