Retirement is creeping up on you, and perhaps you feel the ticking of the clock. But the good news is this: your later career years can actually be some of the most impactful when it comes to turbocharging your retirement savings!

This guide is intended for people in their 50s and early 60s who are nearing retirement. This stage is so important because you have a lot working for you, including peak income potential, the ability to maximize your contributions to savings and retirement, and having an idea of what retirement feels like.

Navigate the complexities of late career retirement planning. Learn how to maximize your savings and ensure a comfortable retirement lifestyle.

The Landscape of Late-Career Retirement Planning Tap Qualified or not?

Advantages You Have

- Greater Income Potential: Typically this is when you make the most money.

- “Catch-Up” Contributions: Designed as a way for older savers to make up for lost time, you can contribute more to retirement accounts.

- Less Debt (Maybe): Some people may have paid off — or paid down — their mortgage.

- Sharper Vision: You probably have a clearer vision of your retirement dream.

Specific Challenges

- Time Horizon: Time for Compounding to Wonder on Miracles.

- Risk of Market Volatility: Less time to recover after a large market decline.

- Health-Related Expenses: A significant worry that rises as we age.

- Caregiving Duties: You might have to help ageing parents or grown children.

- Insecure employment: The possibility of unexpected job loss is more threatening as retirement nears.

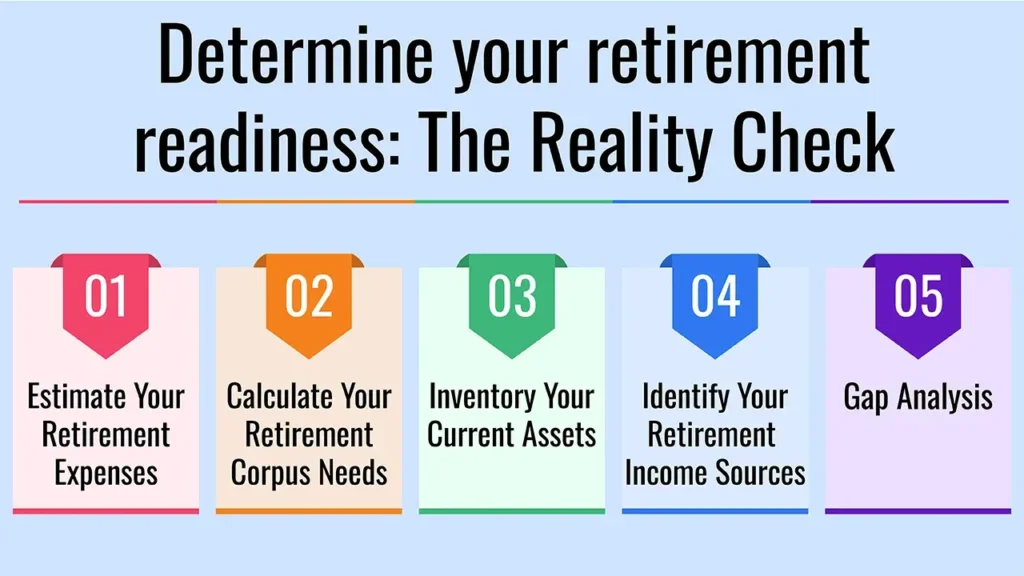

Step 1: Determine your retirement readiness: The Reality Check

Determine Your Retirement Date: When do you want to retire versus when can you afford to retire?

- Estimate Your Retirement Expenses: Establish a comprehensive post-retirement budget to cover housing, food, health, travel, hobbies and entertainment. Keep in mind to adjust for inflation and the possibility that other spending niches could increase.

- Calculate Your Retirement Corpus Needs: What target do you need to hit to sustain the lifestyle you want? It’s best to use rules of thumb, such as 25-30 times annual expenses, or a comprehensive retirement calculator.

- Inventory Your Current Assets: Mention all retirement accounts (EPF, NPS, PPF, mutual funds, stocks, and real estate), savings and other investments.

- Identify Your Retirement Income Sources: Include pensions (if any), NPS annuities, rent and systematic withdrawal plans (SWPs) from mutual funds.

- Gap Analysis: Compare your estimated future needs with your existing savings and income sources to determine the “gap” you have to make up.

Step 2: Save and Contribute as Much as Possible

Supercharge Retirement Accounts

- Catch-Up Contributions: Avail of such enhanced limits for above 50 category (following are the specific provisions concerning NPS, EPF or such other government/employer schemes in India)

- Leverage EPF/VPF: To the extent applicable, enhance voluntary provident fund (VPF) for assured return and tax advantage.

- NPS (National Pension System): Avail of tax benefits under Section 80CCD(1B) for investments over and above 80C.

- PPF (Public Provident Fund): Invest the maximum every year and get tax-free returns.

- ELSS (Equity Linked Saving Schemes): For 80C tax benefits along with exposure to equities, you may consider this.

Aggressive Savings

Trim your discretionary spending and figure out how to raise your savings, perhaps by paying yourself first via automatic transfers.

Convert Non-Earning Assets

Some things you should consider: Selling off your “extras” (like a second home or expensive cars) in order to ramp up your retirement savings.

Step 3: Refine Your Investment Plan

Risk Reassessment

Start the transition of your portfolio from high growth to balanced or conservative. And the aim should be to preserve capital and to grow income, not to see aggressive how-much-can-I-do growth.

Asset Allocation

Talk about the need to “rebalance” as you get older and reduce your exposure to stocks and increase exposure to debt/fixed income as retirement edges closer (i.e., you’ve got a 60/40 equity-to-debt ratio when you’re 40, but that should maybe be more like 40/60, eventually 30/70).

Income-Generating Investments

Debt Funds: For stability and moderate returns.

- Fixed Deposits (FDs): Safe and sure income, but no tax benefits.

- Senior Citizen’s Savings Scheme (SCSS): The SCSS is a government-guaranteed scheme for regular post-retirement income (if you were eligible).

- Annuity Plans: Explain about them being the source of providing guaranteed income for life but also their drawbacks (no liquidity, low returns)

Tax-Efficient Withdrawals

Develop a withdrawal strategy for your various accounts (taxable and tax-exempt) to reduce your tax liability in retirement.

Step 4: Strategic Debt Management

Goal: Debt-Free Retirement

Pay off all high-interest debt (credit cards, personal loans) before retirement.

Mortgage Strategy

Strive to have your home loan repaid or a substantial debt reduction by the time you retire. This will leave you with a sizeable amount of cash flow in retirement.

Avoid New Debt

Be very cautious about taking on extra loans or expanding your debt as you near retirement.

Step 5: Critical Insurance and Healthcare Planning

Health Insurance

Make sure you have good health insurance that carries over into retirement. Think about a super top-up or critical illness policy to meet larger medical expenses.

Long-Term Care (LTC) Insurance

Although relatively infrequent in India compared with parts of the West, talk about whether it makes sense to provide for the possible cost of assisted living or nursing care.

Life Insurance Review

Reevaluate whether you still need term life insurance. If your dependants are no longer depending on your income, you may have the option of scaling back or completely dropping coverage in order to cut costs.

Step 6: Retirement’s Non-Financial Impacts on Households

Define Your Retirement Lifestyle

What are you going to do when you retire? Think about hobbies, travel, volunteer work, family or a passion project.

Social Connections

Be sure to make time for socializing in order to improve your quality of life.

Housing Decisions

Consider downsizing, moving to a less expensive part of the country or taking out a reverse mortgage (on which you should be very sceptical and very careful and should consult experts).

Part-Time Work/Encore Career

Could you work part-time in retirement for a little extra income?

Estate Planning

Review any will or power of attorney documents you have, and think about designating beneficiaries for your assets.

Step 7: Importance of Seeking Professional Help

When You Need a Financial Adviser

If you feel frazzled or have complicated financial circumstances, consider hiring a financial adviser to help with a personalized game plan.

What a Financial Planner Can Offer

A financial planner can help with goal identification, cash flow analysis, investment rebalancing, tax planning, estate planning and withdrawal strategies.

Choosing the Right Advisor

Identify SEBI-registered Investment Advisors (RIAs) or Certified Financial Planners (CFPs) who would provide independent advice and work on a fee-only model.

Conclusion

Focused action in these late working years really can make a difference in your retirement security and comfort level. And with the right moves today, you can be on the road to a full and financially secure retirement.

Call to Action

Begin your retirement checkup today! For help putting the finishing touches on your late-career strategy, seek advice from a financial planner — and download our retirement checklist!

Frequently Asked Questions

1. At age 50-something, is it even worth saving for retirement?

It’s never too late! Although you can’t save as long, there are ways to make the most of your retirement savings.

2. What are the best low-risk investments for someone about to retire?

For stability and predictable returns, you can look at vehicles such as fixed deposits, debt funds, government-backed schemes, etc.

3. What are the best health insurance options for retirees

Ideally, you should look at a comprehensive health insurance plan which includes hospitalisation and outpatient cover and also consider Super Top-up plans for additional cover.

Leave a Reply