Have you ever wondered how a bank determines whether you qualify for a loan or how an insurance company decides what to charge you for coverage? You can thank something called underwriting.

This critical measure essentially assesses the risk involved with a venture, a loan, an insurance policy, or an investment for a fee. In this report, we’ll explain the different types of underwriting, how they operate, and why they’re essential to banks and the stability of markets.

What is Underwriting? The Foundation of Financial Decisions

Underwriting is when an individual or institution takes on financial risk for a fee after working to evaluate the risk associated with a particular venture, loan, or investment.

Role of an Underwriter

This critical judgement call is made by underwriters, the experts who are doing the evaluating. Their core purpose includes:

- Eligibility for loans, insurance and investments.

- Risk quantification and pricing, including interest rates, premiums and prices of securities.

- Protecting the underwriter or bank from potential losses.

Historical Context

Derivative Origin The term “underwriting” comes from a shipping insurance practice whereby two or more parties would sign under the risk, denoting that they had underwritten their names underneath the description of the risk, and were accepting it.

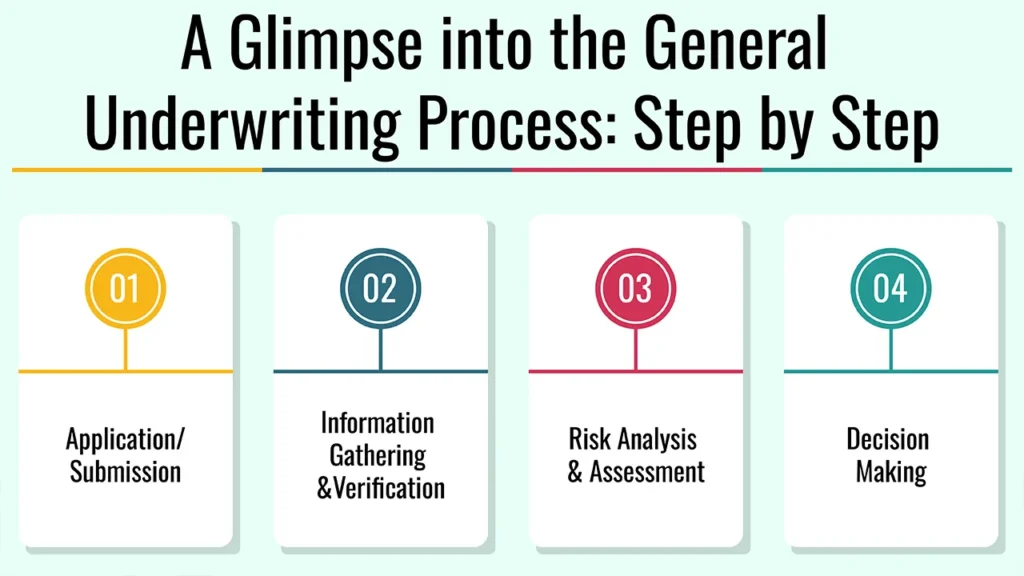

A Glimpse into the General Underwriting Process: Step by Step

1. Application/Submission

The whole process of underwriting commences with the application for a loan, insurance, or other security.

2. Information Gathering & Verification

- Interest and Other Collection: That’s for those financial statements, credit bureau reports, medical data, property valuation and business plans.

- Confirmation of Accuracy: Underwriters confirm the accuracy and completeness of the submitted data.

3. Risk Analysis & Assessment

- Analysis: Processing data using models, algorithms and human analysis.

- Risk Identification: Assessing the probability and effects of risks.

- Creditworthiness: Measuring a candidate’s creditworthiness/risk.

4. Decision Making

- Approved: With rates, terms, or premiums Other specific terms, rates or premiums.

- Conditional Approval: Additional information or conditions requested; Not all criteria have been met.

- Refusal: If the risk is considered to be too great.

Pricing/Terms Setting

Setting interest rates, premiums, or prices of securities according to perceived risk.

Type 1: Origins, Loan Underwriting – Definition of Creditworthiness.

Definition

Loan underwriting is the procedure for determining the borrower’s ability to pay and their creditworthiness.

Key Factors Assessed (The “5 Cs” of Credit)

- Character: Reputation, how you have paid other people in the past.

- Capacity: Debt-to-income ratio, steady income and ability to repay.

- Capital: Money or savings, assets, down payment.

- Collateral: The value of assets offered for security (secured loans such as mortgages).

Common Sub-Types

- Mortgage Underwriting: Focus on the borrower’s financials and property appraisal.

- Personal Loan Underwriting: Emphasis on credit history and debt-to-income.

- Auto Loan Underwriting: Looks at borrower credit and value of car.

- Business Loan Underwriting: Requires a deep dive into business financials, industry and management.

Automated vs. Manual Underwriting

Technology is a factor in loan underwriting, but human underwriters remain essential for complex cases.

Type 2: Insurance Underwriting – Assessing Insurability and Risk

Definition

Insurance underwriting is the process of evaluating the risk of insuring a particular person or asset in a particular portfolio and then determining the terms of insurance (called pricing/products).

Goal

The main objective is to position the company to pay for claims with a profit while providing coverage on a fair basis.

Key Factors Assessed

- Life Insurance: Age, health (medical background, lifestyle patterns), where you work and your family medical history.

- Medical cover: the medical history, pre-existing conditions, the age, and the lifestyle.

- Property & Casualty Insurance: Driving record, claims experience, location of the property, type of property, condition of the property, safety features.

- Business Insurance: Your industry, claims history and safety measures.

Outcomes

- Approval (standard premium)

- Approval (loaded premium/special conditions)

- Denial

Type 3: Underwriting Securities (Bringing Assets to Market)

Definition

The issuance and sale of new securities–stocks or bonds–is often called underwriting because the process is usually led by investment banks. The underwriter takes on the risk of not being able to sell the securities.

Primary Market Role

This process is especially important for IPOs and follow-on offerings.

Types of Securities Underwriting Agreements

- Firm Commitment: The underwriter purchases the entire issue from the issuer and then resells it to investors, taking on full risk.

- Best Efforts: The underwriter stands as agent for the issuer, committing itself only to use ‘best efforts’ to sell the issue and does not guarantee the sale of all of the securities. Risk of Unsold Shares The issuer takes on the risk of any unsold shares.

- All-or-None: A type of “best efforts” offering in which the entire issue is cancelled if the underwriter is unable to sell all of the securities.

- Syndicate: A syndicate is frequently organised, consisting of several investment banks in order to share the risk of large issues.

Process

This involves monitoring issuers, valuing and pricing securities, and marketing and distributing securities issues.

The Significance and Development of Underwriting

1. Risk Management

Underwriting stops banks from taking too much risk, and maintains stability in the market.

2. Market Stability

(b)/(c) It promotes the proper flow of capital and aids investors, by establishing rates and premiums commensurate with the risk of other investors.

3. Technological Advancements

- Automated Underwriting Systems (AUS): Improves the ease of preparation of routine cases.

- Big Data and AI: Towards better risk predictions and personalized interventions.

- Alternative Data: Using sources of non-traditional data to judge creditworthiness (e.g., utility payments, rental history).

Human Element

As much as technology helps us, complex cases do need seasoned human underwriters to take an informed call.

Conclusion

To sum it up, underwriting is pervasive in finance and forms the basis of educated finance decisions. It promotes market trust and stability, allowing institutions and individuals to fight financial risk management well.

Call to Action

Continue researching how to manage your risk and meet with a financial advisor to understand your underwriting criteria, and learn more about a career in underwriting.

Frequently Asked Questions

1. Who is an underwriter?

An underwriter is a professional who determines the risks of loans, insurance or investments.

2. What is the purpose of underwriting?

The purpose of underwriting is simply to mitigate the risk of a financial decision and to guarantee that the institution is able to cover potential losses.

3. Can I appeal the underwriting decision?

In some cases, underwriting decisions can be appealed – particularly if new information is provided that could impact your ranking on risk.

Leave a Reply