Life is unpredictable. From unanticipated medical issues to surprise job loss or an emergency home repair, financial emergencies have a way of shattering even the best of plans. That is when an “emergency fund” becomes your most important financial asset.

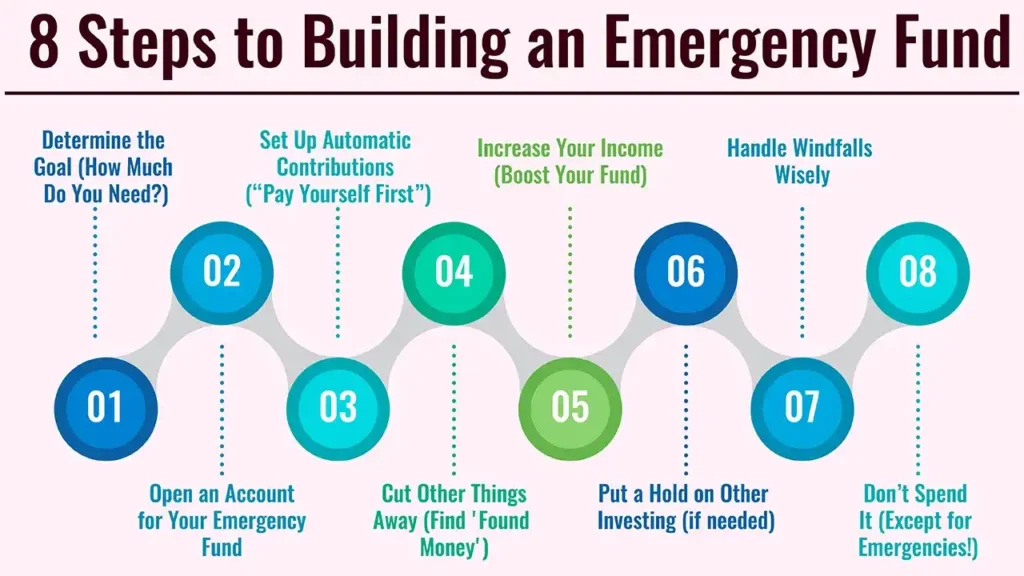

This article provides “8 Steps to Building an Emergency Fund” to serve as your personal financial safety net. Discover “how to save money in an emergency fund” the right way, and it gives you peace of mind yet keeps your long-term financial goals safe from unexpected emergencies.

1. Why You Need an Emergency Fund FIRST off: Does it actually make sense?

The Main Reason: Protecting Your Financial Future

What it is: A set-aside pile of instantly accessible cash (and only cash) for unexpected but necessary expenses.

Why It’s Crucial:

- No Debt: Stops you from using expensive credit cards or personal loans when you need them the most.

- Safeguards Investments: Prevents you from surrendering long-term investments (such as SIPs, FDs or shares) at a loss.

- Helps Ease Stress: It can soothe the minds of those who find themselves easily worried over not knowing what the future holds.

- Economic Recovery: Makes it so you can rebound from challenges more quickly.

- Analogy: It’s the equivalent of the spare tire for your financial journey — you hope you never need it, but when you do, you’re profoundly glad to have it.

2. Here are the 8 Steps to Building an Emergency Fund

Step 1: Determine the Goal (How Much Do You Need?)

- Practical Tip: Total up 3-6 months of nitty-gritty living expenses (fixed expenses like rent or EMI, utilities, groceries, commuting costs, and insurance premiums). Don’t include discretionary spending.

- Considerations: Your job security, number of dependants and health conditions will probably affect whether you are aiming for 3, 6 or even 12 months.

- Example (Indian Context): If your monthly essential expenses are ₹30,000, then your target could be ₹90,000 (3 months) to ₹180,000 (6 months).

Step 2: Open an Account for Your Emergency Fund

- Practical Tip: Get a new term deposit or PPF account or open another bank savings account (Keep the account at a different bank than your regular account). Keep your emergency fund in a separate savings account or liquid mutual fund.

- Why: Separates money from daily spending to prevent the accidental spending of cash. Ensures liquidity.

- Considerations: Choose safety over high returns Accessing your money is easier than ever.

Step 3: Set Up Automatic Contributions (“Pay Yourself First”)

- Practical Tip: Schedule an automatic transfer from your main bank account to your emergency fund account every time you get paid.

- Why: It takes willpower out of the equation. Ensures consistency. These little, regular amounts do add up.

- Example: Automate ₹2,000 or ₹5,000 per month.

Step 4: Cut Other Things Away (Find ‘Found Money’)

- Practical Tip: Keep an eye out for “money leaks” such as unused subscriptions, daily impulse purchases, and purchases made on impulse.

- Why: You can put every penny you save on unnecessary expenses directly into your emergency fund, which will ultimately increase the amount.

Step 5: Increase Your Income (Boost Your Fund)

- Practical Tip: You might explore temporary side hustles, freelancing, selling unused stuff or working more hours.

- Why: Supplementary earnings can be applied 100% toward beefing up your emergency fund sooner without affecting your normal budget.

Step 6: Put a Hold on Other Investing (if needed)

- Practical Tip: At the cost of a few per cent for a short period of time, temporarily park all non-retirement investments (general SIPs, etc.) in the emergency fund account till it is fully funded.

- Why: Your emergency fund is your financial planning; it takes precedence over aggressive investment growth in the early going.

Caveat: Don’t stop your retirement savings if you can possibly avoid it, especially if you receive an employer match.

Step 7: Handle Windfalls Wisely

- Practical Tip: Funnel all surprise money (a tax refund, bonus, gift, or inheritance) into your emergency savings.

- Why: Windfalls bring shortcuts to your goal.

Step 8: Don’t Spend It (Except for Emergencies!)

Practical Tips: Be explicit on what is an emergency. It’s for job loss, a medical crisis, to fix the car or home, not that bleeping new gadget or that night on the beach.

Why: You’re defeating the purpose of the emergency fund, and you’re potentially leaving yourself exposed.

3. Staying on your emergency fund

Keep It Full and Handy

- Replenish: If you need to shed some money, then let building it back up be the first thing you do with your money.

- Review: Every year, review your list of critical costs, and adjust your fund target as your life situation or cost of living changes.

- Place: It should be in a safe and liquid place, such as another savings account or a fixed deposit (FD) which has an auto-renewal and partial withdrawal facility. Avoid illiquid investments.

Conclusion

To sum up, steps to building an emergency fund include setting a target, establishing a separate account, setting up regular contributions, slashing expenses, increasing earnings, and addressing windfalls strategically.

But building an “emergency fund” isn’t just about money; it’s about constructing resilience and peace of mind and giving yourself the flexibility to work toward your financial goals without being derailed by an unwelcome surprise. It’s the silent protector of your future.

Call to Action

Today, even if it requires baby steps, begin the process of building this fundamental security blanket.

Frequently Asked Questions

1. How large should an emergency fund be?

The most widely used rule of thumb is 3 to 6 months of essential living expenses. But if you have a less stable income, dependents or certain health issues, 9-12 months might make more sense.

2. Can I invest my emergency fund, or does it need to be in a savings account?

It needs to mostly be in a very liquid and safe account, e.g., a high-yield savings account or a short-term FD with easy withdrawal. Stay away from risky investments like stocks.

As you may need the money at a time when the markets are in a funk. Some others invest in ultra-safe liquid mutual funds, but make sure you get to know about their instant redemption facility.

3. If it’s my money, can I do whatever I want with my emergency fund?

It’s your money, but an emergency fund serves a very defined purpose: unexpected, unavoidable financial emergencies.

Its very application for non-emergency situations (like a holiday, a new toy, or impulse shopping) debases it and leaves you unprotected when an actual tragedy strikes.

4. What details differentiate an emergency fund from general savings?

General savings could be for certain goals, like a down payment on a house, a car or a trip. An emergency is not “wanting to have more money to meet your monthly obligations if you have an emergency”.

An emergency fund is for UNFORESEEN emergencies only, such as job loss, medical emergencies or a major home repair. It is a financial airbag, not a goal-orientated savings account.

Leave a Reply