Every parent wants to provide their child with the best possible beginning in life – and a good education is crucial to that. But how can you help your child realise his or her academic dreams without destroying your finances?

This guide now provides solutions for “securing your child’s future” and “having the financial confidence to follow your dreams of educating your child from grade school to college”. Secure Your Child’s Future: Expert Education Planning. You may develop a firm base for your kid’s learning path by using these techniques.

Why Today’s Education Planning Is Essential

High Cost of Education: The Unsettling Reality

- Inflation: The increasing cost of education continues to rise at a higher rate than overall inflation, so it’s important to save early and save often.

- Competition: A search for higher-quality education, at times leading to higher fees, which becomes an added pressure for the families.

- Global Education: The thirst for international education equals even higher fees, and families clamor for their children’s best interests.

- Long-Term Implications: Not saving for college can mean long-term damage to your finances in the form of debt and few options when it comes to your child’s education.

For current trends and statistics on college costs in the U.S., a widely recognized source is the College Board. Explore data on tuition and fees from College Board’s Trends in College Pricing.

The Great Benefit of Early Planning: Increasing Your Advantage

Such early planning means you get the benefit of the magic of compounding. Even small amounts saved regularly can amount to much larger sums when given time to grow, so getting it right early can be a powerful technique for securing your child’s future.

Pillar 1: Identify Your Child’s Education Goals

- Vision: What level of schooling do you want for your child? (Undergraduate, postgraduate, professional-related, study abroad?)

- Timeline: How many years in the future is this goal?

- Cost Estimate: Search the websites of the desired institutions and courses for the most current costs, and calculate future costs with inflation.

- Anticipated Earnings: Think about what your child can earn once they graduate when considering loans.

Pillar 2: Take Snapshot of Your Financial Situation

- Existing Savings: Estimate the amount you have saved thus far for your child’s education.

- Earnings & Spend: Decide what you can afford to save on a monthly basis for schooling.

- Current Investments: You should evaluate if your existing investment strategies meet your education objectives.

- Debt Status: High-interest debt can sabotage your efforts to save for education.

Important Investment Paths for Global Education Planning

Using Tax-Advantaged College Savings Plans

Dedicated Education Funds:

- 529 Plans (US): Grow your money tax-deferred and spend it tax-free on qualified education expenses.

- RESPs (Canada): Registered Education Savings Plans with CESG.

- Child Growth Plans/ULIPs (India): These are popular products that are very good for investment, and the working parent is assured that even if something happens to them, their kids are taken care of, though they may involve some intricacies and high expenses.

- Junior ISAs/Child Trust Funds (UK): Savings for your children’s education with tax benefits.

- Public Provident Fund (PPF) / Employee Provident Fund (EPF) (India): are long-term saving options which can be used partially for education.

Diversified Investment Portfolios for Growth

- Mutual Funds/ETFs: Diversified funds offer investment growth over time.

- Equities vs. Debt: The risk-return balance depends upon the time horizon of your education goal.

- SIPs (Systematic Investment Plans): Focus on investing regularly in a disciplined manner through the method of dollar-cost averaging to build your savings over time.

Exploring Education Loans

- The role of loans: In the eventuality that planning falls short or to meet certain portions of higher education costs, loans may become a viable option.

- Types: government-backed loans (through a traditional banking lender), private bank loans, international student loans.

- Things to know: When weighing education loans, consider low interest rates, favourable repayment terms and whether you need collateral.

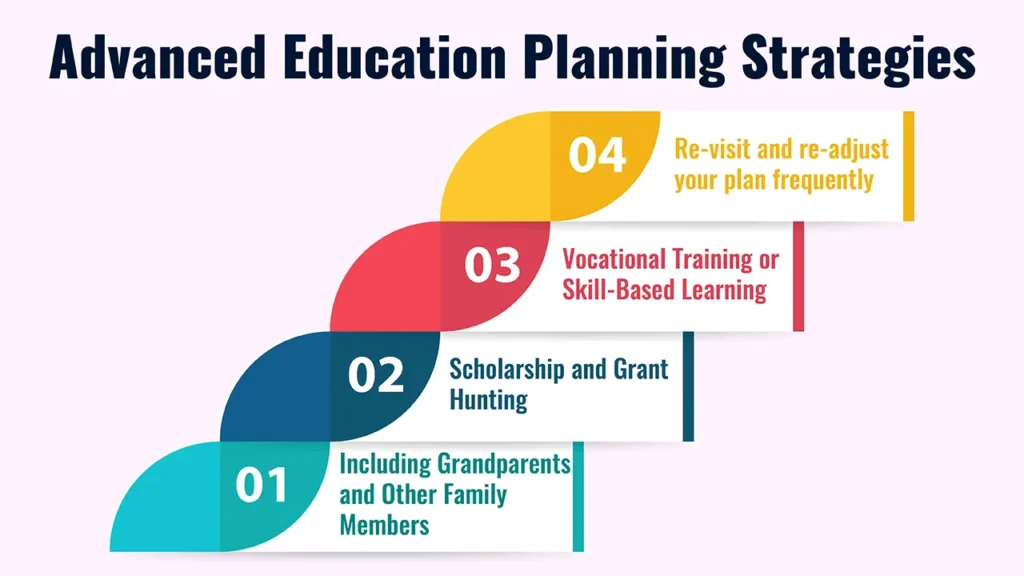

Advanced Education Planning Strategies

Including Grandparents and Other Family Members

Examine how gifts or contributions from family can really supercharge savings for your child’s education. Refer to the relevant tax considerations a gift would be subject to in the commentary.

Scholarship and Grant Hunting

Stress the fact that good grades can mean free money. Give tips on how to find and apply for scholarships and grants to help lower the cost of an education.

Vocational Training or Skill-Based Learning

Emphasise that not all paths to a valuable education lead to a four-year degree. Explain the advantages of learning a skill for career prep and financial freedom.

Re-visit and readjust your plan frequently

Life happens, markets move and prices increase, so what you want to do is review your education plan on a regular basis (I do annually). Be ready to shift your plan as your child grows and evolves and their goals change.

Avoid these common mistakes to secure your child’s future.

- Starting Too Late: Giving up the benefits of compounding.

- Overbudget: Not considering inflation and unexpected costs.

- Risk Disregarded: Lack of proper insurance (life, health) to hedge the education plan.

- Concentration: Placing all education savings in one asset class.

- Muddying Objectives: Relying on educational savings for other uses can undercut your strategy.

- Not Involving the Child: As they grow, their preferences and aspirations may change.

Conclusion

In conclusion, successful education planning includes setting specific objectives, evaluating your financial position, making maximum use of any potential investments, and regularly reviewing your plan.

The initiative you’re taking today paves the way for your child tomorrow. Leaving a legacy: A great legacy is to “protect your children’s future” by planning a thoughtful education plan.

Call to Action

Ask parents to begin (or revisit) their child’s education plan today and make an appointment with a financial advisor for more personal assistance.

Frequently Asked Questions

1. When should I start saving for my child’s education?

The best time is always right now! The earlier you begin, the more time your money has to multiply through compounding, greatly reducing the pressure to save more later. Sometimes it takes small, recurring donations to have a bigger effect over the long term.

2. What is the cost of higher education for my child?

This really depends on your child’s programme of study, institution (public vs. private, in-state vs. out-of-state), and location.

Look up what it currently costs and add the inflation rate for education (usually higher than general inflation) to get a reasonable future value. This projection a financial counsellor should be able to help with.

3. Do term-specific child education plans (such as RESPs, child ULIPs, and 529 plans) outperform total investments?

Often, yes. 529 savings plans often provide tax benefits (such as tax-deferred growth or tax-free withdrawals for qualified expenses) and sometimes even government grants, which could help you grow your savings more so than with ordinary investment accounts. Make sure you understand their features and fees.

4. Retirement savings or my child’s education savings?

Both are important, but financial planners typically recommend putting retirement savings first. You can borrow for education (student loans), but not generally for retirement. With money not an issue, a parent will more easily be able to help out with their child’s education in many ways.

Leave a Reply